CCL PRODUCTS || Consistently Performing Stocks #25

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

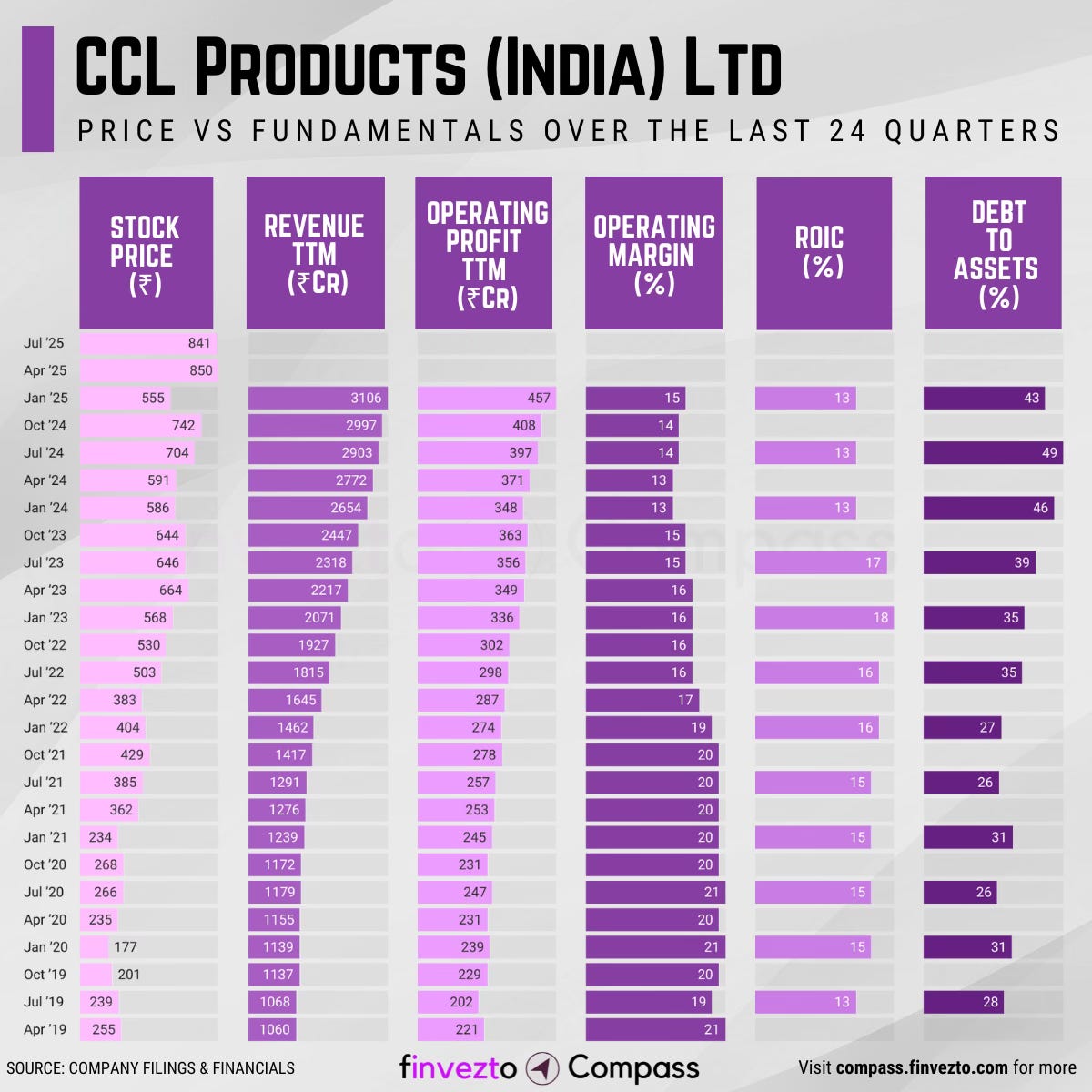

Today, we will look at the key fundamentals & business of CCL Products (India) Ltd.

Click here to learn more about each of the parameters in the chart above.

What Has Led to This Consistency

Company Overview

Founded in 1994, CCL Products (India) Limited began with a 3,000 TPA (tons per annum) coffee processing plant in Andhra Pradesh.

Today, it is one of the world's largest private label instant coffee manufacturer, exporting to over 100 countries.

Product Segments include:

Spray-dried coffee (hot air dehydration creating uniform particles)

Freeze-dried coffee (sublimation dehydration preserving aroma compounds)

Agglomerated coffee (enhanced solubility granulated processing)

Roast & ground coffee (traditional segment for regional markets)

Private label manufacturing (1,000+ unique blends for global brands)

Revenue generation primarily from export markets (86% international) with strong presence across 100+ countries in Europe, Asia-Pacific, Middle East, and Americas.

Operates four manufacturing facilities across India, Vietnam, and Switzerland.

Export Dominance

CCL maintains pricing power through established global relationships.

Long-term contracts provide 6-8 months advance order visibility enabling accurate demand forecasting and inventory management optimization → Demand visibility

Serves 250+ global brands across diverse geographies preventing over-dependence on any single market or customer relationship → Customer/Geographic diversification

Produces 1,000+ unique coffee blends and offers customization capabilities to customers that competitors cannot easily replicate → MOAT/Premium Pricing

Manufacturing & Technology Excellence

CCL’s advanced manufacturing capabilities and technological innovations create operational advantages and market barriers.

India's first freeze-dried instant coffee plant (2005) provides 15-year technological head start in premium coffee segment commanding 40-50% higher margins → Technology leadership

Freeze-drying technology preserves volatile coffee compounds creating superior product differentiation versus standard spray-dried alternatives.

Combined 71,000+ TPA capacity operates at near 100% utilization demonstrating strong demand validation across all facilities → Efficient Capacity utilization

₹400 crores Tirupati facility investment incorporates latest Swiss equipment technology providing 16,000 MT additional capacity → Capacity expansion

Swiss and Brazilian technology integration ensures international quality standards enabling access to regulated European and North American markets.

Geographic Arbitrage

Vietnam operations leverage proximity to world's second-largest coffee producer (20% global production) offering 15-20% lower green coffee procurement costs → Cost advantage

ASEAN Free Trade Area membership through Vietnam facility provides duty-free access to 685 million population market worth $3.6 trillion GDP → Market access

Switzerland facility commands premium pricing averaging $18.75/pound versus $4/pound for other origins due to Swiss-made quality perception → Premium positioning

India's Export Oriented Unit status enables duty-free imports of green coffee and equipment. The status provides export incentives and faster customs clearance → Trade benefits

Strategic Acquisitions

CCL’s Targeted acquisitions create competitive moats and enable business diversification.

Lofbergs Group acquisition (£550,000) provides direct UK supermarket access in Europe's largest instant coffee market worth $850 million annually → Market penetration

Six acquired brands (Percol, Rocket Fuel, Plantation Wharf, The London Blend, Perk Up, Percol Fusion) generate immediate revenue streams with established consumer recognition.

Continental Coffee SA acquisition offers European manufacturing base with agglomerated coffee specialization serving premium market segments.

Vietnam facility expansion (13,500 MT additional capacity) positions company for growing ASEAN demand and maintains cost advantages.

Brand Portfolio Expansion

Transformation to diversified FMCG company with proprietary brands across categories.

Continental Coffee brand achieved No.3 market position in Indian instant coffee segment competing against Nestlé and HUL

Continental Greenbird plant-based protein products (chicken-like nuggets, sausages, kababs) target emerging ₹300 crores meat substitute market → Category diversification

Malgudi brand test launch (June 2025) in South Indian snacks category represents geographic expansion beyond coffee focus → Product expansion

Consistency Formula

Export Dominance + Manufacturing Excellence → Revenue Stability

Geographic Arbitrage + Strategic Acquisitions → Cost Benefits & Market Expansion

Brand Portfolio Expansion → Growth Diversification

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research