Manorama Industries || Consistently Performing Stocks #49

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they were able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Let’s explore the business and fundamentals of MANORAMA INDUSTRIES this week.

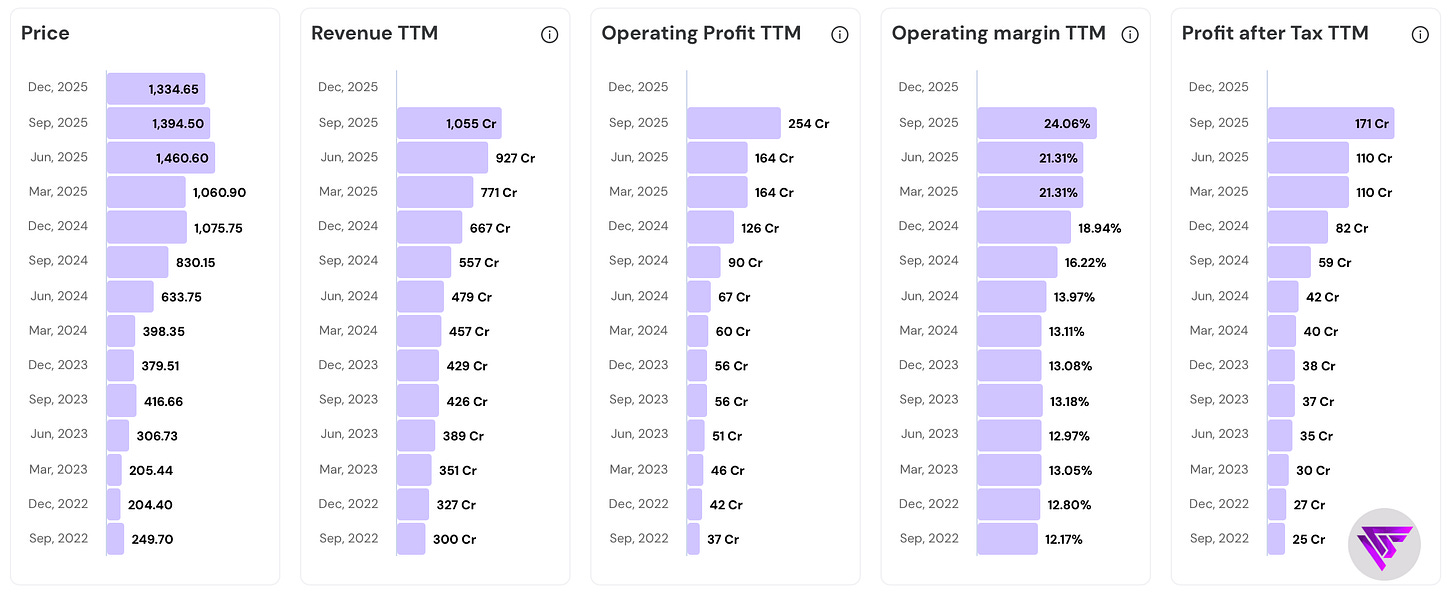

In the last 3 years…

- This Stock's price has surged 5.3 times (from 249.70 to 1,334.65)

- Revenue has grown 3.5 times (from 300 Cr to 1,055 Cr)

- Operating profit has skyrocketed 6.9 times (from 37 Cr to 254 Cr)

- PAT has grown 6.8 times (from 25 Cr to 171 Cr)

- Operating Margins have doubled from 12.17% to 24.06%

Take a look at the numbers below. Incredible Consistency.

Their Road to Consistency

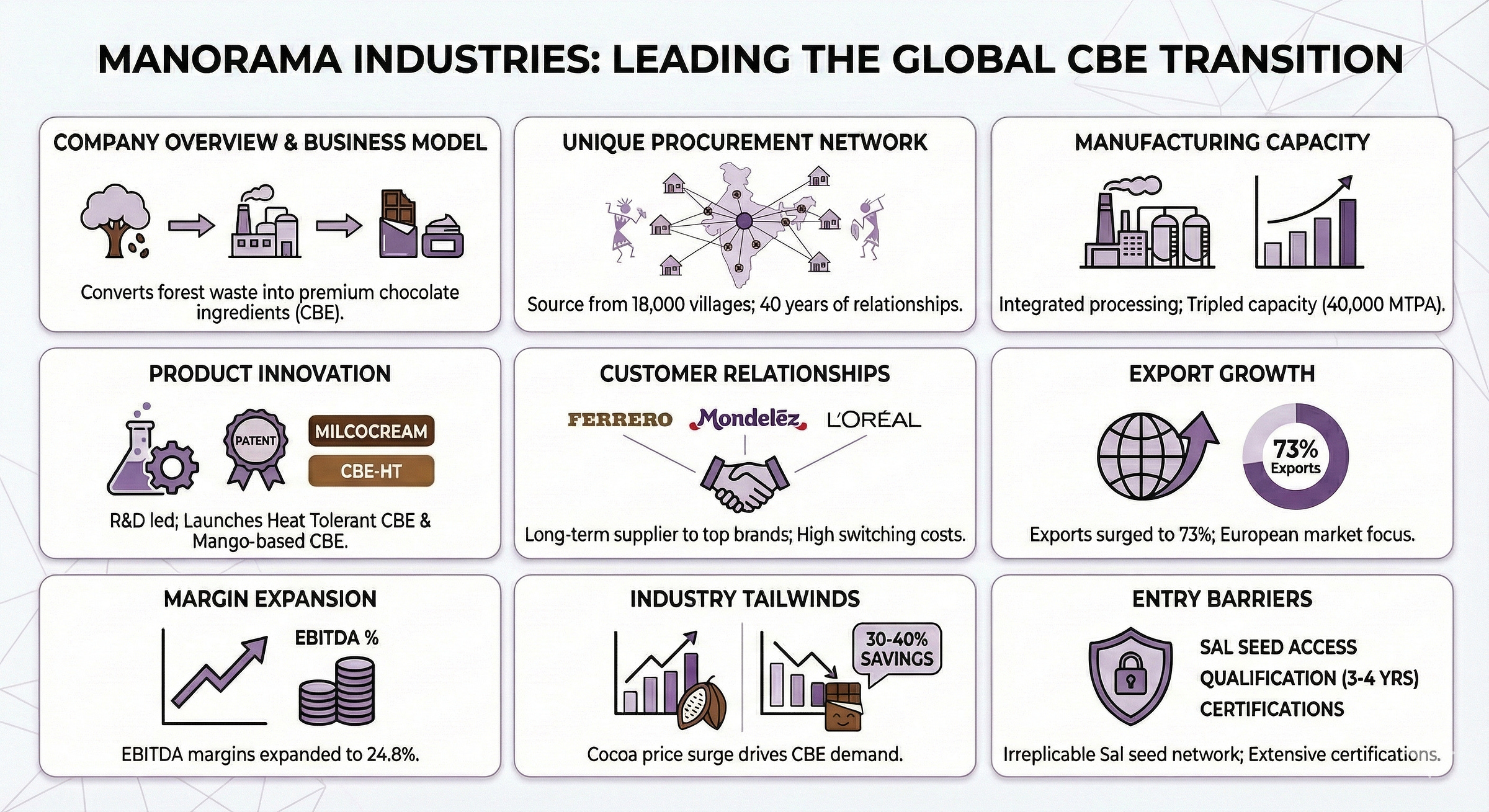

1. Company Overview & Business Model

Manorama Industries converts forest waste into premium chocolate ingredients. This Raipur-based company is one of the 7 global producers of Cocoa Butter Equivalents (CBE).

The business model is simple. Collect seeds and kernels that fall naturally from forest trees from tribal communitis. Extract the fats through proprietary processes. Fractionate them into precise specifications. Supply finished products to chocolate manufactures (Ferrero, Mondelez) and cosmetic companies (L’Oréal) requiring consistent quality.

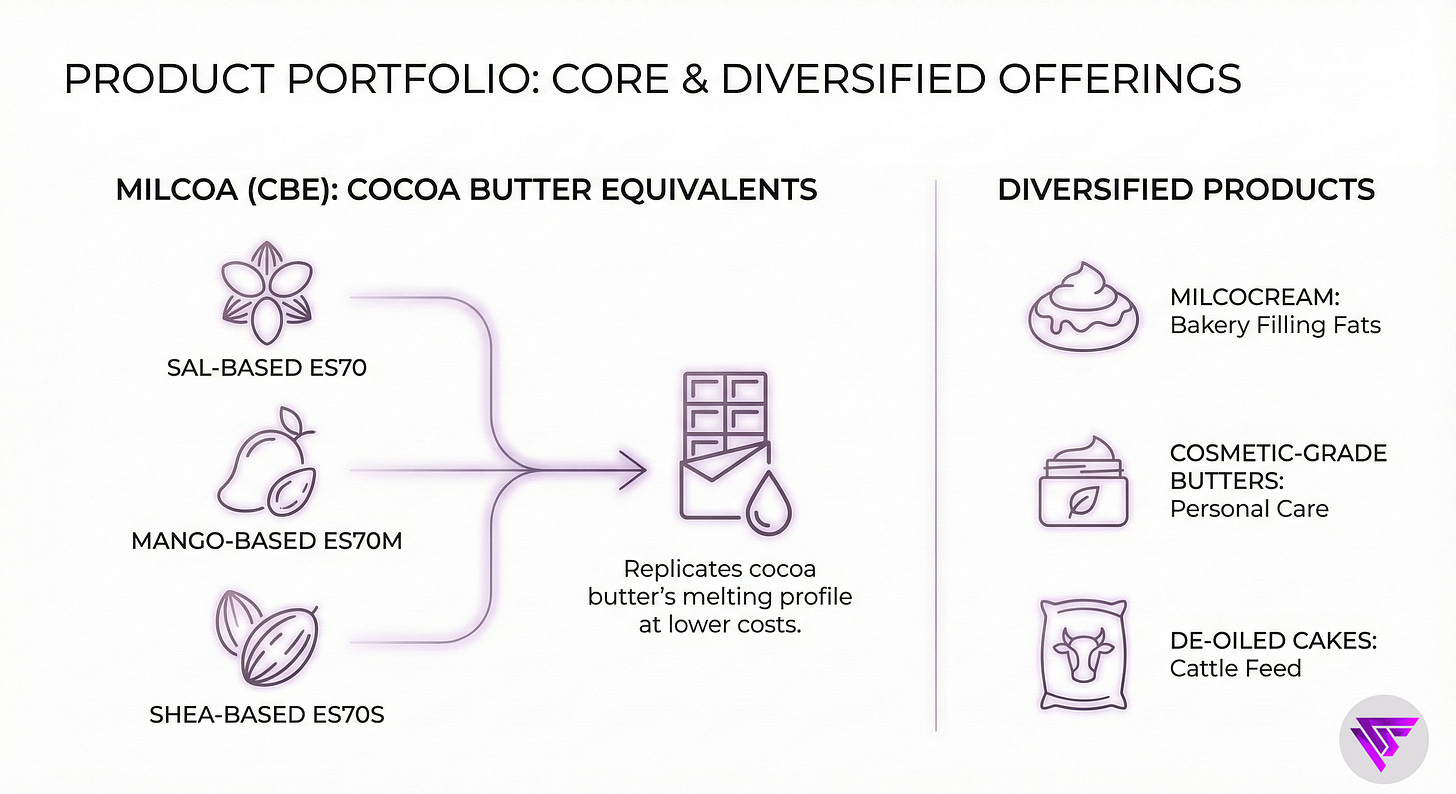

The product portfolio centers on the MILCOA brand of CBE products. These include Sal-based ES70, Mango-based ES70M, and Shea-based ES70S variants, each designed to replicate cocoa butter’s melting profile at substantially lower costs.

The company also produces bakery filling fats under the MILCOCREAM brand, cosmetic-grade butters for personal care applications, and de-oiled cakes sold as cattle feed.

Basically, Every part of the procured seeds generates revenue.

With cocoa prices quadrupling since 2022, chocolate manufacturers worldwide are scrambling for Cocoa Butter alternatives.

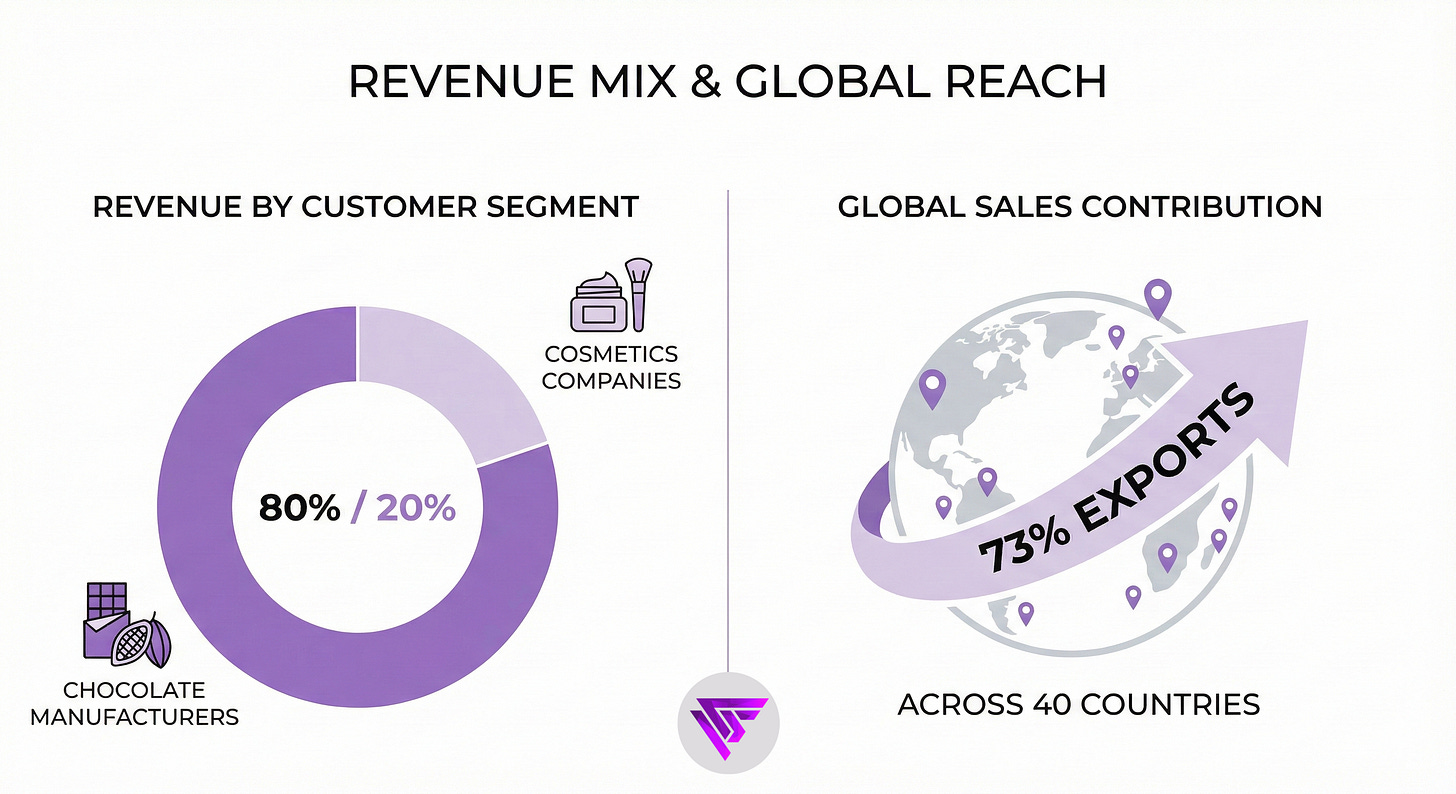

Currently, 80% of MANORAMA’s revenue comes from chocolate manufacturers and 20% from cosmetics companies. Exports now comprise 73% of sales across 40 countries.

The “waste to product” positioning creates both cost advantages and sustainability credentials that appeal to ESG-conscious multinationals.

2. The Unique Procurement network

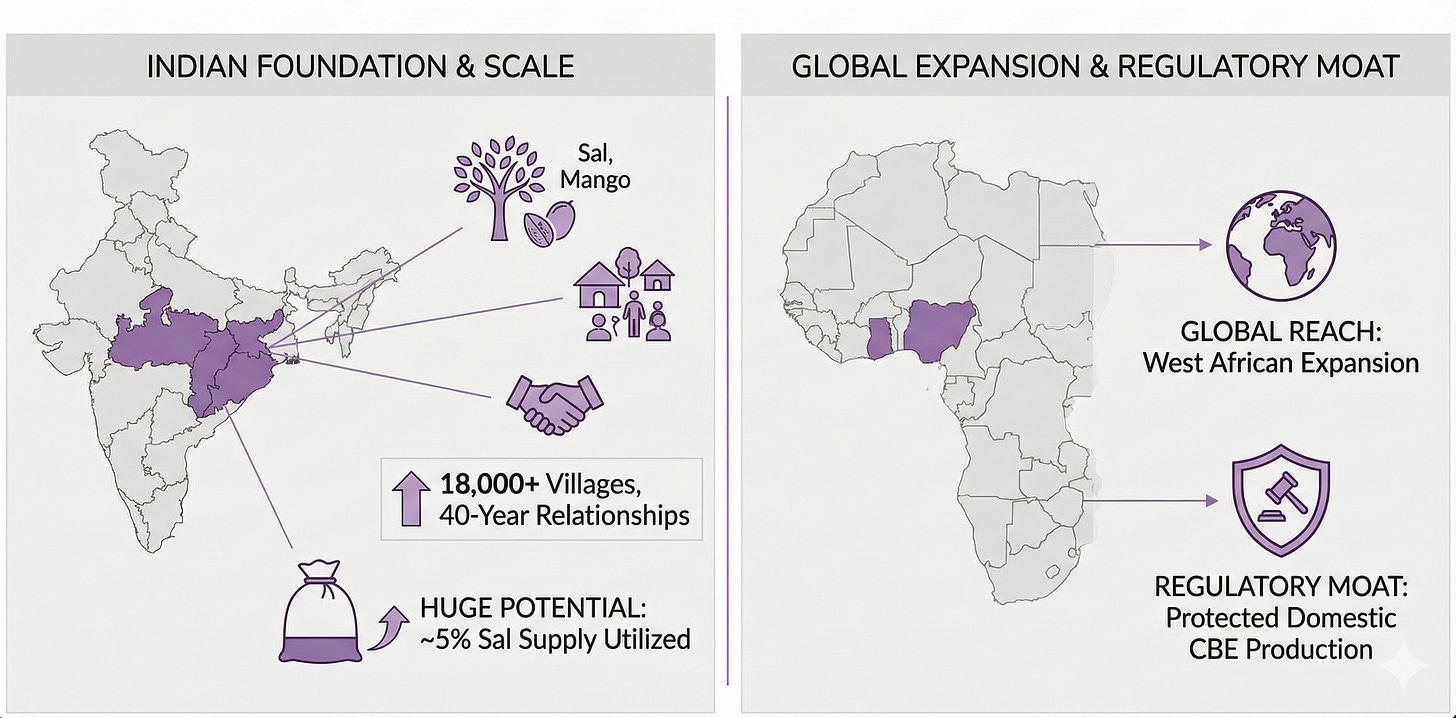

Manorama’s foundational advantage is in the forests of Chhattisgarh, Jharkhand, Odisha, and Madhya Pradesh. The company sources Sal seeds and mango kernels through a network spanning 18,000 villages, where tribal women collect 15-20 kilograms of fallen seeds daily during the May-June harvesting season.

This collection infrastructure represents 40 years of relationship building that competitors cannot quickly replicate.

Currently, the company currently utilizes only 5% of available Sal seed supply from Chhattisgarh forests alone, indicating enormous headroom for growth without supply constraints.

Each procurement center maintains quality protocols requiring seeds to reach processing facilities within 72 hours to preserve fat content.

Management has built these relationships through consistent buying, fair pricing, and community engagement over four decades.

International sourcing is also done through Manorama Africa Limited in Ghana.

The company established six new West African subsidiaries in FY25 across Nigeria, Togo, Ivory Coast, Benin, Burkina Faso, and Ghana to deepen this sourcing advantage.

Regulatory protection reinforces the procurement moat as well. Indian regulations permit Cocoa Butter Equivalents (CBE) manufacturing only from Sal, Mango, and Kokum seeds, with high import duties on Shea-based fats protecting domestic producers from foreign competition.

3. Integrating Manufacturing Capacity

The Birkoni facility near Raipur houses an integrated processing complex capable of handling the entire value chain from crude extraction to finished Cocoa Equivalent Butter (CBE).

Fractionation capacity tripled from 15,000 MTPA to 40,000 MTPA between 2022 and 2024, with a new 25,000 TPA unit commissioned in July 2024. This expansion positions Manorama to capture growing CBE demand without capacity bottlenecks.

The May 2023 commissioning of a 15,000 TPA interesterification plant added a critical processing capability that allows customization of fat melting profiles for specific customer requirements. This technology enables production of heat-tolerant CBE variants for tropical markets where standard chocolate would melt at ambient temperatures.

Solvent extraction capacity of 90,000 MTPA handles initial processing of raw seeds into crude butter.

The integrated design minimizes handling losses and maintains tight quality control from raw seed to finished product.

Storage infrastructure expansion has also happened. They constructed 2,000 MT capacity tanks in FY24 and acquiring 20 acres of adjacent land for future development.

This addresses the seasonal nature of raw material availability, allowing bulk procurement during harvest periods for year-round processing.

Current capacity utilization stands at approximately 62%, with targeted 75-85% utilization in FY26.

Management plans a further 30% capacity expansion in H2 FY26, bringing total fractionation to 52,000 TPA by 2026-27.

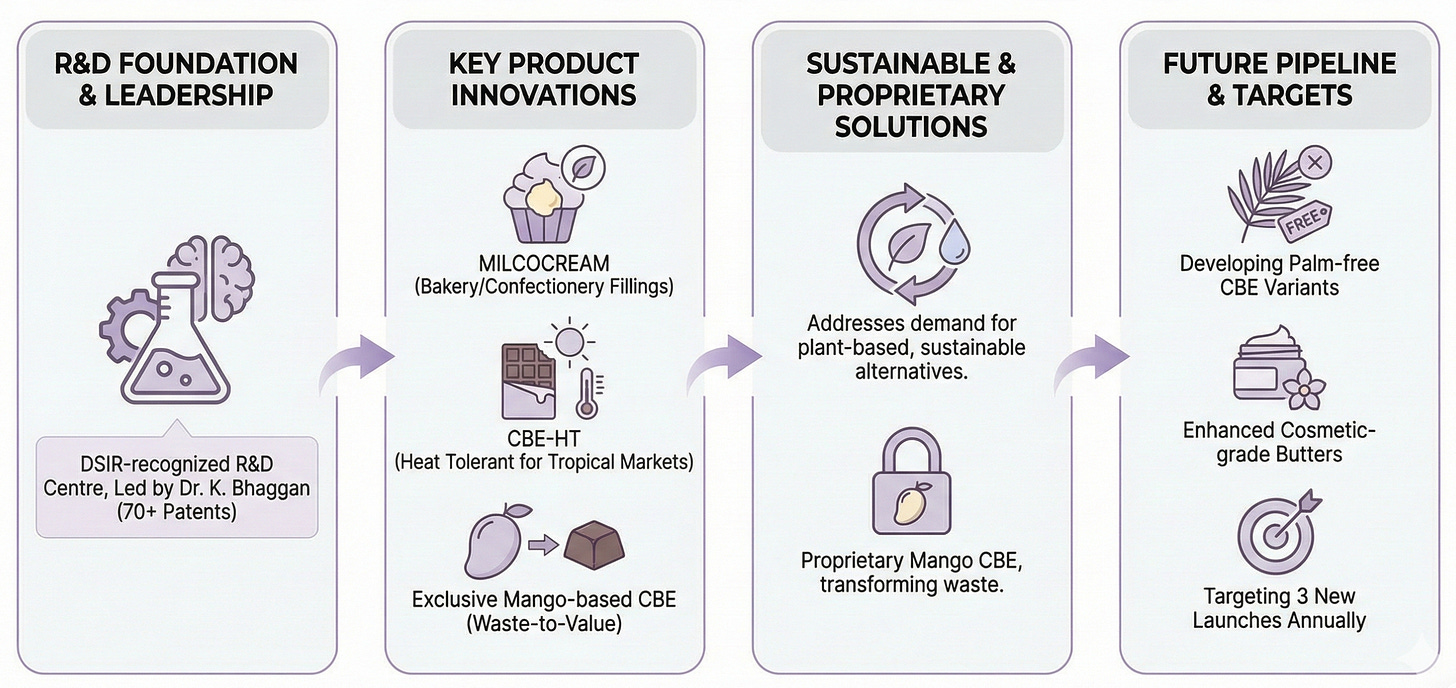

4. Product Innovation

The MILCOA Research and Development Centre holds Government of India DSIR recognition for scientific research, led by Dr. Krishnadath Bhaggan who brings 70 patents from his 21 years at Bunge Loders Croklaan. This R&D leadership enables continuous product development targeting specific customer requirements rather than commodity specifications.

The launch of MILCOCREAM in 2024 expanded applications into center-filling fats for chocolate confections and bake-stable filling fats for bakery products.

These formulations address growing demand for plant-based, sustainable alternatives to traditional ingredients in cookies, wafers, and premium spreads.

Development of CBE-HT (Heat Tolerant) variants specifically addresses tropical market requirements where standard chocolate products would lose structural integrity.

This innovation opens markets across Southeast Asia, Middle East, and domestic India where temperature-stable chocolate commands premium pricing.

The company produces Mango-based CBE exclusively worldwide, creating a proprietary product that competitors cannot offer as yet.

Mango kernels, essentially waste from India’s massive fruit processing industry, transform into premium chocolate ingredients through Manorama’s unique processing capabilities.

Management targets three new product launches annually, maintaining relevance with customers facing evolving consumer preferences.

Current development includes palm-free CBE variants for markets seeking to eliminate palm oil from supply chains and enhanced cosmetic-grade butters for personal care applications.

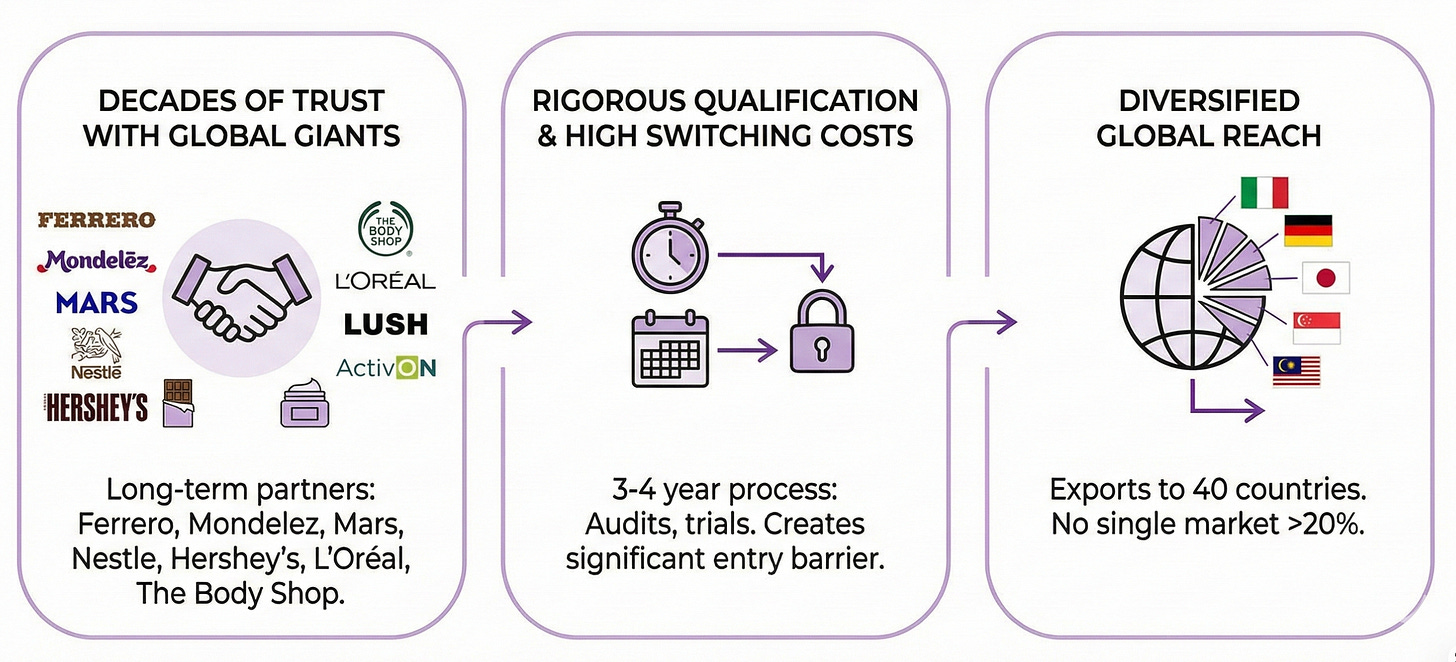

5. Customer relationships spanning decades

Approval as a qualified supplier to Ferrero, Mondelez, Mars, Nestle, and Hershey’s represents years of rigorous evaluation. Major chocolate manufacturers require 3-4 years to qualify new ingredient suppliers through food safety audits, quality testing, and production trials. This extended qualification process creates significant switching costs once approved.

The Body Shop International holds a formal long-term supply agreement for mango butter, demonstrating how cosmetics customers also commit to extended relationships.

L’Oréal, Lush, and Korean cosmetics manufacturer ActivON similarly rely on Manorama for consistent supply of organic cosmetic butters meeting stringent purity requirements.

Export customers span 40 countries with no single market exceeding 20% of sales.

Key destinations include Italy, Germany, Japan, Singapore, and Malaysia, each representing established relationships with major regional buyers.

Chocolate manufacturers prioritize supply security over marginal cost savings given the food safety implications of switching suppliers.

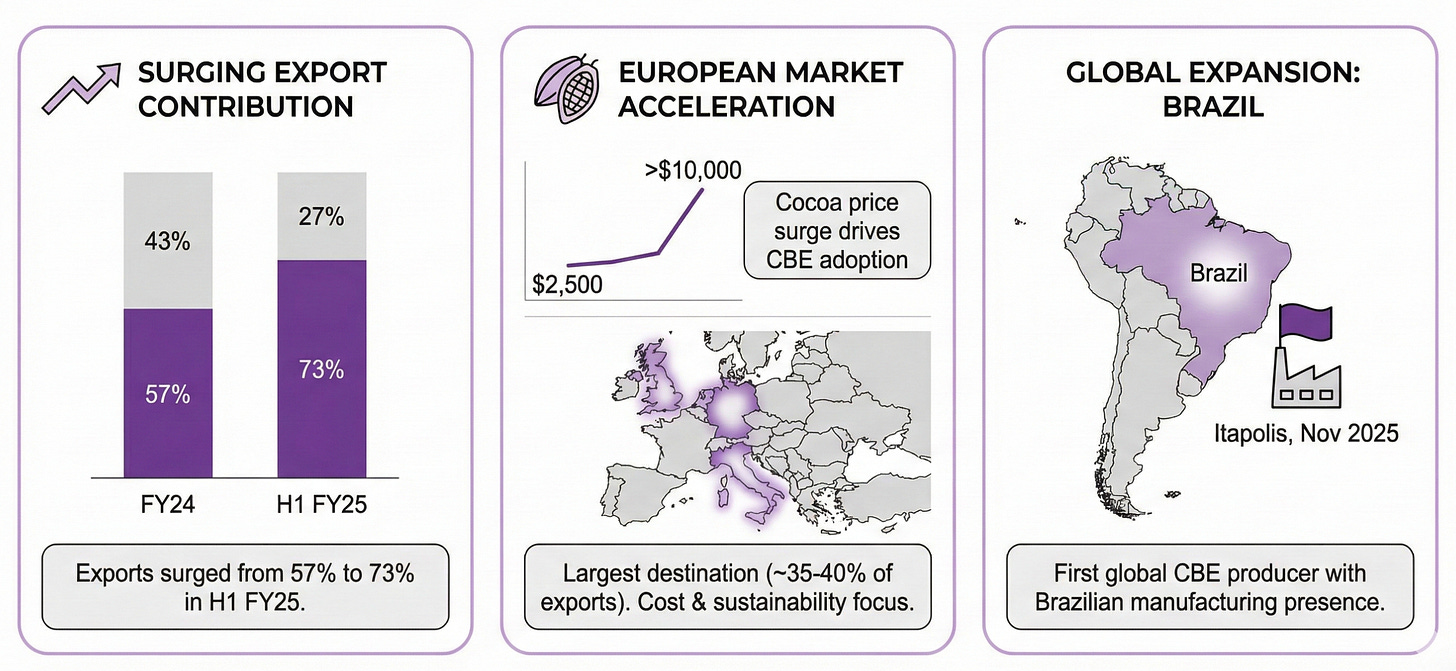

6. Export Growth reshaping the revenue mix

The export contribution surged from 57% in FY24 to 73% in H1 FY25.

Cocoa prices quadrupled from $2,500 to over $10,000 per tonne in the recent years. European chocolate manufacturers facing margin pressure from cocoa costs accelerated CBE adoption. This has aided Manorama.

European markets now represent the largest export destination, accounting for ~35-40% of Manorama’s overseas sales.

Major buyers in Italy, Germany, Netherlands, and UK source MILCOA CBE for chocolate production for both cost advantages and sustainability credentials that support consumer-facing messaging.

The Brazil market entry through Manorama Latin America LTDA and partnership with DEKEL Agroindústria creates manufacturing presence in South America.

Production from the Itapolis facility in Brazil beginning Nov 2025 positions Manorama as the first global CBE producer manufacturing in Brazil.

India sales, while declining as a percentage, continues growing in absolute terms as Indian chocolate consumption expands.

7. Margin Expansion

EBITDA margins expanded from 16.6% in FY23 to 24.8% in FY25 driven by higher capacity utilization and premium product mix.

Value-added products now comprise 70-75% of revenue.

The strategic shift toward higher-specification fractionated products commands premium pricing that flow directly to margins.

By-Product monetization improves overall realizations compared to international competitors.

De-oiled cakes sell as protein-rich cattle feed in India’s dairy industry.

Soap-grade oils and fatty acids find domestic industrial applications. These secondary revenue streams effectively reduce net raw material costs and improve margins.

8. Industry Tailwinds

Global cocoa prices remain structurally elevated at ~$8,000 to $10,000 per tonne versus historical averages of $2,500-3,000. One of the reasons is that West African supply constraints from aging trees, climate impacts, and disease affecting 81% of Ghana’s cocoa crop.

CBE provides chocolate manufacturers 30-40% cost savings versus cocoa butter. It also maintains comparable sensory and functional properties.

EU regulations permitting 5% vegetable fat in chocolate formulations create addressable market across European production.

The EU Deforestation Regulation (EUDR) adds 4% to cocoa costs through compliance requirements, further improving CBE’s relative economics.

Chocolate manufacturers increasingly view CBE as operational resilience rather than cost-cutting.

The global CBE market which was ~$1.23 billion in 2024 is expected to grow at 6% CAGR.

Growing chocolate consumption in emerging markets including India, China, and Southeast Asia drives demand for temperature-stable specialty fats suitable for tropical distribution. Manorama’s heat-tolerant CBE variants specifically address this growing segment.

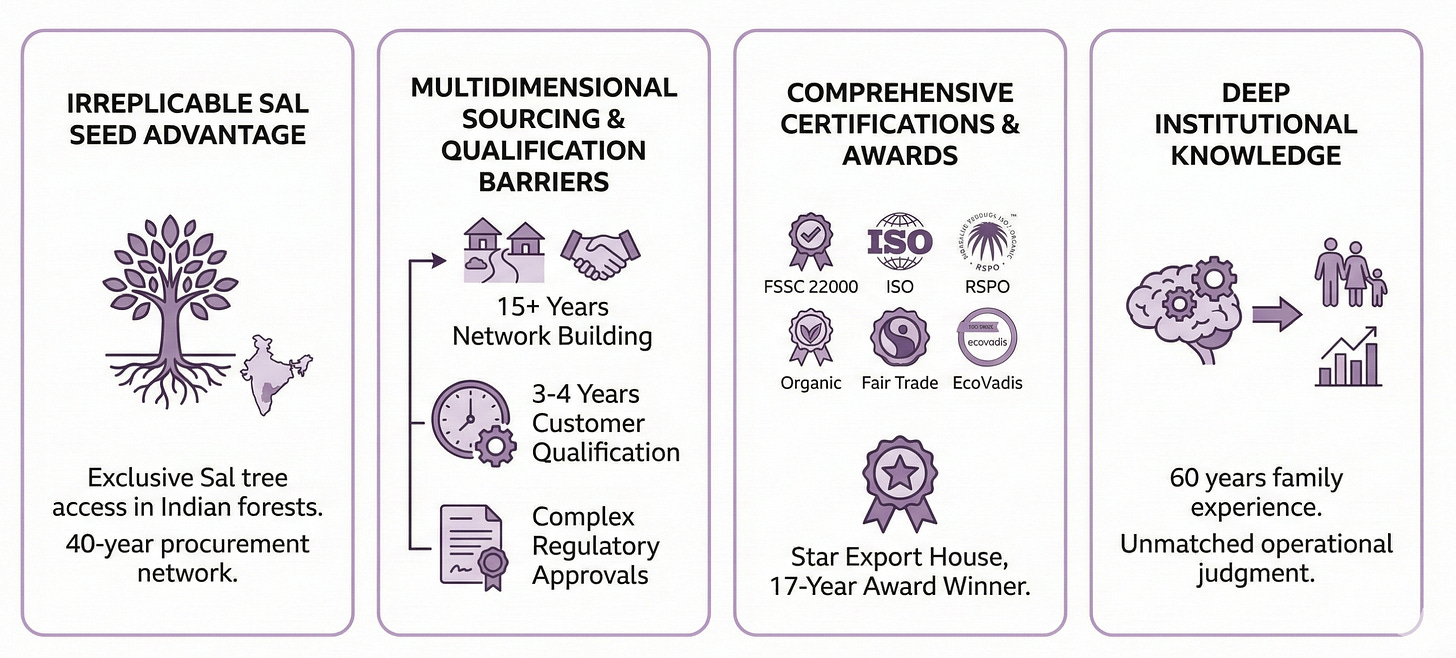

9. Entry barriers for Competitors & New Players

The Sal seed advantage represents an irreplicable barrier. Sal trees grow only in Indian forests, and Manorama’s 40-year procurement network provides exclusive access to this raw material.

Global competitors using Shea nuts cannot match the unique triglyceride profile of Sal-based CBE without establishing equivalent Indian sourcing infrastructure.

Entry barriers compound across multiple dimensions. Building village-level collection networks requires 15+ years of relationship development.

Customer qualification demands 3-4 years of evaluation. Regulatory approvals across jurisdictions require extensive documentation. Technical expertise in fractionation chemistry requires specialized talent.

Manorama holds Star Export House status from the Government of India and has received “Highest Processor and Exporter” awards for 17 consecutive years.

Comprehensive certifications create qualification advantages: FSSC 22000, ISO 9001, ISO 14001, RSPO, Kosher, Halal, USDA Organic, Fair Trade, and EcoVadis. Major customers require these credentials for supply chain compliance.

Management’s 60 years of family experience in minor oilseeds provides institutional knowledge that guides procurement decisions, customer relationships and strategic planning.

This accumulated expertise translates into operational judgment that newer entrants cannot quickly replicate.

10. Summary: Their Consistency Formula

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

Shea nuts have a high butter content of 45–50% and contain symmetrical triglycerides, making them a viable raw material for CBE formulation after fractionation. The processed solid fraction, Shea stearin, is obtained by solvent fractionation and is often blended with PMF to produce Shea-based CBE.

Shea based CBE resembles the closest properties and structure to that of Cocoa butter so why would one move from Shea based CBE to Sal based CBE given the company has exotic chocolate makers as their client?

Sal-based CBE is useful, economical, and functional — but it’s usually blended or used where perfect cocoa-butter behaviour is less critical.

Would like to get corrected in case i am wrong.

Thank you

Nice