NARAYANA HRUDAYALAYA || Consistently Performing Stocks #24

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

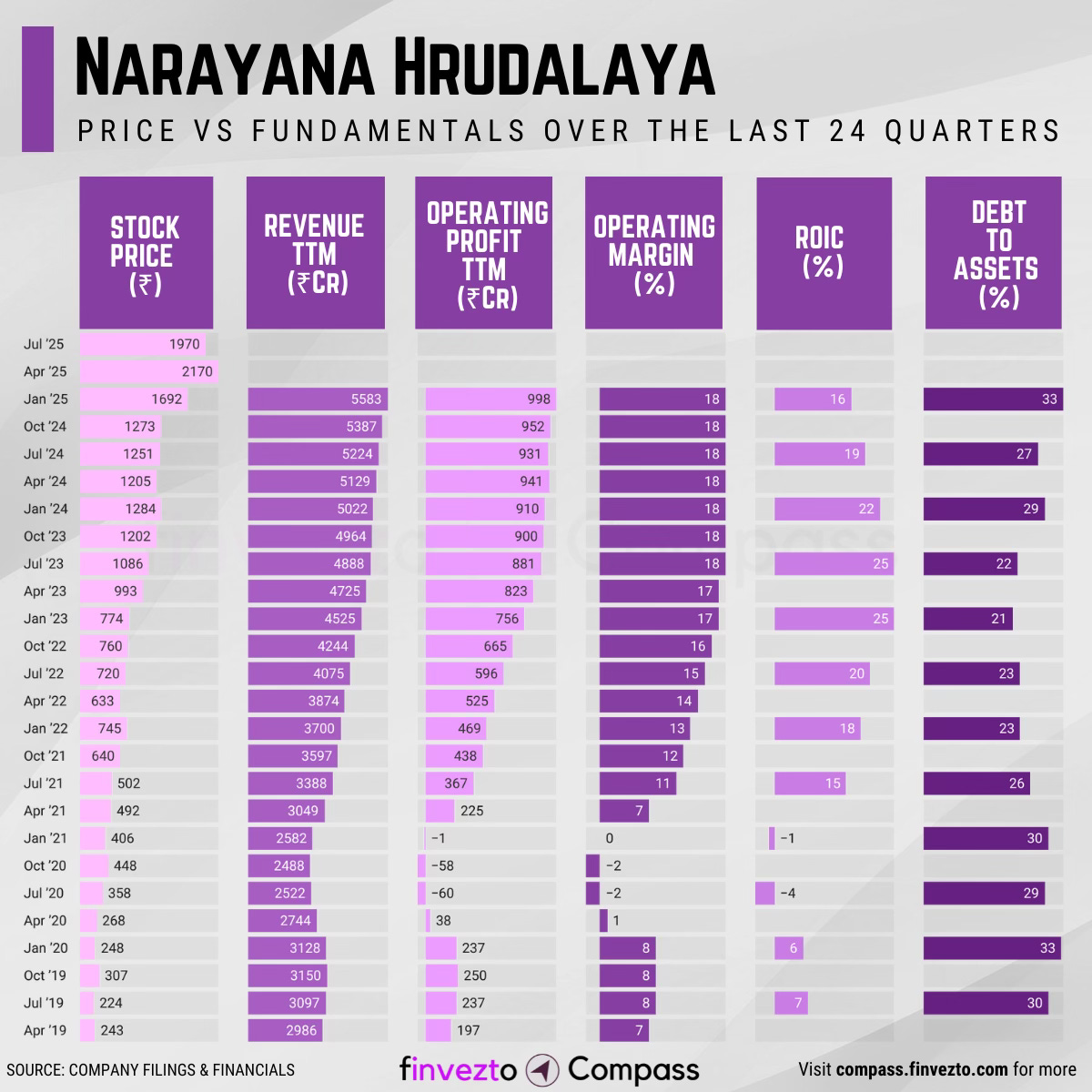

Today, we will look at the key fundamentals & business of Narayana Hrudayalaya Ltd. Click here to learn more about each of the parameters in the chart below.

What Has Led to This Consistency

Company Overview

Established in 2000 by cardiac surgeon Dr. Devi Prasad Shetty, Narayana Hrudayalaya has transformed into India's largest multi-specialty healthcare chain by bed count, serving patients globally for over 24 years with specialized focus on affordable tertiary care.

Product Segments include:

Cardiac Sciences with 4,000+ surgeries annually, 1.4% mortality rate

Oncology centers of excellence across multiple locations

Neurosciences with comprehensive brain and spine care

Transplant Services offering multi-organ transplant capabilities

Specialty Care spanning 30+ medical specialties

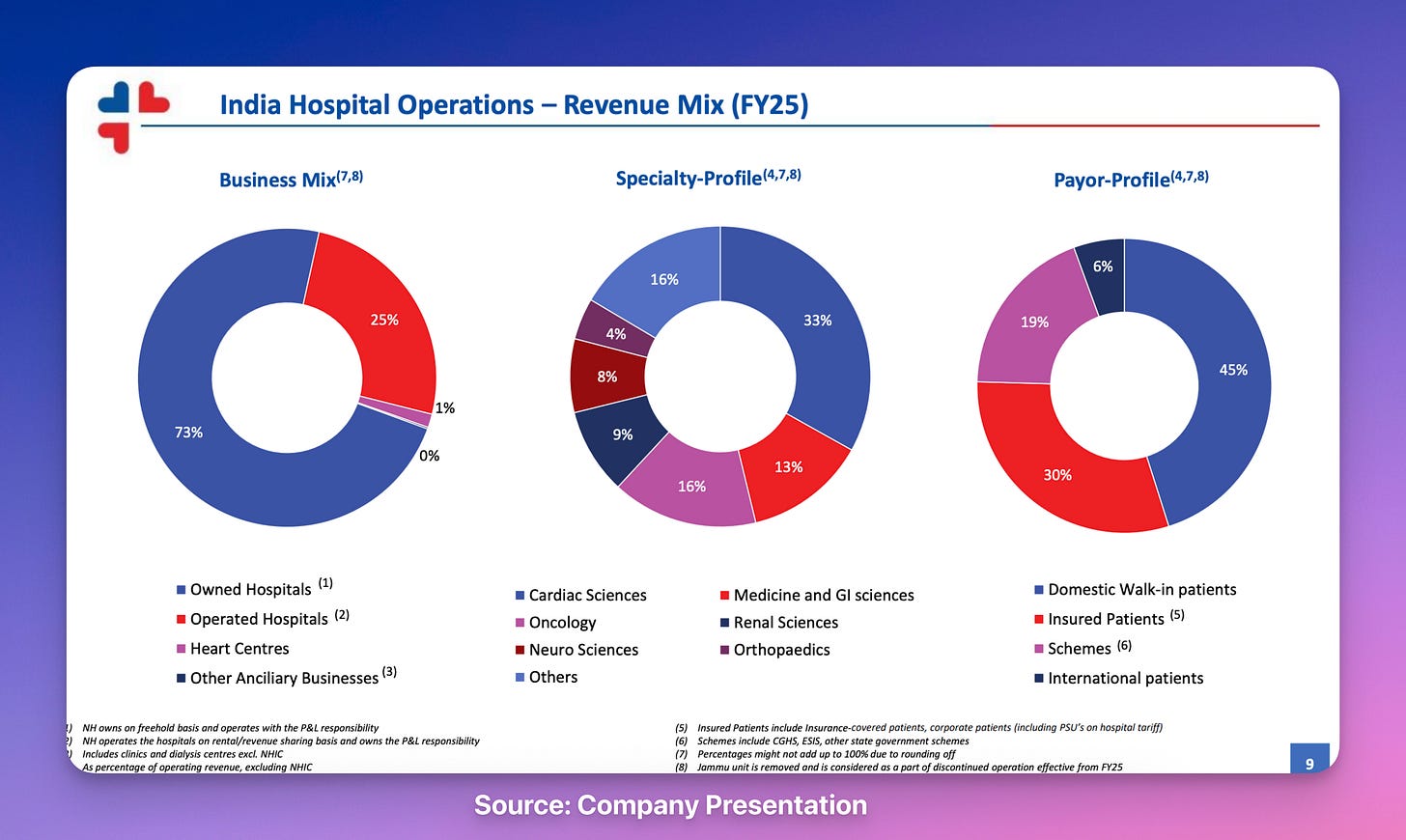

Revenue generation primarily from domestic markets with strategic international presence in Caribbean and medical tourism from 78+ countries.

The company creates sustainable economics through cross-subsidization model where premium patients fund free/subsidized care for 50%+ of patient base.

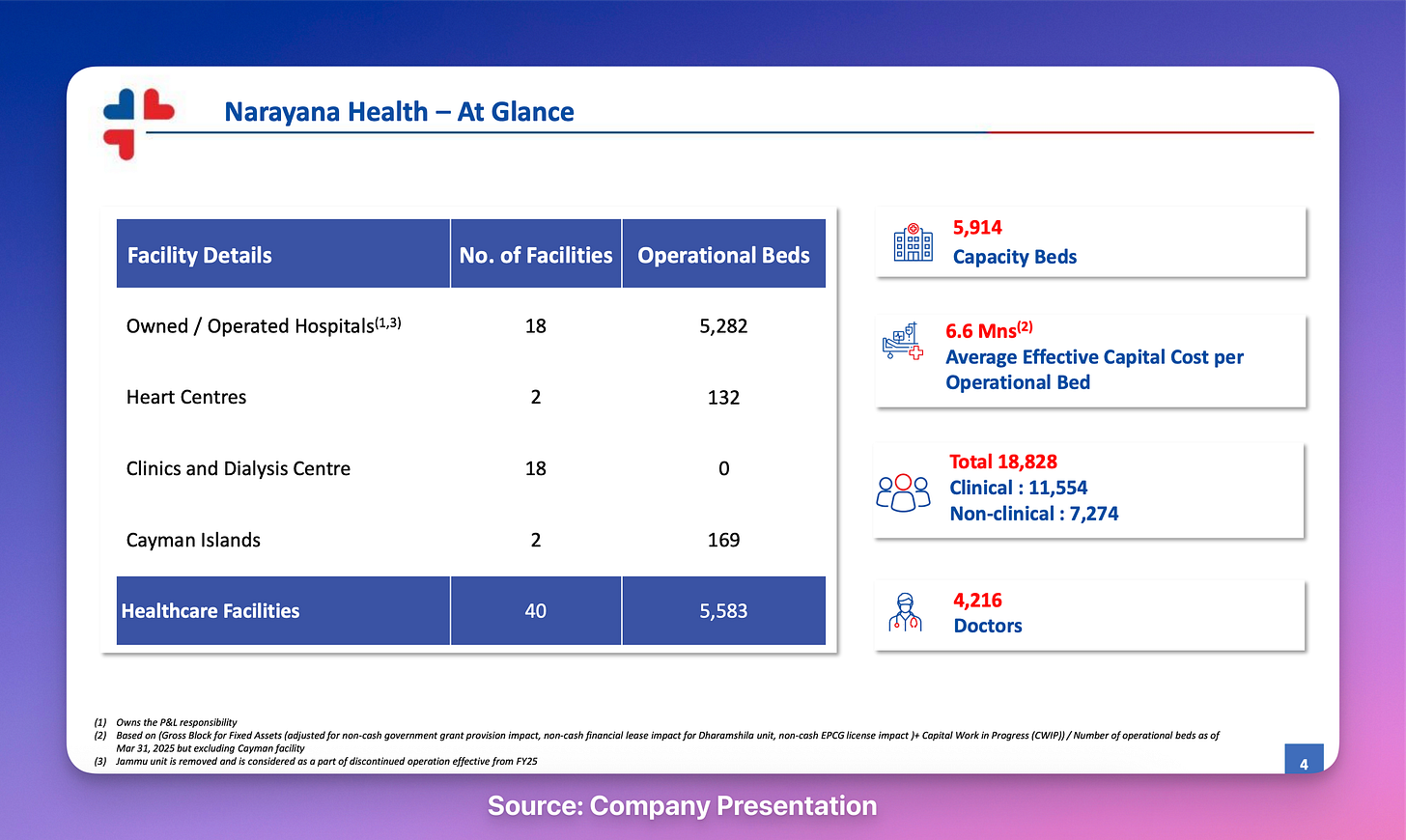

Operates 40 healthcare facilities globally with 5,820+ operational beds and 800+ telemedicine centers, serving 2.6 million patients annually across multiple continents.

Assembly-Line Operations

Narayana applies manufacturing principles to healthcare, performing 30+ cardiac surgeries daily with standardized protocols and extreme surgeon specialization.

Surgeons focus exclusively on surgery while dedicated teams handle pre-operative, post-operative tasks.

Enables 400-600 procedures annually versus 100-200 industry average → Reduced per-surgery costs through volume

Standardized treatment protocols across all facilities achieve 1.4% CABG mortality rates versus 1.9% in US → Superior clinical outcomes

14-hour daily equipment utilization versus 8-hour industry standard → Fixed cost optimization

Pay-per-use equipment model eliminates large capital investments, paying only when machines are utilized → Cash flow improvement

Cross-Subsidization Economics

Strategic patient mix with 50%+ receiving free or subsidized treatment funded by paying patients creates sustainable affordable care ecosystem.

Yeshasvini micro-insurance scheme covers 4 million farmers providing predictable revenue stream from government partnerships → Volume stability

Premium patients pay for non-clinical amenities → Margin enhancement

Robin Hood style economics model cross-subsidizes charitable care.

Medical tourism generates 10-12% revenue from international patients paying premium rates → Foreign currency earnings

Hub-and-Spoke Network

Centralized specialist facilities connected to 800+ telemedicine centers globally route complex cases efficiently.

Tertiary care hubs in metros connected to smaller hospitals in tier-2/3 cities enable initial local treatment → Geographic expansion

Complex case transfers to specialist facilities optimize resource allocation

World's largest tele-cardiology network spans 53 countries through satellite connectivity → Asset-light revenue model

Government hospital partnerships across multiple states provide management contracts without capital investment → Asset-light expansion

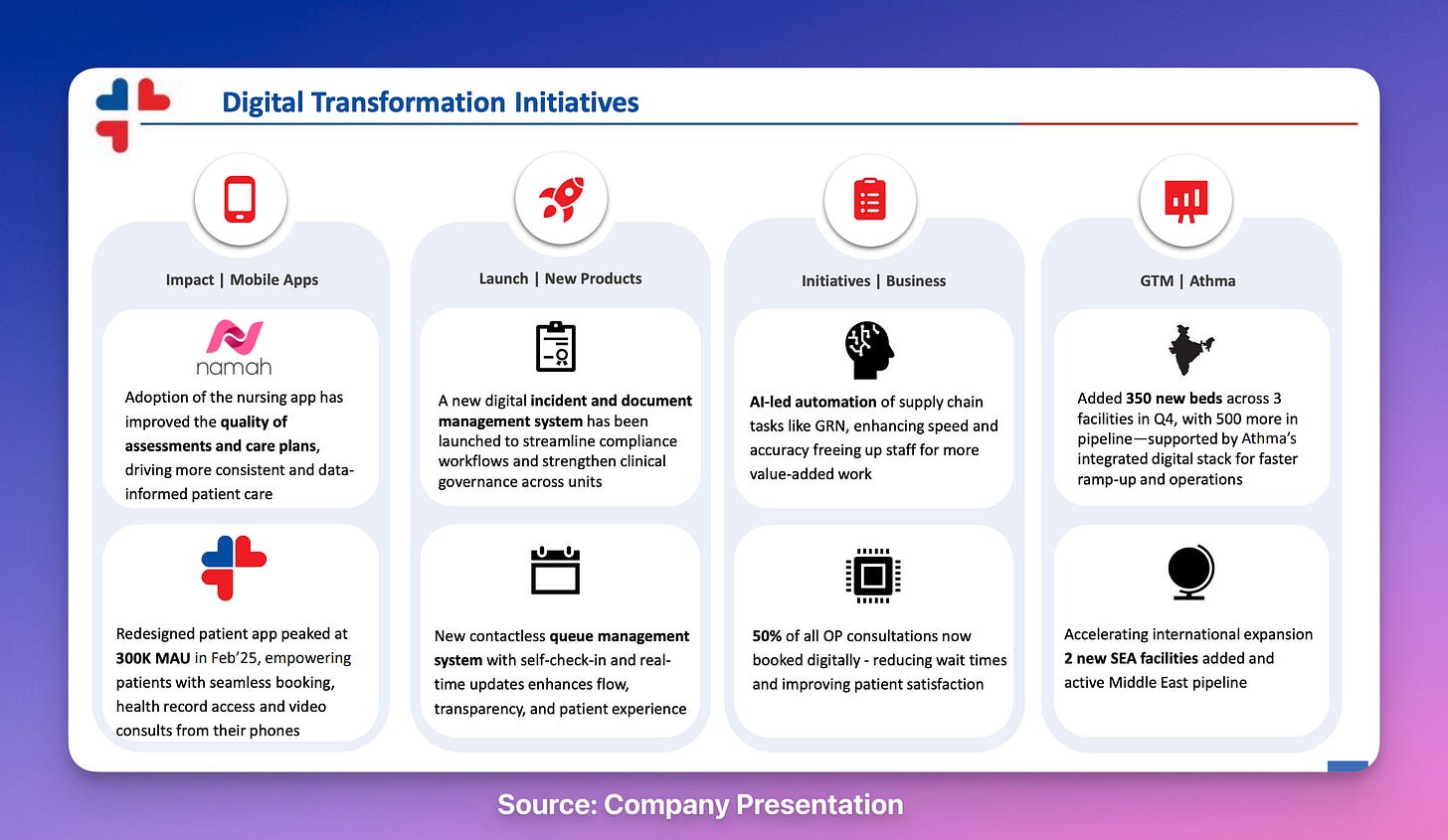

Technology Integration

Microsoft Azure-powered "Medha" platform provides real-time analytics across 3,000+ doctors, replacing Excel-based systems with predictive intelligence.

Daily P&L tracking → Faster decision-making

AI pilot projects for diagnostic imaging reduce radiologist workload, improve accuracy and cut diagnosis time from hours to minutes → Diagnostic efficiency

Athma digital health platform achieved ₹200 crore revenue increase from 2021-2023

99.99% system uptime through NetApp partnership ensures uninterrupted clinical operations

International Expansion

Health City Cayman Islands (wholly‑owned subsidiary of NH) generates $142 million annual revenue (20%+ of total) serving 60+ countries with zero mortality rates and JCI Enterprise Accreditation.

Caribbean positioning provides access to North American medical tourism markets at 25-40% of US costs while maintaining equivalent outcomes → Premium revenue stream

JCI accreditation validates international quality standards, enabling medical tourism revenue and premium pricing despite lower costs

Established referral networks create sustainable international patient flow

US$300+ million investment opens doors for Latin American expansion generating stable foreign currency earnings

Cost Innovation

Superior efficiency in converting scale to profitability through process standardization and resource optimization across the network.

Centralized procurement across 40 facilities provides bulk purchasing power → Supply cost reduction of 25-30%

Device reuse programs after sterilization cut equipment costs by 60-80% while maintaining safety standards

Seven manufacturing plants provide optimal logistics costs and market proximity → Vertical integration

Asset-light expansion through leasing reduces capital requirements by 50% enabling faster market entry

Consistency Formula

Assembly-Line Specialization + Cross-Subsidization Economics → Sustainable Cost Advantage

Hub-and-Spoke Network + Technology Integration → Market Dominance

International Expansion + Operational Excellence → Capital Efficiency

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research