KPIT TECHNOLOGIES || Consistently Performing Stocks #21

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

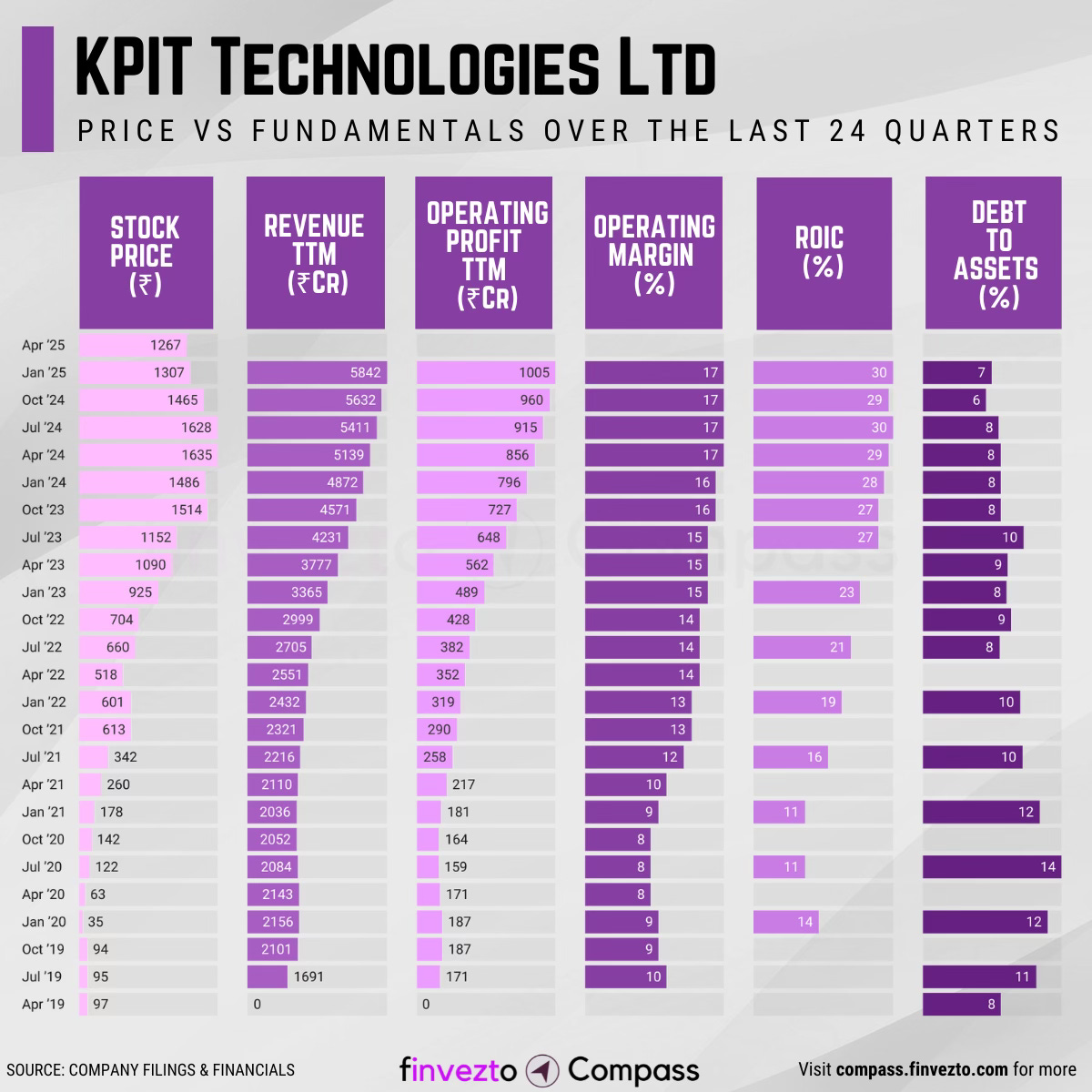

Today, we will look at the key fundamentals & business of KPIT Technologies Ltd.

Click here to learn more about each of the parameters in the chart above.

What Has Led to This Consistency

Company Overview

Established in 1990, transformed into pure-play automotive software specialist through 2019 demerger with Birlasoft. Develops automotive software across autonomous driving, electrification, connectivity, and software-defined vehicle architectures.

Product Segments include:

Autonomous Driving & ADAS Software

Vehicle Electrification Solutions

Connected Vehicle Platforms

Software-Defined Vehicle Architecture

Revenue generation primarily from automotive software services (100% automotive focus since 2019)

Specializes in safety-critical automotive software, a complex niche requiring functional safety certification (ISO 26262) and regulatory compliance across global markets.

KPIT serves 25+ global OEMs including Mercedes-Benz, BMW, Honda, Renault, and Volkswagen with solutions powering over 20 million vehicles globally.

Global Execution

KPIT operates across 31 offices in 16 countries with globally distributed engineering model enabling 24/7 development cycles and combining cost advantages with local market proximity.

International markets contribute 95%+ of revenue, with strong presence across Europe (45%), Americas (30%), and Asia-Pacific (25%) regions

European operations focus on ADAS and autonomous driving technologies, with Munich center housing 120+ engineers for ADAS/AD development

Recent geographic expansion includes Sweden technology center in Gothenburg at Lindholmen Science Park (May 2025) to serve Volvo, Scania, and regional OEMs

Engineering centers positioned in key automotive innovation hubs across Europe, Americas, and Asia-Pacific enable faster project delivery and reduced development timelines

Domain Specialization

KPIT's pure-play automotive focus eliminates resource conflicts and enables concentrated expertise development.

Specialized sales force understands 2-3 year automotive procurement cycles and complex functional safety standards (ISO 26262)

Deep automotive domain knowledge enables premium pricing through safety criticality → Pricing power + margin expansion

Concentrated talent programs develop 2,000+ specialists exclusively in electrification, autonomous driving, and connected solutions → Expertise depth that is not easily replicable

Automotive-specific R&D investments focus on software-defined vehicles, ADAS, and electrification technologies

Strategic Partnerships

KPIT maintains deep relationships with global OEMs, positioning itself as essential technology partner.

Renault Group partnership deploys 600+ engineers globally across ADAS, chassis, and platform engineering for next-generation vehicle development.

Mercedes-Benz collaboration integrates KPIT directly into MBRDI's software-defined vehicle development processes

Honda partnership expanded to deploy 2,000+ software professionals globally through 2030, covering operating systems, autonomous driving, and vehicle electrification

Strategic acquisitions: PathPartner integration (₹1 billion, April 2024) enhances semiconductor partnerships, Technica Engineering acquisition (€80 million) adds hardware prototyping

Technology Leadership

KPIT has over 58+ filed patents and award-winning capabilities spanning embedded systems to cloud services.

KSAR platform provides production-ready solutions meeting the highest automotive safety integrity level required for life-critical systems

Industry standardization platform ensures automotive software components work together regardless of developer → Interoperability

Volkswagen AG approved KPIT's software stack for vehicle communication systems, validating technical excellence

Patent portfolio focuses on autonomous vehicles (50% of Q2 2024 grants) and electronic warfare technologies

Market Timing & Tailwinds

KPIT's 2019 pure-play transformation perfectly aligned with automotive industry's accelerated shift toward software-defined architectures, providing first-mover advantages as software became the primary vehicle differentiator.

2019 demerger timing coincided with automotive industry reaching software inflection point, where Tesla's software-first approach forced traditional OEMs to prioritize digital transformation

COVID-19 pandemic (2020-2021) accelerated automotive digital transformation by 3-5 years, benefiting KPIT's established software capabilities

Traditional automotive suppliers entered software transition 2020-2022, significantly later than KPIT's 2019 focus shift, creating timing advantages in talent acquisition and market positioning

Regulatory landscape shifted toward software-centric compliance requirements 2024-2025 (ISO/SAE 21434 cybersecurity, UN Regulation 155/156), favoring established software expertise

Software-defined vehicle market explosion from $213.5 billion (2024) to projected $1.2 trillion by 2030 validates KPIT's early transformation timing

Consistency Formula

Domain Specialization + Strategic Partnerships → Revenue Stability

Global Execution + Technology Leadership → Strong profit margins

Market Timing + Tailwinds → Sustainable competitive advantage

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research