The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business a little bit more, figure out the key growth drivers and identify broader industry trends & patterns. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

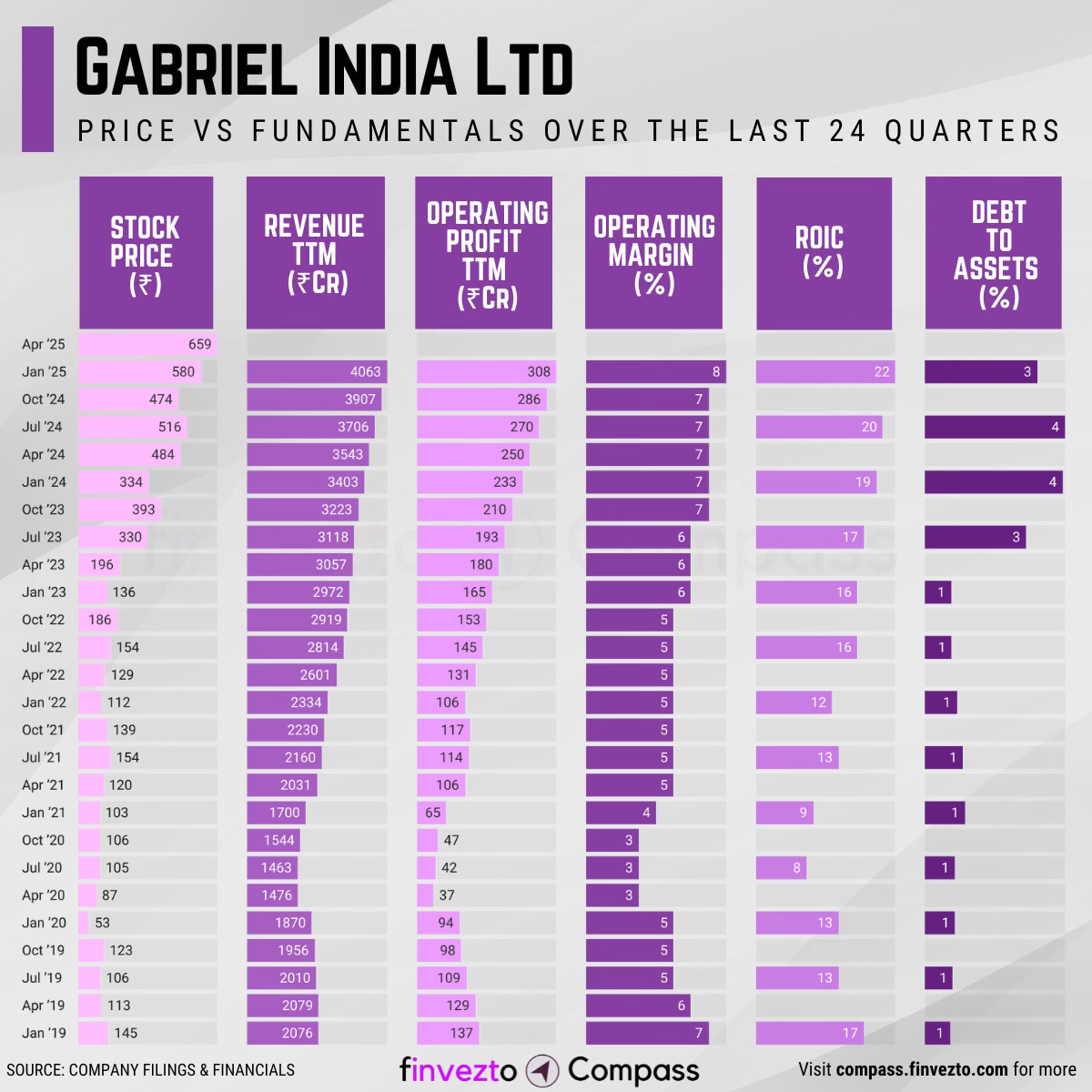

Today, we will look at the key fundamentals & business of Gabriel India Ltd.

What Has Led to This Consistency

Company Overview

Gabriel India Limited was established in 1961

India's leading manufacturer of ride control products including shock absorbers, struts, and front forks.

The company serves two-wheelers, three-wheelers, passenger vehicles, commercial vehicles, and railways through a B2B model, with market leadership of ~89% market share in commercial vehicles & railways.

Marquee clientele across all vehicle segments

Only Indian player with diversified operations across all automotive segments, first-mover advantage in electric vehicles, and indigenous development capabilities for high-speed train components.

Gabriel is the flagship company of ANAND Group and employs 4,466 people across seven manufacturing facilities.

Market Leadership

Gabriel India is the dominant market leader in shock absorbers and ride control products across multiple automotive segments.

Gabriel holds:

89% market share in commercial vehicles & railways,

30% in two-wheelers/three-wheelers, and

24-25% in passenger vehicles.

This dominance comes from consistent product quality, reliable delivery, and 60+ year partnerships with car manufacturers.

Key Customers include Maruti Suzuki, Tata Motors, Hero MotoCorp, Honda, Mahindra, and Ashok Leyland.

Primary supplier status with TVS Motors in 2W/3W segment

Top supplier to Maruti Suzuki, Volkswagen, and Mahindra & Mahindra in passenger cars

Portfolio Diversification

Gabriel manufactures over 500 models of ride control products across multiple automotive segments. This diversification provides stability.

Gabriel supplies shock absorbers, struts, and front forks across all segments. Other players like Jamna Auto focus only on leaf springs, Banco Products only on shock absorbers.

It also acts as a single-source supplier for multiple ride control components to OEMs.

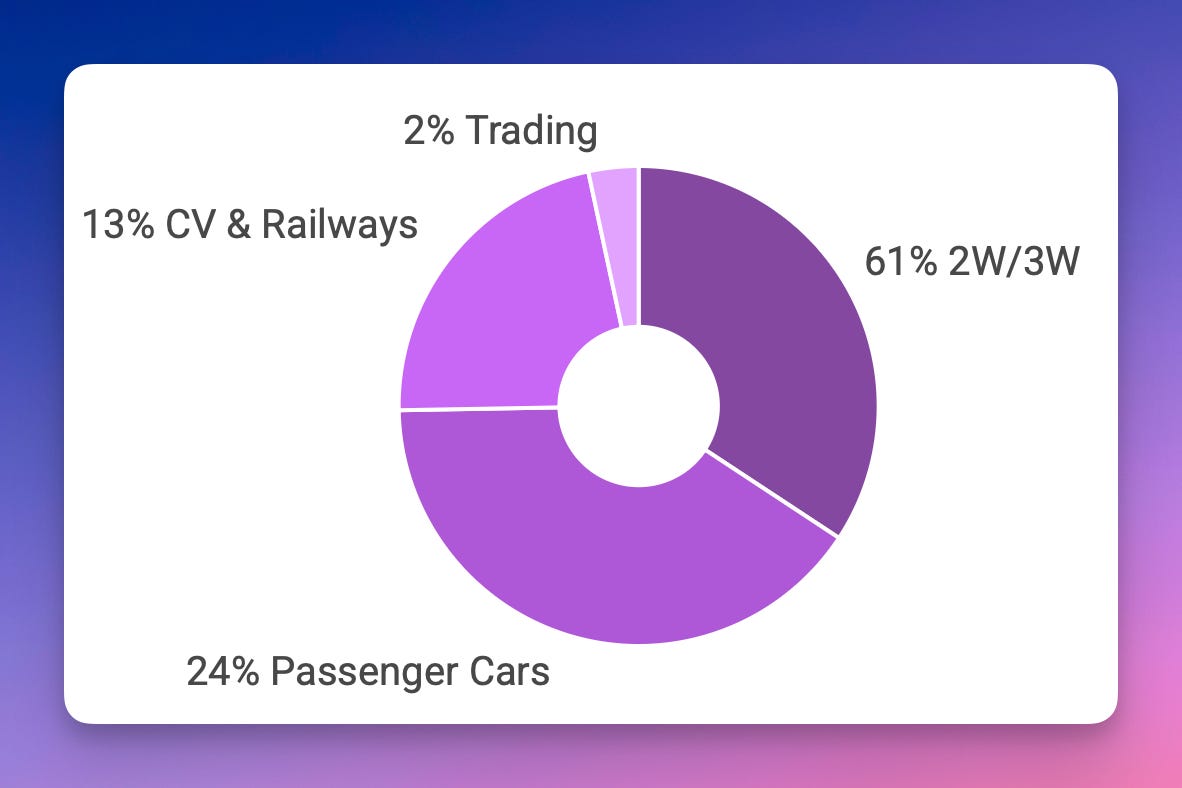

Revenue mix of GABRIEL (FY24), diversified across segments.

Aftermarket Network

Gabriel operates through 794 distributors and 26000 retailers across India, generating predictable recurring revenue streams less cyclical than OEM sales. The company's 'fit-and-forget' reputation cements its aftermarket leadership.

Aftermarket business enjoys higher margins than OEM sales and generates revenue throughout vehicle lifecycles. This provides stability when new vehicle sales decline.

Current Channel revenue mix: 87% OEM sales, 11% aftermarket sales, 2% exports

Aftermarket Sales grew at 7% YoY in FY25.

Strategic Acquisitions

Gabriel's 2025 acquisition of Marelli Motherson Auto Suspension Parts assets for ₹60 crores added 3.2 million shock absorber and 1 million gas spring units of annual capacity. The deal included License and Technical Assistance Agreements with Marelli Suspension Systems Italy.

The deal positions Gabriel for higher value-added products and premium market segments.

40% increase in shock absorber production from Marelli acquisition

Exclusive license agreements with Marelli Suspension Systems Italy

Deal completed January 2025, adding premium gas spring technology

EV Leadership

Gabriel positioned itself early in India's rapidly expanding EV market, beginning partnerships around 2020-2021 and actively supplying by August 2021. Major players like TVS and Bajaj scaled their EV offerings only in 2022-2023.

Gabriel now holds approximately 70% market share in the electric two-wheeler sector, supplying suspension components to major EV manufacturers including OLA, River, and TVS.

Supplies to Ola Electric (35% EV market share), TVS (second largest EV player), and emerging players like River and Ather

EV segment growth: 40% YoY in EV-2W and 60% YoY in EV-3W (Q3 FY24)

2-year head start over traditional players in EV component supply

Innovation Excellence

75 patents filed (6 granted), demonstrating continuous innovation through multiple R&D centers and collaborations with global leaders like KYB Corporation (Japan), KYBSE (Spain), and Yamaha Motor Hydraulic System (Japan).

The company operates R&D facilities in Chakan and Hosur, plus a European technology center in Belgium. Innovation investments enable proprietary products with premium pricing.

First Indian company to develop train shock absorbers for 200+ kmph high-speed trains

FSD technology currently exclusive to Mahindra XUV700 in Indian market

Global Presence

Gabriel demonstrates strong export growth at 15% CAGR across 45+ countries in five continents.

Gabriel's exports are split 54% OEM and 46% aftermarket, showing diversified international revenue streams.

Export markets span Europe (25%), America (32%), Asia (22%), and other regions (21%)

Supplies to ISUZU's Thailand and Indonesia operations, demonstrating global OEM quality standards

Consistency Formula

Market Leadership + Product Diversification → Revenue Stability

Innovation + Smart Acquisitions → Technology Leadership

Aftermarket Network + Global Sales → Steady Income Streams

EV Leadership + Innovation → Future-Ready Business

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research