Time Technoplast Ltd || Consistently Performing Stocks #47

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they were able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Let’s Start.

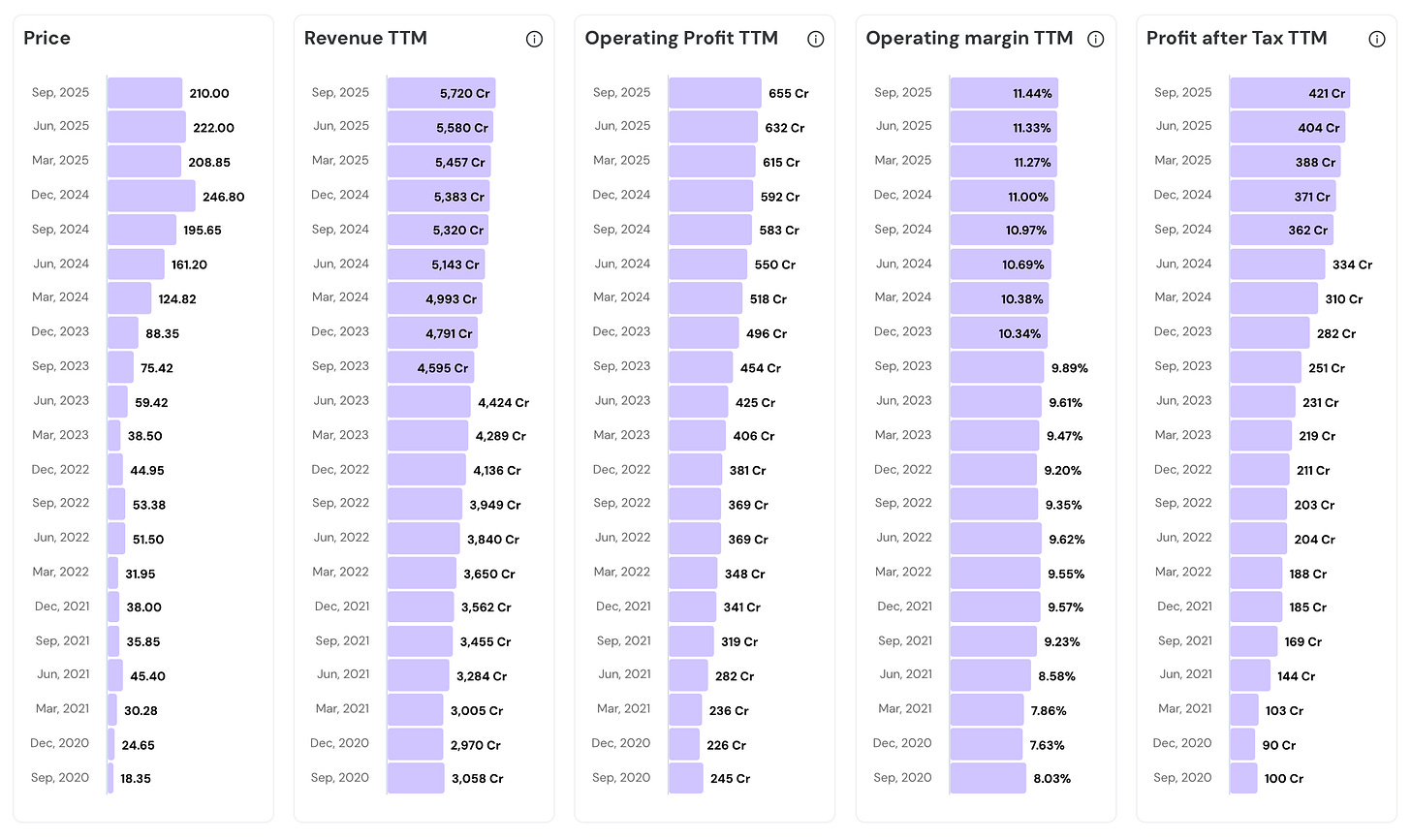

In the last 5 years…

- TIMETECHNO's stock price has surged 11.4 times

- Revenue has grown 1.9 times

- Operating profit has grown 2.7 times

- PAT has grown 4.2 times

- Operating Margins have increased from 8.03% to 11.44%

Take a look at the numbers below. Incredible Consistency.Let us explore how they are able to perform consistently.

Their Road to Consistency

1. Overview and Business model

Time Technoplast is a multinational manufacturer of polymer and composite products serving multiple industries. The business is largely B2B, serving institutional clients.

Segment Mix…

Polymer Products include Plastic Drums, Jerry Cans, Pails, Polyethylene (PE) pipes, Turf, Mattings, Disposable Bins and MOX Films. This segment accounts for ~73% of revenue.

Composite Products include Intermediate Bulk Containers (IBC), Composite Cylinders (LPG, Oxygen & CNG), Energy storage devices, Auto Products and Steel Drums. This segment accounts for ~27% of revenue.

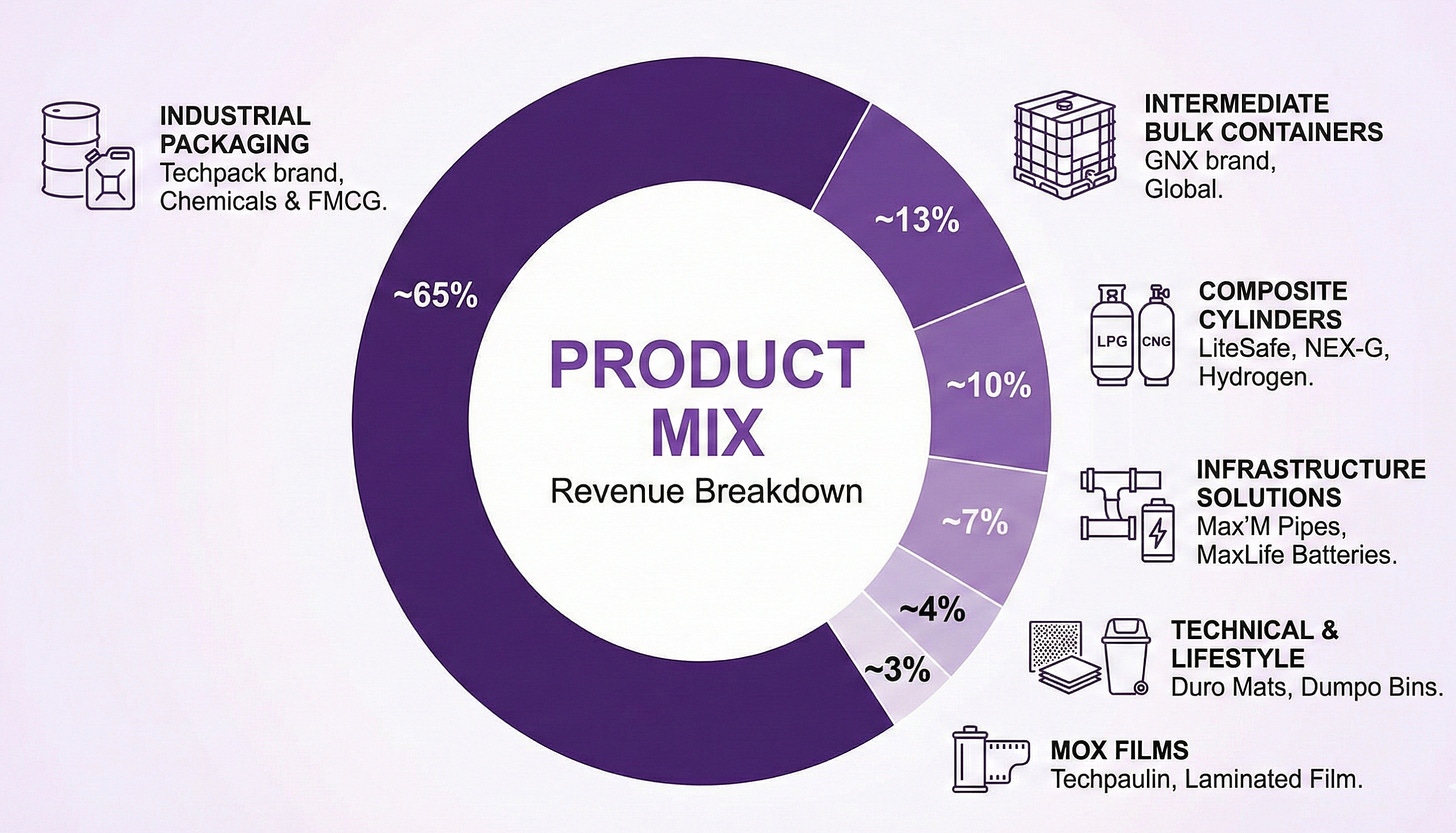

Product Mix…

Industrial Packaging (~65% of Revenue) includes drums, containers, jerry cans, and Conipack pails marketed under the Techpack brand, predominantly serving the Chemical and FMCG industries.

Intermediate Bulk Containers (~13%) are marketed globally under the GNX brand.

Composite Cylinders (~10%) include LiteSafe LPG Cylinders, NEX-G CNG Cascades, and cylinders for hydrogen and oxygen.

Infrastructure Solutions (~7%) comprises HDPE pipes branded as Max’M for water supply, drainage, and sewage applications, alongside MaxLife valve-regulated lead-acid batteries supplied to railways and solar industries.

Technical & Lifestyle (4%) offers matting solutions under Duro Wipe, Duro Soft, Duro Turf, Duro Comfort, and Meadowz brands, along with Dumpo Bins for waste disposal.

Mox Films (3%) provides multilayer multi-axis oriented x-cross laminated film marketed as Techpaulin.

Market Leadership…

It holds a market share of over 55% in the domestic industrial packaging segment.

It is the largest manufacturer of large-size plastic drums, the 2nd largest manufacturer of composite cylinders.

It is the 3rd largest manufacturer of Intermediate Bulk Containers (IBCs) globally.

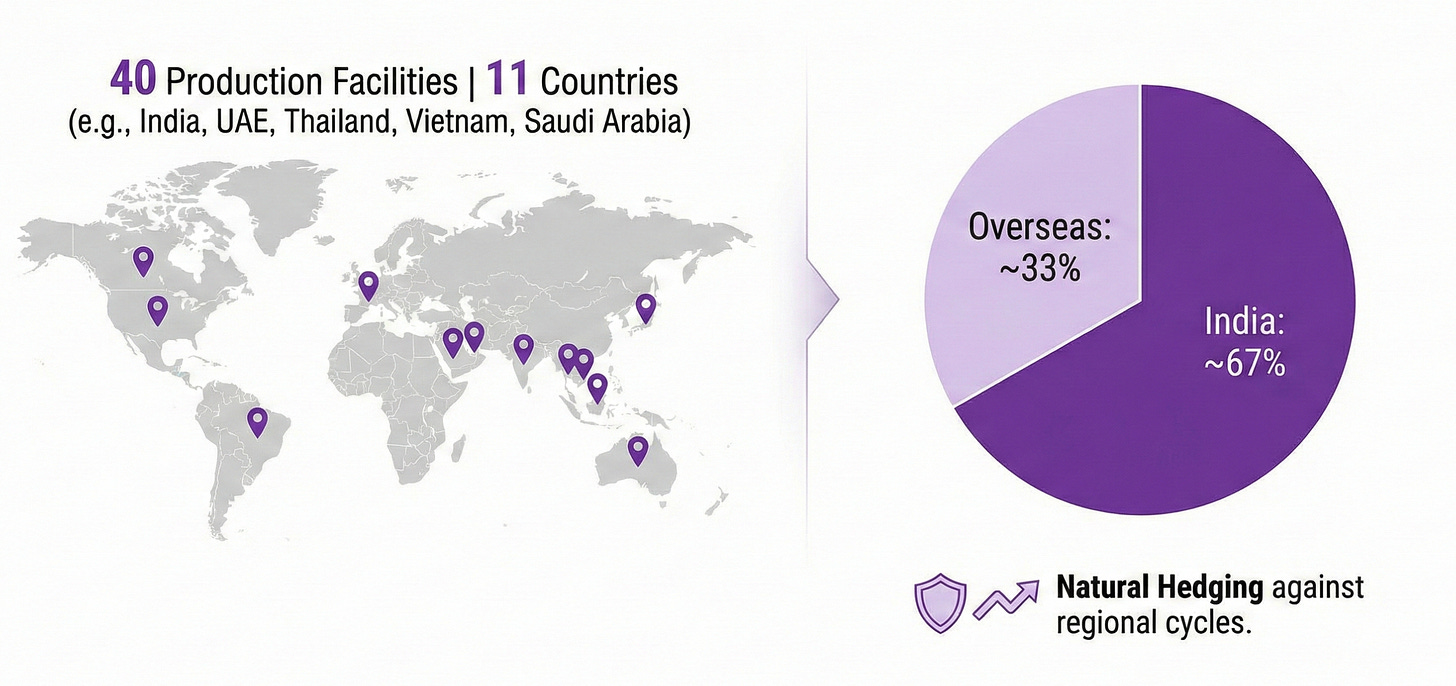

Global Mix…

The company operates 40 production facilities across 11 countries including India, UAE, Thailand, Vietnam, and Saudi Arabia.

India contributes ~67% of revenues while overseas markets add 33%, providing natural hedging against regional cycles.

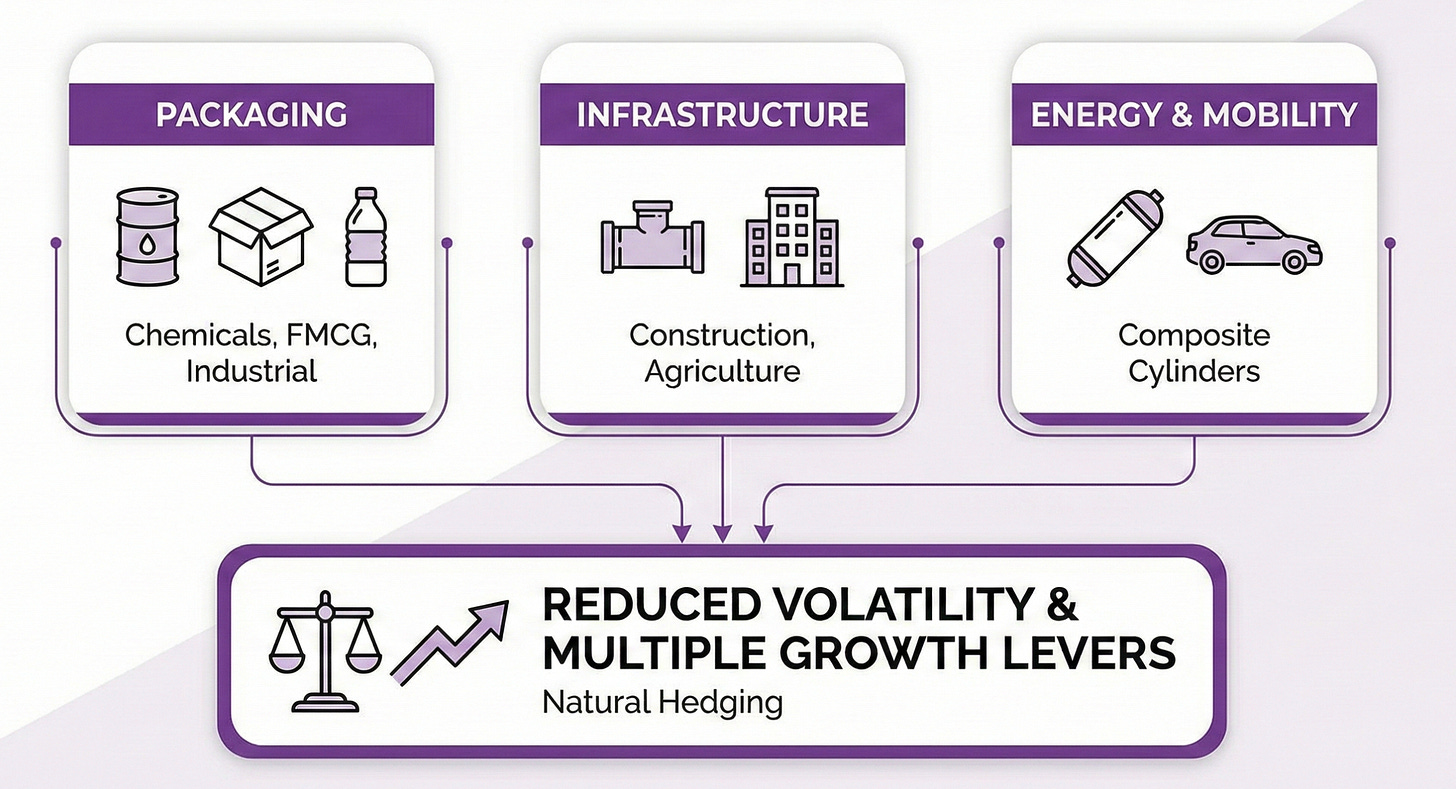

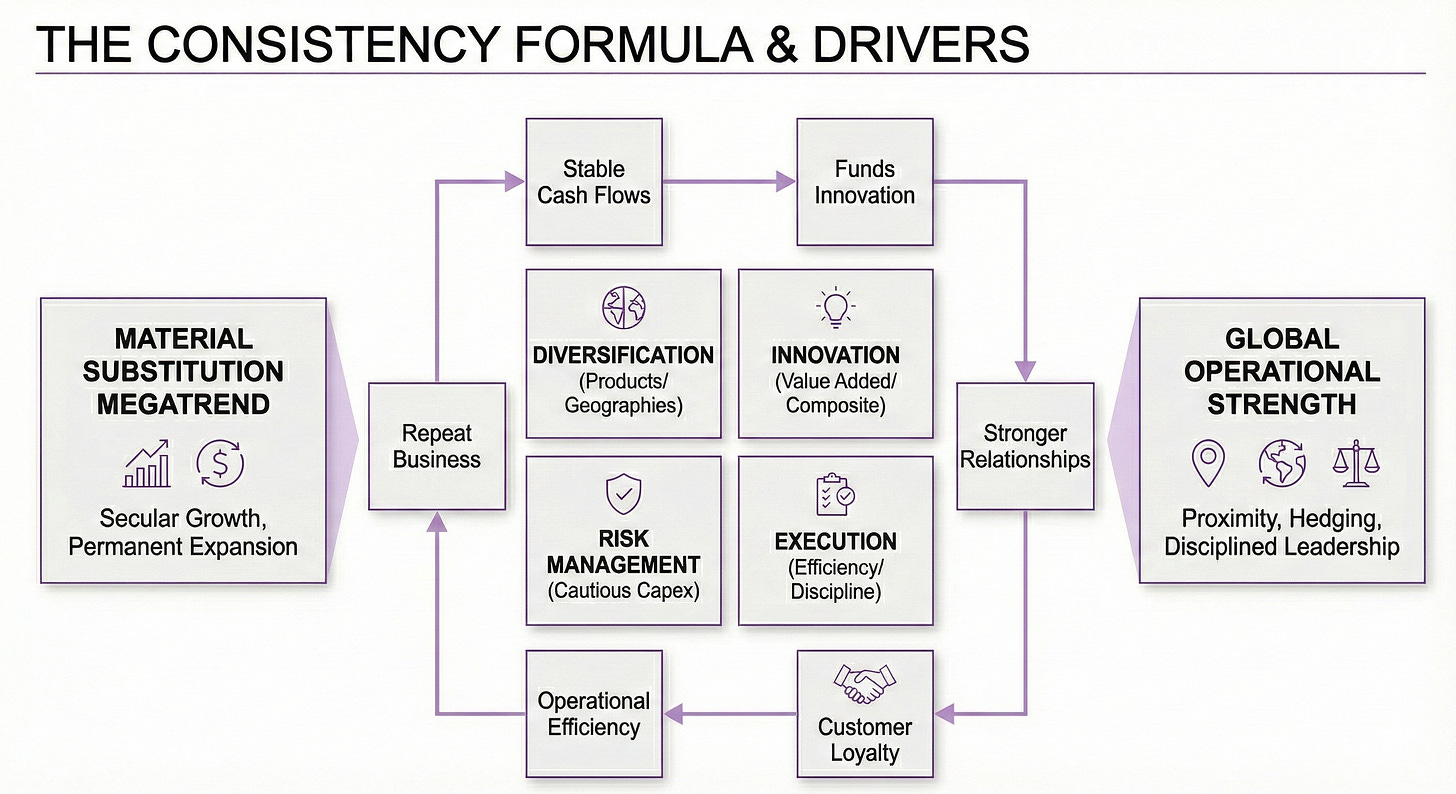

2. Diversified Product Portfolio Fuels Stability

A core reason for steady growth is that TIMETECHNO does not rely on one product or one sector.

Time Technoplast participates in many industries through distinct applications. Packaging serves chemicals, FMCG, and industrial manufacturers. Infrastructure plastics serve construction and agriculture needs. Composite cylinders serve energy and mobility applications.

These different demand streams reduce volatility and create multiple growth levers. A temporary slowdown in industrial production can be offset by resilience in consumer staples packaging.

A broad product set also enables deeper relationships through cross-selling.

A customer buying IBCs often needs drums, components, or films too. Bundled needs increase revenue per account and raise switching costs.

The company serves 900+ institutional clients including Fortune 500 names like Dow, BASF and Shell. Clients value the convenience of one reliable partner across multiple polymer solutions.

Customer concentration remains low relative to the breadth of its client base. No single customer dominates revenues.

The company's industrial packaging customers span chemicals at 31%, FMCG at 29%, construction chemicals at 13%, paints at 12%, and pharmaceuticals at 15%.

When one sector faces headwinds, others often remain robust.

3. Focus on Innovation & Value-Added Products

Upgrading its product mix.

Time Technoplast has steadily pushed into value-added products that attract better pricing and longer customer commitments.

The company strategically reclassifies its portfolio into Established Products and Value-Added Products. In H1FY26, Value-Added Products grew by 17%, significantly outpacing established products which grew at 8%.

This shift reduces dependence on commoditized categories and creates a clearer runway for durable growth.

A strong example is the push into composite gas cylinders.

These cylinders are lighter, safer, and easier to handle compared with traditional metal cylinders.

The CNG composite cascade business witnessed 36% growth in Q2 FY25 alone.

Building capability at scale in such products positions the company as a technology leader rather than just a volume manufacturer.

Innovation also shows up in regulatory leadership.

Time Technoplast became the first company in India to receive PESO approval for manufacturing Type-IV composite cylinders for Hydrogen in March 2024.

These approvals represent years of testing and validation, creating a formidable moat against potential competitors.

The company also received PESO approval for Type-IV CNG cylinders and Type-III cylinders for Oxygen, demonstrating breadth in high-pressure gas storage technology.

Exploring applications linked to clean energy and mobility.

December 2025 marked successful flight trials of hydrogen powered drones using Type-III composite cylinders.

The company partnered with Drone Stark Technologies for this application. Each new product expands the addressable market and keeps the story evolving for customers and investors.

The company allocates approximately ₹100 crore annually to research and development, representing roughly 5% of revenue.

A dedicated R&D team of 35 technical experts with average experience exceeding 20 years drives product innovation.

This creates a repeatable loop where today's stability funds tomorrow's growth.

4. Manufacturing Scale and Strategic Proximity

Time Technoplast built manufacturing presence close to where customers need products delivered.

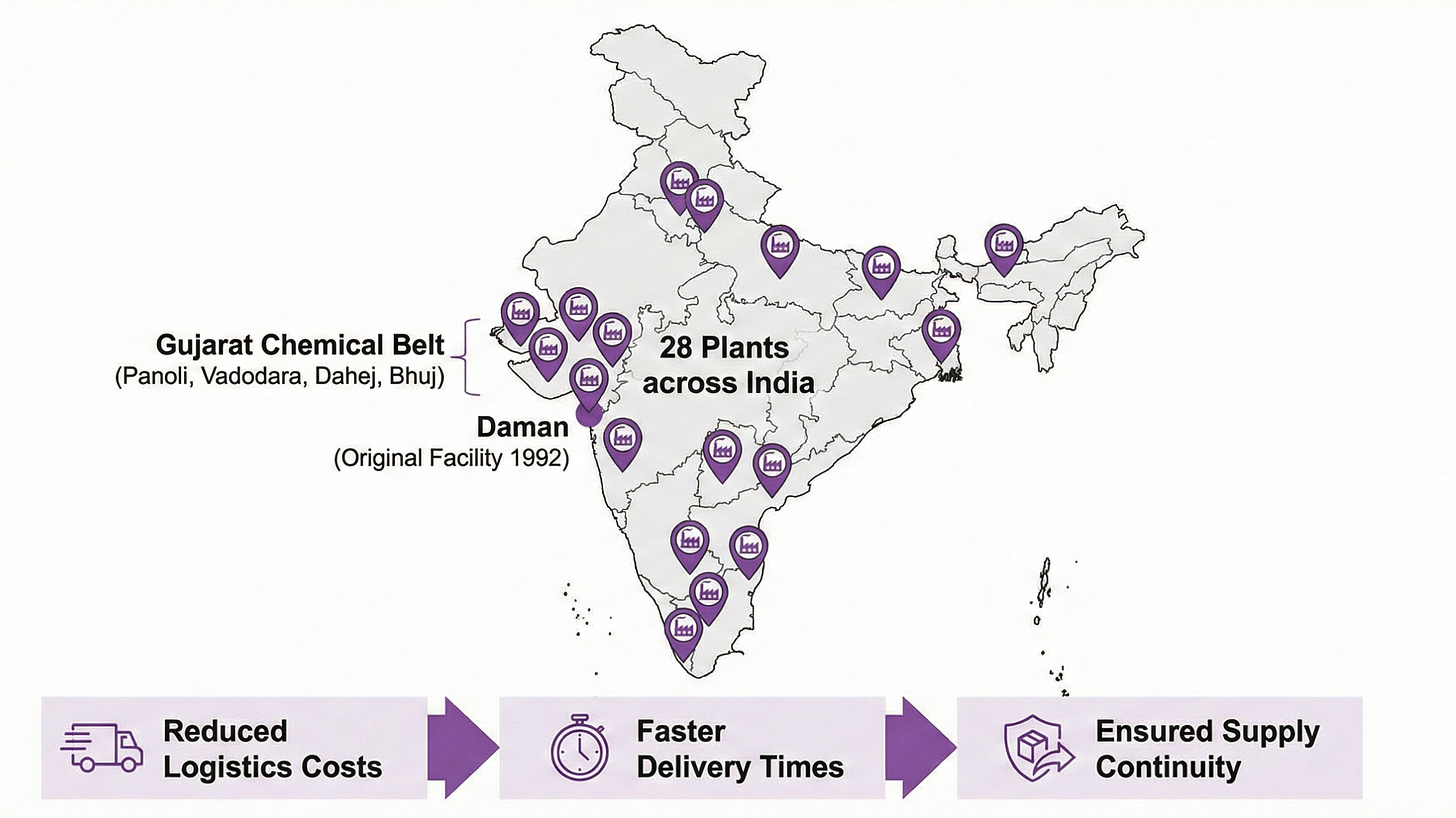

The company operates 28 plants across India strategically located in western, southern, northern and eastern regions.

Daman hosts the original 1992 facility. Gujarat facilities at Panoli, Vadodara, Dahej and Bhuj serve the chemical belt.

This distributed footprint reduces logistics costs and delivery times while ensuring supply continuity.

International manufacturing spans 10 countries outside India providing geographic resilience.

UAE operations in Sharjah serve Middle Eastern markets.

Thailand and Vietnam plants manufacture for Southeast Asian customers.

The newest additions include Saudi Arabia in January 2025 and Iowa USA for North American IBC supply.

Each facility maintains similar quality standards ensuring consistent customer experience globally.

Manufacturing proximity creates a competitive moat that commodity players cannot easily replicate.

Large plastic drums and IBCs are voluminous but relatively lightweight products. Transporting empty packaging over long distances results in shipping air, which destroys margins.

Time Technoplast strategically locates facilities within 200 to 300 km radius of major chemical clusters. This geographical interdependence creates a formidable barrier to entry.

Capacity expansion follows a disciplined brownfield approach with annual capex remaining between Rs 150 to 200 crore.

FY25 investments totaled Rs 195 crore with Rs 120 crore specifically earmarked for composite cylinder capacity.

The company added 36,000 CNG cylinder capacity bringing monthly production capability to 600 cascades.

5. Strong Customer Relationships

In B2B manufacturing, consistency often comes from relationships, not marketing.

Time Technoplast has built deep partnerships with large industrial clients who value reliability.

Once a product is qualified and integrated into operations, switching suppliers becomes costly and risky for the customer.

Industrial packaging customers require dependable supply without quality variations that could contaminate their products.

Repeat orders form a strong base.

Many customers place recurring orders for standardized packaging formats and components.

Distribution infrastructure reaches 345 cities and towns across India. This creates predictability in volumes and helps plants run at stable utilization.

Indian Oil Corporation represents validation for composite cylinders.

IOCL placed orders totaling Rs 235 crore for Type-IV LPG cylinders. The 758,814 cylinder order demonstrates manufacturing scale capability and must be delivered over 12 months.

Additional orders followed initial deliveries, with government oil marketing companies including BPCL and HPCL representing similar opportunities.

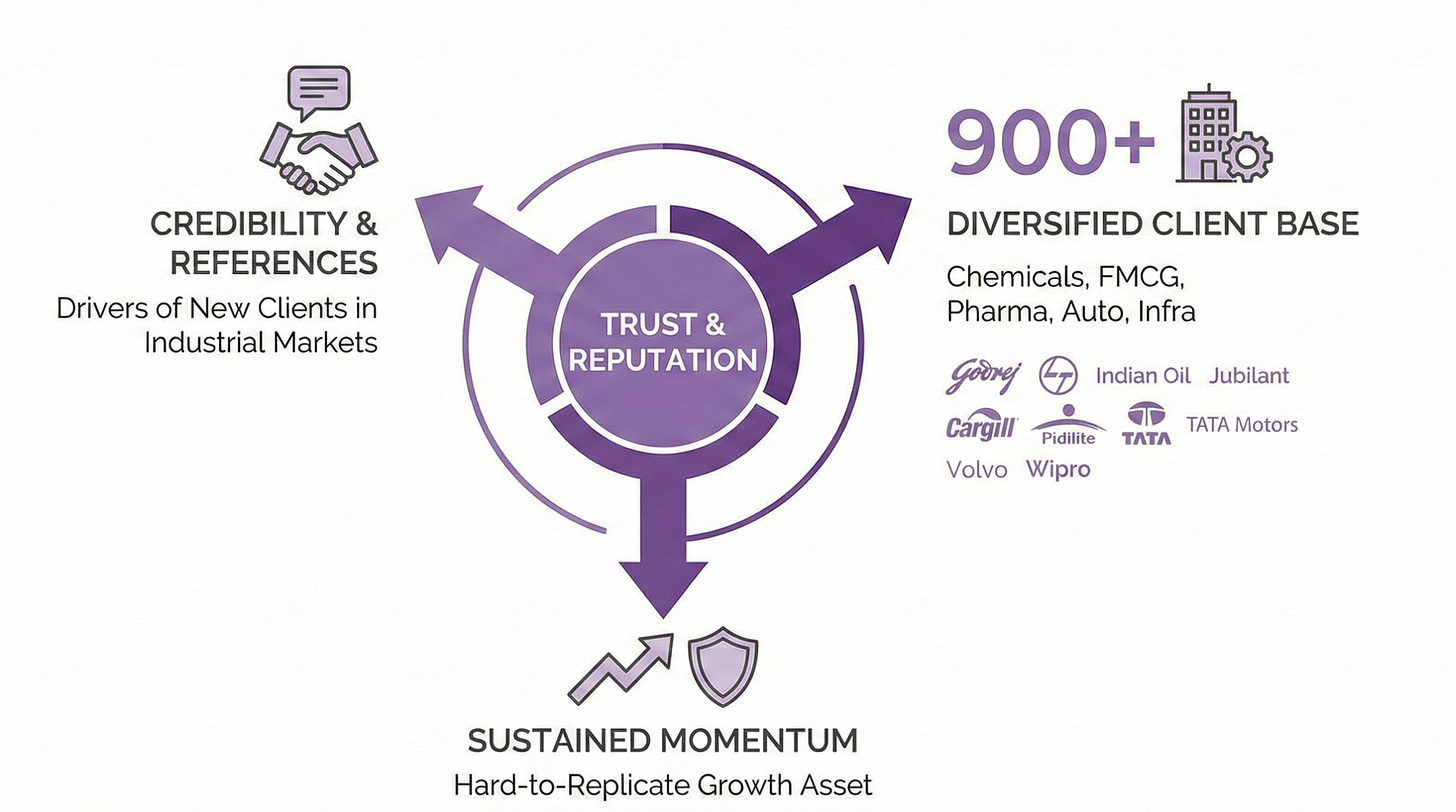

Strong relationships…

New clients often come through credibility and references, especially in industrial markets.

Time Technoplast serves 900+ institutional clients with diversified demand across chemicals, FMCG, pharmaceuticals, automotive and infrastructure sectors. This includes marquee clients such as Godrej, L&T, Indian Oil, Jubilant Lifesciences, Cargill, Pidilite, TATA Motors, Volvo, Wipro, etc.

Over time, this trust becomes a growth asset that is hard to replicate, helping the company sustain momentum year after year.

6. Material Substitution Driving Secular Growth

The company positioned itself early to benefit from the global shift away from metal packaging towards advanced polymers and composites.

Steel drums dominated industrial packaging for decades until Time Technoplast introduced PE drums in 1992 as India’s first alternative.

Polymer drums weigh 70% less than steel equivalents and resist corrosion completely. The company essentially created the category it now dominates.

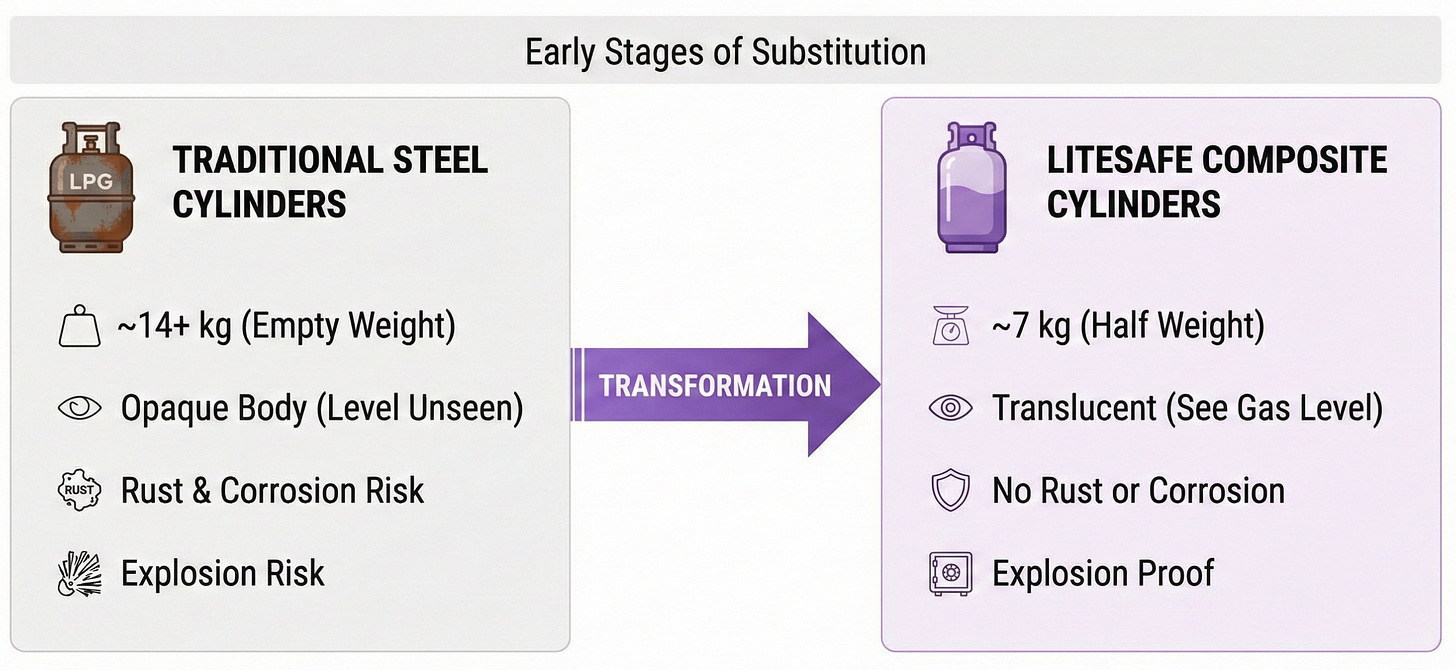

This material substitution theme extends into composite cylinders where the transformation remains in early stages.

Traditional LPG cylinders made from steel weigh over 14 kg empty.

Time Technoplast’s LiteSafe composite cylinders weigh just half that amount (~7 Kgs). The translucent body allows users to see remaining gas levels. These cylinders cannot rust or corrode and are explosion proof unlike metal cylinders.

The CNG cascade business applies similar logic to commercial vehicle fuel storage.

Type-IV composite cylinders carry twice the CNG compared to equivalent steel cascades.

A single cascade unit replaces multiple traditional cylinders. The weight savings translate directly into payload capacity for transport operators, effectively halving the transportation cost per kg of gas. This economic advantage has fueled explosive demand growth.

Hydrogen storage represents the next frontier of material substitution.

As mentioned earlier, the company became the first in India to receive PESO approval for Type-IV hydrogen composite cylinders.

As India’s National Green Hydrogen Mission targets 5 million metric tonnes of production by 2030, storage infrastructure demand will surge. Time Technoplast positioned itself three to four years ahead of this opportunity through patient R&D investment.

India’s packaging industry reached US$101 billion in 2024 ranking third globally after surpassing Japan.

Projected growth at 10.7% CAGR takes the market to US$170 billion by 2030.

Each percentage point of metal-to-plastic conversion creates permanent market expansion that Time Technoplast captures.

7. Summary

That’s it for today.

FINVEZTO.COM | Build Wealth. With Clarity.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

Thank you, Good Analysis. If you could mention about the potential risks, it would be of great help.