MAPMYINDIA (C.E. Info Systems) || Consistently Performing Stocks #41

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they were able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Today, we will look at the key fundamentals & business of MAPMYINDIA (C.E. Info Systems Ltd)

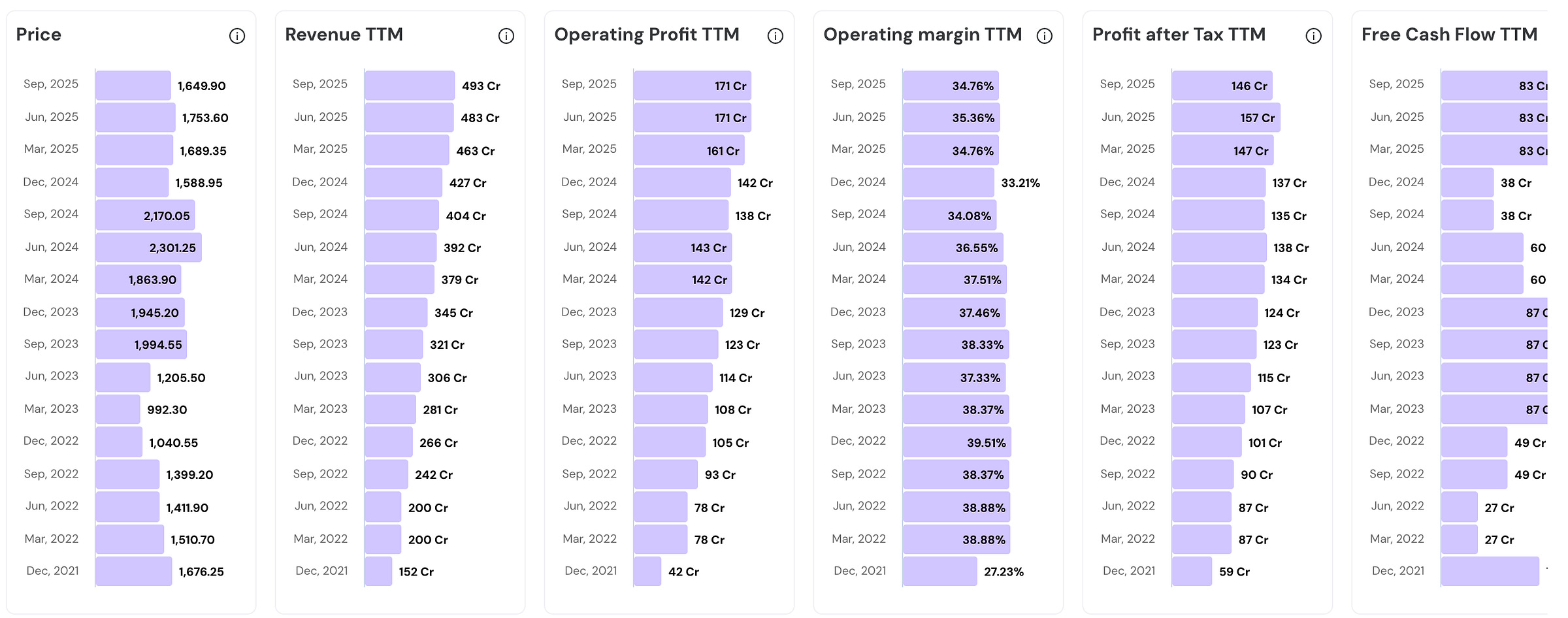

The above performance chart of MAPMYINDIA shows increasing trend in Revenue, Operating Profit and Net Profit along with high Operating Margin. How did MAPMYINDIA achieve this consistency?

Let us explore.

Their Road to Consistency

Overview & Business Model

Founded in 1995 by Rakesh and Rashmi Verma, MapMyIndia spent 25 years building India’s most comprehensive digital map before going public in December 2021.

The IPO was oversubscribed 154 times, opening at a 65% premium.

But the real story began after listing, when the company transformed regulatory advantages and technological depth into sustained growth. We will dive deeper into it. Let’s begin with the business model.

MapMyIndia operates a hybrid business model that combines Maps as a Service (MaaS), Software as a Service (SaaS) and Platform as a Service (PaaS) with IoT hardware sales.

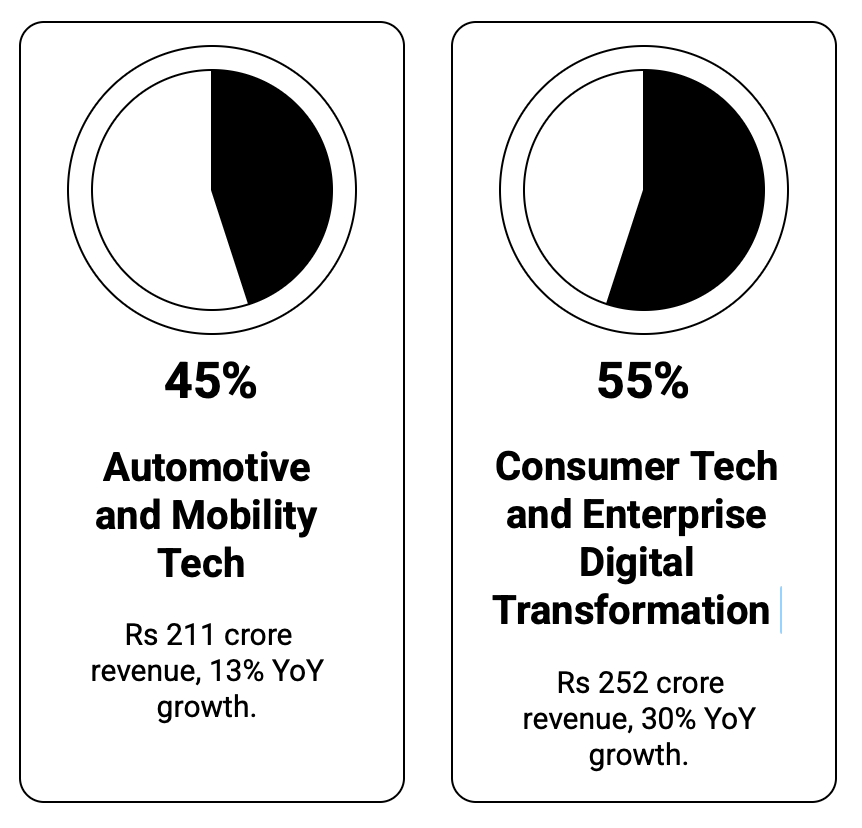

Revenue splits into 2 Segments:

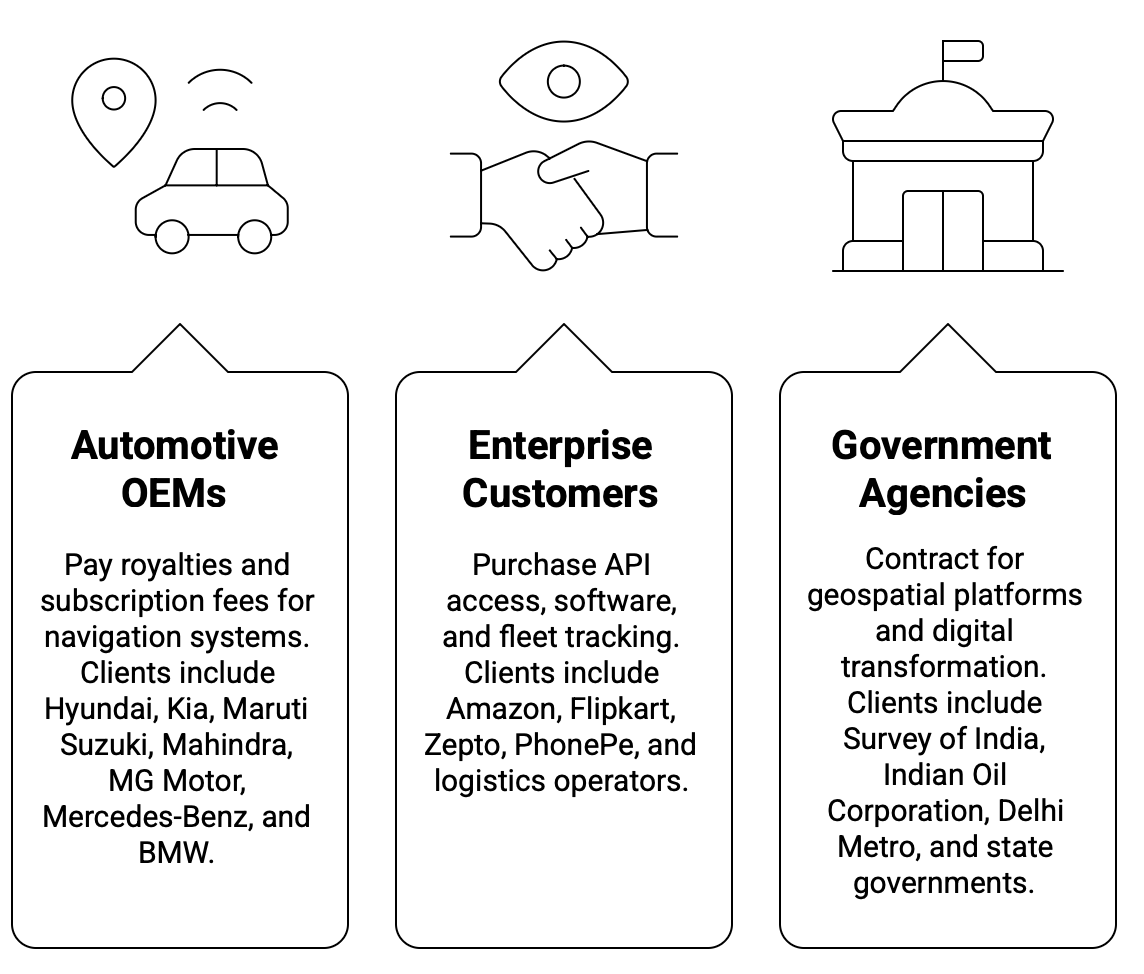

The company monetizes its core digital mapping database across 3 major customer segments:

MapMyIndia serves over 2,000 B2B and B2B2C customers. This diversification reduced concentration risk as the number of customers contributing 80% of revenue expanded from 35 in FY22 to 75 in FY25.

Technology Moat

MapMyIndia’s consistent performance stems first from a technological foundation that competitors cannot easily replicate.

The company operates 750+ field surveyors who walk and drive Indian streets daily, collecting ground-truth data with hundreds of attributes per location.

This army of mappers captures building footprints, exact house numbers, floor and flat details, photographs, and building types across India’s complex addressing landscape.

The result is 6.3 million kilometers of mapped roads covering 98.5% of India’s network, 17.8 million places of interest, and 14.5 million addresses with doorstep-level accuracy.

Google Maps may have satellite imagery, but MapMyIndia has three decades of professional field surveys creating data depth that matters for India’s unstructured environment.

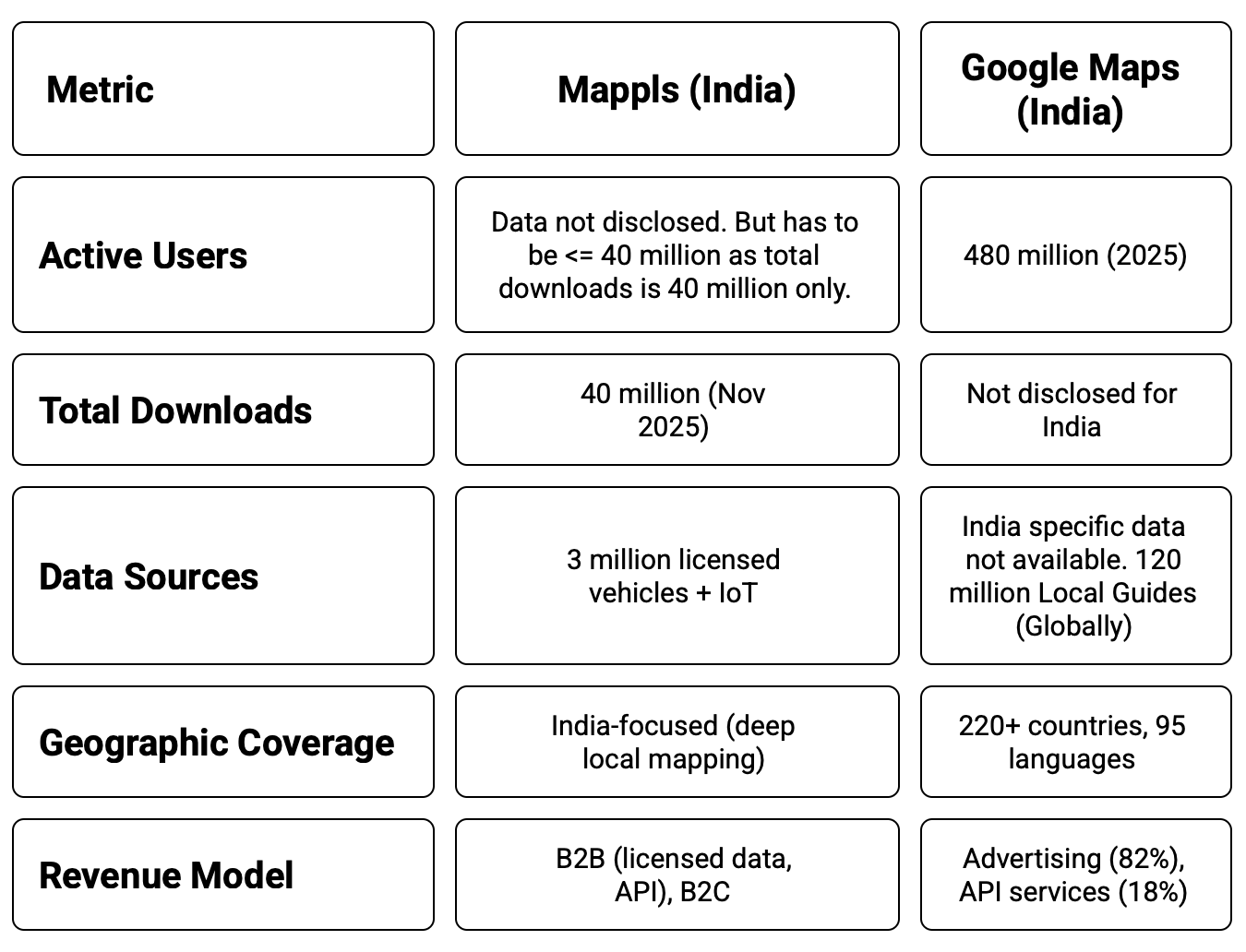

Having said the above, Google Maps is still the king. Here is a quick comparison of Mappls vs Google Maps based on the data I could collect.

Network Effects

MapMyIndia’s network effects began with a simple insight: every vehicle becomes a data collector.

By FY25, 3 million licensed vehicles were generating continuous probe data on traffic speeds, travel times, and road conditions. IoT devices on commercial vehicles added location and movement data. The Mappls consumer app (competing with Google Maps) crossed 40 million downloads by November 2025, doubling from 20 million in early 2024.

This creates a flywheel. More users produced better maps. Better maps attracted more users.

The data advantage has become tangible. It delivers accuracy that algorithmic approaches cannot match. MapMyIndia’s knowledge of speed breakers, potholes, sharp curves, and accident-prone zones comes from three decades of ground surveys and user reports.

New entrants face an impossible task. They lack the baseline data. They need to build infrastructure for real-time collection from scratch.

This moat translates to pricing power. Customers pay premium rates for accuracy and coverage. Each new user added strengthens the competitive position. The network effects compound with scale.

E-Commerce Database & Switching Costs

MapMyIndia’s database includes 14.5 million addresses with doorstep accuracy, house numbers for 36 major cities, and 2 billion digital address combinations through the eLoc system.

E-commerce and logistics companies that integrate MapMyIndia’s address APIs embed these identifiers into their systems.

Order management platforms, customer databases, and delivery routing all reference MapMyIndia’s location codes.

Switching to another provider requires remapping millions of address records, testing to ensure accuracy, and coordinating across multiple systems.

The operational risk of failed deliveries during migration outweighs potential cost savings, creating a lock-in with MapMyIndia.

As more companies adopt MapMyIndia’s addressing standards, the ecosystem reinforcement grows stronger. Illustration of both Switching costs and Network effects.

Developer Ecosystem

The developer ecosystem creates a different network effect.

As more developers build applications using MapMyIndia’s APIs and SDKs, a knowledge base accumulates.

GitHub repositories provide sample code. Stack Overflow threads answer integration questions. Online documentation improves based on developer feedback.

This ecosystem makes MapMyIndia easier to adopt for new developers.The platform becomes the default choice for Indian startups building location-based services.

As more apps launch on MapMyIndia infrastructure, end users become familiar with the interface and behavior, creating user-side network effects that complement developer-side adoption.

Cross-product synergies create platform effects within MapMyIndia’s offering suite. For example, a customer initially using basic mapping APIs discovers navigation SDKs, then adds geocoding services, later adopts fleet tracking etc.

Each product integration increases switching costs and deepens the relationship.

Platform effects transform MapMyIndia from a vendor into infrastructure that becomes more valuable as adoption deepens.

Product Innovation & EV navigation

Product innovation accelerated dramatically from 2022 to 2025.

In December 2022, the company launched a complete line of consumer IoT products including the Navisor helmet-mounted navigation device for two-wheelers. Also launched Mappls CarEye dash camera with live streaming capabilities, and integrated car entertainment systems.

In 2023, MapMyIndia introduced RealView, a 360-degree panoramic street imagery service covering major Indian cities, competing directly with Google Street View.

The company also launched RealVerse, creating 3D digital twins of physical spaces for metaverse applications and urban planning.

September 2024 brought an industry-first feature. An AI-powered live traffic signal timers in Bengaluru, developed with the traffic police, providing countdown displays for 125 smart signals with up to 500 meters advance warning.

The automotive technology suite evolved rapidly to capture emerging opportunities. MapMyIndia built the N-CASE platform, standing for Navigation, Connected vehicles, ADAS, Shared mobility, and Electric vehicles.

The EV-specific capabilities gained particular importance as electric vehicle sales accelerated. MapMyIndia’s navigation calculates precise range based on battery models, terrain, traffic, and driving patterns.

The system maps charging station locations with real-time availability, charging speeds, and connector types across India’s fragmented charging infrastructure.

These EV optimization features became selling points.

The company secured contracts with multiple EV manufacturers including Ather, BYD, and new-age EV startups precisely because competitors lacked equivalent India-specific EV navigation capabilities.

Regulatory Tailwinds

The Indian government’s February 2021 geospatial policy reforms fundamentally altered MapMyIndia’s competitive landscape, creating advantages that accelerated from 2022 onward.

For 70 years, British-era restrictions limited who could collect and update mapping data in India.

The 2021 Guidelines for Acquiring and Producing Geospatial Data eliminated pre-approval requirements, allowed Indian companies to access satellite imagery with resolution below 1 meter.

Foreign mapping companies face accuracy restrictions that prevent them from providing below 1-meter horizontal resolution without partnering with Indian entities. They cannot own terrestrial mapping infrastructure or operate ground control stations within India.

Restrictions that previously required government clearance for map updates were also removed. MapMyIndia could now update maps in near real-time without bureaucratic delays.

The National Geospatial Policy of 2022 set even more ambitious targets that positioned MapMyIndia for exponential growth.

The policy aimed to grow India’s geospatial industry to Rs 1 lakh crore by 2030, up from approximately Rs 30,000 crore in FY24.This implies a 22% compound annual growth rate driven by open data access, commercial participation, and public-private partnerships.

MapMyIndia won the contract to power this platform in November 2024, a project of national importance that provides geospatial datasets to government departments, academia, and industry nationwide.

This single contract establishes MapMyIndia as infrastructure for India’s spatial data ecosystem, similar to how Google Maps serves that role globally.

Data sovereignty

Data sovereignty became a powerful competitive advantage as government and enterprise customers prioritized Indian providers.

MapMyIndia stores all data on Tier 3 certified servers within India, displays borders according to Government of India specifications, and maintains transparent privacy policies without advertising-driven data harvesting.

When Indian Oil Corporation needed to track 23,000 LPG trucks carrying critical energy infrastructure across the country, they selected MapMyIndia over foreign alternatives.

When Survey of India designed the National Geo-Spatial Platform to manage sensitive geospatial data including defense applications, they chose MapMyIndia.

When banking and financial services companies require location verification for KYC compliance, they prefer an Indian provider where data never leaves the country.

These decisions reflect genuine concerns about data residency and sovereignty that favor domestic players.

Government contracts increasingly specify preferences for Indian companies, sometimes making domestic ownership a mandatory criterion.

The Production-Linked Incentive scheme for smartphones, which MapMyIndia actively lobbied, could eventually mandate pre-installation of Indian mapping apps on PLI-certified devices.

Automotive Dominance through Deep Integration

MapMyIndia commands 90% market share in automotive GPS navigation and 95% in in-dash navigation systems across India.

When an automotive OEM selects MapMyIndia, they commit to a multi-year relationship.

The mapping software integrates with the vehicle’s infotainment system and telematics control unit. Engineers spend months customizing the interface, tuning the voice guidance, and testing across different driving conditions.

This integration creates 3 to 5 year contract cycles where switching providers becomes impractical. The company embedded its technology in 1.9 million new vehicles in FY23, 2.5 million in FY24, and over 3 million in FY25, growing significantly faster than the 12.5% automotive industry growth rate.

The January 2024 Hyundai-Kia contract demonstrated the scale and scope of MapMyIndia’s automotive relationships. The Rs 400 crore, 5-year deal covers both Hyundai Motor India and Kia India, providing map data, connected services, real-time and predictive traffic, mobile SDKs, online search capabilities, and call center maps.

Hyundai and Kia represent major players in the Indian market with combined annual sales exceeding 800,000 vehicles.

The contract structure includes both per-vehicle royalties and annual subscription fees for connected services, creating dual revenue streams.

MapMyIndia’s automotive advantage extends beyond navigation.

The N-CASE suite provides embedded navigation, connected car platforms with real-time traffic and crash assistance, ADAS maps with precise lane-level guidance for safety features, shared mobility platforms for OEMs entering ride-hailing, and EV-specific optimization.

In FY24 and FY25, the company won contracts with multiple EV OEMs who required specialized capabilities. Electric vehicles create anxiety about range and charging, making accurate range calculation and charging station mapping mission-critical features rather than nice-to-haves.

MapMyIndia’s battery models incorporate terrain, traffic patterns, climate, and driving behavior to provide precise range estimates.

When EV adoption accelerates toward government targets of 30% for private cars by 2030, MapMyIndia’s installed base in EV navigation provides locked-in growth.

The competitive dynamics in automotive favor incumbents like MapMyIndia over new entrants. When Ola announced plans to develop its own mapping platform in 2024, industry observers questioned the feasibility.

MapMyIndia spent three decades perfecting these capabilities. The company’s RealView 3D photo-realistic junction guidance prevents wrong turns at complicated flyovers and underpasses, a feature absent from Google Maps and critical for driver safety.

Automotive OEMs prioritize reliability and proven performance over experimentation.

MapMyIndia’s 90% market share reflects not just first-mover advantage but sustained execution quality that keeps customers from switching.

Consistency Strategy

Data Moat (6.3M km across India, 14.5M addresses)

↓

Attracts Customers (Automotive OEMs, E-commerce, Government)

↓

End users Generate Probe Data (3M vehicles, 40M app users)

↓

Network Effects Strengthen (More users → Better maps)

↓

Deep Integration Creates Switching Costs (3-5 year auto contracts, embedded eLoc codes)

↓

Regulatory Protection Reinforces Moat (Indian status, data sovereignty, <1m resolution access)

↓

Enables Product Innovation (EV navigation, IoT hardware, RealView, AI traffic signals)

↓

Innovation Deepens Customer Relationships (Cross-selling, platform effects)

↓

Expands Revenue Streams (Royalties + Subscriptions + Platform fees + Hardware)

↓

Reinvest in Data Collection & Technology

↓

Even Stronger Data Moat

↓

The cycle continues…

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.