Market Review & Analysis for October 03-06, 2023

A comprehensive round up of what happened last week in the Indian Markets and outlook for upcoming week

Global Markets Summary

Global sentiments remained subdued throughout the week, impacting global equity indices.

Nifty 50 and BSE Sensex closed the week with losses of 0.18% and 0.27%.

The US Federal Reserve’s hawkish tone signaled prolonged higher interest rates.

JPMorgan CEO Jamie Dimon warned of a worst-case scenario with a 7% rate hike and stagflation.

Rising bond yields and a stronger US dollar led to reduced interest in emerging market equities.

Brent crude oil prices nearing USD95/bbl raised inflation fears, particularly for India’s current account deficit.

Concerns about China’s property market further weighed on sentiment.

US bond yields and crude oil prices eased slightly on Friday, sparking a relief rally on Friday.

Positive Eurozone inflation and UK GDP data boosted sentiment in Europe.

Industrial profits in China surged. China is expected to achieve economic growth of slightly more than 5%.

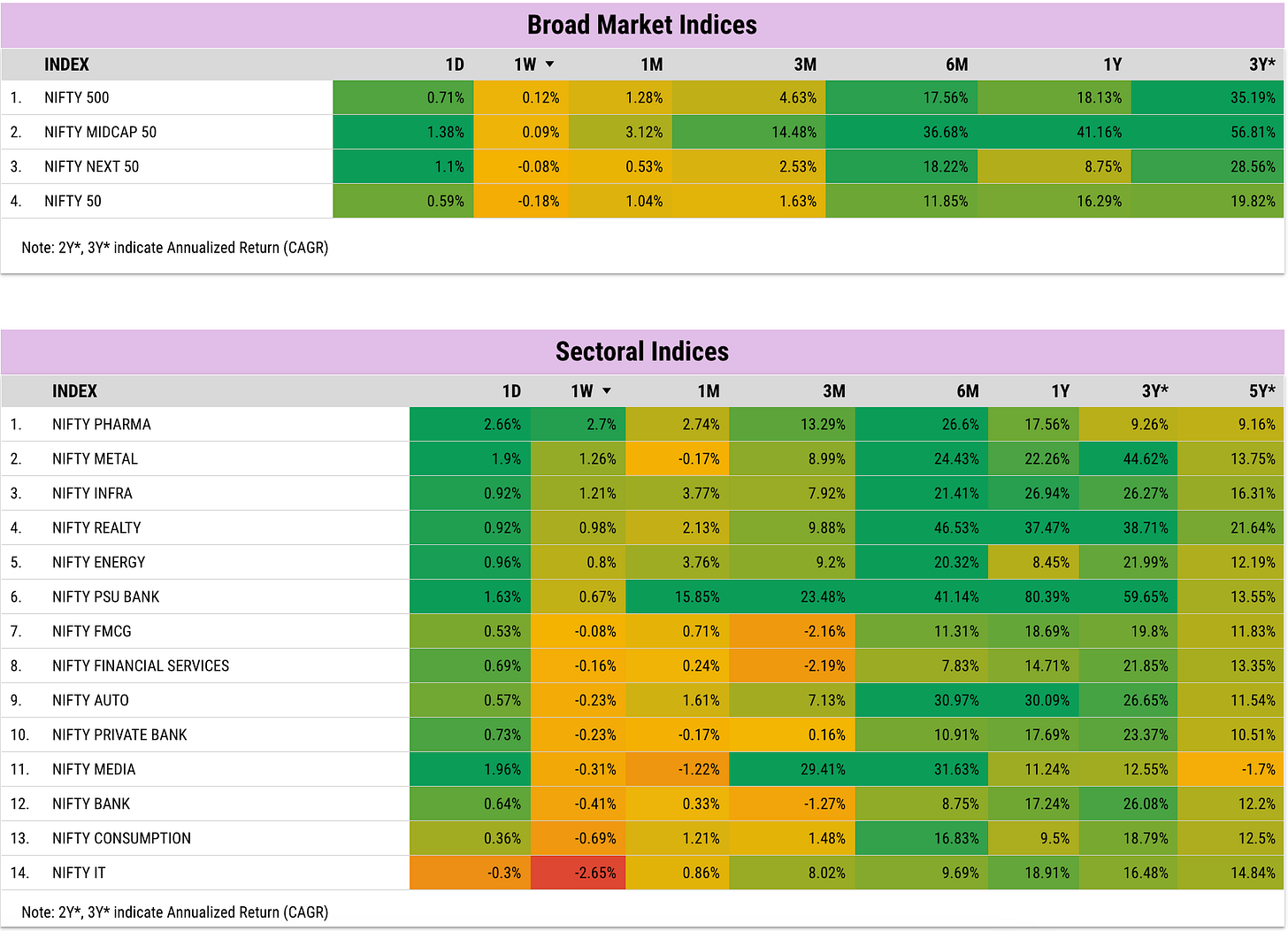

Indian Indices Peformance

Midcap and Small Caps did better than Nifty last week as they have done in the last 1 year or so.

Pharma, Metals & Infra gained. IT lost the most.

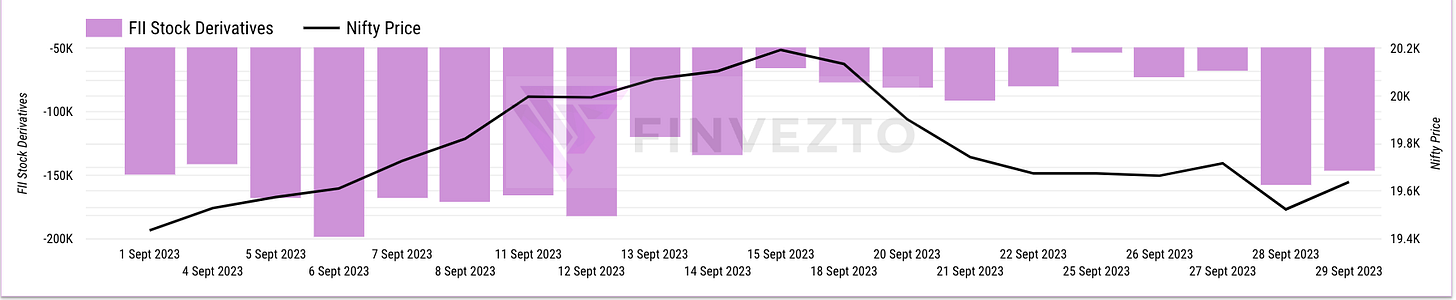

FII Positions Analysis

FIIs continued to be net sellers in the cash market.

FIIs continue to hold short positions on Index Derivatives. However, they slightly reduced their shorts on the Index on Friday. Overall, their net Index View is Bearish.

FIIs increased their short positions on Stock Derivatives over the week. Their net view on F&O Stocks in Bearish.

We check FII positions on a daily basis to understand their sentiment as the correlation of Nifty price moves with FII position is almost 70%. That is both move in the same direction 70% of the time.

Important Stock Announcements from Last Week

Key Mergers/Acquisitions/Joint Ventures/Collaborations

Emami enters the juice category with a 26% equity stake in Axiom Ayurveda, makers of AloFrut.

Saregama India acquires 51.8% shares in digital entertainment company Pocket Aces Pictures for Rs 174 crore.

Sun Pharmaceutical subsidiary to acquire remaining 25% shares of Sun Pharma de México for MXN $161.85 million.

Godrej Agrovet partners with Sime Darby Plantation to supply high-quality oil palm seeds in India.

Aurobindo Pharma subsidiary Auro Vaccines partners with Hilleman Laboratories to develop and commercialize a pentavalent vaccine for children.

Dixon Technologies’ subsidiary Padget Electronics signs agreement with Xiaomi for smartphone manufacturing in Noida.

Tata Power Renewable Energy to establish a 41 MW captive solar plant in Tamil Nadu for TP Solar’s new manufacturing facility.

JSW Steel terminated its joint venture agreement with National Steel Holding and purchased NSHL’s 50% stake in NSL Green Recycling.

Key Management Appointments/Resignations

Bank of Maharashtra appoints Pradeep Kumar Srivastava as Chief Technology Officer.

MAS Financial Services appoints Riddhi Bhayani as Chief Compliance Officer.

Radhesh R Welling resigns as MD of Navin Fluorine International; Sudhir R Deo appointed additional director.

Bajaj Finserv appoints Ramaswamy Subramaniam as President – Private Equity.

SBI Life Insurance appoints Amit Jhingran as MD and CEO, replacing Mahesh Kumar Sharma, who becomes Deputy MD in SBI Corporate Centre.

Vijaya Diagnostic Centre appointed Sura Suprita Reddy as MD & CEO for five years.

Madras Fertilizers appoints Priya Ranjan Panda as CFO.

Key Buying/Selling Deals

YES Bank acquires 1,79,37,200 equity shares of YES Securities (India) for nearly Rs 100 crore.

Delta Corp: Ashish Rameshchandra Kacholia sold 15 lakh shares in open market transactions.

Sequoia Capital India Investment Holdings III exits Quick Heal Technologies, while Vikas Khemani’s Carnelian Asset Advisors buys shares.

Happiest Minds Technologies’ promoter Ashok Soota sells 1.1% stake to fund SKAN and Happiest Health.

Abu Dhabi-based International Holding Company to sell more than 1% stakes in Adani Green Energy and Adani Energy Solutions.

HDFC Asset Management Company: Invested Rs 25 crore in subsidiary HDFC AMC International (IFSC).

MIV Investment Services buys 1.6 lakh shares in Krsnaa Diagnostics, while Invesco Mutual Fund sells 1.95 lakh shares.

Voltamp Transformers: Promoter sells 12% equity, while mutual funds and others buy 6.95% stake.

Aviator Global Investment Fund bought shares in Hinduja Global Solutions, while Legends (Cayman) sold shares.

Ambadi Enterprises sold shares in Cholamandalam Financial Holdings, while Nomura India Investment Fund bought shares.

Reliance Retail Ventures received Rs 2,069.50 crore from KKR and allotted equity shares.

Key Business Updates/New Orders/Projects/Expansion/CAPEX

NLC India ties up long-term power purchase agreements for its thermal power project in Odisha.

Deep Industries received a Letter of Award for charter hiring of HP compressors at GCP Geleki, Assam.

NBCC India announces e-auction of 14.75 lakh sq ft commercial space in World Trade Centre, New Delhi.

Oberoi Realty enters a Development Agreement for land in Tardeo, Mumbai, expecting to generate 2.5 lakh sq ft of free sale space.

Century Textiles and Industries: Sells out phase 1 of Birla Trimaya for Rs 500 crore within 36 hours.

Welspun Corp: Subsidiary Sintex BAPL signed MOU for manufacturing unit in Telangana with up to Rs 350 crore investment.

Deep Industries received a Letter of Award for charter hiring of HP compressors at GCP Geleki, Assam.

IRCON International executed a contract agreement for the signalling and telecommunication system in Sri Lanka.

3i Infotech: Receives a 5-year contract worth Rs 39.55 crore from Ujjivan Small Finance Bank for end-user support services.

IPO/Listing/De-Listing

Cellecor Gadgets debuts on NSE Emerge at Rs 92 per share.

Marco Cables & Conductors makes its NSE Emerge debut at an offer price of Rs 36 per share.

Techknowgreen Solutions lists on BSE SME at Rs 86 per share for 10 trading days.

Hi-Green Carbon starts trading on NSE Emerge at Rs 75 per share, specializing in waste tire recycling.

Signature Global India, an affordable housing company debuts on BSE and NSE on September 27 at Rs 385 per share.

Kundan Edifice debuted on NSE Emerge at Rs 91 per share as an LED strip lights manufacturer.

Madhusudan Masala: Listed equity shares on NSE Emerge at Rs 70 per share.

Sai Silks Kalamandir, Ethnic apparel retailer lists shares on September 27 at Rs 222 per share.

Key Regulatory/Tax related Announcements

Infosys receives IGST demand order notice for Rs 26.5 lakh for non-receipt of foreign inward remittance.

Delta Corp received an intimation for alleged tax liability of Rs 11,139.61 crore.

Life Insurance Corporation of India will appeal a demand of Rs 290.49 crore in goods and service tax.

Prataap Snacks: GST Authority conducts search and seizure at manufacturing unit in Bengaluru.

US FDA issues Form-483 with 2 observations after inspecting Piramal Pharma’s Bethlehem facility.

Key Corporate Actions (Buybacks/Dividends/Fund Raising/QIP/NCD)

Sheela Foam: Closed QIP and allocated equity shares at Rs 1,078 per share, raising Rs 1,200 crore.

Sterling and Wilson Renewable Energy considers raising funds via non-convertible debt instruments or equity shares.

Shree Renuka Sugars received board approval to acquire Anamika Sugar Mills for Rs 235.5 crore and raise funds of up to Rs 285 crore through non-convertible debentures.

Important Upcoming Events

Monday, October 2

October 2 is a market holiday.

BoJ Summary of Opinions: Release of summary of opinions from the Bank of Japan's latest policy review in September.

Tuesday, October 3

India Manufacturing PMI: Release of India's Manufacturing PM for September.

Wednesday, October 4

Jibun Bank Services PMI Final: Final figures for Japan's Services PM and Composite PM for September.

Thursday, October 5

Sep Global Services PMI: Release of India's Services PM and Composite PM for September.

US Initial Jobless Claims: Release of initial iobless claims data for the week ending September 30.

RBI Interest Rate Decision: Announcement of the Reserve Bank of India's interest rate decision following their meeting on October 4.

Friday, October 6

Credit Growth YoY: Release of year-on-year credit growth data for India up to September 22.

That’s all for this week!

FINVEZTO.COM | Comprehensive Investing & Trading Analytics Platform

💼 Toolkit - https://finvezto.com/toolkit

𝕏 Connect on Twitter (X) - https://twitter.com/finvezto

Know More About Us - https://www.linkedin.com/in/finvezto

📧 E-mail: support@finvezto.com

For Queries, WhatsApp us here - https://wa.me/918148413194