The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

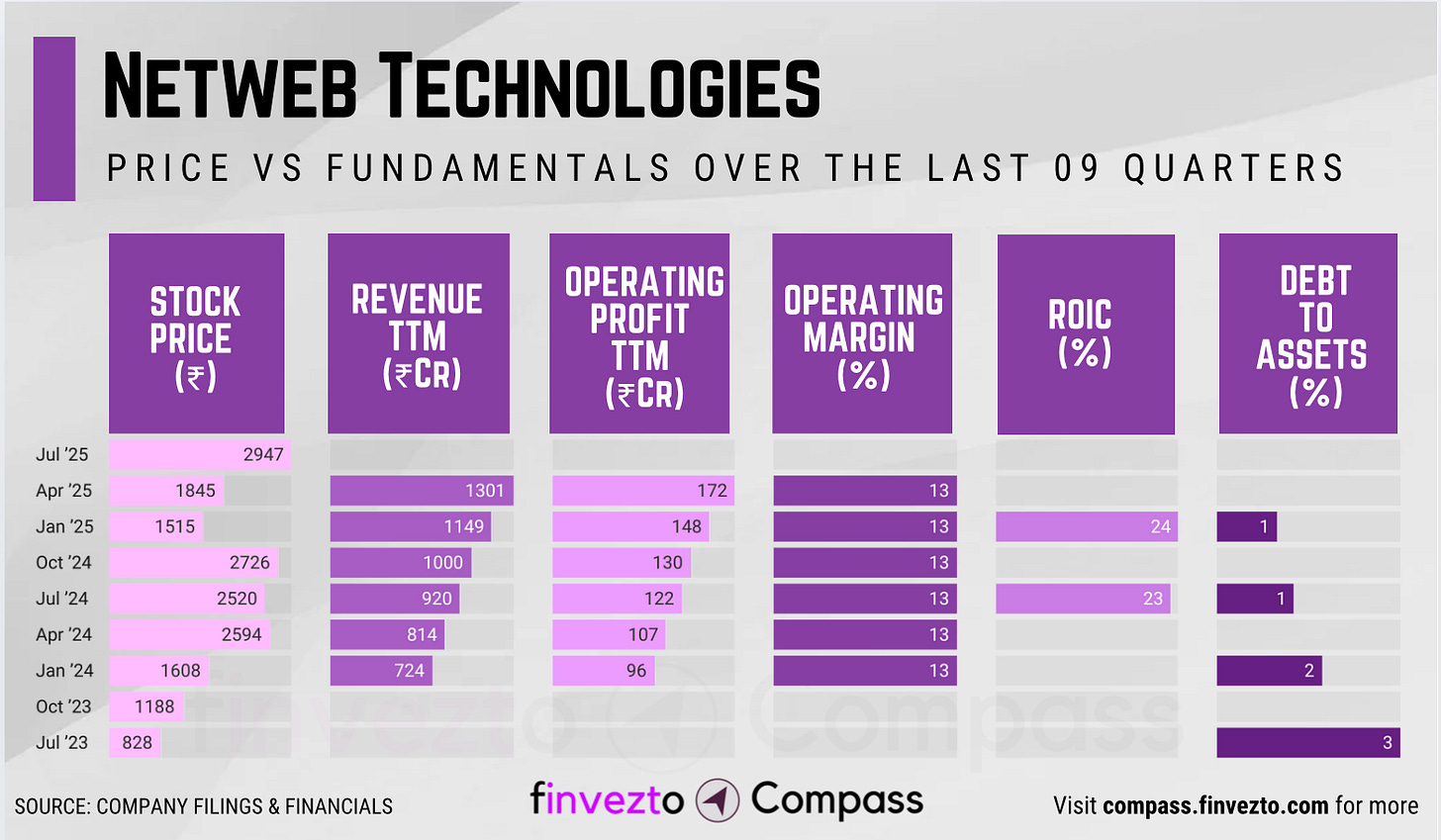

Today, we will look at the key fundamentals & business of Netweb Technologies India Ltd. Click here to learn more about each of the parameters in the chart below.

What Has Led to This Consistency

Company Overview

Netweb Technologies India Ltd, established in 1999, transformed from a domestic server manufacturer into India's leading supercomputing OEM serving government institutions, research centers, and enterprises.

The company operates in India's supercomputing market projected to grow at 13.7% CAGR to USD 1.78 billion by 2030.

Product Segments:

High-Performance Computing Systems (supercomputing clusters and AI infrastructure)

Private Cloud Infrastructure (Tyrone brand hyperconverged solutions)

Artificial Intelligence Systems (GPU-accelerated platforms contributing 29% of Q1 FY26 revenue)

Storage and Server Solutions (high-performance storage arrays and server configurations)

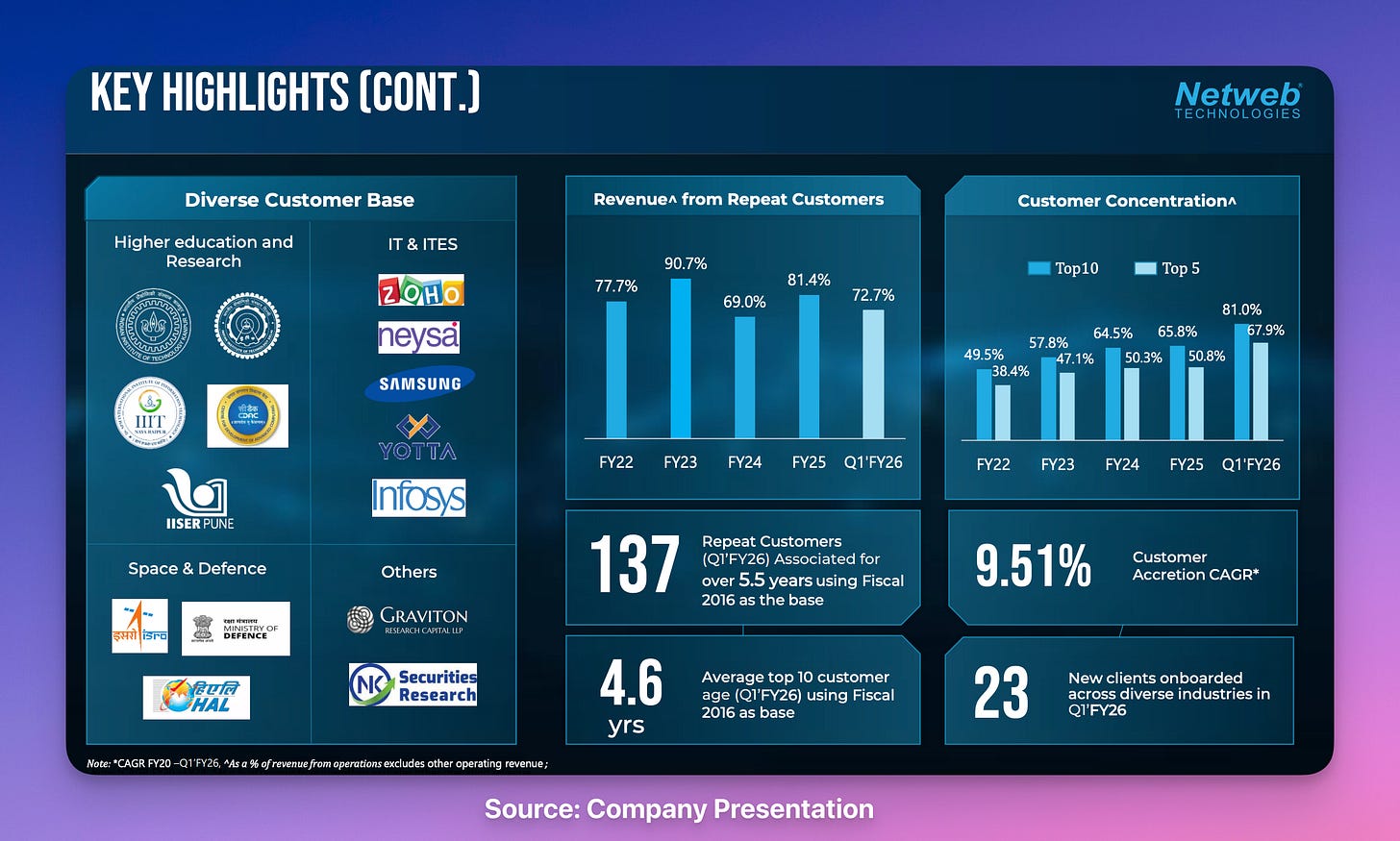

Revenue generation combines product sales and recurring service contracts through established government relationships and expanding private enterprise segments. The company operates through integrated manufacturing leveraging strategic technology partnerships with NVIDIA and AMD.

Government Infrastructure Lock-in

C-DAC partnership spanning 20+ years managing India's ₹4,500 crore National Supercomputing Mission requires Netweb's specialized software. Government AI budget allocations jumped 1,056% in 2025-26.

Netweb earned security clearances across defense research installations including DRDO and ISRO through proven track record of handling sensitive computing projects. New competitors need 24+ months just for approval processes → Entry barriers

Netweb qualifies for PLI scheme benefits providing 4-6% margin advantages over imports. Government tenders give 20-25% scoring benefits to domestic suppliers.

Technical Specialization Depth

Deep supercomputing expertise creates competitive barriers.

Netweb designs and manufactures circuit boards in-house, enabling custom hardware solutions. About 60% of government projects require custom specifications → technical differentiation

Netweb operates computing infrastructure across national research institutions. The company has built expertise in managing complex installations that require specialized maintenance → Institutional knowledge

Netweb launched 200+ dual processor server models under Tyrone brand covering diverse computing requirements from entry-level to high-performance configurations → Product breadth

NVIDIA Partnership Access

Netweb manufactures next-generation NVIDIA processors for the Indian market. This positions the company as primary supplier before these products become widely available → Timing advantage

NVIDIA shares early product specifications with Netweb for joint development projects. This accelerates Netweb's product development compared to competitors who wait for public releases → Development speed

NVIDIA partnership enables participation in government AI infrastructure projects requiring advanced hardware.

Consistency Formula

Government Infrastructure Lock-in + Technical Specialization Depth → Revenue Predictability

NVIDIA Partnership Access + Domestic Manufacturing Scale → Market Leadership

FINVEZTO.COM | Actionable Investing & Trading Ideas

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.