Paras Defence and Space Technologies || Consistently Performing Stocks #50

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI RA. The primary objective of this post is to understand how the business has been able to perform consistently over the years. This is an educational post and not a recommendation to buy the stock.

Let’s explore the business and fundamentals of Paras Defence and Space Technologies Ltd this week.

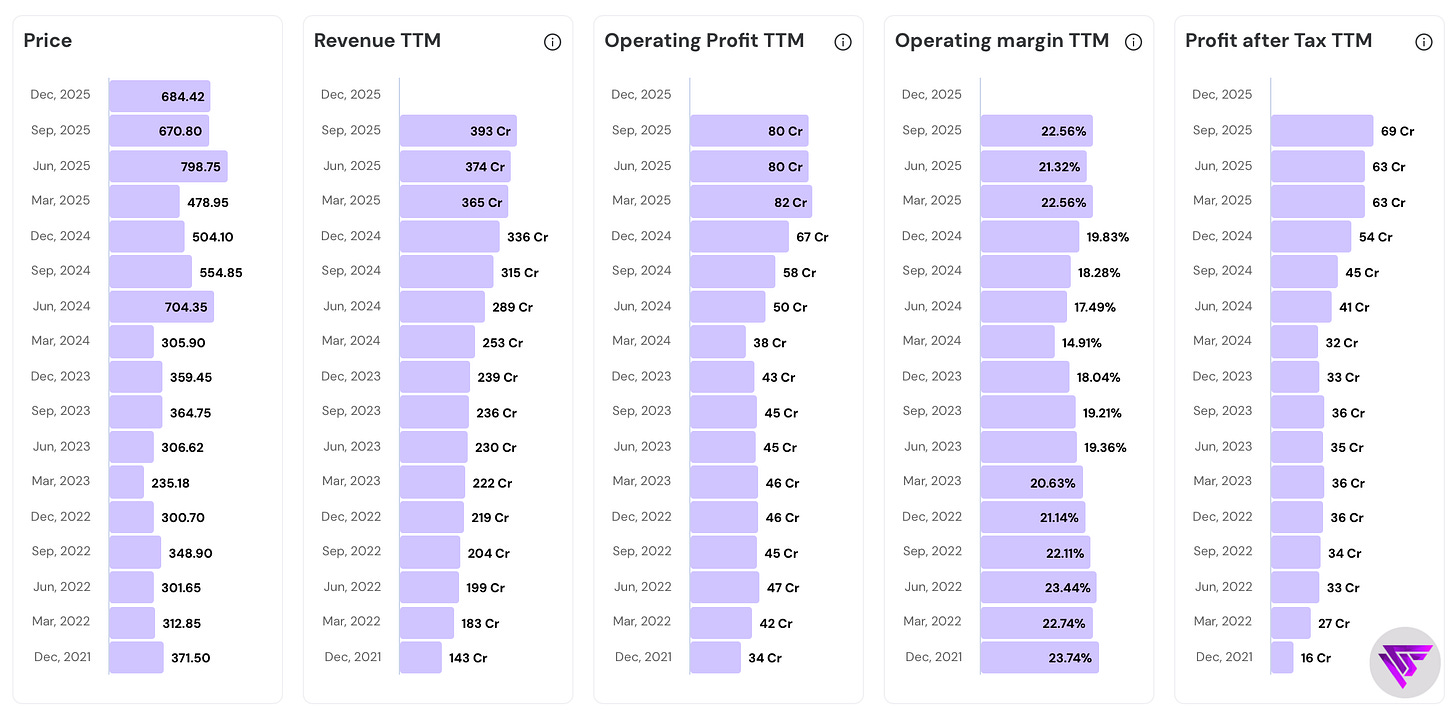

In the last 4 years…

- Stock price has grown 1.8 times (from 371.50 to 684.42)

- Revenue has grown 2.7 times (from 143 Cr to 393 Cr)

- Operating profit has grown 2.4 times (from 34 Cr to 80 Cr)

- PAT has surged 4.3 times (from 16 Cr to 69 Cr)

Take a look at the numbers below. Incredible Consistency.

Let us explore.

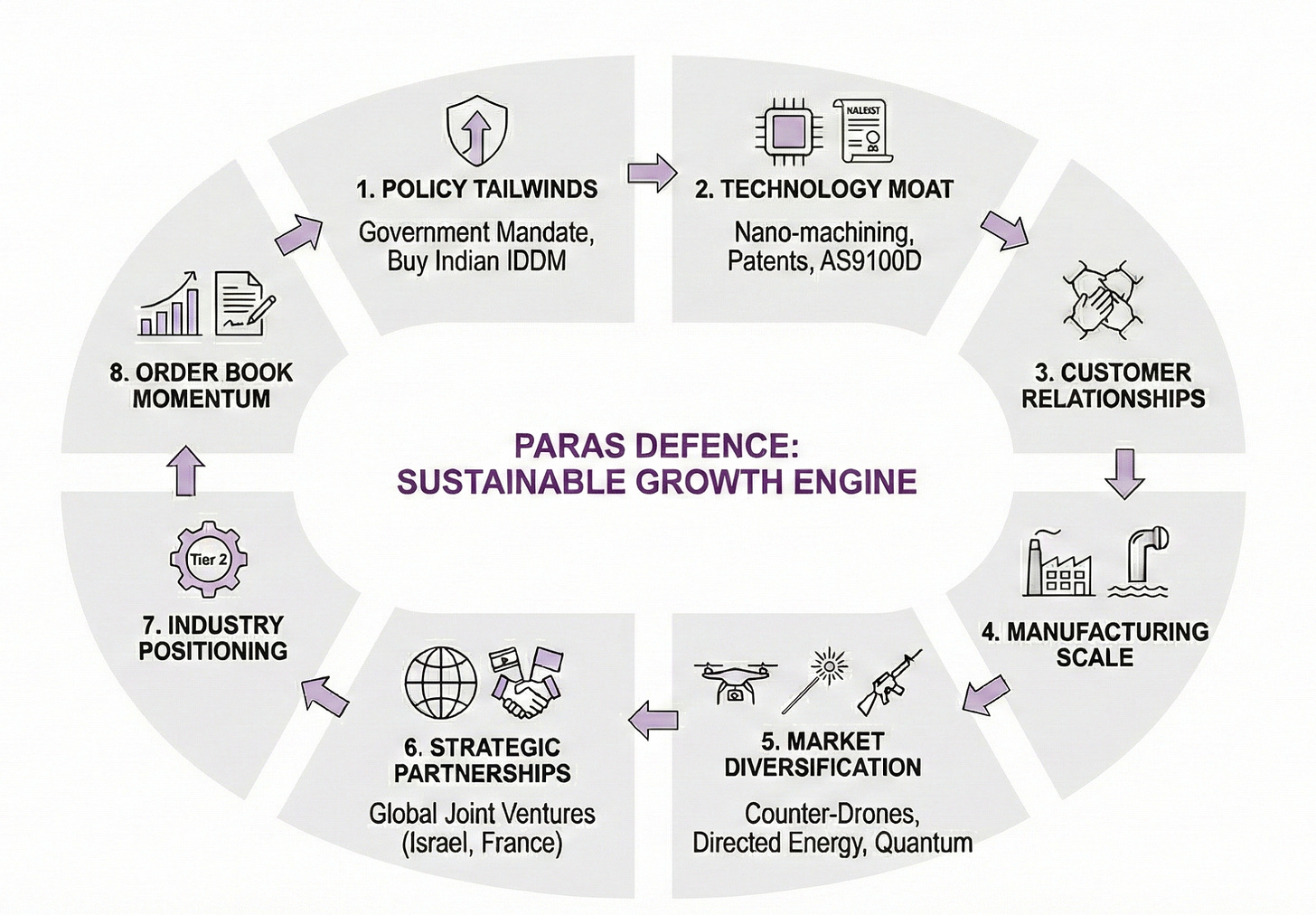

Their Road to Consistency

1. Company Overview & Business Model

Paras Defence and Space Technologies designs, develops, and manufactures precision engineering products for India’s defence and space sectors.

Founded in 1979 as a small engineering workshop in Mumbai, the company has evolved into a Tier 2 defence engineering firm with 600+ employees and manufacturing facilities across Navi Mumbai, Ambernath, Bengaluru, and Hyderabad.

The business model is transitioning from component supplier to systems integrator. Rather than selling individual optical elements, Paras now delivers complete solutions from concept to commissioning.

For example, a submarine periscope project involves designing the optical system, manufacturing precision components, integrating sensors and electronics, testing under military specifications and supporting deployment. PARAS does all this.

What makes PARAS interesting is its collection of monopoly positions.

Paras is the sole Indian supplier of critical imaging components for space applications, including diffractive gratings for hyperspectral imaging.

It is the only Indian company manufacturing infrared optics at scale.

It is the only private company in the Asia-Pacific region building turnkey optronic periscopes for submarines.

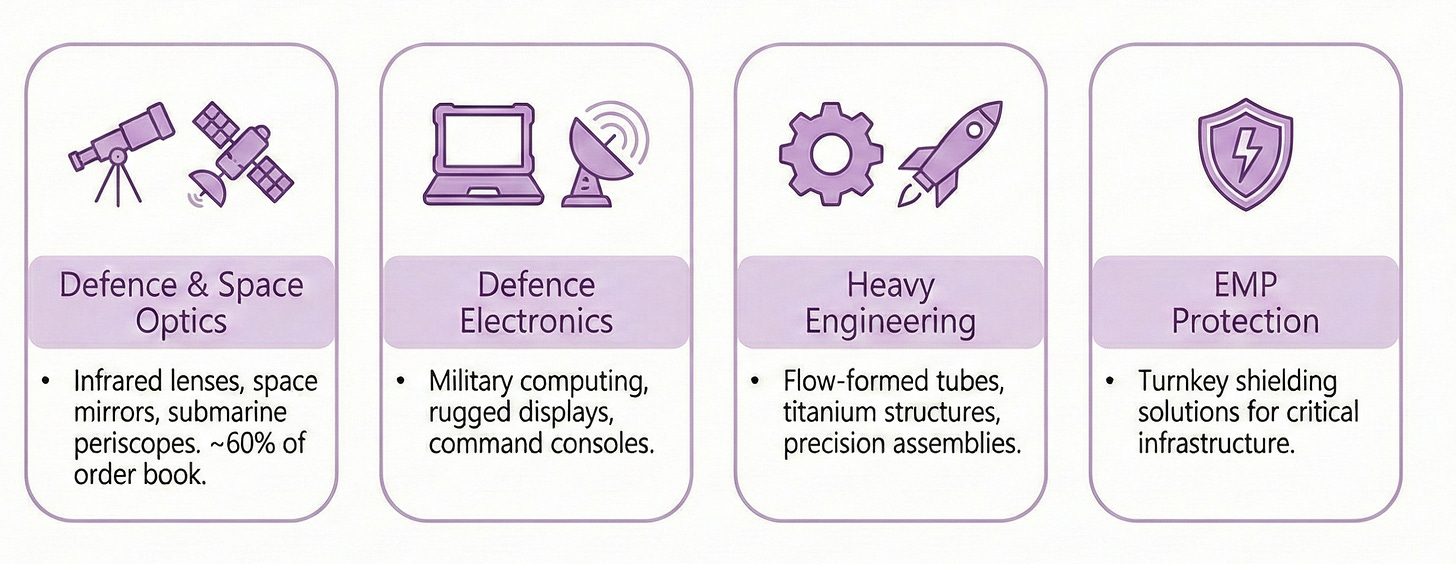

Product Mix

The company operates across 4 major product segments.

Defence and Space Optics contributes about 60% of the order book, manufacturing infrared lenses, diffractive gratings, large space mirrors, and optronic periscopes for submarines.

Defence Electronics provides military-grade computing systems, rugged displays, and command consoles for the armed forces.

Heavy Engineering produces flow-formed tubes for rockets and missiles, titanium structures, and precision mechanical assemblies.

Electromagnetic Pulse Protection delivers turnkey solutions for shielding critical infrastructure from EMP attacks.

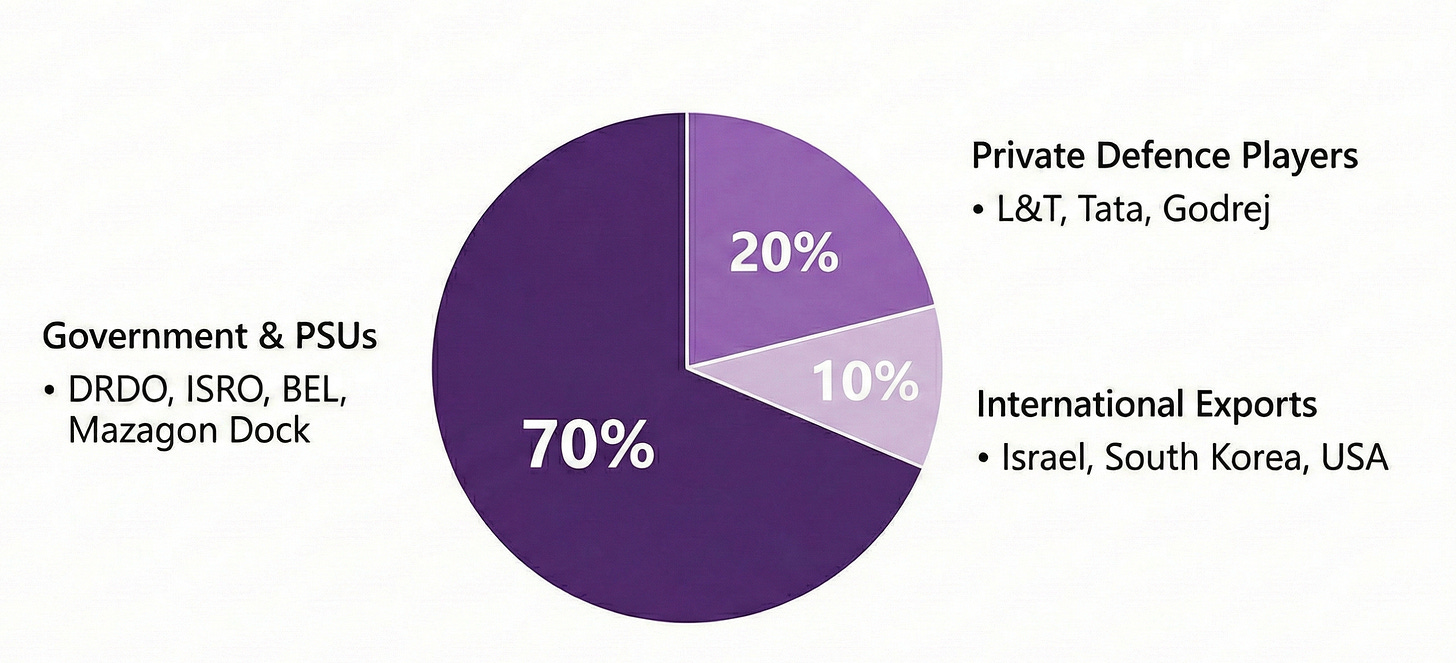

Revenue Mix

Revenue flows primarily from government entities and defence public sector undertakings, which account for approximately 70% of business. DRDO laboratories, ISRO, Bharat Electronics Limited, and Mazagon Dock are anchor customers.

Private defence players like L&T, Tata, and Godrej contribute another 20%

International exports to Israel, South Korea, and the United States represent roughly 10% of revenue.

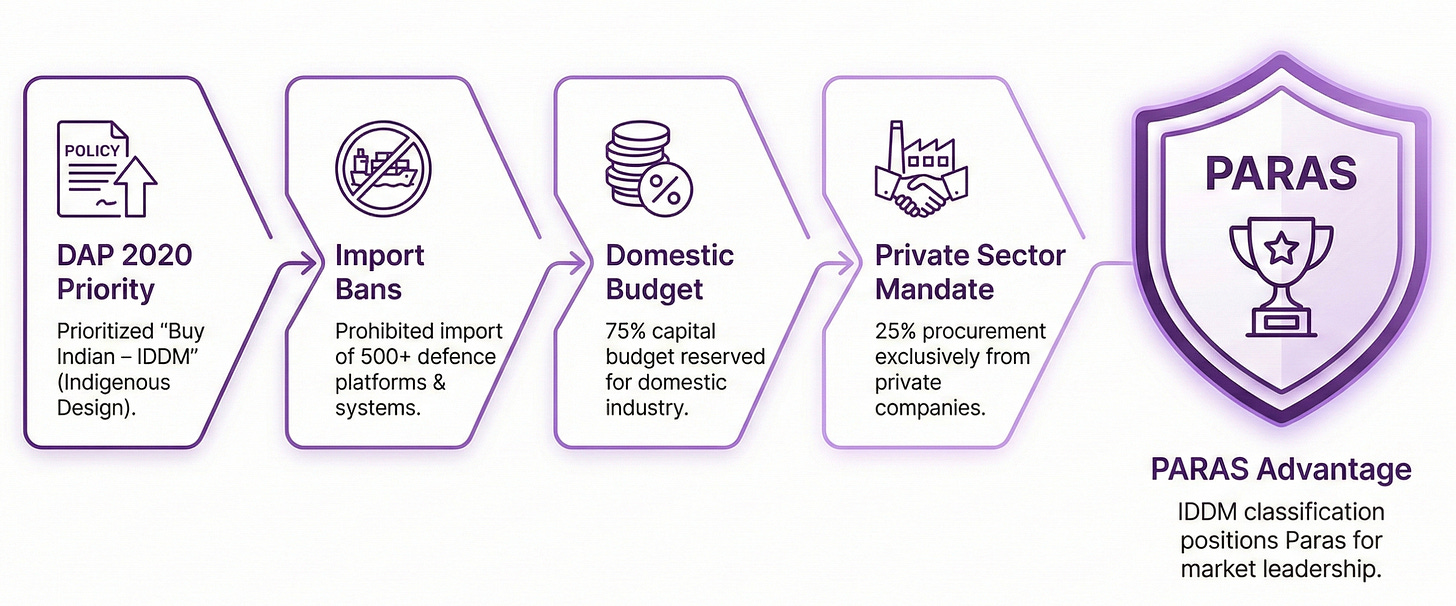

2. The Defence Policy Tailwinds

The Indian government fundamentally reshaped defence procurement rules starting 2020, creating a policy environment uniquely favorable to companies with indigenous design capabilities like Paras Defence.

Defence Acquisition Procedure 2020 placed Buy Indian IDDM (Indigenously Designed, Developed and Manufactured) at the top of procurement priorities. This gives Paras an advantage over companies relying on licensed foreign technology.

Five Positive Indigenisation Lists notified by the Department of Military Affairs progressively since 2021 prohibit import of 509 specified defence items. This aids PARAS.

Paras holds IDDM classification across its product lines, placing it ahead of competitors in contract wins where domestic design capability became a qualifying criterion rather than a nice-to-have advantage.

75% of India’s defence modernization budget totaling Rs 1.80 lakh crore is now reserved for domestic procurement. This implies, Paras competes for a larger share of an expanding pool.

Also, the Indian government mandated that 25% of defence procurement come exclusively from private sector companies, opening doors that remained closed. Previously defence PSUs used to capture entire contracts.

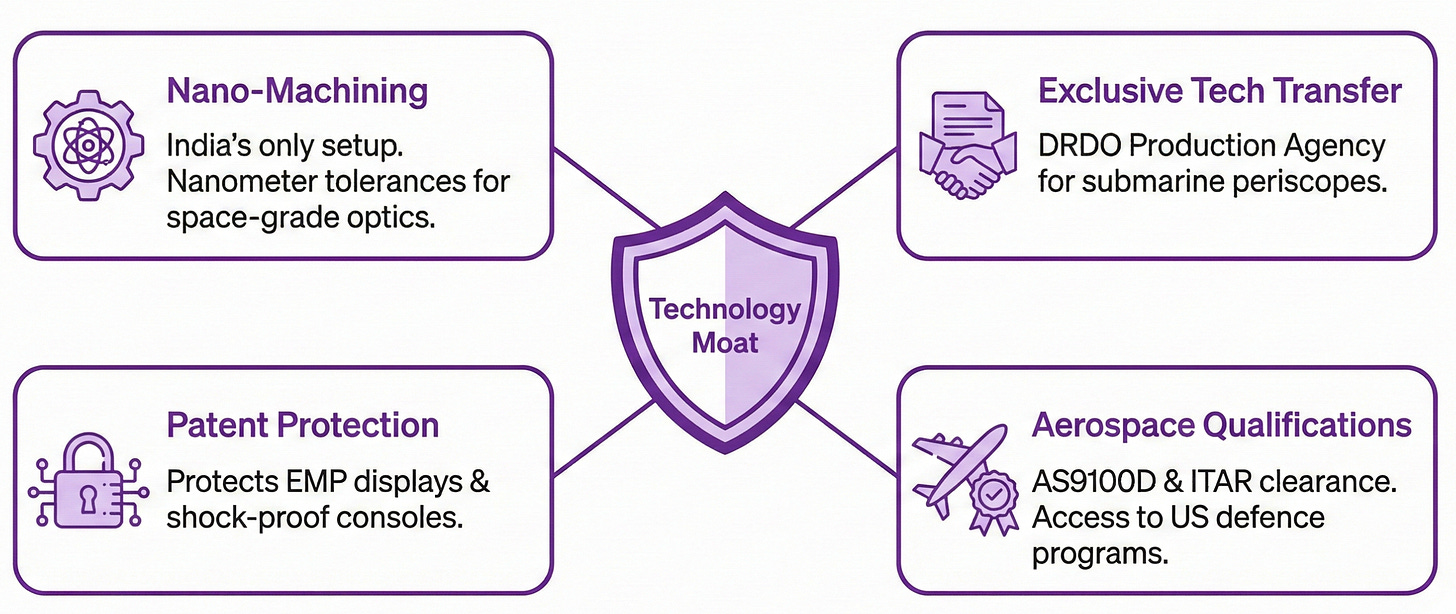

3. Technology Moat

Paras has invested in specialized capabilities over the years. Investments in nano-machining, patents, and aerospace certifications require multi-year commitments that cannot be easily replicated by new entrants.

India’s only nano-machining setup for ultra-precision optical manufacturing produces components with nanometer tolerances essential for space-grade optics. Competing here requires multi-year investment in equipment, training, and process development.

DRDO designated Paras as Production Agency for optronic submarine periscopes through formal Technology Transfer agreements. This means DRDO-developed technology gets manufactured exclusively by Paras for the Indian Navy.

100+ R&D personnel including former ISRO scientists enable responding to custom requirements rather than selling standard products. When DRDO needs specialized hyperspectral payloads, Paras can design and build to specification.

Patents protect critical innovations including EMP-protected displays and shock-proof consoles, preventing direct copying of successful designs.

AS9100D aerospace quality standard and ITAR clearance enable participation in US defence programs. This is a market that is difficult to crack. Most Indian companies cannot access it due to lengthy qualification requirements.

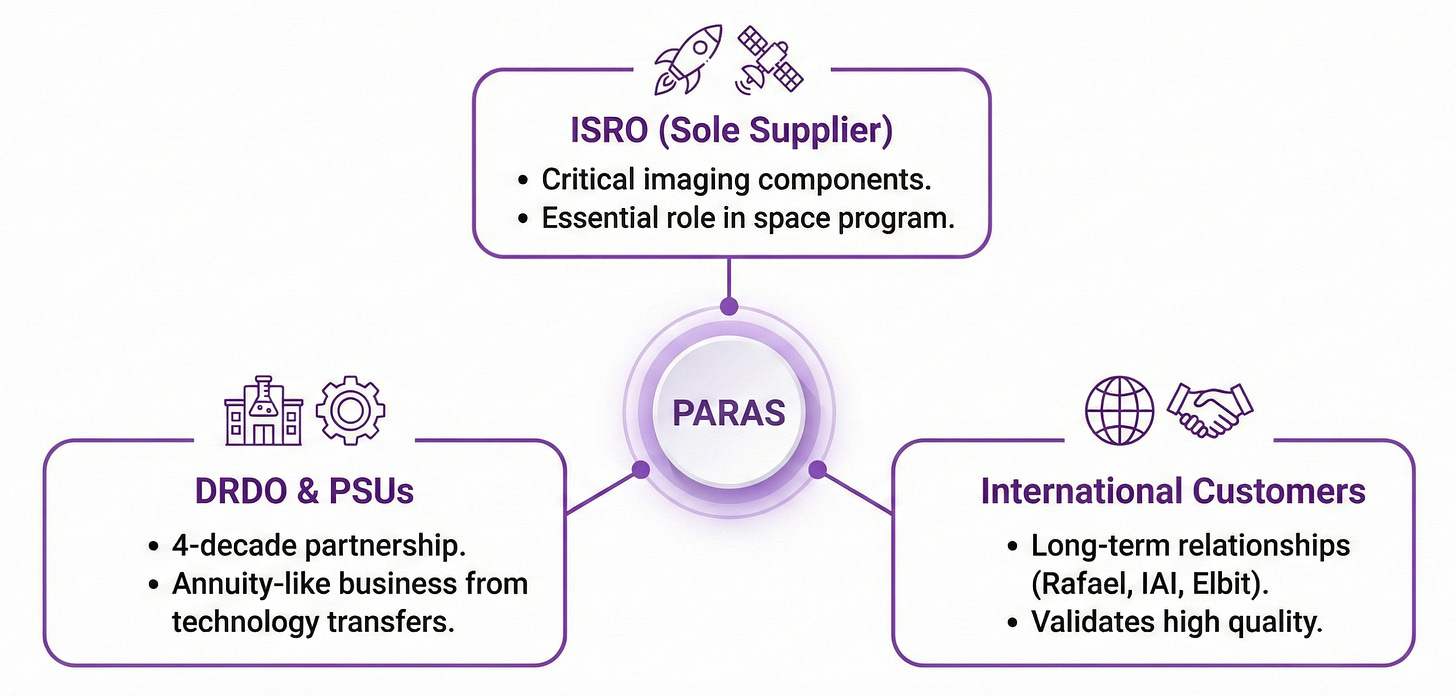

4. Customer Relationships

Four decades of government relationships provide revenue predictability. Long-term partnerships with ISRO, DRDO, and defence PSUs position Paras as a preferred supplier.

ISRO depends on Paras as its sole Indian supplier for critical imaging components including large-size space optics and diffractive gratings.

Every Indian satellite mission using hyperspectral imaging requires Paras components.

When ISRO Chairman S. Somanath inaugurated the company’s new optical testing facility in November 2024, he explicitly acknowledged Paras’s essential role in India’s space program.

DRDO laboratories have worked with Paras for four decades on progressively complex projects.

Multiple Technology Transfer agreements from DRDO covering submarine periscopes, border surveillance systems, and driver night sights for T-90 tanks create annuity-like business as the military procures these items over multi-year cycles. This explains PARAS’ consistent Revenue.

International customers including Rafael, IAI, and Elbit have maintained purchasing relationships spanning multiple years. The September 2025 Elbit order followed years of successful deliveries. It validates high quality.

5. Manufacturing capabilities at scale

Paras invested systematically in vertical integration, specialized equipment, and workforce expansion that creates barriers competitors cannot easily overcome.

The Nerul facility houses integrated capabilities for optics manufacturing, electronic assembly, system integration, and testing under one roof.

An entire submarine periscope project can be completed within the Nerul facility.

Diamond turning machines, CNC grinding equipment, and complete optical coating setups including Diamond-like Carbon represent state-of-the-art infrastructure.

Flow forming capability at the Ambernath heavy engineering facility produces seamless tubes essential for missile motor casings, serving programs across DRDO, ISRO, and private aerospace customers.

SAMAR Level 4 certification from DRDO validates manufacturing quality against defence-specific standards.

New entrants must invest years achieving comparable certification & capabilities.

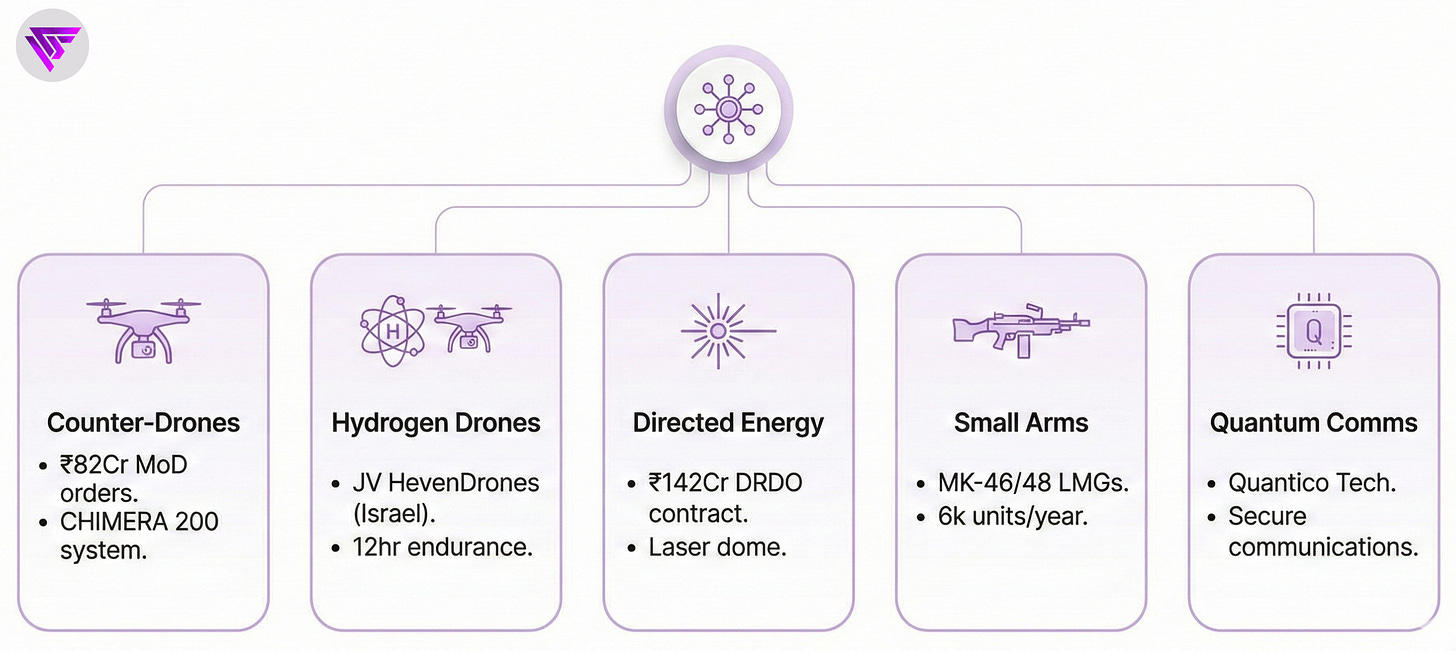

6. Diversification into adjacent markets

Paras systematically entered new market segments leveraging existing capabilities and reducing concentration risk. Counter-drones, Hydrogen-powered drones, Directed energy weapons, Small arms manufacturing, and Quantum communications represent expansion into Rs 82+ crore order opportunities.

Subsidiary Paras Anti-Drone Technologies emerged as a counter-UAS leader with ₹82 crore in Ministry of Defence orders during late 2025 alone. The CHIMERA 200 system combines RF detection and neutralization in a man-portable device.

Joint venture with HevenDrones Israel launched May 2025 brings hydrogen-powered drone technology offering 12-hour flight endurance versus 30 minutes for battery drones. This provides both offensive capabilities that complement the existing counter-drone business.

Entry into directed energy weapons through the ₹142 crore DRDO laser dome contract positions Paras in emerging technology. Their existing optics expertise provides natural advantages in beam direction systems.

Arms manufacturing license received January 2025 enables production of MK-46 and MK-48 light machine guns at 6,000 units annually for each model. Small arms manufacturing provides recurring volume production unlike project-based engineering work.

Quantum communication subsidiary Quantico Technologies explores next-generation secure communications. Early investment in quantum sensing, positions Paras for eventual market emergence. When quantum-resistant encryption replaces current systems, the opportunity will be huge.

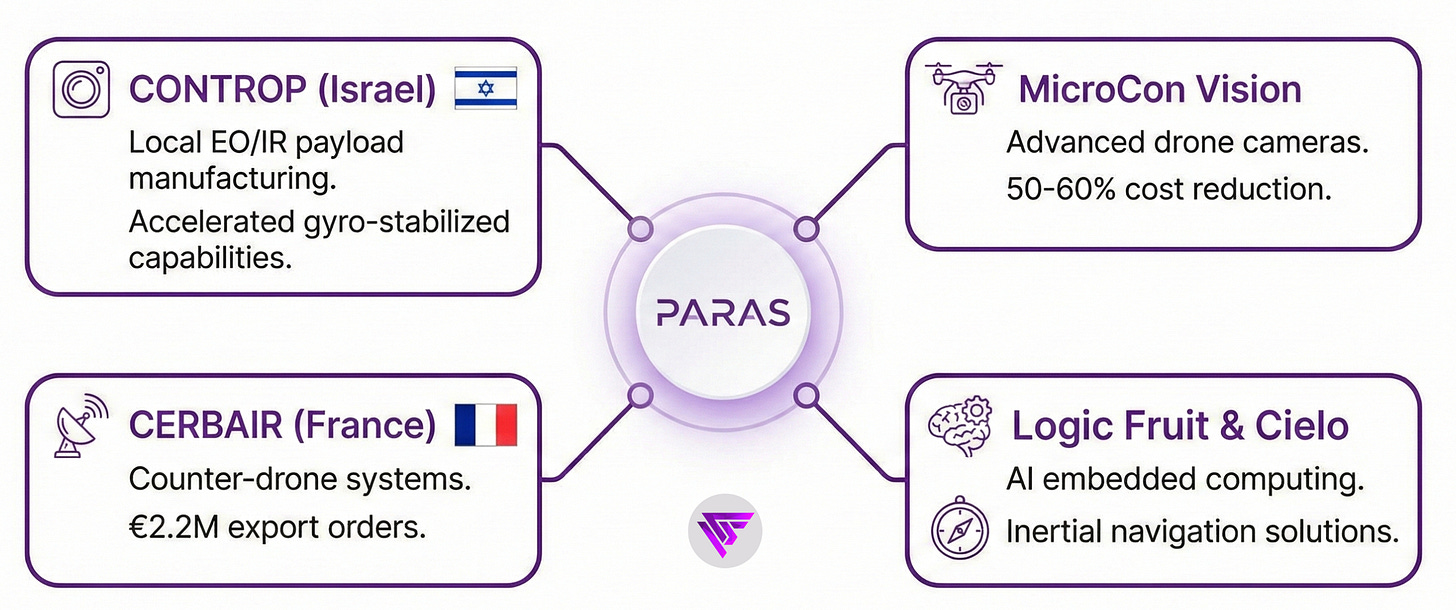

7. Strategic Partnerships

International partnerships provide technology access and market reach that would take decades to develop independently. Joint ventures with Israeli and French companies accelerate capability development. This spreads R&D costs across multiple markets.

Joint venture with CONTROP Precision Technologies Israel established in 2024 enables manufacturing EO/IR payloads locally.

This partnership accelerated gyro-stabilized camera system capabilities that would otherwise require lengthy R&D programs.

MicroCon Vision partnership announced in April 2025 provides access to advanced drone camera technology at 50-60% cost reduction versus alternative sources.

CERBAIR France collaboration on counter-drone systems led to €2.2 million export orders.

Strategic investment of $1.15 million in Logic Fruit Technologies announced at Aero India 2025 brings AI-driven embedded computing expertise as AI becomes integral to military systems.

MoU with Cielo Israel in October 2025 addresses inertial navigation solutions critical for guided munitions and autonomous systems.

8. Industry Positioning

Paras operates in Tier 2 defence engineering, supplying subsystems and components to prime contractors rather than competing for entire platforms. This positioning avoids direct competition with giants like L&T.

For example, when L&T wins a naval program, Paras supplies optronic systems to it. PARAS wins either way in large programs without needing to compete directly with conglomerates.

Indian defence production grew from Rs 46,429 crore in FY15 to Rs 1.54 lakh crore in FY25, representing 232% expansion.

Defence corridor development in Tamil Nadu and Uttar Pradesh represents Rs 20,000 crore in planned investment. This attracts more prime contractors (like L&T) who need specialized components (from PARAS).

Defence exports reached Rs 23,622 crore in FY25, representing 34x growth from Rs 686 crore in FY14.

Paras contributes through component supplies to Israeli customers and direct system exports.

9. Order Book Momentum

Paras demonstrated consistent ability to win new business. Order book grew 4.3x in the last 4 years without any single blockbuster contract. This accumulation happened through dozens of orders across product lines.

Order book expanded from Rs 215 crore in March 2021 to Rs 928 crore by March 2025, representing 4.3x growth through systematic accumulation rather than dependency on mega-contracts.

Composition shifted toward higher-margin optronic systems now comprising 60% of the order book versus 40% for defence engineering.

The Rs 142 crore DRDO order for laser-based air defence systems in March 2025 marked entry into directed energy weapons.

Export orders reached $3.8 million from Elbit Security Systems Israel and €2.2 million from CERBAIR France, validating that Paras technology meets global standards.

Order execution visibility extends well into FY27 based on current book size and typical 18-36 month delivery timelines, providing revenue certainty.

10. Consistency Formula and Drivers

That’s it for today.

FINVEZTO.COM | Build Wealth. With Clarity.

We give you a proven Flexi-Wealth System to build a Resilient Portfolio that works across market cycles, your lifetime & beyond. Learn more about the system at finvezto.com

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.