DODLA DAIRY || Consistently Performing Stocks #28

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

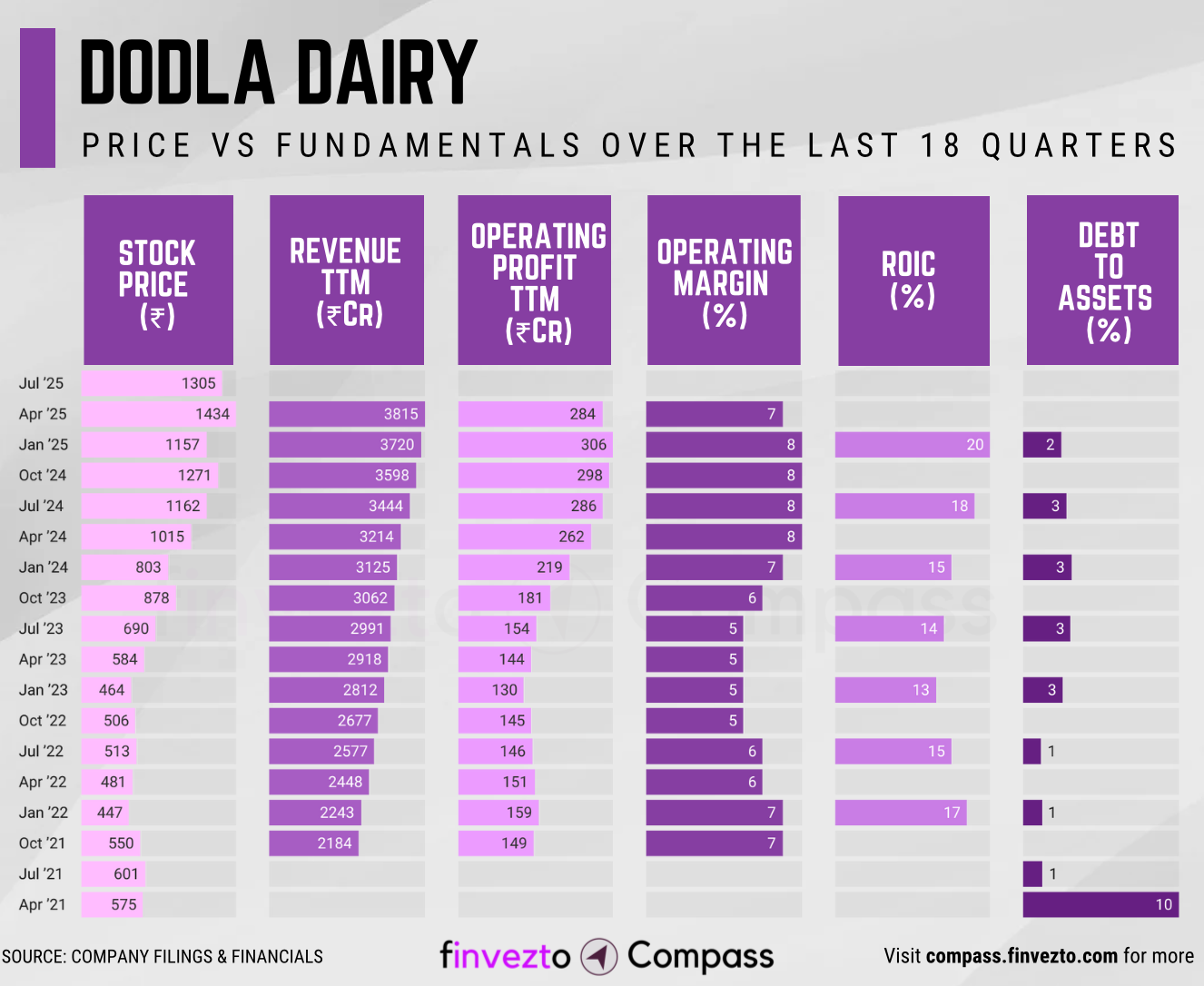

Today, we will look at the key fundamentals & business of Dodla Dairy Ltd. Click here to learn more about each of the parameters in the chart below.

What Has Led to This Consistency

Company Overview

Dodla Dairy Limited was established in 1995. Evolved from a regional South Indian player into a pan-India dairy company with unique international presence across African markets as well.

Product Segments include:

Liquid Milk Portfolio: Fresh milk (5 variants), UHT milk, standardized, toned, double-toned variants across mass and premium segments

Value-Added Products: Curd, buttermilk, ghee, paneer, flavored milk, doodh peda, lassi, ice cream, milk-based sweets

Specialty Manufacturing: Skimmed milk powder, cattle feed production through Orgafeed subsidiary

International Operations: Processing and distribution across Uganda and Kenya markets

The company operates a vertically integrated business model serving urban and semi-urban populations across multiple states in India

Manufacturing Excellence

Fully automated processing lines integrate real-time quality monitoring with ERP systems, enabling consistent product standardization → Quality Assurance

Kenya plant commissioning adds 100,000 liters daily capacity with Dairy Top targeting Africa's untapped middle-class demand

Value-Added Products (VAP) contribute 35% of revenue compared to 25-30% industry average performance demonstrating superior premiumization execution → Pricing power

Specialized SMP plants transform commodity milk into higher-margin products, enabling portfolio diversification beyond basic liquid milk → Margin Expansion

Supply Chain Integration

Integrated supply chain architecture delivers advantages through vertical coordination and quality control.

188 milk chilling centers provide reliable procurement access to farmers across 5 states, establishing supply security.

Telangana and Andhra Pradesh regional dominance. Processes 17.1 lakh liters daily across southern markets.

Orgafeed cattle feed business serves 35-40% of procurement farmers and generates 14.7% EBITDA margins creating ecosystem stickiness

Real-time ERP integration enables quality traceability from village collection to consumer delivery, building consumer trust

Cold chain infrastructure spanning sales offices ensures product freshness across extended networks → Distribution advantage

600+ retail parlours provide direct customer touchpoints that eliminate distributor margins and help gather direct consumer insights.

Strategic Acquisitions

Geographic diversification through systematic acquisitions.

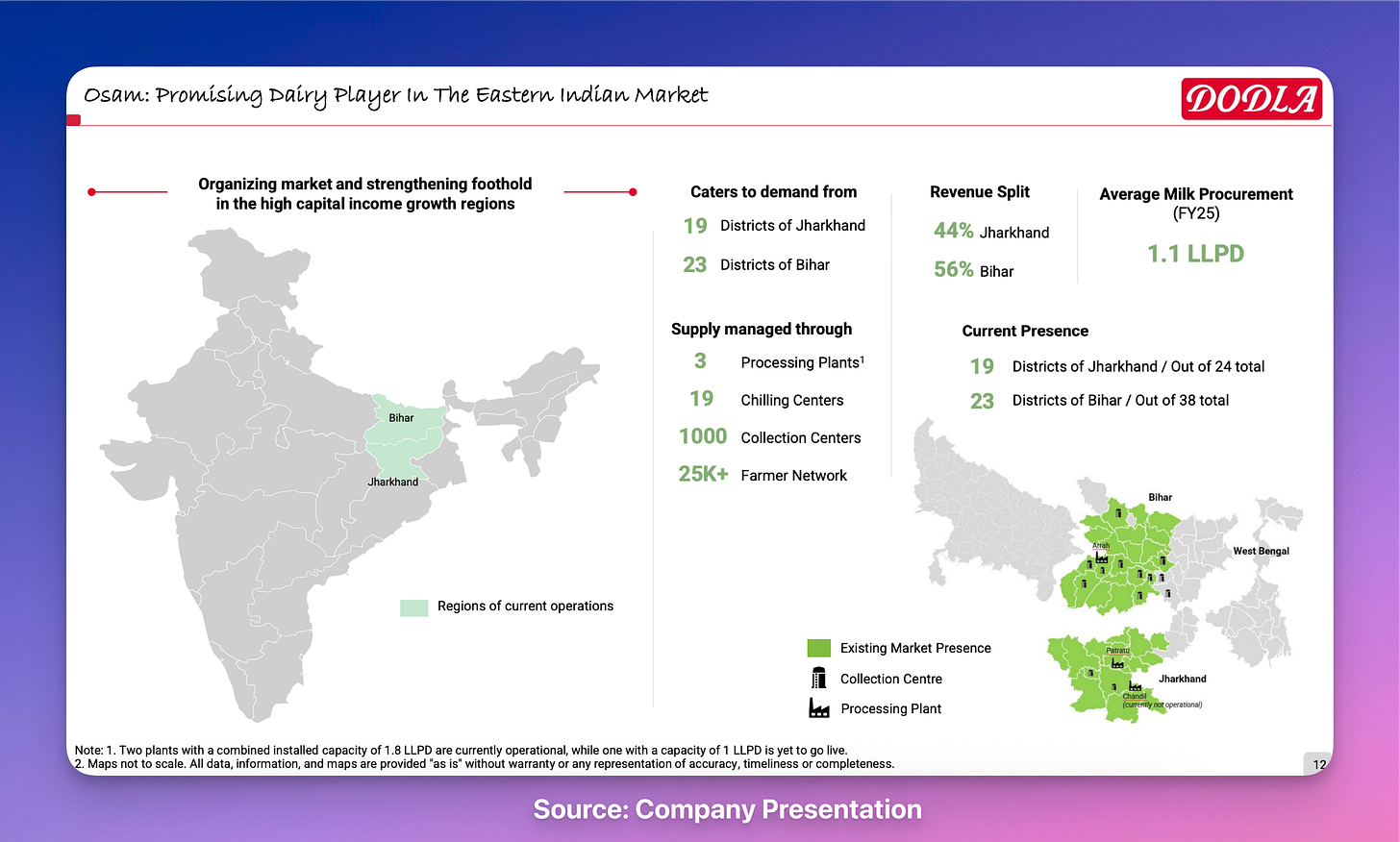

Osam acquisition delivers immediate Bihar-Jharkhand access providing access to 25,000+ eastern farmers → Supply growth

Osam transaction also helped acquire 1,000 collection centers and 19 chilling facilities avoiding years of development and providing instant infrastructure → Speed

Sri Krishna Milks acquisition in Karnataka strengthened regional market share and added capacity and specialized production

Distribution Network

Extensive agent and distributor networks across 11 states provide comprehensive market coverage ensuring product availability

Standardized retail parlours establish direct consumer touchpoints that bypass traditional distribution margins and provide brand visibility

Multi-format distribution strategy spanning modern trade, general trade, and institutional sales creates channel diversification that reduces dependency risk

Dedicated sales offices with territory management enable localized market intelligence providing competitive insights superior to centralized distribution models

Market Positioning & Growth

A2 milk and functional dairy premiumization growing 15-20% annually versus 5-7% commodity milk growth positioning established VAP portfolio ahead of competitors → Premium capture

Indian dairy sector projected growth from $146.8 billion to $274.09 billion by 2032 creates expansion opportunities.

Uganda and Kenya operations contribute 10.2% of total company revenue providing international market diversification.

Eastern India market development through Osam acquisition captures highest growth potential regions with lower competitive intensity than saturated southern markets.

Consistency Formula

Supply Chain Integration + Manufacturing Excellence → Operational Dominance

Strategic Acquisitions + Distribution Network → Market Leadership

Market Positioning + Manufacturing Excellence → Sustainable Growth

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research