DHANUKA AGRITECH || Consistently Performing Stocks #37

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they are able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Today, we will look at the key fundamentals & business of Dhanuka Agritech Ltd.

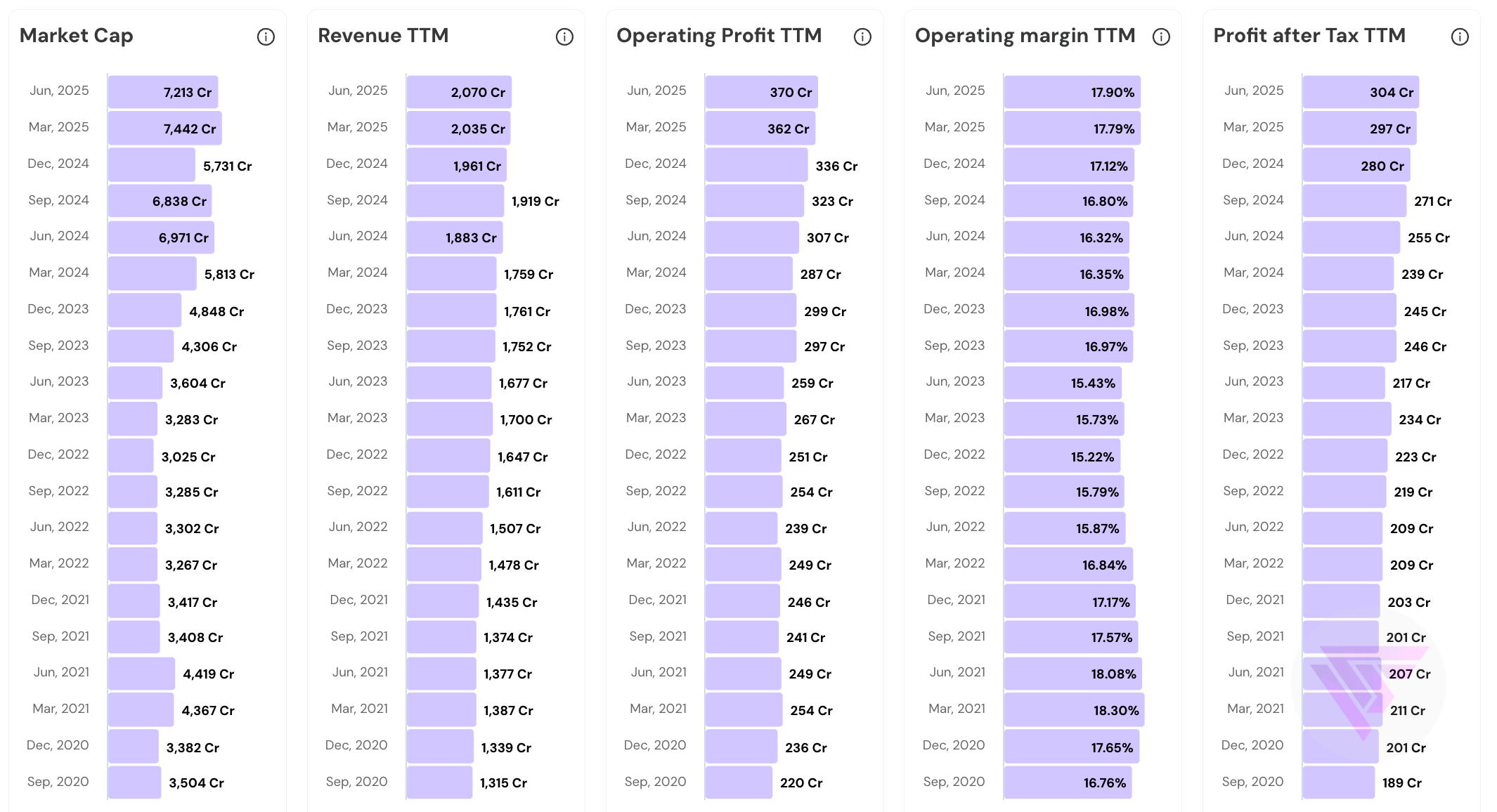

Increasing Revenue, Operating Profit and PAT along with steady Operating Margins. How has DHANUKA AGRITECH been able to perform consistently?

Let us explore.

The Keys to Consistency

Company Overview

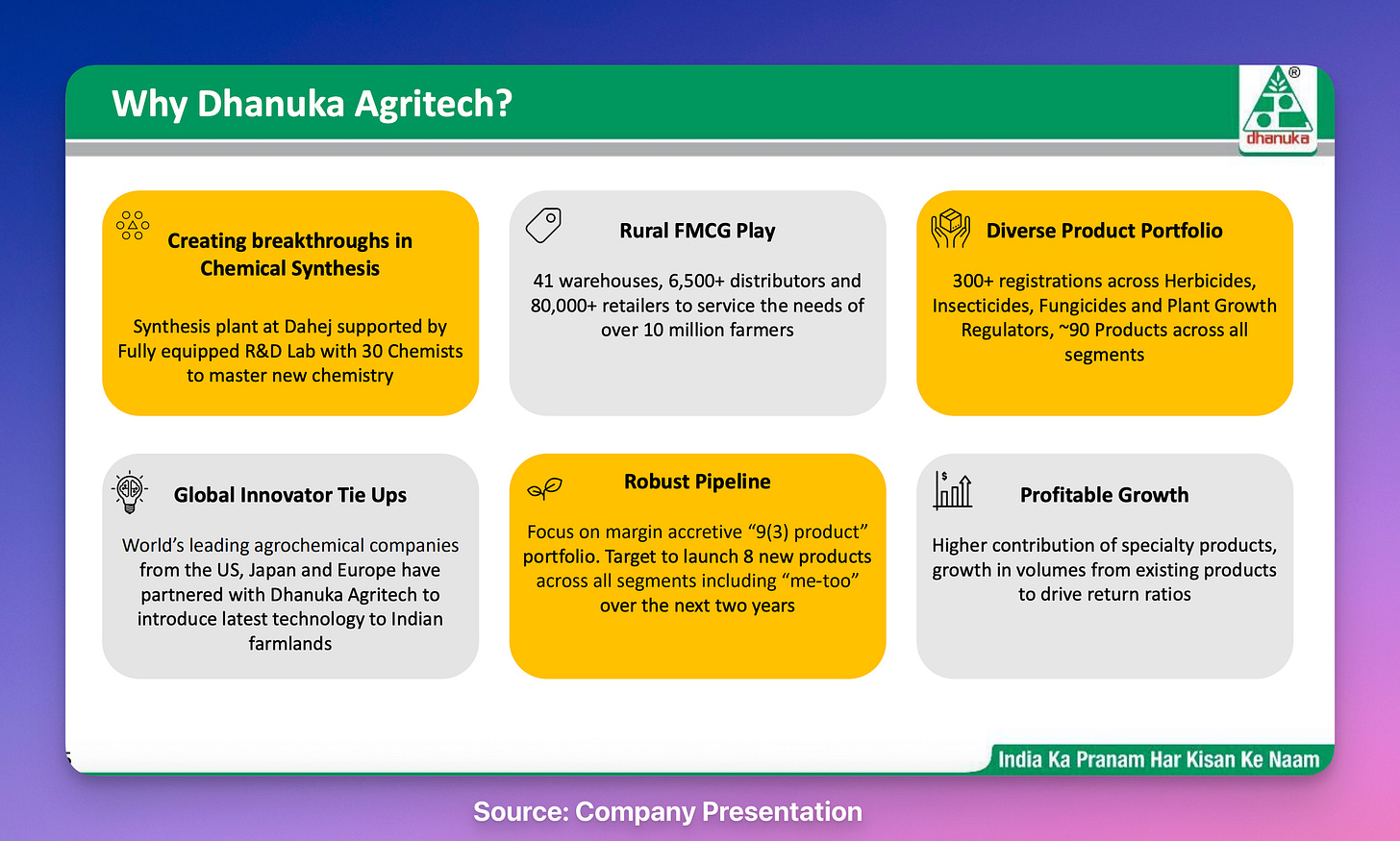

Founded in 1980, Dhanuka Agritech Limited specializes in crop protection products (herbicides, insecticides, fungicides, PGRs).

Dr. R.G. Agarwal discovered that farmers needed both the products and credit to finance them. He built a business model where the Distributors finance seasonal purchases of farmers and deepen relationships with them.

Dhanuka has Pan-India reach with ~6,500+ distributors, 80,000+ retailers, 41 warehouses, and touchpoints to 10+ million farmers. Almost a rural FMCG engine.

The company leans on global tech tie-ups to bring new formulations to market, then brands and promotes them in India.

Product Segments include:

Herbicides for weed management across cereals, sugarcane, and commercial crops

Insecticides for pest control across contact, systemic, and specialized applications

Fungicides for disease management including newly acquired premium international products

Plant Growth Regulators and Biologicals for sustainable agriculture applications

Crop protection products are consumable by nature, requiring farmers to purchase fresh supplies every growing season. Multiple cropping cycles create continuous demand throughout the year.

Distribution Fortress

Dhanuka's distribution system creates recurring revenue through farmer dependency and long-term relationships.

~6.5k distributors / 80k+ retailers provide depth and velocity across micro-markets. Kind of a distribution moat.

41 warehouses enable faster replenishment and season-critical availability.

Dhanuka’s distributors advance ₹50,000-2 lakh credit per farmer for seasonal purchases, creating financial dependency that ensures repeat business every cropping cycle → Revenue predictability

The network is positioned like that of an FMCG firm—frequent, repeat purchases and wide SKU spread.

44 years of distributor relationships has created credit systems, trust mechanisms, and local farming knowledge transfer.

Balanced Product Mix

Product mix remains diversified. But let us look closer the mix over the quarters. Category mix is tilting with seasons and premium launches. When Insecticides share increases, Herbicides share falls and vice versa. Look at the numbers below.

Q3 FY25 – Insecticides 29.99%, Fungicides 19.96%, Herbicides 34.71%, Others 15.34%

Q4 FY25 – Insecticides 38%, Fungicides 13%, Herbicides 32%, Others 17%

Q1 FY26 – Insecticides 23%, Fungicides 11%, Herbicides 50%, Others 16%

New products since FY25 are also driving premiumizations → higher margins.

Introduced Lanevo (insecticide) and MYCORe Super (bio-fertiliser), and launched Roxa (Pyroxasulfone 85% WG) for wheat in Q3 FY25.

Technology Partnerships

Dhanuka's Japanese alliances and section 9(3) product focus create margin advantages that competitors cannot access.

10+ global collaborations (US/Japan/Europe) feed a steady stream of first-to-India chemistries.

6 Japanese partnerships with companies like Sumitomo Chemical give Dhanuka first access to new molecules before any competitor enters India.

Nissan Chemical alliance underpinned LaNevo (2024), boosting the premium insecticide play.

Dhanuka focuses on original product registrations rather than generic "copy" products, providing higher margins. 8 new launches planned over next two years as well.

Company research center systematically converts Japanese technology into 2-3 new Indian product launches every year.

Manufacturing Integration

Dhanuka's unique manufacturing setup reduces costs and creates new revenue streams that drive consistent performance.

Multi-site formulation backbone at Sanand, Udhampur, Keshwana & Dahej provides redundancy and throughput.

Supply-chain depth helps absorb monsoon-linked demand swings without stockouts in key belts.

Dahej (Gujarat) technical/synthesis plant + R&D Lab established in 2023 with ~30 chemists strengthens cost, speed, and chemistry depth.

Recent Bayer acquisition gives Dhanuka global manufacturing and marketing rights for fungicides across 20+ countries worth ₹200+ crores annually.

Industry Tailwinds

Rising farm incomes via policy support. MSPs for Kharif crops were raised again for 2025–26 (notably cotton +₹589/qtl), and sugarcane FRP was hiked to ₹355/qtl for 2025–26 (after an ~8% hike for 2024–25). Higher assured prices typically lift input spend on seeds/crop-protection. A positive for Dhanuka.

Drone spraying push by Govt lowers application friction. The Centre updated SMAM mechanisation guidelines (2024/2025), funds demos (up to ~₹10 lakh per drone) and is rolling out Namo Drone Didi to 15,000 women SHGs. This accelerates adoption of branded inputs from companies such as Dhanuka.

Shift toward biologicals & IPM. Government IPM programs targeted 3,300 million biocontrol releases and 10+ lakh ha coverage in 2024–25. Positive for companies such as Dhanuka with bio lines and sustainable positioning.

Internationalisation

Acquired international rights to Iprovalicarb & Triadimenol (Bayer AG) in Jan–Feb 2025, enabling sales in 20+ countries and a planned India brand launch.

Strategy includes onshoring manufacturing to Dahej for at least one molecule to improve economics and control.

The Bayer assets are expected to add materially to FY26, seeding a recurring export stream.

Export capability diversifies earnings beyond domestic monsoon cycles.

Resilience Enablers

Despite being hit with raw-material inflation, in-house synthesis (Dahej) and portfolio premiumization have cushioned the impact.

Seasonality/disease variability hit fungicide offtake in 2024–25, yet new launches such as LaNevo, MYCORe did well demonstrating product mix resilience.

Geographic & crop diversification plus channel velocity reduce localized weather risk.

Credit-profile strength (CARE AA) maintains financial flexibility to invest through cycles.

Consistency Formula

Distribution Fortress → Reach + Predictable repeat demand

Premium Pipeline & Mix → Margin Accretion and Improvement

Manufacturing Integration → Cost & Speed edge

Industry Tailwinds → Higher Wallet Share

Internationalisation → New Profit Pools

Resilience Enablers→ Performance across Cycles

To summarize, this is what Dhanuka has done/trying to do:

Global tie-ups & R&D → premium launches → channel push & credit → repeat seasonal purchases → stronger cash flows → reinvest in registrations, brand, and manufacturing → even more defensible mix and margins

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Trading Strategies (Enhancers)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

Insightful.

Thank you for sharing.

Thanks for writing this, it clarifies a lot about how Dhanuka has build such a robust, seemingly resilient, business model. It's genuinely insightful to see the underlying mechanics of consistent performance in any sector, though for agriculture especially, one always wonders about the long-term sustainability impact of current practices.