Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they are able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Let’s start ⬇️

Today, we will look at the key fundamentals & business of Olectra Greentech Ltd.

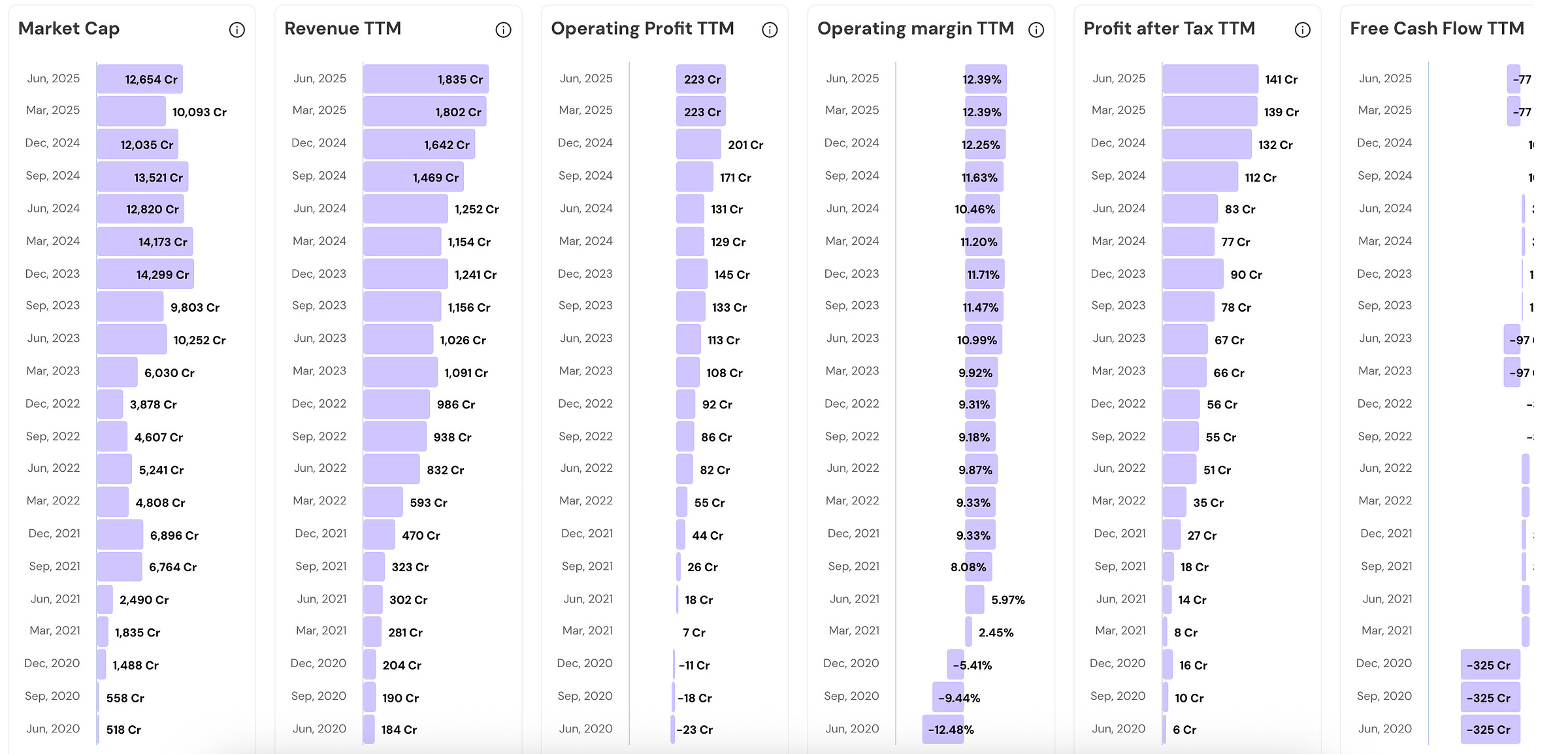

Key Fundamental Metrics of OLECTRA

Over the last 20 Quarters, OLECTRA has shown consistent performance. Please check the chart below to visualize the same.

What Has Led to This Consistency

Company Overview

Incorporated in 2000, a leading manufacturer of electric buses in India , and completed homologation of first E-Bus in 2017.

More than 8 years of experience in manufacturing and commercialization of Electric buses.

Olectra holds 41% market share in India's electric bus segment.

Product Segments include:

Electric Bus Division: 7-meter, 9-meter, and 12-meter electric buses for state transport undertakings and private operators

Insulator Division: Composite polymer insulators for power transmission and distribution networks

Commercial Vehicle Division: Electric trucks and tippers for goods transportation and construction applications

After-sales Services: 12-year maintenance contracts and spare parts supply for electric vehicle fleets

Strategic Partnership with BYD

Olectra has a partnership with BYD, World’s largest EV manufacturer

BYD technology partnership until 2030 provides exclusive access to globally proven electric vehicle technology including Blade Battery systems and powertrain components unavailable to fellow competitors.

Manufacturing know-how transfer from BYD creates production efficiency advantages.

Proven technology platform with 500km range and superior safety through Blade Battery provides competitive advantages.

Industry Tailwinds

The Government’s PM e-Bus Sewa – Payment Security Mechanism (PSM) was formally notified on October 28, 2024, introducing a funded backstop and payment security coverage for up to 12 years, which materially reduces counterparty risk for OEMs/operators.

Under the PSM scheme, OLECTRA benefits from RBI-linked Direct Debit Mandate, improving quick financial closure for bus contracts.

PSM scheme also improves cash flows for firms like OLECTRA. The Cash Conversion Cycle improves.

The Indian Govt has reported steady PSM scheme progress. Till Feb 2025, 7,293 buses were approved and ₹983.75 crore sanctioned for depot and power infrastructure across multiple cities.

CESL (Ministry of Power subsidiary) recently opened a 10,900-electric-bus, multi-city tender in July 2025 under the PM E-DRIVE scheme. This allocates buses to Bengaluru, Delhi, Hyderabad, Ahmedabad, and Surat, boosting order momentum for Olectra and other major OEMs.

Cost Curve & Tech Tailwinds

Battery Prices continue to inch lower in 2025 keeping TCO (Total Cost of Ownership) in check. 2025 witnessed manufacturer overcapacity that continues to pressure battery pricing downward. This lowers bus costs and enables faster paybacks for operators.

Blade-battery platform showcased by Olectra at Bharat Mobility Global Expo 2025 focuses on range & safety.

The new platform provides a range of ~500 km per charge alongside higher energy density and compact packaging that improves stability and space.

Adoption Momentum

Delhi is scaling aggressively, targeting 7,000–8,000 e-buses by February 2026 from a current base of ~3,400, alongside power and depot upgrades.

New depots and public charging assets commissioned in 2025 are improving uptime and route feasibility as fleets grow.

Chandigarh continues to add capacity, with 328 e-buses sanctioned under PM e-Bus Sewa to expand clean public transport coverage.

Intercity e-bus services are beginning to scale, widening the addressable market beyond urban buses. The newly launched Greater Noida–Dehradun electric service adds a 300-km proof-point for long-haul viability.

Strong Tender Momentum over the last few years

In the last 5 years there have been at least six publicly disclosed LOAs totalling ~10,597 e-buses across states. This indicates an active orderbook and provides multi-quarter revenue visibility.

Contract mix supports multi-year cash-flow visibility. Most city orders (APSRTC, BEST, TSRTC) are GCC/OPEX for 10 to 12 years with Annual Maintenance Contract. This enables recurring revenue.

In April 2025, Olectra received a Letter of Award from HRTC for 297 e-buses on an outright sale plus maintenance basis, with deliveries scheduled over 11 months.

Maharashtra’s large 5,150-bus program (which had seen cancellation headlines in May) was subsequently reinstated under a revised schedule in June 2025.

Supplied 550 E-buses to TSRTC (Telangana) including 50 intercity + 500 intracity buses.

Consistency Formula

BYD partnership & Blade Battery IP (till 2030) → Technology moat and proven platform → Higher reliability/safety and stronger tender acceptance.

Industry Tailwinds + Adoption Momentum → Increasing Demand and Revenues.

Multi-year Contracts → Annuity-like service revenues → Smoother, recurring cash flows.

Cost Curve and Tech Tailwinds → More competitive bids and higher win rates.

FINVEZTO.COM | Start Building Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.