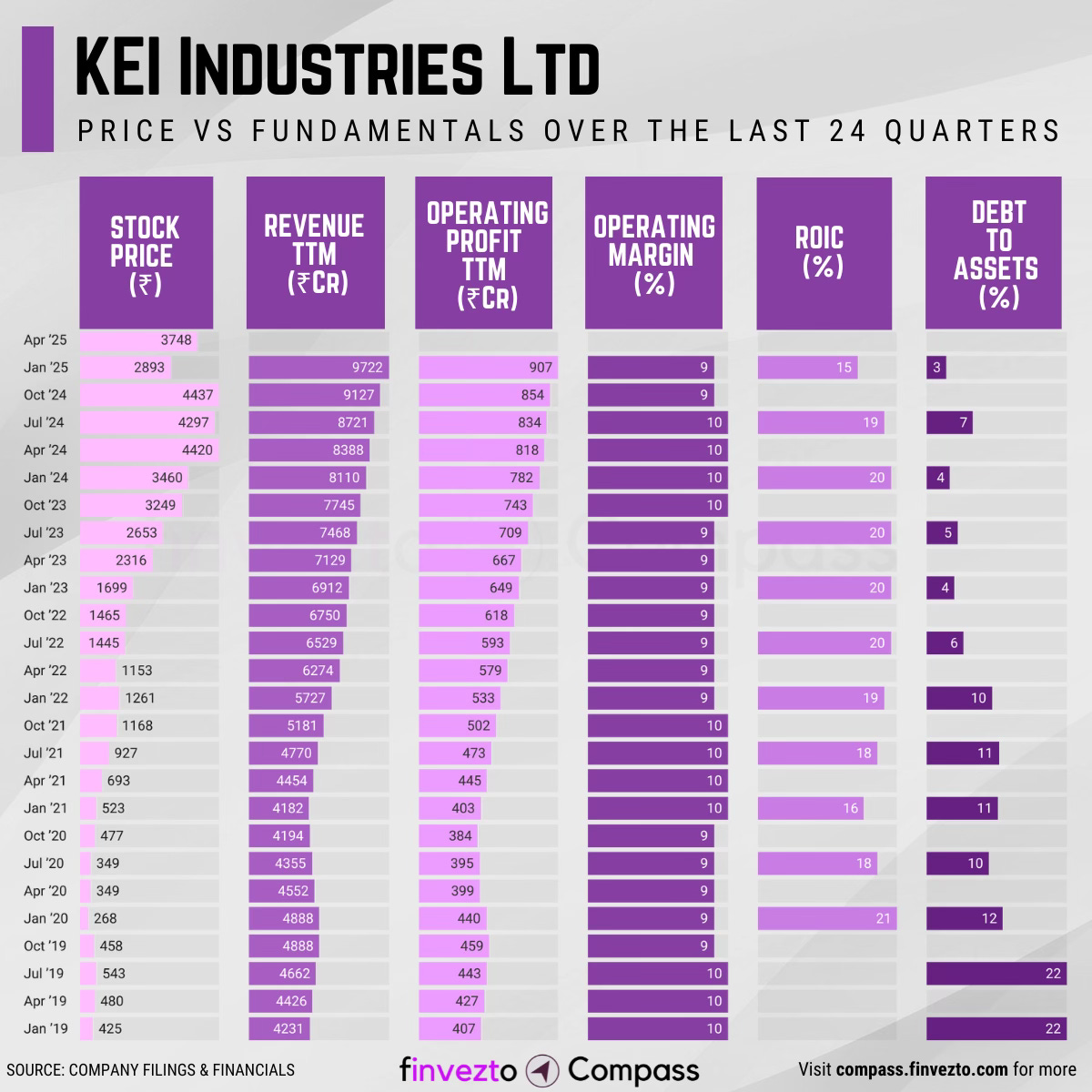

KEI Industries Ltd || Consistently Performing Stocks #18

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business a little bit more, figure out the key growth drivers and identify broader industry trends & patterns. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

Today, we will look at the key fundamentals & business of KEI Industries Ltd.

What Has Led to This Consistency

Company Overview

Established in 1968 as Krishna Electrical Industries partnership firm, converted to public limited company in 1992, and has grown into India's leading manufacturer of wire and cable solutions serving clients across sectors globally for over 50 years.

Product Segments include

Wires and Cables

Stainless Steel Wires

Turnkey Projects/Engineering, Procurement and Construction (EPC) Projects

Revenue generation primarily from the Wires and Cables segment (90% of the business)

Manufactures Extra-High Voltage (EHV), Medium Voltage (MV) and Low Voltage (LV) power cables, along with control and instrumentation cables, winding wires, flexible and house wires, and stainless steel wires.

KEI holds 10-12% market share in organized cables segment, competing with Polycab (20-22%), Havells (15-17%), and Finolex (12-14%).

Wide Product Basket

KEI's product range spans the entire voltage spectrum from house wires to 400KV extra-high voltage cables.

LT Power cables (41% of KEI’s revenue) serve industrial and infrastructure projects with longer-term contracts

HT Cables (17%) and EHV cables (5%) cater to large power transmission projects with premium pricing

House wires (27% of KEI’s revenue) benefit from residential construction and replacement demand with shorter cycles.

Industrial cables serve manufacturing sectors with different business cycles than construction-related products

Balanced Customer Mix

KEI balances volume and profitability through institutional customers (46% of business) and retail customers (44%). Institutional customers provide large-volume orders with predictable demand patterns and long-term relationships.

Retail segment offers higher margins and smaller order sizes

Retail segment provides recession resistance as replacement demand continues during economic slowdowns

KEI built diversified base through early investment in organized retail distribution

The company achieved this through consistent quality delivery that created word-of-mouth recommendations. Over 2,000 institutional customers span power utilities, infrastructure developers, and industrial segments.

Demand volatility from any single customer remains minimal

KEI's top 10 customers contribute only 15% of sales versus competitors who often face 25-40% concentration risk

Operational Excellence

KEI's operating margins demonstrates superior efficiency in converting sales to profit. The company's gross profit margin of 22.70% exceeds the industry average of 19.06%.

Seven manufacturing plants provide optimal logistics costs and market proximity

Backward integration through PVC compound plants reduces costs

Optimal capacity utilization of 80-85% in cables division

Upcoming Sanand facility represents strategic capacity addition ahead of demand cycles

Export Strategy

Exports accounted for 13% of FY25 sales. Share of Exports has doubled over the last 5 years. It is expected to grow at 10% CAGR over the next 5 years.

Delivers European quality standards with 20-30% cost savings versus global competitors

KEI’s Technical capabilities allow customization for regional requirements (desert-resistant cables for Middle East, fire-resistant variants for Australian mining)

KEI’s Manufacturing scale and backward integration provide reliable supply chains for large infrastructure projects.

Consistency Formula

Wide Product Basket + Balanced Customer Mix → Revenue Stability

Operational Excellence → Strong cash generation

Export Strategy → Forex Hedge and Revenue Diversity

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research