POLY MEDICURE || Consistently Performing Stocks #22

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

Today, we will look at the key fundamentals & business of Poly Medicure Ltd. Click here to learn more about each of the parameters in the chart below.

What Has Led to This Consistency

Company Overview

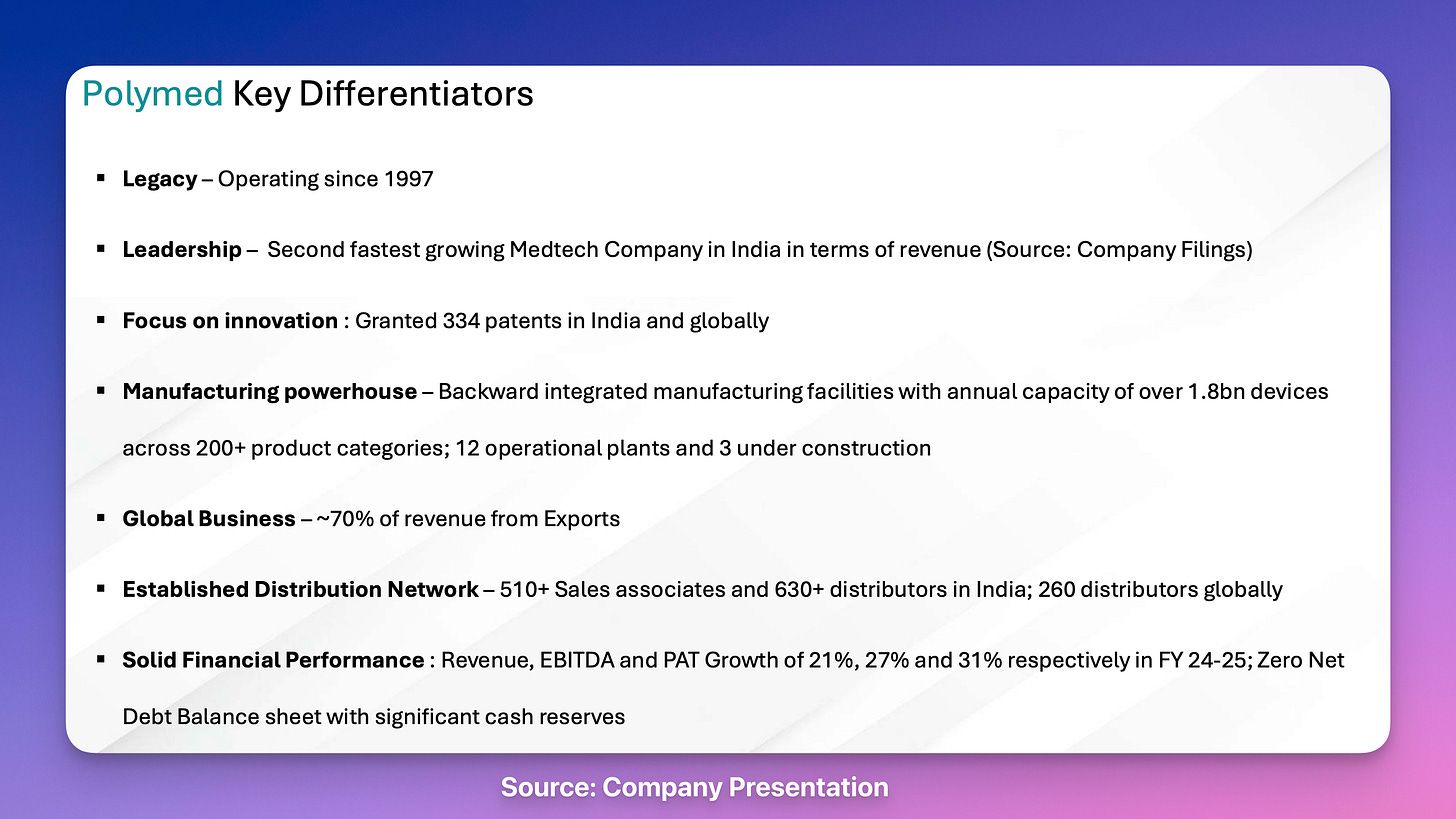

Established in 1995, Poly Medicure Limited has transformed into India's largest medical device exporter, serving regulated markets globally for nearly 30 years with specialized focus on consumable medical devices - single-use disposable products.

Product Segments include:

Disposable medical devices across 12 therapeutic specialties

Infusion therapy systems and vascular access catheters

Central venous catheters and renal care equipment

Oncology devices including chemo ports and specialized equipment

Revenue generation primarily from export markets with strong presence in Europe, Americas, and Asia-Pacific regions.

The company creates recurring revenue streams through established hospital relationships with consumable medical devices that require regular replacement.

Operates 12 manufacturing facilities globally with combined capacity of 1.8+ billion devices annually, serving major healthcare systems globally.

Market Positioning

Market leadership as India's largest medical device exporter for 10+ years. → Establishes premium brand positioning and pricing power in global markets

Specialized focus on consumable medical devices → Enables concentrated expertise and resource allocation compared to diversified competitors

12-13% market share in India's ₹560 million renal care market with 60% FY25 growth.

Export Transformation

Poly Medicure systematically evolved from a domestic manufacturer to India's largest medical device exporter for 10+ consecutive years. They have built export leadership through strategic geographic expansion and regulatory excellence.

It generates 70% of total revenue from exports. Spread across 125+ countries, exports grew at 24% YoY in FY25. This reduces dependency on single domestic market. Also enables premium pricing in regulated economies.

EU MDR certification achieved for 54 products across therapeutic areas. Enables direct market access to European healthcare systems contributing to 50% of export revenue.

Global manufacturing infrastructure spans 12 facilities across India, China, Italy, Egypt. This provides local market access, reduces shipping costs and removes trade barriers.

Operational Excellence

Manufacturing scale and systematic automation investments create operational leverage required for regulated medical device markets.

Production capacity of 1.8+ billion units annually across 12 facilities with 200+ product categories → Achieves economies of scale + Meets surge demand during health emergencies.

International certifications including ISO 13485:2016, FDA compliance, and EU MDR across facilities → Enables premium healthcare market access contributing to 70% of company revenue

Innovation Pipeline

R&D investments and intellectual property development establish technological barriers and also enable premium pricing.

Patent portfolio spanning 334 granted patents across 12 therapeutic areas (as of March 2025)

Government-approved R&D facility with rapid prototyping and 3D printing capabilities → Reduces dependence on external development reducing time-to-market for new products

Consistency Formula

Export Transformation + Operational Excellence → Revenue Predictability

Market Positioning → Premium Pricing

Innovation Pipeline → Competitive Moat

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research