MARKSANS PHARMA || Consistently Performing Stocks #20

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

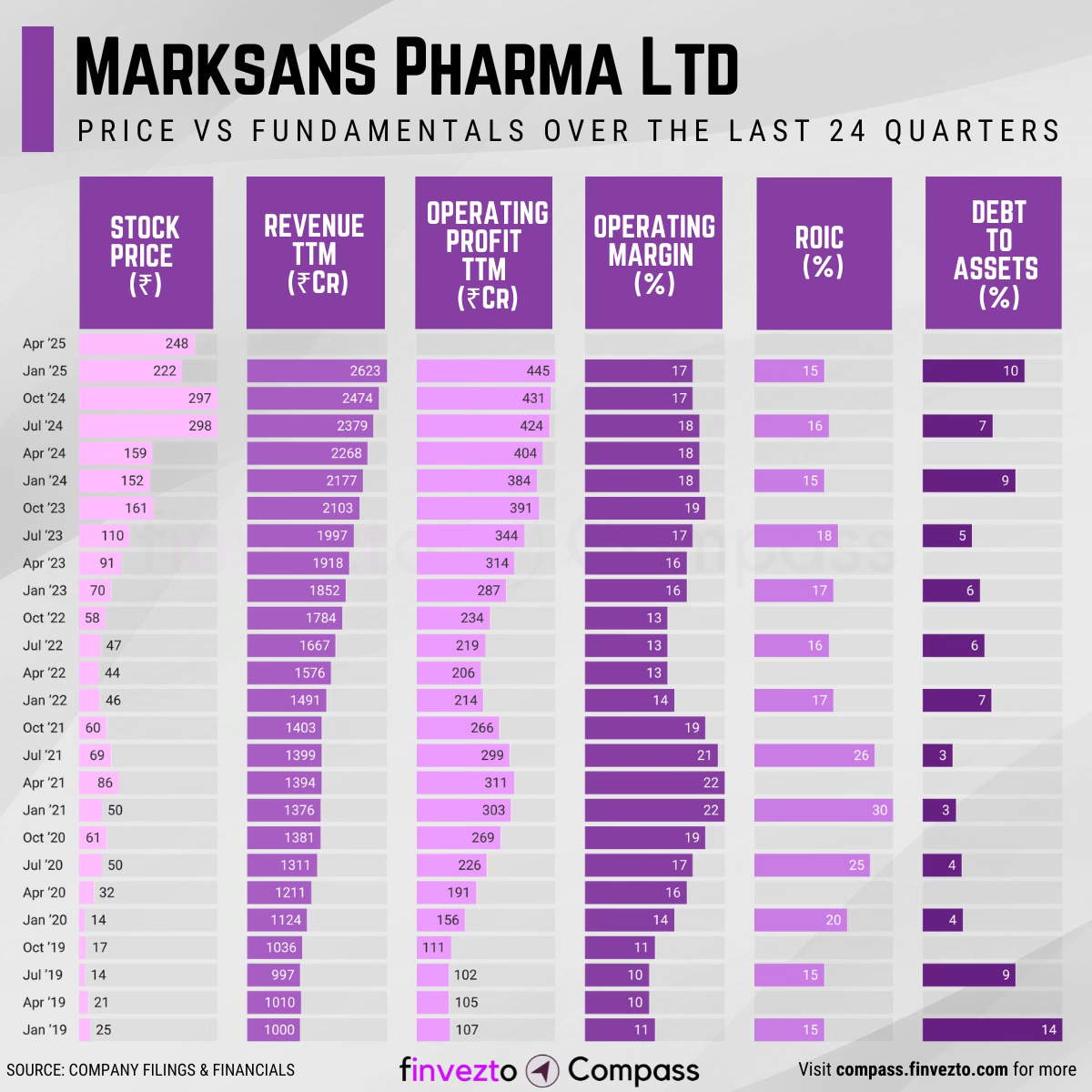

Today, we will look at the key fundamentals & business of Marksans Pharma Ltd. Click here to learn more about each of the parameters in the chart below.

What Has Led to This Consistency

Company Overview

Established in 2005 by Mark Saldanha from the Glenmark pharmaceutical family. Has grown into a specialized manufacturer of soft gelatin capsules serving regulated markets globally for nearly 20 years.

Product Segments include:

Soft Gelatin Capsules

Pharmaceutical Manufacturing Services

Contract Development and Manufacturing

Revenue generation primarily from regulated markets including UK/Europe, USA, and Australia (95% of the business)

Specializes in soft gelatin capsule technology, a complex niche segment that delivers drugs pre-dissolved in liquid form for higher bioavailability compared to traditional solid tablets.

Operates manufacturing facilities across India, UK, and US with combined capacity of 16+ billion units annually, serving 50+ countries through seven subsidiaries.

Revenue Diversification

Marksans spreads business across multiple countries generating 87-92% revenue from wealthy, well-regulated markets (UK/Europe + USA + Australia) for risk reduction and seasonal balance.

Marksans' revenue distribution: UK/Europe (40%), USA (47%), Australia (9%), India domestic (6-8%), Rest of World (4-5%) → Diversification

Marksans benefits from cold and flu seasons varying across hemispheres, balancing sales throughout the year with Northern Hemisphere peaks (Oct-Mar) and Southern Hemisphere peaks (Apr-Sep) → Seasonal revenue balance

Marksans' local subsidiaries leverage regional expertise: Bell, Sons & Co. (UK's largest private-label cough liquid manufacturer), Nova Pharmaceuticals (100+ Australian TGA approvals), Time-Cap Laboratories (FDA-approved US facility) → Local market penetration

Marksans' Rest of World markets (Middle East, Africa, emerging markets) revenue grew 17.9% annually from 2017-24, reaching ₹110+ crores in FY25 with India domestic contributing ₹160+ crores → Emerging market expansion + domestic growth

Strategic Acquisitions

Marksans built global market access through targeted acquisitions, establishing presence in major pharmaceutical markets.

Tevapharm India Goa facility purchase (2023) doubled Indian production capacity from 8 billion to 16 billion units annually

Access Healthcare acquisition (2022) strengthened Middle East and North Africa presence

Time-Cap Laboratories acquisition (2015) provided first US manufacturing facility with established FDA approvals and $30+ million annual revenue stream

Bell, Sons & Co. and Relonchem acquisitions (2008) established European market dominance, with Bell, Sons & Co. now the biggest private-label cough medicine maker in UK

Regulatory Excellence

Marksans uses quality standards as their competitive weapon, with recent clean inspections from US FDA, German health authorities, and UK regulators providing premium market access.

Marksans received recent US FDA approvals for multiple products: Loratadine, Esomeprazole, Guaifenesin, and Acetaminophen+Ibuprofen combinations → Premium market access

Marksans' manufacturing facilities have been approved by US FDA, UK regulators, and Australian authorities across three continents → Global manufacturing reach

Marksans' official approvals for over-the-counter medicines enable premium pricing versus generic competitors with 18-24 month approval timelines creating entry barriers → Competitive pricing advantage

Marksans maintains ISO 9001:2015 and WHO-GMP certifications across all facilities with 99.2% regulatory submission approval rate → Exceptional compliance standards

Operational Transformation

Marksans transformed from contract manufacturing to selling own branded products.

Marksans' business model shift: 2009 (contract work only) → 2014 (80% own products) → 2021 (minimal contract work) → Higher margins + pricing control

Marksans' combined global production exceeds 16 billion units annually with multiple product capabilities → Production scale + lower unit costs

Marksans, in the recent years has implemented automated production lines and digitized inventory management systems reducing manufacturing cycle time by 35% and operational costs by 22% → Efficiency improvements

Product Innovation

Marksans focuses on creating over-the-counter (OTC) medicines with complex formulations.

108 new products under development across global markets with special extended-release and coating technologies

Global OTC drugs market expansion: $125.28 billion (2023) → $229.01 billion projected (2033)

Innovation beyond traditional products: new factory capabilities for gummies and creams expanding beyond pills and capsules

Soft gel specialization benefits from aging populations, rising healthcare costs, and self-treatment preferences

Consistency Formula

Strategic Acquisitions + Regulatory Excellence → Market Access and Pricing Power

Geographic Diversification + Operational Transformation → Stable Revenue Streams

Product Innovation → Competitive Moat & Growth Opportunities

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research