Data Patterns Ltd || Consistently Performing Stocks #48

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they were able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Let’s explore the business and fundamentals of DATA PATTERNS this week.

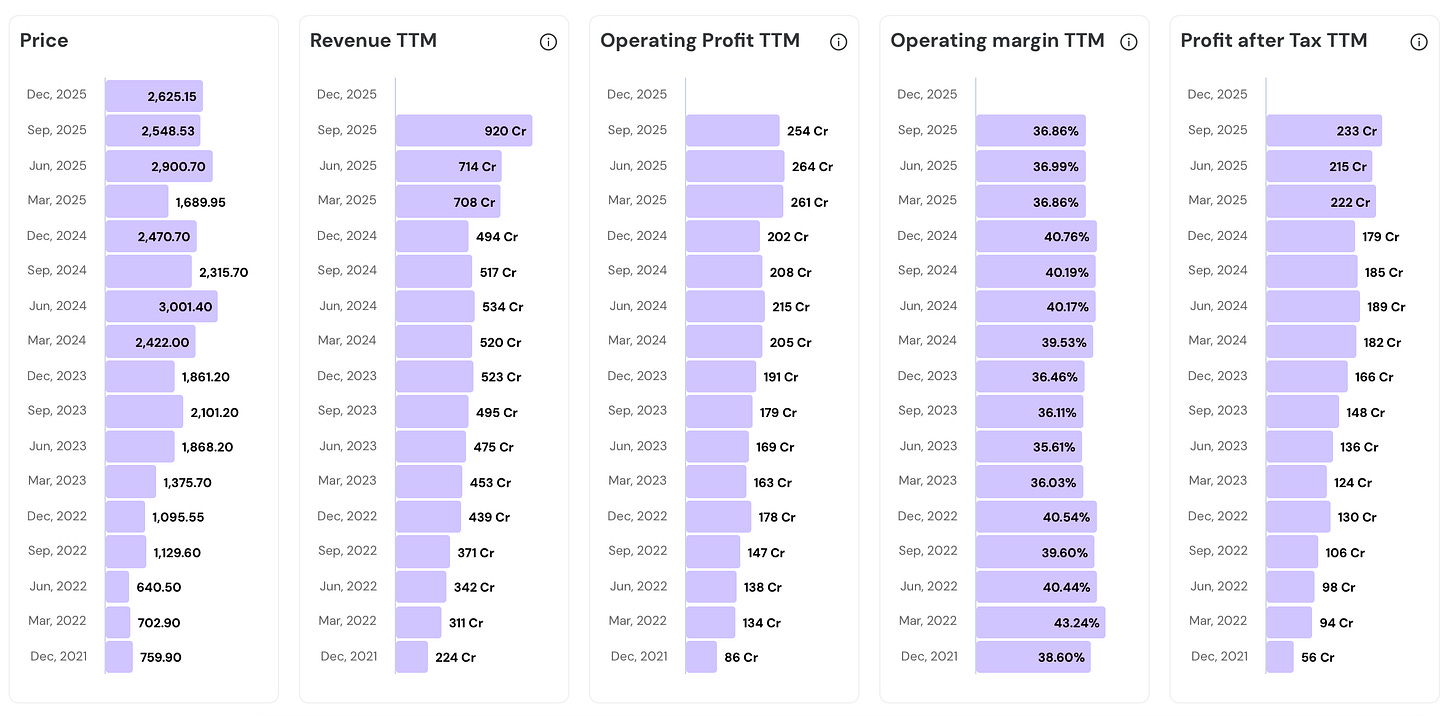

In the last 4 years…

- Stock price has surged 3.5 times (from 759.90 to 2,625.15)

- Revenue has grown 4.1 times (from 224 Cr to 920 Cr)

- Operating profit has grown 3 times (from 86 Cr to 254 Cr)

- PAT has grown 4.2 times (from 56 Cr to 233 Cr)

- Operating Margins are healthy around 35% to 40%

Take a look at the numbers below. Incredible Consistency.

Their Road to Consistency

1. Company Overview & Business Model

Data Patterns (India) Ltd is a defense and aerospace electronics company that designs and manufactures the mission systems that sit inside aircraft, ships, missiles, and space platforms.

The company operates a vertically integrated model where design, development, testing, and manufacturing are largely done in-house. This helps control quality, timelines, and the learning curve across programs.

The business model is IP-led, where the company invests early in building indigenous solutions. So, when a procurement window opens, it can compete with a ready product and capture more value from design ownership.

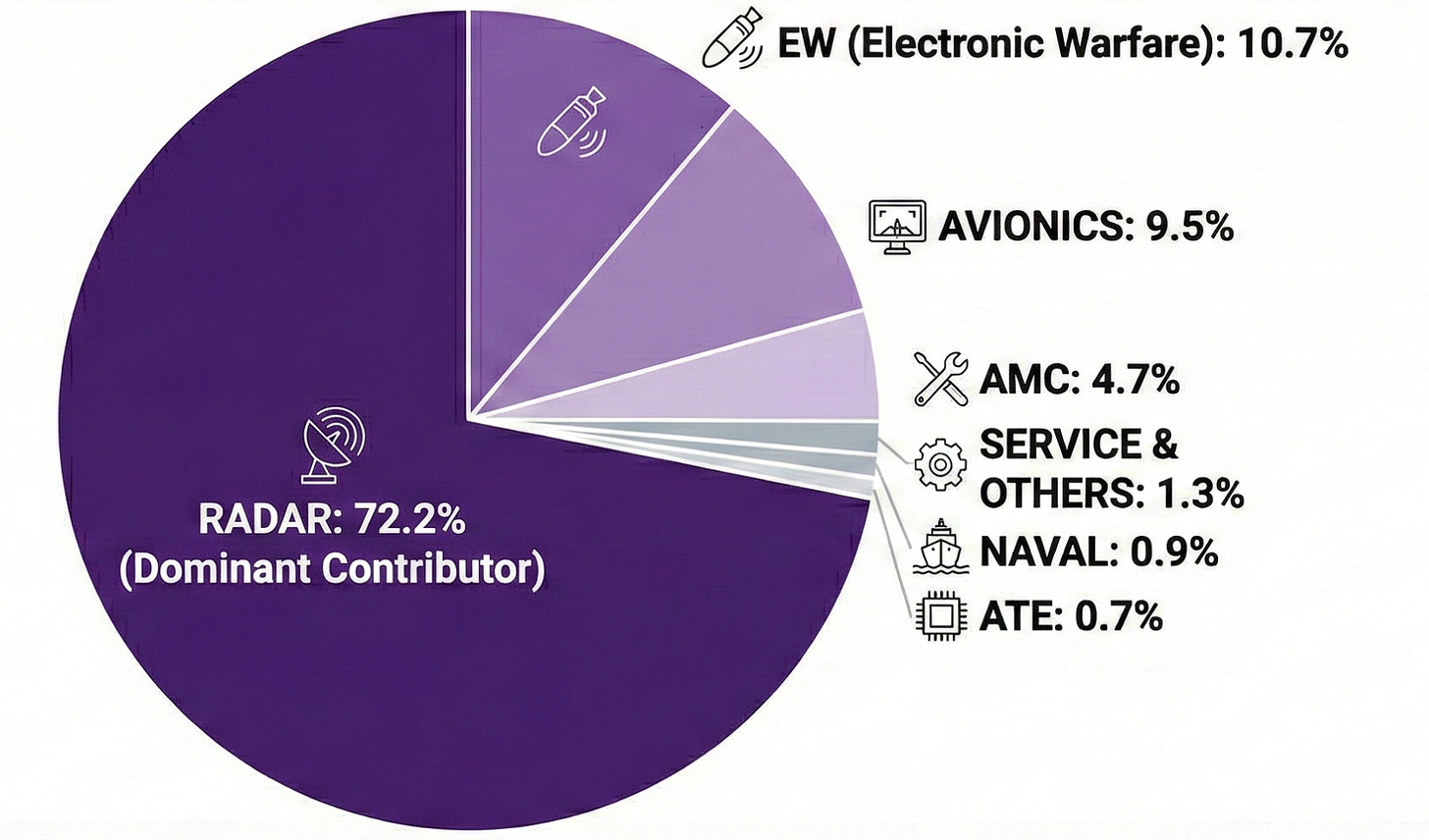

Revenue Mix

Revenue is built around high-value defense electronics such as radar subsystems, electronic warfare modules, avionics computers etc. Numbers as on H1 FY26 below.

Radar: 72.2% (The dominant contributor)

EW (Electronic Warfare): 10.7%

Avionics: 9.5%

AMC (Annual Maintenance Contracts): 4.7%

Service and Others: 1.3%

Naval: 0.9%

ATE (Automatic Test Equipment): 0.7%

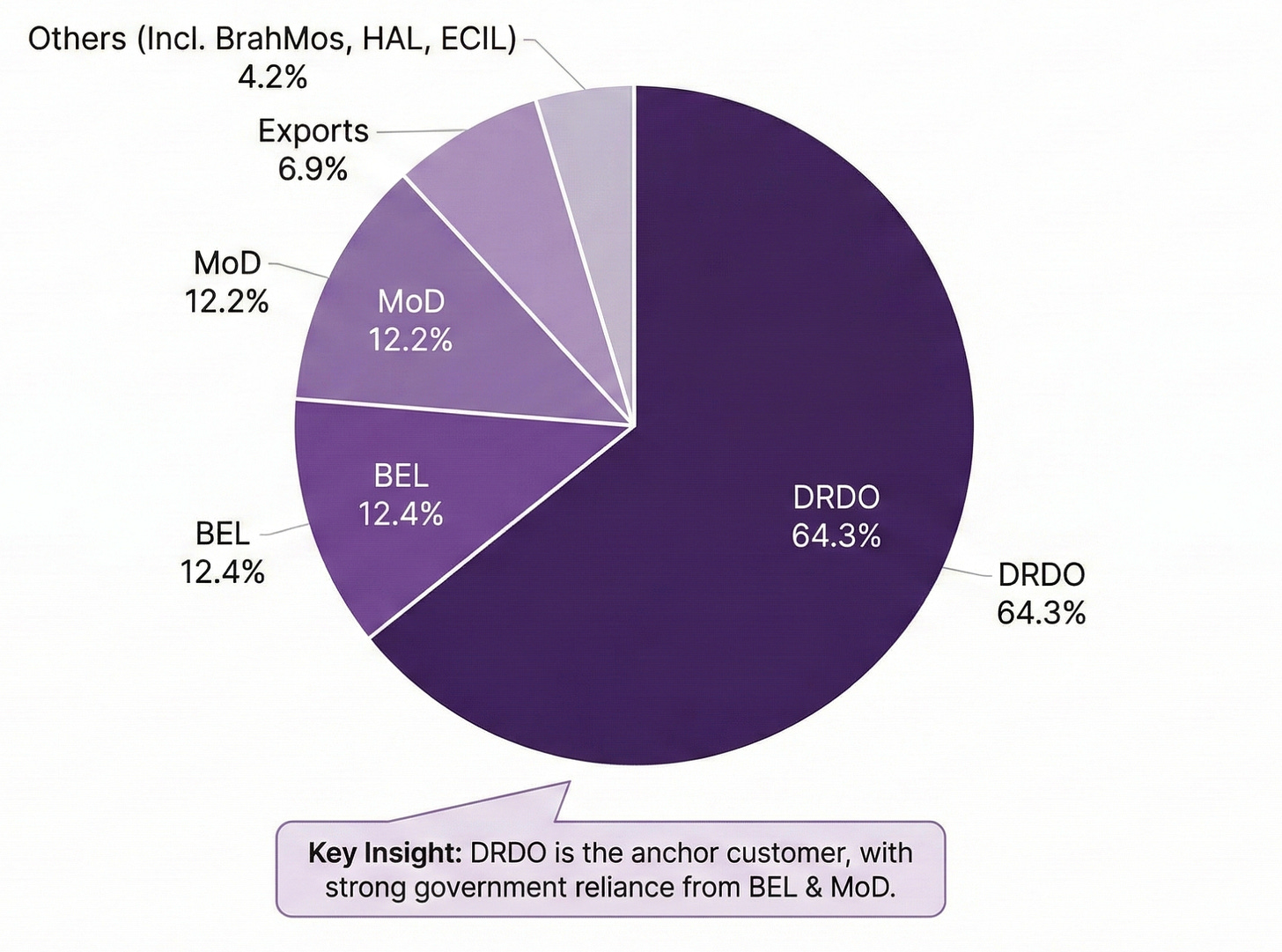

Customer Mix

Customers are mainly Indian defense and space organizations, including DRDO labs, defense PSUs, and platform integrators. This creates long program lifecycles and repeat opportunities through upgrades, spares, and additional lots.

2. Vertically Integrated Model

At its core, the business model is predicated on the capability to design and manufacture functional electronics hardware in-house.

The capabilities stack includes:

Hardware Design: The ability to engineer high-density, multi-layer PCBs capable of surviving the extreme G-forces of missile flight and the thermal variances of avionics environments.

Firmware and Software: The development of proprietary code for FPGAs and real-time operating systems (RTOS). This is a critical moat. Hardware can be reverse-engineered. But the complex logic embedded in the firmware is not easy to replicate.

Mechanical Engineering: The design of ruggedized chassis and enclosures that provide electromagnetic interference (EMI) shielding and thermal dissipation without active cooling, a requirement for many military applications.

Qualification and Testing: In-house environmental testing facilities allows for rapid iteration. Instead of waiting weeks for slots at government labs, Data Patterns engineers can test, fail, and redesign in real-time.

This integration allows Data Patterns to operate as a "One-Stop Shop" for defense electronics.

When a client like DRDO requires a new radar signal processor, Data Patterns can execute the hardware, software, and mechanical packaging concurrently.

This reduces the "Time-to-Market" significantly, a metric that is increasingly becoming a competitive differentiator in Indian defense procurement.

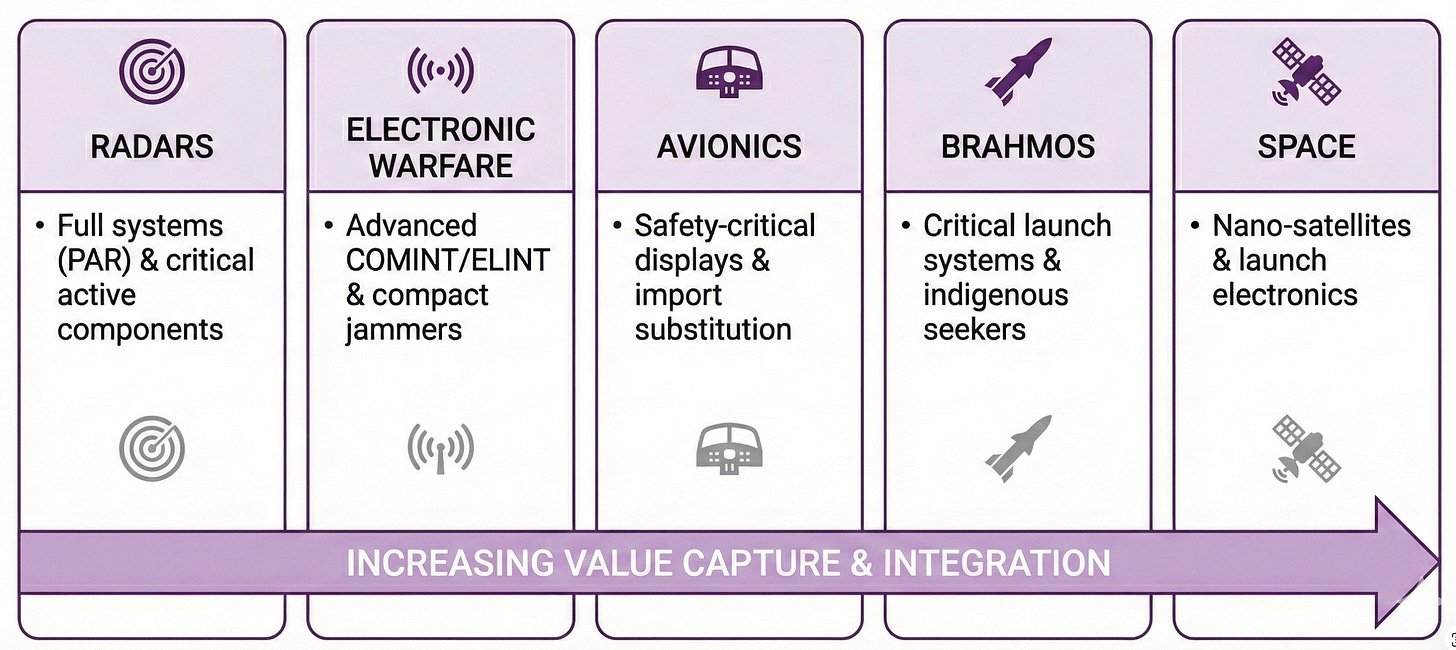

3. Product Portfolio Evolution

Over the last 3 years, DATA PATTERNS has successfully graduated from supplying “cards” (printed circuit boards) to “boxes” (enclosed subsystems) to “systems” (complete operational units).

Radars

Radars have emerged as the primary growth vertical, contributing significantly to the recent surge in the order book.

Precision Approach Radars (PAR): Data Patterns has delivered complete PAR systems to the armed forces. These systems are critical for air traffic control, guiding aircraft to safe landings in zero-visibility conditions. The ability to deliver the entire system demonstrates the company’s maturity as a Tier-1 integrator.

Arudhra and Ashwini Radars: The company is a key partner in these indigenous medium-power radar programs. DRDO leads the top-level design but Data Patterns supplies the critical “active” components that constitute the heart of the radar.

Meteorological Radars: Beyond military use, the company has developed and deployed wind profile radars for atmospheric sensing, diversifying its utility into the scientific and civilian domains.

Electronic Warfare (EW)

COMINT and ELINT: The company designs products for Communications Intelligence (intercepting enemy radio) and Electronic Intelligence (intercepting enemy radar). These systems are deployed on ground vehicles (like the “Dharashakti” program) and airborne platforms.

Jammers: The portfolio includes wideband jammers capable of neutralizing enemy communications. It fits powerful jamming capabilities into smaller, lighter pods suitable for drones and light aircraft.

Avionics

Cockpit Displays: It manufactures the Glass Cockpit displays (Multi-Function Displays) that serve as the pilot’s primary interface. These are safety-critical systems requiring the highest level of certification.

Mission Computers: The company supplies the computing cores that process flight data and weapon solutions.

Import Substitution: A major growth vector is the replacement of Russian avionics in the Su-30 MKI and Mi-17 helicopters. Data Patterns has developed indigenous alternatives for systems like the Radar Warning Receiver (RWR), offering the Indian Air Force a way to upgrade its fleet independent of foreign OEMs.

BrahMos Missile Systems

Fire Control System (FCS): Data Patterns develops and manufactures the FCS, the system responsible for launching the BrahMos missile. This is a critical, recurring requirement for every BrahMos regiment inducted.

The Seeker Frontier: The company has moved up the value chain to develop the RF Seeker. The radar in the nose of the missile that guides it to the target. This was historically imported. Indigenizing it represents a massive value capture opportunity.

Small Satellites

Looking to the future, Data Patterns has invested in the space sector.

Nano-Satellites: The company has a history of building nano-satellites (e.g., NiUSAT).

Thrust Vector Control: It supplies electronics for the launch vehicles themselves, playing a role in ISRO’s supply chain. This vertical is currently smaller but offers high growth potential as the private space sector opens up.

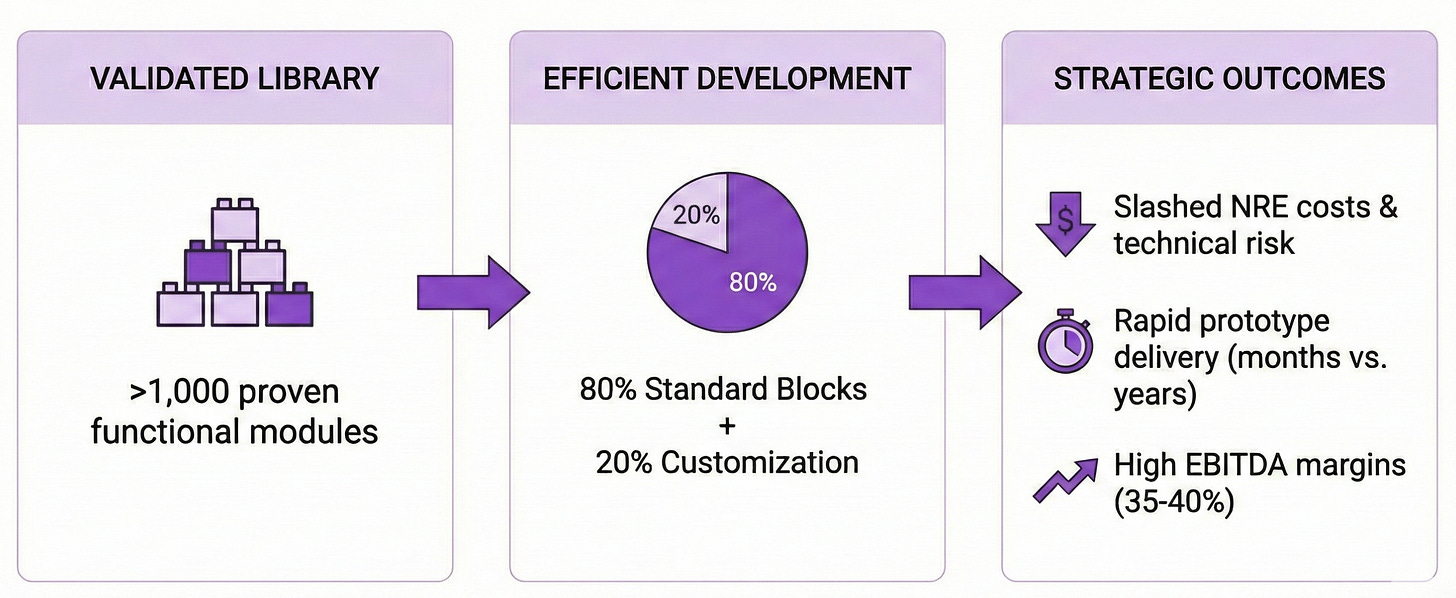

4. The “Reusable Building Block” R&D Strategy

The secret to Data Patterns’ high margins (consistently in the 35-40% EBITDA range) and rapid delivery is its unique R&D architecture.

Over three decades, Data Patterns has built a library of over 1,000 distinct, validated “building blocks”. This approach transforms the bespoke nature of defense engineering into a modular, scalable process.

A “building block” is a modular functional unit. For example, a specific FPGA code block for Fast Fourier Transform (FFT), a power supply module compliant with MIL-STD-461, or a specific VME-bus processor card.

When a new requirement arrives engineers do not start from a blank sheet. They audit the library and realize that 80% of the required functionality (processing, power, data interfaces) already exists as proven modules.

They pull these blocks off the digital shelf and focus their engineering effort solely on the 20% of customization required for the specific application.

Non-Recurring Engineering (NRE) costs are slashed. The company avoids reinventing the wheel, allowing it to bid competitively.

Technical risk is minimized because the core components have already been proven in the field on other platforms. A processor card that has flown on the Tejas has already survived vibration and thermal qualification. Using it on a helicopter carries minimal risk of failure.

This allows Data Patterns to deliver prototypes in months rather than years, a speed that often stuns competitors used to traditional waterfall development cycles.

5. Manufacturing & Scale

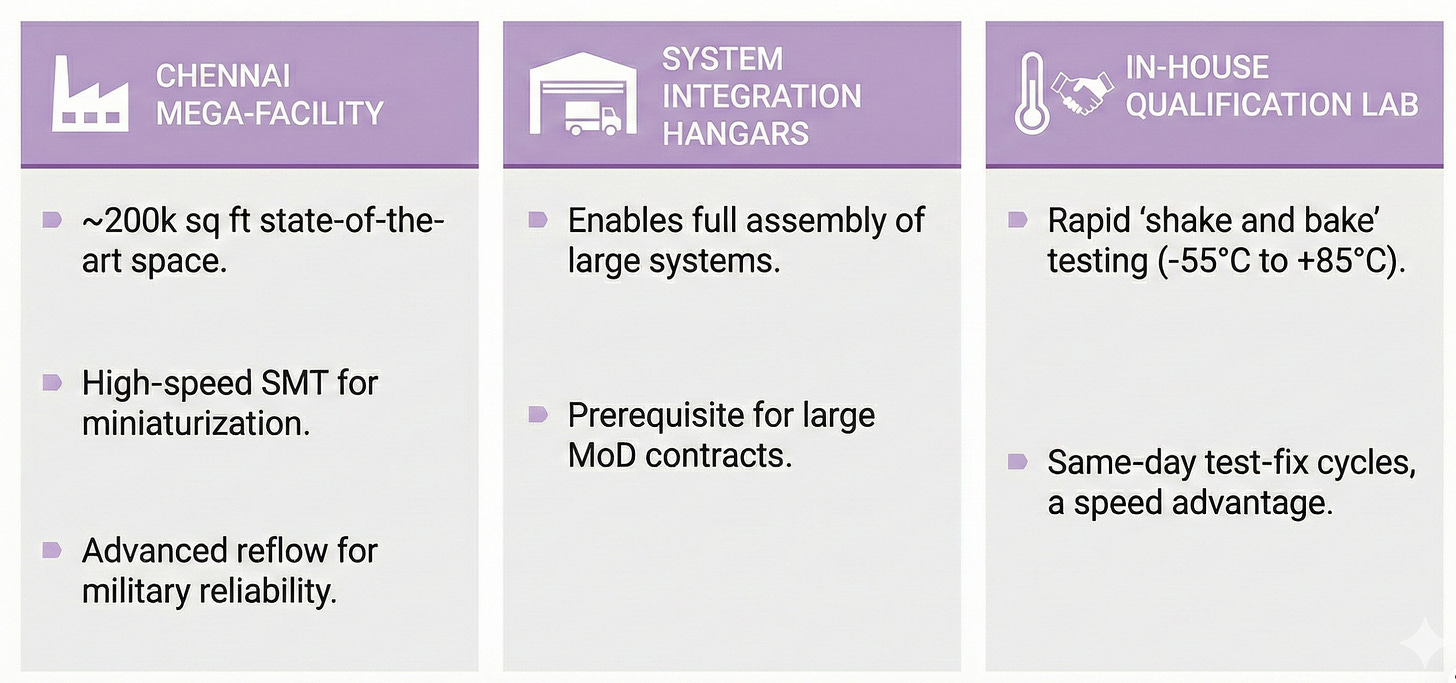

The Chennai Mega-Facility

The company operates a state-of-the-art manufacturing capability spread over 5.75 acres in the SIPCOT IT Park, Chennai.

Floor Space: The facility comprises approximately 200,000 square feet of manufacturing and design space. This scale is rare for a private defense electronics player in India.

SMT Lines: The factory floor is equipped with high-speed Surface Mount Technology (SMT) lines capable of placing tens of thousands of components per hour. These lines handle components as small as 01005 chips (0.4mm x 0.2mm), essential for the miniaturized electronics required in missile seekers and drone avionics.

Reflow Soldering: The facility utilizes 10-zone reflow ovens (Vitronics XPM2) which provide precise thermal profiling. This is critical for military boards that have high thermal mass due to thick copper layers, ensuring solder joints are reliable enough to withstand decades of service.

System Integration Hangars

A pivotal addition in the last three years has been the construction of large system integration hangars.

The Constraint: Previously, the company could build the “brains” of a radar (the electronics box) but lacked the space to assemble the “body” (the truck, the mast, the generator).

The Solution: The new hangars allow large military trucks to drive in. Data Patterns can now integrate the electronics, install the cooling systems, mount the antenna arrays, and test the fully assembled mobile radar station under one roof. This physical capability was a prerequisite for bidding on large MoD contracts for complete systems, directly enabling the order book surge.

In-House Environmental Qualification

Defense electronics must survive “Shake and Bake” testing (extreme vibration and temperature cycling)

Strategic Asset: Data Patterns owns its own environmental testing lab, including vibration tables and thermal chambers capable of -55°C to +85°C testing.

Speed Advantage: Competitors often have to book slots at external government labs (like ETDC), leading to weeks of delay. Data Patterns engineers can test a prototype, identify a failure, and fix it the same day. This internal loop is a hidden driver of their ability to meet tight delivery schedules.

6. Regulatory Tailwinds

The external environment has shifted decisively in favor of Data Patterns. The Indian Government’s “Atmanirbhar Bharat” (Self-Reliant India) initiative has created a protected market for indigenous firms.

Positive Indigenization Lists (PILs)

The Ministry of Defence (MoD) has promulgated multiple “Positive Indigenization Lists” (PILs), effectively embargo lists that ban the import of specific defense items after a certain date.

Direct Impact: Items relevant to Data Patterns such as “Next Generation Low Level Tracking Radars,” “Electronic Warfare Systems,” and “Mission Computers” feature prominently on these lists.

Market Reservation: This policy legally mandates that the armed forces procure these items from Indian companies. It eliminates competition from global defense giants (like Thales, Elbit, or Raytheon) for these specific categories, funneling the entire domestic demand to capable Indian players like Data Patterns.

Defence Acquisition Procedure (DAP) 2020

The DAP 2020 introduced the “Buy (Indian-IDDM)” category as the highest priority for procurement.

IDDM Priority: This category requires 50% indigenous content. Because Data Patterns designs its products in-house (IP ownership), it easily meets and often exceeds this threshold (often >60-80%).

This gives it priority over competitors who might be assembling foreign kits (which would fall under “Buy Indian” or “Buy & Make” categories with lower priority).

7. Order Book Dynamics

An analysis of the order book reveals the mechanics of the company’s growth consistency.

Order Book Expansion

The order book has shown a robust upward trajectory.

FY22 Baseline: The order book stood at roughly ₹476 Cr.

FY24/25 Status: By the end of FY24/early FY25, the order book had surged past ₹1,083 Cr

Book-to-Bill ratio consistently stays above 2x, providing clear revenue visibility for 24 months. This buffer allows management to plan capacity and procurement efficiently, smoothing out operational variance.

Development vs Production Contracts

In the past, the order book was dominated by development contracts. These are lumpy. When a contract ends, revenue stops.

Today, production contracts constitute the majority (often >60-70%). Production orders are recurring. Once the company starts producing the Fire Control System for BrahMos, it continues to do so for years as the missile is inducted. This shift from “project revenue” to “annuity-like revenue” is the primary stabilizer of the company’s growth.

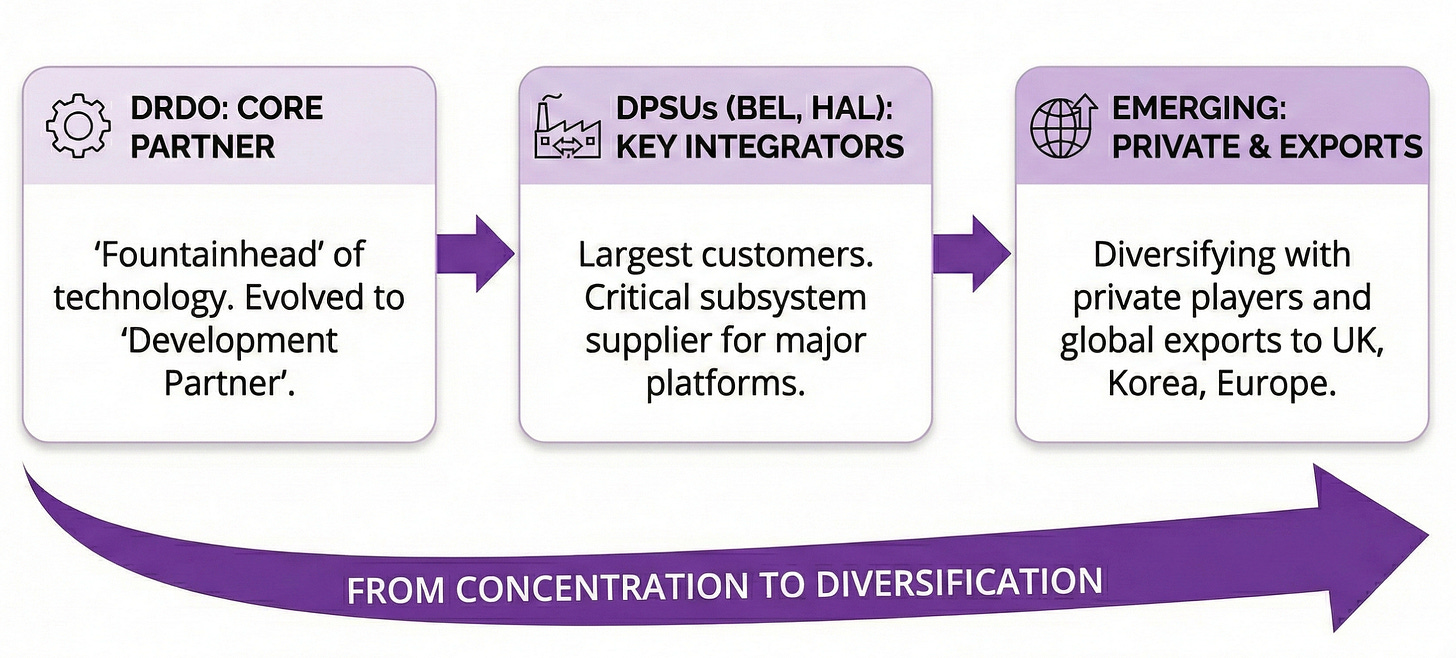

8. Customer Ecosystem

Data Patterns has historically been dependent on a few large customers, but its ecosystem is evolving.

The DRDO Relationship

DRDO remains the “fountainhead” of technology and the primary source of development contracts. Data Patterns works with clusters of DRDO labs:

LRDE (Electronics & Radar Development Establishment): For radar programs like Arudhra and Ashwini.

DLRL (Defence Electronics Research Laboratory): For Electronic Warfare systems like Himshakti.

RCI (Research Centre Imarat): For missile seekers and avionics. The relationship has evolved from “Vendor” to “Development Partner,” where Data Patterns engineers often co-locate or work in tandem with DRDO scientists on system definition.

Defence Public Sector Undertakings (DPSUs)

BEL (Bharat Electronics Ltd) and HAL (Hindustan Aeronautics Ltd) are technically competitors but practically constitute the company’s largest customers.

The Integrator Role: BEL often acts as the prime integrator for massive systems (like the Akash missile system). Data Patterns supplies critical subsystems to BEL. As BEL grows, Data Patterns grows as a preferred downstream supplier.

HAL: The relationship focuses on avionics for the Tejas, ALH (Advanced Light Helicopter), and LCH (Light Combat Helicopter).

Emerging Private Sector and Exports

Private Sector: As private players like L&T and Tata Advanced Systems win defense contracts, Data Patterns supplies them with specialized electronics, effectively hedging its bets across both public and private contractors.

Exports: This is the new frontier. The company has secured orders from UK and South Korean entities, integrating into their global supply chains. More significantly, the delivery of the T-PAR radar to a European nation marks a breakthrough. Selling a full indigenous system to a Western market, validating the quality of Indian R&D.

9. Risk Landscape

A balanced analysis must account for the structural risks that threaten the “consistency” narrative.

Working Capital Intensity

The defense electronics business is capital hungry.

Inventory Drag: To ensure consistency, Data Patterns must hold high levels of inventory (often 6-9 months). This is a buffer against the long lead times of imported military-grade components (semiconductors, specialized connectors) which can take up to 40 weeks to arrive.

Receivable Cycles: Government customers are reliable but slow. Debtor days can stretch to 300 days or so.

Impact: This locks up cash. While the company is currently net debt-free (thanks to IPO/QIP proceeds as well), scaling further will put pressure on free cash flow unless the working capital cycle is compressed.

Supply Chain Vulnerability

Despite “Atmanirbhar” positioning, the raw materials (silicon) are still imported.

The company relies on FPGAs from Xilinx/Intel and RF components from Western suppliers. Geopolitical sanctions (e.g., ITAR restrictions) or global shortages (like the 2021 chip crisis) can paralyze production.

The company manages this through strategic stockpiling and long-term agreements, but the vulnerability remains.

Execution Lumpiness

Quarter-on-quarter revenue can be volatile.

Revenue recognition in defense is tied to the customer signing the “Acceptance Note.”

If a DRDO inspector is unavailable for the Site Acceptance Test (SAT) in the last week of March, crores of revenue slip into April (Q1).

This creates “lumpy” quarters, as seen in Q1/Q2 FY25. The “consistency” is therefore best viewed on an annual trailing basis rather than quarterly.

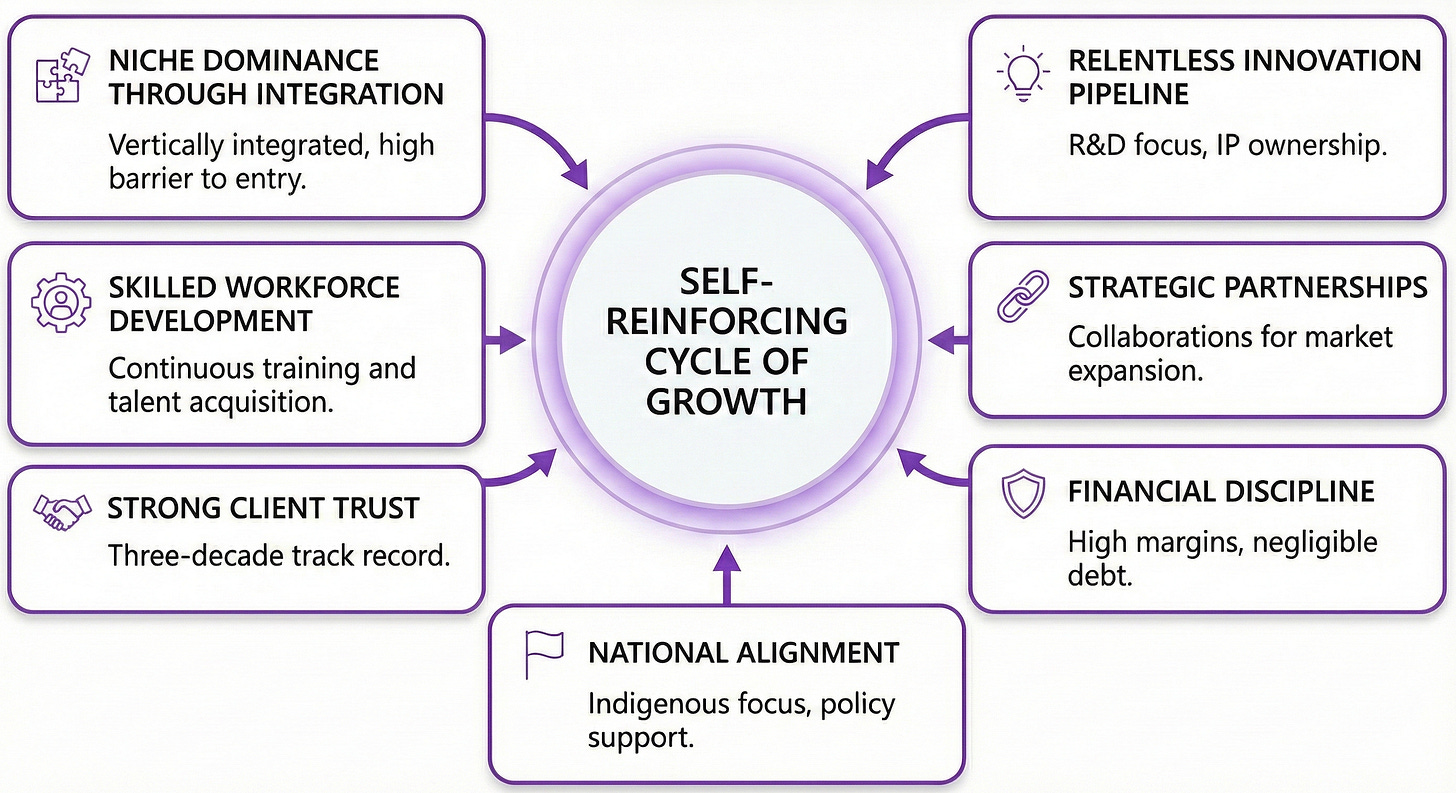

10. Their Consistency Formula (Summary)

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.