HINDUSTAN FOODS || Consistently Performing Stocks #29

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

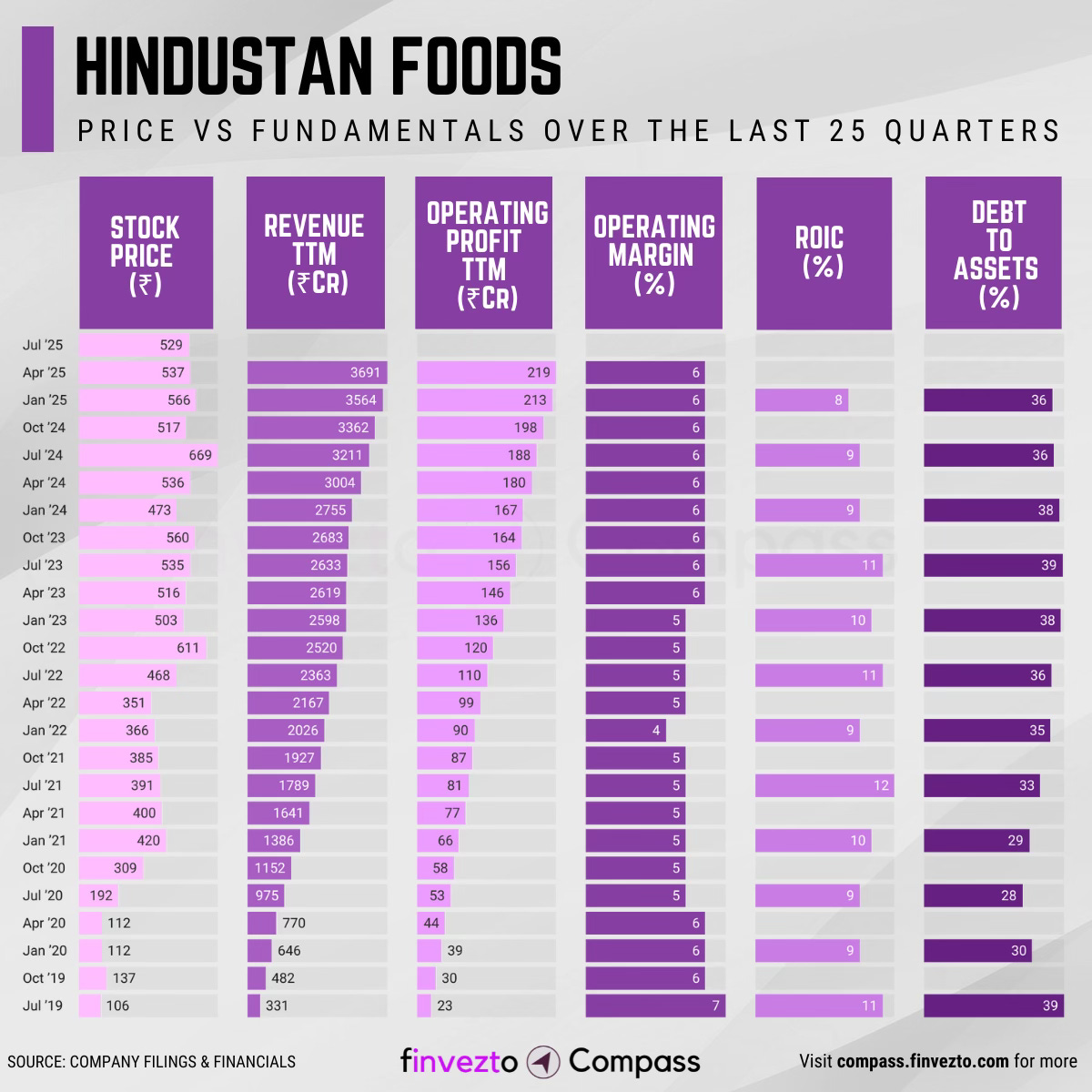

Today, we will look at the key fundamentals & business of Hindustan Foods Ltd.

Click here to learn more about each of the parameters in the chart above.

What Has Led to This Consistency

Company Overview

Founded in 1984 as a Dempo-Glaxo joint venture for baby food manufacturing, Hindustan Foods Limited operated as a single-brand manufacturer for 25 years.

Following a 2013 acquisition by Vanity Case Group, it transformed into India's largest diversified FMCG contract manufacturer serving marquee clients across multiple categories.

Product Segments include:

Food & Beverages - breakfast cereals, instant foods, beverages, ice cream manufacturing

Personal Care & Beauty - hair care, skin care, toiletries, color cosmetics production

Home Care - fabric care, surface cleaners, pest control product manufacturing

Leather & Sports Footwear - premium footwear and accessories for international brands

The company operates three distinct business models across 11 manufacturing facilities:

Dedicated Manufacturing - exclusive facilities for single clients

Flexible Contract Manufacturing - shared production lines across multiple brands

Private Label Manufacturing - complete product development and packaging services

Switching Cost Engineering

The company deliberately structures client relationships to make supplier changes financially and operationally difficult.

Dedicated facilities require client working capital commitments averaging Rs 50-80 crores per facility. These 5-7 year payback periods make supplier changes financially prohibitive → Capital lock-in

Proprietary formulation development creates technical dependencies. Clients own recipes but require HFL's specific equipment and process parameters → Switching barriers

Co-located warehousing and supply chain integration reduce clients' total cost of ownership. This creates logistical dependencies → Client stickiness

Multi-year quality certifications with international clients require 18-24 month validation cycles. This creates temporal barriers to supplier switching → Regulatory moats

Contract Architecture

Long-term agreements provide revenue predictability and pricing power.

Minimum 5-7 year contracts with automatic renewals include early termination penalties. These penalties equal 12-18 months of committed volumes → Contractual protection

Guaranteed return structures are built into dedicated facility agreements. These ensure minimum profitability regardless of volume fluctuations → Downside protection

Take-or-pay clauses require clients to purchase minimum volumes even during demand downturns. This protects capacity utilization rates regardless of market conditions → Volume guarantees

Price escalation mechanisms tied to raw material and labor costs provide automatic margin protection against inflation → Pricing power

Strategic Partnerships

Exclusive supplier relationships create market access barriers and eliminate competition.

Sole-source manufacturing for Mortein vaporizers prevents Reckitt Benckiser supplier diversification. → Exclusive contracts

Preferred supplier status with Hindustan Unilever covers 30%+ of their beverage outsourcing. This creates priority access for new product launches → Revenue growth

International brand manufacturing requires stringent European and US standards compliance. This creates qualification barriers excluding most domestic competitors → Regulatory barriers

Relationships spanning 15-20 years with key clients create institutional knowledge and process optimization. New suppliers cannot easily replicate this → Competitive protection

Margin Amplification

Scale and efficiency advantages drive profitability expansion.

Higher capacity utilization spreads fixed costs across more production units. This improves margins as facilities move from current 65-70% to optimal 85%+ levels → Operating leverage

Shared infrastructure between categories allows rapid line extensions without proportional capital investment. This reduces incremental manufacturing costs → Asset efficiency

Backward integration into packaging and label printing eliminates third-party margins. This also controls quality and delivery schedules → Margin capture

Automated material handling and robotic packaging reduce labor costs per unit by 25-30% compared to manual operations → Productivity gains

Consistency Formula

Switching Cost Engineering + Contract Architecture → Revenue Predictability

Monopolistic Positioning + Margin Amplification → Profitability Growth

Client Dependencies + Operational Scale → Competitive Moat

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research

At the end of the day, for shareholders, the stock returns matters! Negative returns since last 2 years.

Hi InInspite of the Operating profit doubled in the last 3 years the stock price not moved at all.

Any other special reasons why the price of the stock struck in the same price band.