Finvezto Daily Market Bytes, 04 Dec 2024

Your daily dose of bite-syzed stock, business & economy updates

In today’s edition, we cover:

New GST Proposal triggers fall in ITC

China Ban Boosts Indian Graphite

Swiggy witnesses Strong Growth & Narrowing Losses in Q2FY25

Key Stock Updates

New GST Proposal triggers fall in ITC

The News:

Group of Ministers (GoM) propose GST rate hike on 148 items, including a new 35% slab for tobacco and aerated beverages, alongside higher taxes on premium garments and watches.

The Details:

The proposal aims to bridge the gap between current GST rates and revenue-neutral rates despite existing high taxes like the 28% slab.

Premium products face steeper taxes, with garments above ₹1500 and ₹10000, and watches above ₹25000 targeted for increases.

Implementation would create a 5th tax slab, further complicating India's GST structure which already contrasts with simpler global tax systems.

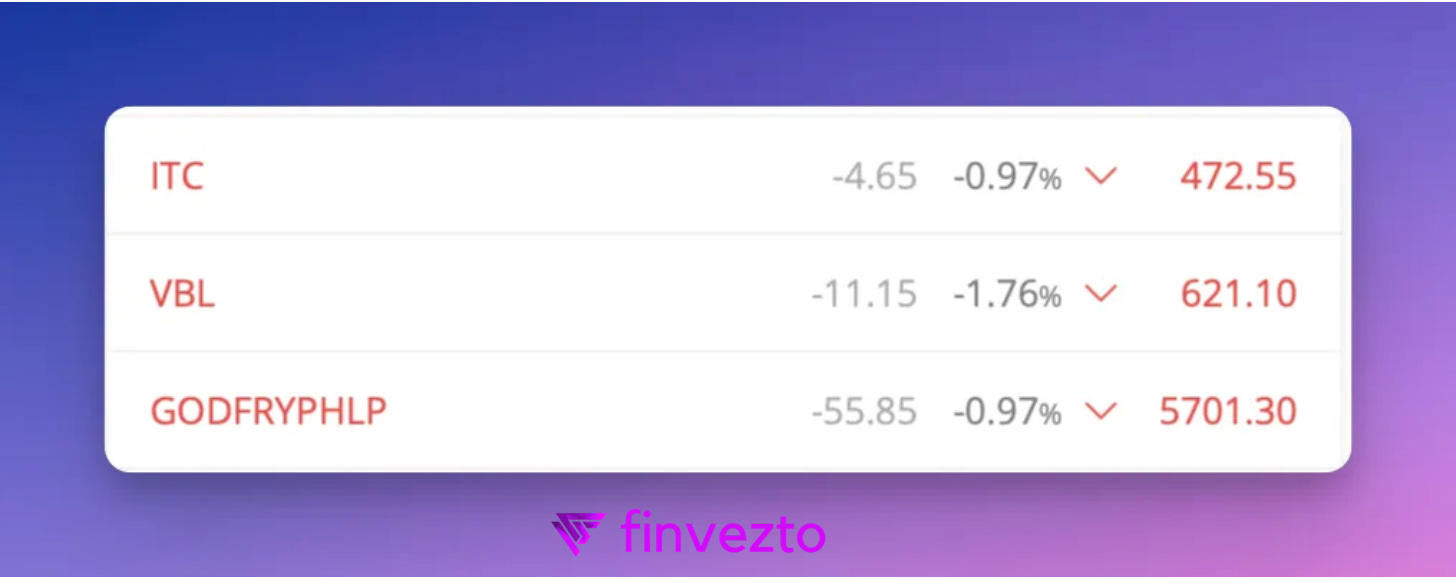

ITC, Godfrey Phillips India, and Varun Beverages stocks declined on the news.

The GST Council's December 21 meeting will determine which proposals are accepted.

Note: The CBIT clarifies that media reports about GST rate changes are premature and speculative, as the Group of Ministers (GoM) has not yet finalized its recommendations. The final decision on any GST rate changes rests with the GST Council, chaired by the Union Finance Minister, and not with the GoM, which is only a recommendatory body.

China Ban Boosts Indian Graphite

The News:

Indian graphite manufacturers HEG and Graphite India shot up after China announced stricter controls on graphite exports to US.

The Details:

China's bans gallium, germanium, and antimony exports, alongside tighter reviews for graphite shipments to US.

This led to a sharp rise in HEG & Graphite India.

The restrictions come as China's response to US semiconductor sector targeting, creating an opportunity for Indian manufacturers to expand their global market presence.

The development particularly impacts electric vehicle battery and semiconductor manufacturing sectors, where graphite is a critical component.

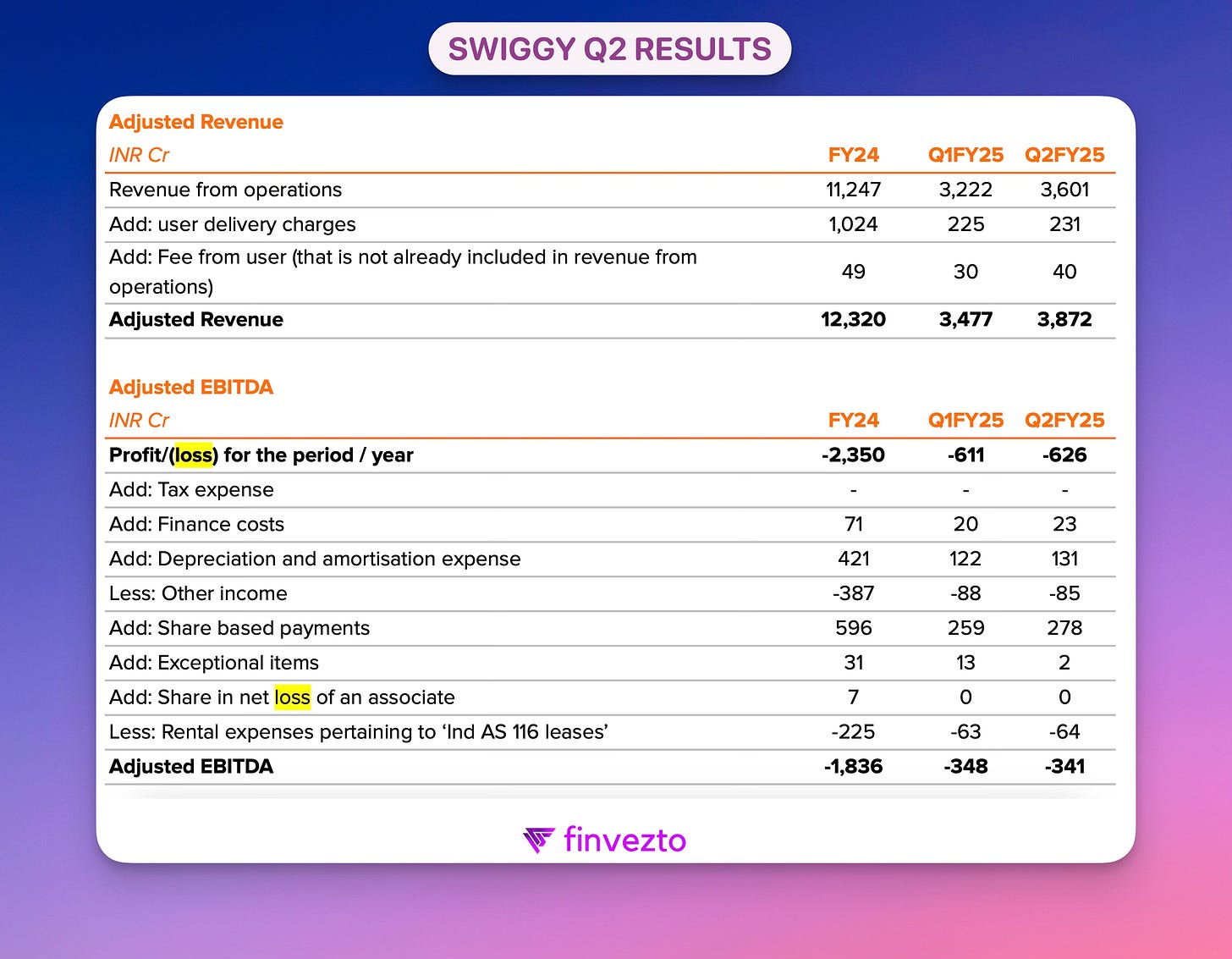

Swiggy witnesses Strong Growth & Narrowing Losses in Q2FY25

The News:

Swiggy reported a 5% reduction in net loss to ₹625.53 crore in Q2FY25, while revenue surged 30% to ₹3,601 crore. Monthly active users grew to 17.1 million, marking a 19% year-over-year increase.

The Details:

The company's Food Delivery business achieved EBITDA profitability with ₹112 crore.

Instamart doubled revenue to ₹490 crore. Instamart expanded to 54 cities, delivering 32,000 unique items with an average delivery time of 13 minutes, and plans to double its dark store count by March 2025.

Their new '10-minute delivery' service 'Bolt' captured 5% of deliveries within eight weeks of launch.

Swiggy expects to achieve positive consolidated Adjusted EBITDA by Q3FY26.

Key Stock Updates

NEW ORDERS

RVNL gets ₹187 crore order from East Central Railway

Aimtron Electronics bags ₹37.70 crore telecom sector order

Vinyas secures domestic and international orders worth ₹48.03 crore

NBCC wins ₹213 crore Motilal Nehru College construction contract

PARTNERSHIPS, ACQUISITIONS & INVESTMENTS

TCS joins Bank of Bhutan to upgrade their digital banking infrastructure

Kaynes Technology acquires 54% stake in Austrian railway monitoring firm Sensonic

Nazara invests ₹196 crore in gaming and education platforms

Aditya Birla Capital invests ₹300 crore in housing finance subsidiary

Kashipur Holdings raises India Glycols stake to 50.35%, becomes holding company

PB Fintech forms healthcare services subsidiary PB Healthcare

CORE BUSINESS UPDATES

Solar Energy Corp lifts tender ban on Reliance Power, except Reliance Nu Bess

Indian Energy Exchange November electricity trade rises 15.7% to 9,689 MU

Sudarshan Chemical launches Sumica Bright Gold 41633 for industrial applications

United Breweries introduces Amstel Grande premium beer in West Bengal

Tata Power Renewable starts 431 MW solar project in Madhya Pradesh

Gland Pharma receives US FDA nod for Latanoprost Ophthalmic Solution

CORPORATE ACTIONS

ONGC invests ₹10,000 crore in OPaL through rights issue

Godrej Properties raises ₹6,000 crore through QIP to reduce debt

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This daily update highlights market trends for your awareness. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

We offer the following services. Please click on each link to know more.