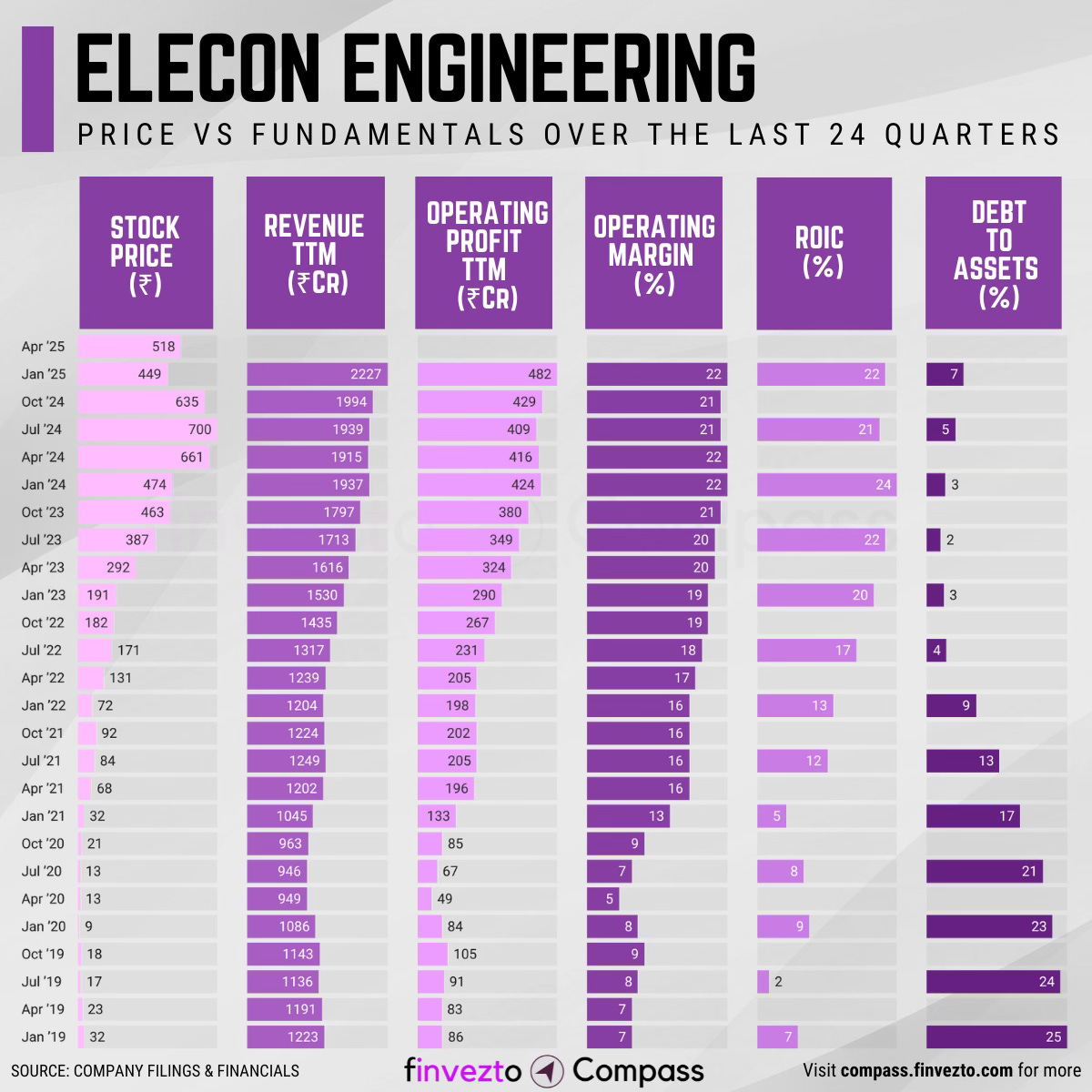

ELECON ENGINEERING || Consistently Performing Stocks #12

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business a little bit more, figure out the key growth drivers and identify broader industry trends & patterns. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

Today, we will look at the key fundamentals & business of Elecon Engineering Company Ltd.

What Has Led to This Consistency

Company Overview

Elecon Engineering Company Ltd, founded in 1951 and headquartered in Anand, Gujarat, is Asia's largest manufacturer of industrial gears and material handling equipment (MHE). The company operates in core sectors like power, steel, cement, mining, and ports, with a global presence across 85+ countries.

Simply put, Elecon’s products transfer power and move materials in factories, power plants, steel mills, cement plants, ports, and mining operations. Think of them as providing the critical mechanical systems that keep industrial processes running efficiently.

With over seven decades of operation in India, Elecon has established itself as a leader in engineered solutions, supporting industrial automation and infrastructure growth across multiple sectors.

Dual Revenue Stream

Elecon operates through two distinct divisions: the Gear Division and Material Handling Equipment (MHE) Division.

The Gear Division manufactures industrial gears for power plants, steel mills, and cement factories, while the MHE Division produces equipment like stackers, reclaimers, and port mechanization systems for mining, ports, and infrastructure sectors.

When the Gear Division experienced flat growth in the past, the MHE Division's fast growth offset the slowdown. This dual structure reduces dependence on any single product category and creates balance against sector-specific market fluctuations.

Sector Diversification

Elecon serves numerous industrial sectors including power generation, steel manufacturing, cement production, ports, mining, defense, sugar processing, rubber, plastics, and oil & gas.

This cross-sector presence reduces risk from industry-specific downturns, as weakness in one sector can be offset by strength in others.

The company's products are essential components in critical infrastructure industries, providing stability through varied economic cycles.

This sector diversification protects against fluctuations caused by government policy changes, commodity price movements, or sector-specific challenges while maintaining consistent order flow.

Aftermarket Revenue

Elecon maintains a substantial aftermarket business offering spare parts, maintenance, and repair services for its installed equipment base.

This segment generates recurring revenue that remains stable despite economic cycles, as industrial machinery requires regular maintenance regardless of economic conditions.

The aftermarket provides predictable income even during periods when new equipment sales may slow due to reduced capital expenditure in client industries.

This service-based revenue acts as a stabilizing factor for overall business performance and maintains customer relationships that can lead to equipment replacement orders in the future.

Vertical Integration

Elecon's in-house foundry, metal casting factory, and fabrication facilities, metal shaping workshops, deliver end-to-end manufacturing capabilities, reducing dependence on external vendors for critical components.

This vertical integration minimizes vulnerability to supply chain disruptions and material price fluctuations.

Global Partnerships

Elecon has expanded internationally through OEM partnerships, particularly in Europe. With 11 new overseas partnerships in the last 1.5 years, international revenue grew from 24% to 34% of total revenue.

These partnerships enable market entry without the capital investment of direct expansion. Elecon benefits from "China plus one" sourcing strategies, where companies maintain Chinese suppliers but add alternative countries to diversify supply chains.

Facilities in UK, Sweden, USA, and Netherlands support a distribution network reaching 85+ countries.

Operational Excellence

Elecon operates state-of-the-art manufacturing facilities spread across 335,000 square meters with over 700 machine tools.

The company has implemented lean manufacturing principles and process optimization to improve inventory turnover and reduce receivables.

R&D Capabilities

Elecon maintains two DSIR-approved R&D centers with 100+ engineers, 2 secured patents (5 pending), and 20+ specialized design software systems.

The expertise allows Elecon to differentiate through engineering rather than just price, following a structured R&D process that ensures continuous improvement and adaptation to evolving industry needs.

Consistency Formula

Dual Revenue Stream + Sector Diversification → Economic Cycle Resilience

Vertical Integration + Operational Excellence → Manufacturing Self-Sufficiency

R&D Capabilities + Aftermarket Revenue → Sustainable Growth Engine

Global Partnerships + Government Initiative Alignment → Expanding Market Reach

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Useful & Actionable Stock Market Tools