Garware Technical Fibres || Consistently Performing Stocks #40

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they are able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Today, we will look at the key fundamentals & business of Garware Technical Fibres.

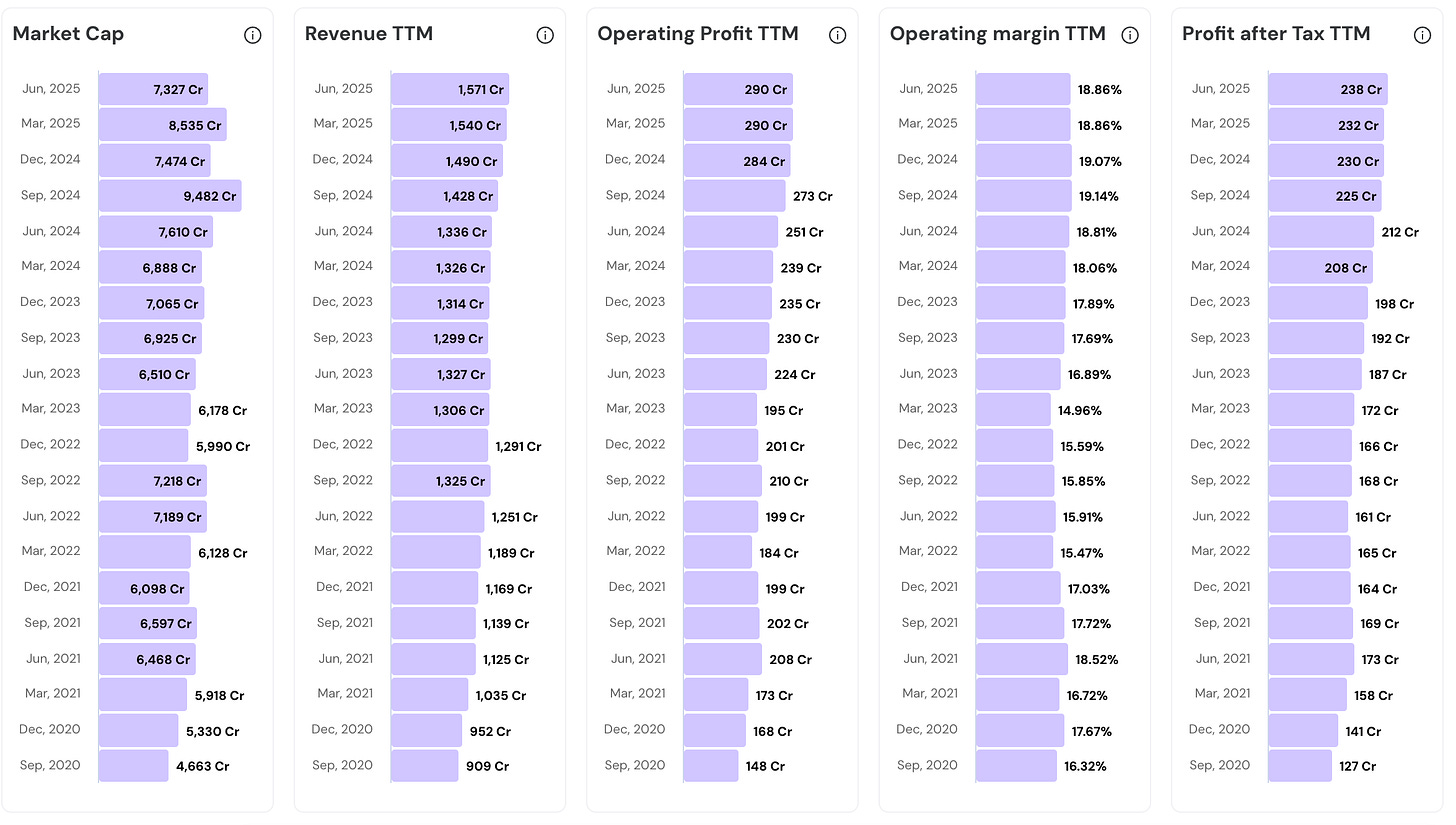

Increasing Revenue, Operating Profit and Net Profit along with increasing Operating Margins. This indicates the company has pricing power and is achieving operating leverage.

How did GARFIBRES achieve this consistency?

Let us explore.

Their Road to Consistency

Overview & Business Model

Garware Technical Fibres started in 1976 as a collaboration with Wall Industries USA to serve India’s fishing industry. Today, the company has evolved into a diversified technical textiles leader serving 75 countries.

The business model centers on B2B customers who need mission-critical products, particularly in the fishing industry. A fishing net might represent just about 2-3% of operational costs for a fishing business, but its failure means lost catch and livelihood. Similarly, aquaculture cage nets protect millions of dollars worth of salmon, where a breach causes catastrophic fish escapes. This creates unusual pricing power for businesses like Garware.

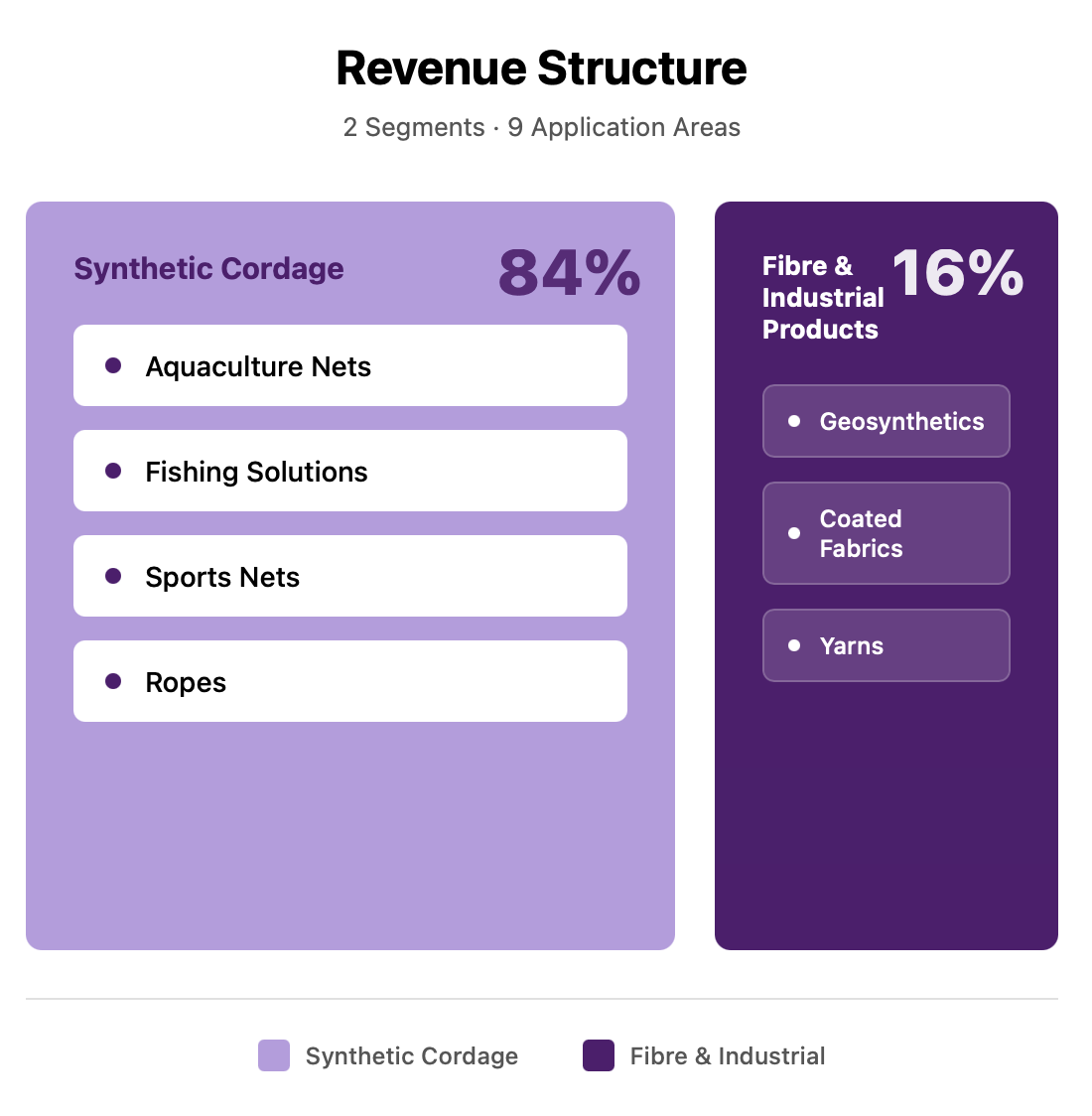

Revenue flows through 2 reporting segments:

Synthetic Cordage

Fibre & Industrial Products

Geographic Mix

International markets contribute 60% of revenue, spanning 75 countries across North America, Europe, South America, and Asia.

Domestic business provides 40%, anchored in fisheries and infrastructure. This 60/40 split has remained remarkably stable from 2022 to 2024, demonstrating balanced portfolio management.

Their products include patented innovations, customized solutions, and technically sophisticated products that command premium pricing.

The company operates with 20,000 SKUs, an extraordinary breadth that creates barriers to replication.

Manufacturing happens at two facilities in Maharashtra. The Pune plant handles primary operations. The Wai facility focuses on vertical integration and innovative products. Both sites maintain ISO 9001 and ISO 14001 certifications.

Product Portfolio Diversification

Aquaculture constitutes the largest and fastest-growing segment. Products include cage nets for smolt and grow-out stages, predator nets against seals and sea lions, lice shields, mooring ropes, and UHMPE specialty solutions. The segment serves salmon, sea bass, sea bream, tilapia, tuna, and emerging species. Growth has been fueled by Chile and Norway in recent times.

Fisheries remains foundational to their business. Product range spans bottom trawling nets, pelagic trawling, purse seine, gill nets, and specialized fishing ropes.

Geosynthetics delivers robust year-on-year growth with good visibility into future projects. Applications include highway and railway slope protection, erosion control, landslide mitigation, coastal protection, and environmental solutions.

They secured complex projects requiring Swiss Federal Institute standards for avalanche barriers. The infrastructure boom creates a multi-year growth runway.

Sports products represent another leg of diversification. Nets supply Wimbledon tennis courts and English Premier League facilities.

They hold the Sports Goods Export Promotion Council award for highest exports. Products cover cricket, football, tennis, golf, hockey, and mountaineering. While smaller than core segments, sports provides geographic and customer diversification.

Industrial applications span defense, shipping, offshore oil and gas, power transmission, and coated fabrics.

Garfil Transline Rope is 15% stronger than conventional transmission line ropes and includes rope break indicator technology for safety.

Defense products include air-inflatable shelters, recovery ropes, and fire-retardant covers for the Indian Navy and Coast Guard. These government relationships provide steady demand.

Strategic Market Positioning and Dominance

Garware holds a 95% market share in Canadian aquaculture, almost owning the market. This dominance stems from decades of relationship building and proven product performance in harsh conditions. Canadian salmon farmers trust Garware nets because failure rates are demonstrably lower than alternatives. The switching costs are high when the entire operation depends on cage integrity.

In Scotland, they command 70% market share through a partnership with Knox. The relationship gives them distribution access.

Norwegian operations center on a partnership with Selstad, serving major producers including Mowi, one of the world’s largest salmon farming companies. Garware also hired former Mowi personnel as technical advisors to deepen market understanding.

Chile represents their growth frontier, where they have captured 35% market share after 10 years of persistent effort. Revenue from the Chilean subsidiary reached Rs 114 crore in FY2024, demonstrating successful market penetration.

The domestic fisheries segment in India shows different dynamics. Garware is synonymous with quality along India’s 7,500 km coastline. They dominate the organized market. Other fragmented unorganized players compete on price in lower segments. The company focuses on gaining share in premium categories where their brand equity and product performance justify price premiums.

Geosynthetics emerged as a spectacular growth driver during in 2024. Projects include avalanche protection on the Kargil-Zanskar highway, hazardous waste landfill capping in central India, and erosion control on the Tapi River.

Infrastructure spending under PM Gati Shakti also creates sustained tailwinds. The company has proven solutions for roads and railways also, positioning them as a preferred partner for complex engineering challenges.

Innovation & R&D

The company maintains a 22-member R&D team, all holding advanced degrees in textile technology. This team operates from a government-recognized R&D facility that has filed over 90 patent applications and secured 24-28 grants.

Investment in R&D runs at approximately 5-10% of annual revenue, a sixfold increase since 2011 when the current Chairman took charge.

Let me highlight one of their products, Sapphire X18 that exemplifies their application-focused innovation approach. Chilean salmon farmers faced devastating attacks from sea lions that could rip through conventional nets. Garware developed a specialized predator net with superior stiffness and cut resistance specifically engineered for this threat. The product launched during 2023-2024 and contributed to what management described as spectacular growth in South America.

Let me also highlight their sustainability-driven innovation through the V2 Technology platform. They embedded antifouling properties directly into HDPE composite fibers, eliminating the need for copper-based chemical treatments. This reduces biofouling by 50%, cutting cleaning frequency in half. Over 25,000 metric tonnes of these sustainable nets have been deployed, preventing 122.5 million kg of CO2 equivalent emissions compared to traditional nylon alternatives.

Such sustainability innovations open doors with environmentally conscious customers, particularly in Scandinavian markets where environmental standards drive purchase decisions.

Manufacturing Excellence and Operational Stability

The company operates at 80-90% capacity utilization consistently, an impressive achievement given demand volatility.

Capacity is modular by design, allowing reallocation between product segments. When aquaculture demand softens, the same equipment can produce fishing nets or sports products. This flexibility prevents the boom-bust cycles that plague specialized manufacturers.

In 2024, they formalized Total Productive Maintenance systems and increased automation for reliability. Best practices were systematically integrated across both plants in Pune and Wai. Quality certified from European and American bodies.

The company maintains annual capital expenditure of Rs 40-50 crore for brownfield expansion.

This disciplined approach avoids the trap of overbuilding capacity during boom times. The modular additions keep the asset base flexible. Combined with their debt-free balance sheet, this creates financial resilience that supports consistency through industry cycles.

Global Customer Relationships and Diversification

Garware’s customer base spans from small-scale fishermen with 200 horsepower boats to multinational salmon producers managing thousands of cages.

This breadth provides stability as different customer segments face different cycles. Infrastructure customers operate on multi-year project timelines while fishing demand follows seasonal but predictable patterns.

Long-term contracts with major customers create revenue visibility. These partnerships involve technical collaboration where Garware participates in solution design. For example, they conducted extensive product trials with Mowi and Camanchaca during Chilean market entry. Success in trials led to broader adoption. The consultative approach builds switching costs beyond the product itself.

These measurable benefits justify premium pricing and create loyal customers who view Garware as a profit partner, not a supplier.

Six overseas offices provide local presence in key markets. These are not just sales offices but technical support centers. When Norwegian farmers face challenges, local Garware staff can respond immediately. This proximity differentiates them from competitors who serve international markets from distant headquarters.

Response time matters when fish welfare and regulatory compliance are at stake.

Supply Chain Management

Raw materials for Garware are predominantly crude oil derivatives including HDPE, polypropylene, nylon, and polyester yarn. This creates vulnerability to oil price swings and petrochemical industry dynamics.

A few large polymer producers dominate supply, giving them pricing power. Garware navigated significant raw material inflation during 2023.

Their value-added product strategy provided the critical buffer. Products that deliver measurable economic benefits can absorb cost increases and pass them to customers. The 70% composition of value-added products in the portfolio enables margin protection during inflationary periods. Commodity players lack this flexibility.

The 2025 acquisition of Offshore & Trawl Supply (OTS) in Norway represents backward integration. OTS operates one of Europe’s most modern synthetic rope manufacturing facilities. The acquisition brings advanced engineering capabilities and proximity to European raw material sources.

Inventory management proved critical during the 2022 container shortage crisis. Cycle times to dispatch goods increased dramatically despite having materials ready. Inventory levels rose, impacting working capital and cash flows. By early 2023, conditions normalized validating their crisis management approach.

Modular and flexible machinery allows rapid production ramping when demand spikes. Product changeover happens at a relatively fast pace compared to industry norms. This operational agility maximizes opportunity capture. The two-plant structure provides redundancy. If one facility faces disruption, the other maintains operations, ensuring customer service continuity.

Consistency Formula & Strategy

Target mission-critical, non-cyclical markets → build deep innovation moat through R&D and patents → establish premium pricing via superior performance and switching costs → diversify across geographies, products, and segments → maintain operational and financial flexibility with modular capacity and zero debt → achieve consistent, shock-resistant growth.

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

❤️