VA TECH WABAG || Consistently Performing Stocks #46

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they were able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Let’s Start.

In the last 5 years…

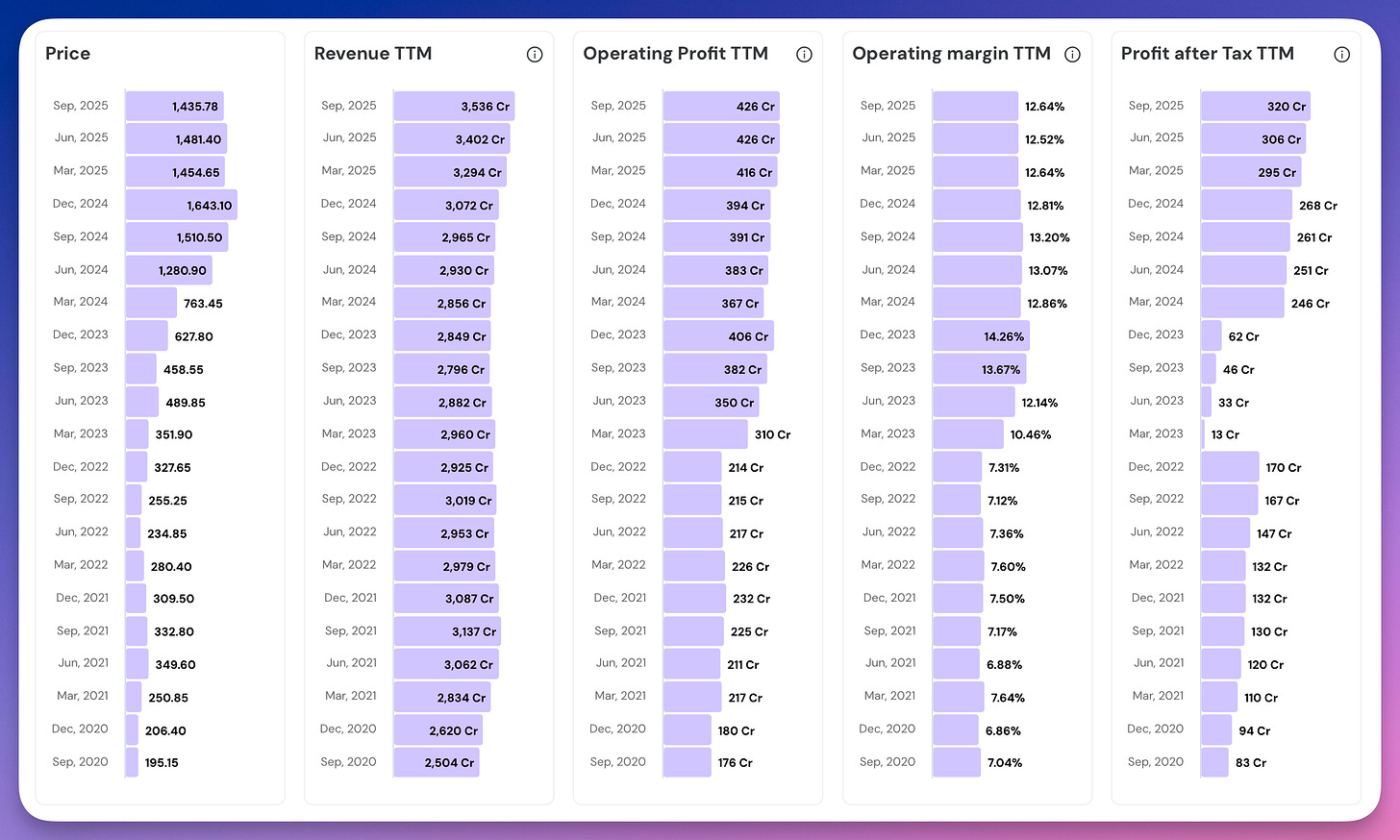

This Stock’s price has surged 7.4 times

Revenue has grown 1.4 times

Operating profit has grown 2.4 times

PAT has grown 3.9 times

Operating Margins have increased from 7.04% to 12.64%

Take a look at the numbers below. Incredible Consistency.Did you guess the stock?

Yes, VA Tech Wabag. India's largest pure-play water technology company.

Let us explore.

Their Road to Consistency

Overview and Business model

VA TECH WABAG operates as India’s only globally-ranked pure-play water technology company.

Their business model is simple. WABAG designs, builds, and operates water treatment plants for cities and industries. The company operates in municipal water treatment, industrial water, desalination, wastewater treatment, and zero liquid discharge systems.

WABAG follows an asset-light model by focusing on high-value design, engineering and O&M services and outsourcing civil construction. This keeps capex, debt and depreciation low.

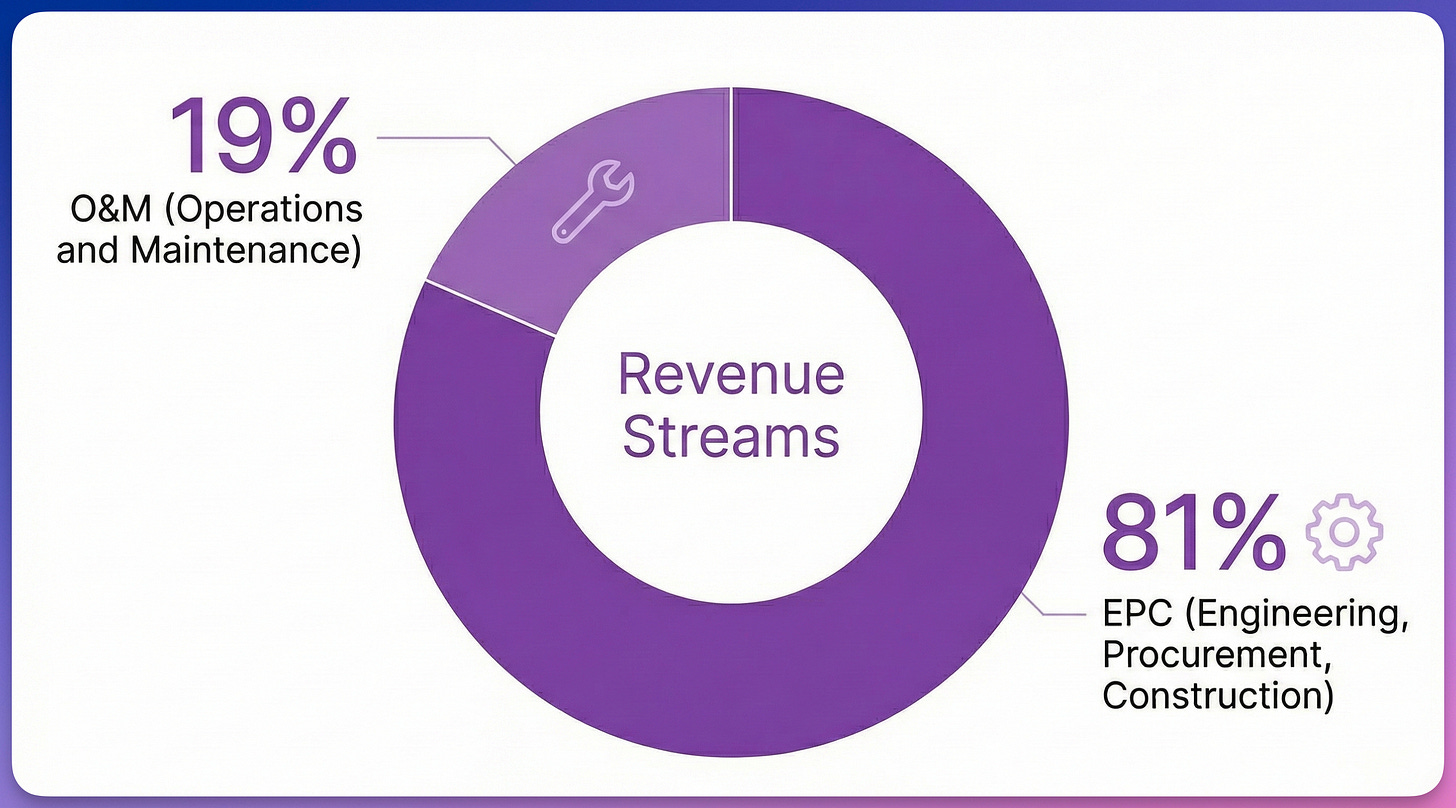

Revenue comes from two streams.

EPC (Engineering, Procurement, Construction) contributes 81% of revenue.

O&M (Operations and Maintenance) adds the remaining 19%.

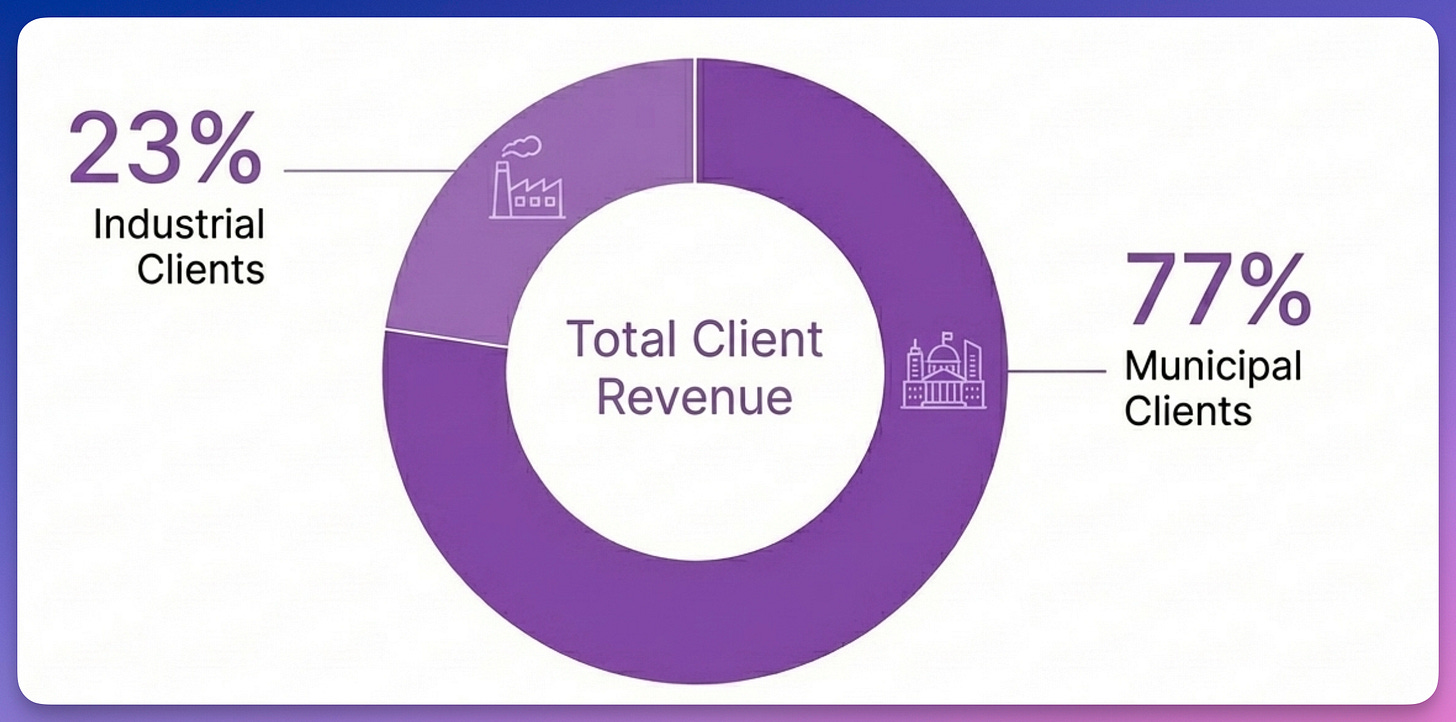

Municipal clients contribute ~77% of revenue; Industrial clients add ~23%.

Geographically, India generates 53% of revenue with international markets contributing 47%. This diversified mix across segments, clients, and geographies provides natural stability.

Government Infra push and Industry Tailwinds

Water scarcity is not a temporary theme. India’s water demand will be twice the available supply by 2030. WABAG sits at the center of this multi-decade opportunity.

The government has responded with unprecedented infrastructure spending.

Jal Jeevan Mission has allocated ₹3.60 lakh crore to provide tap water to every rural household. Coverage has jumped from 17% in 2019 to over 80% in 2025. WABAG executes projects under this flagship program.

AMRUT 2.0 adds another ₹2.99 lakh crore for urban water infrastructure. The program targets 100% sewerage management in 500 cities. WABAG has won multiple city-level wastewater contracts under AMRUT.

Namami Gange has become a significant revenue source. WABAG manages 195 crore liters per day under this river cleaning mission. The ₹1,187 crore Patna sewerage project is among the largest wins.

Water budget allocations increased 55% in 2024-25 to ₹30,234 crore. This signals sustained government commitment. Policy has shifted from water supply to water recycling.

Zero Liquid Discharge mandates now require industries to treat all wastewater. WABAG’s ZLD expertise positions it perfectly for this regulatory push.

Technology Leadership

WABAG has built its consistency on the foundation of proprietary technology. The company maintains 125+ intellectual property rights across patents and trademarks. They represent decades of R&D investment in water treatment processes.

In 2023, WABAG won the Global Water Award for its NMDC Zero Liquid Discharge plant in Chhattisgarh. This plant recovers nearly 100% of industrial wastewater for reuse. The recognition validated WABAG’s position as a technology leader rather than a commodity contractor.

In 2024, the company’s Jubail Industrial City wastewater plant in Saudi Arabia won the Energy Globe World Award. This plant serves 120 million liters daily while recovering energy from biogas. The win demonstrated that WABAG’s technology translates across geographies.

WABAG operates three dedicated R&D centers in Chennai, Vienna, and Winterthur. These centers continuously develop next-generation solutions.

WABAG has built 68 desalination plants across 17 countries since 1995. No other Indian company can match this track record in complex water treatment.

Global Diversification

WABAG operates across 25 countries spanning 4 continents. International revenue contributes 47% of the total. This is among the highest for any Indian infrastructure company.

The Middle East has emerged as a major growth engine. In September 2024, WABAG won a ₹2,700 crore desalination project in Yanbu, Saudi Arabia.

Saudi Vision 2030 requires massive water infrastructure investment. In November 2024, the company secured a $371 million sewage treatment plant in Riyadh. The order demonstrates global confidence in WABAG’s capabilities.

Africa is opening as a new frontier. In December 2024, WABAG entered Zambia with a €78 million wastewater project. This first African order beyond North Africa signals expansion intent.

Nepal has become another growth market. The company won multiple ADB-funded projects totaling ₹650 crore in 2024. Multilateral funding reduces payment risk in emerging markets.

Repeat Relationships

Consistency comes from serving customers well. Repeat business is the highest form of customer endorsement.

Reliance Industries has trusted WABAG for 40 years. In October 2024, Reliance placed another ₹430 crore repeat order for water systems at Dahej and Nagothane. This relationship spans multiple facilities across decades.

Chennai Metro Water is another long-standing partner. In August 2024, WABAG won a ₹415 crore O&M contract for the Nemmeli desalination plant. This 7-year agreement continues a relationship spanning multiple projects. Upon completion of the 400 MLD Perur plant, WABAG will supply 70% of Chennai’s desalinated water.

IOCL Panipat extended their O&M contract by three years in 2024. The ₹20 crore renewal shows operational excellence creates sticky customers.

Bahrain awarded repeat O&M orders worth ₹118 crore in 2024. International customers also demonstrate loyalty.

GAIL continues awarding new projects. The ₹340 crore Pata petrochemical ZLD plant in 2024 added to multiple previous GAIL orders.

Management Quality

Behind every consistent company is a consistent leader. Rajiv Mittal has led WABAG for over two decades. His track record explains much of the company’s performance.

In 2005, Mr Mittal led a management buyout to acquire the Indian operations.

2 years later, Mr Mittal executed a rare reverse acquisition. The Indian subsidiary bought the Austrian parent from Siemens for $100 million. This bold move gave WABAG global technology rights.

Global Water Intelligence ranked Mittal among the World’s Top 20 Most Transformative Leaders in water. The recognition came from industry peers who witnessed the transformation firsthand.

In March 2025, management announced a $100 million partnership with Norfund for municipal projects.

Management discipline also shows in bid selectivity. The 25-30% win rate means WABAG pursues margin over market share. This approach sustains profitability through cycles.

Operational Capabilities

WABAG has built operational capabilities over 9 decades. The company has completed 6,500 projects across 25 countries.

The 400 MLD Perur desalination plant in Chennai is Southeast Asia’s largest. WABAG is executing this ₹4,276 crore project in consortium with Metito. Engineering is advanced and equipment deliveries have commenced. Completion is expected by December 2026.

Revenue growth accelerated to 15.3% in FY25 after years of slower execution. The improvement demonstrates operational bottlenecks are clearing. H1FY26 revenue reached ₹1,549 crore maintaining the acceleration.

The company operates three R&D centers ensuring technology transfer to project sites. Chennai handles Indian innovations while Vienna and Winterthur contribute European expertise.

The 2,000 strong workforce includes specialized water engineers rarely available elsewhere. Project selectivity supports execution quality.

Management focuses on projects with clear payment mechanisms.

Their Consistency Formula

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.