CAPLIN POINT || Consistently Performing Stocks #38

What has led to the consistency?

Every week I study the business of one stock as part of my research activities as a SEBI registered RA. The primary objective of this post is to understand the business in the context of its performance over the last 5 years and how they are able to perform consistently. Most of the research below is based on past Annual Reports and recent Quarterly Investor presentations. This is an educational post and not a recommendation to buy the stock.

Today, we will look at the key fundamentals & business of Caplin Point Laboratories Ltd.

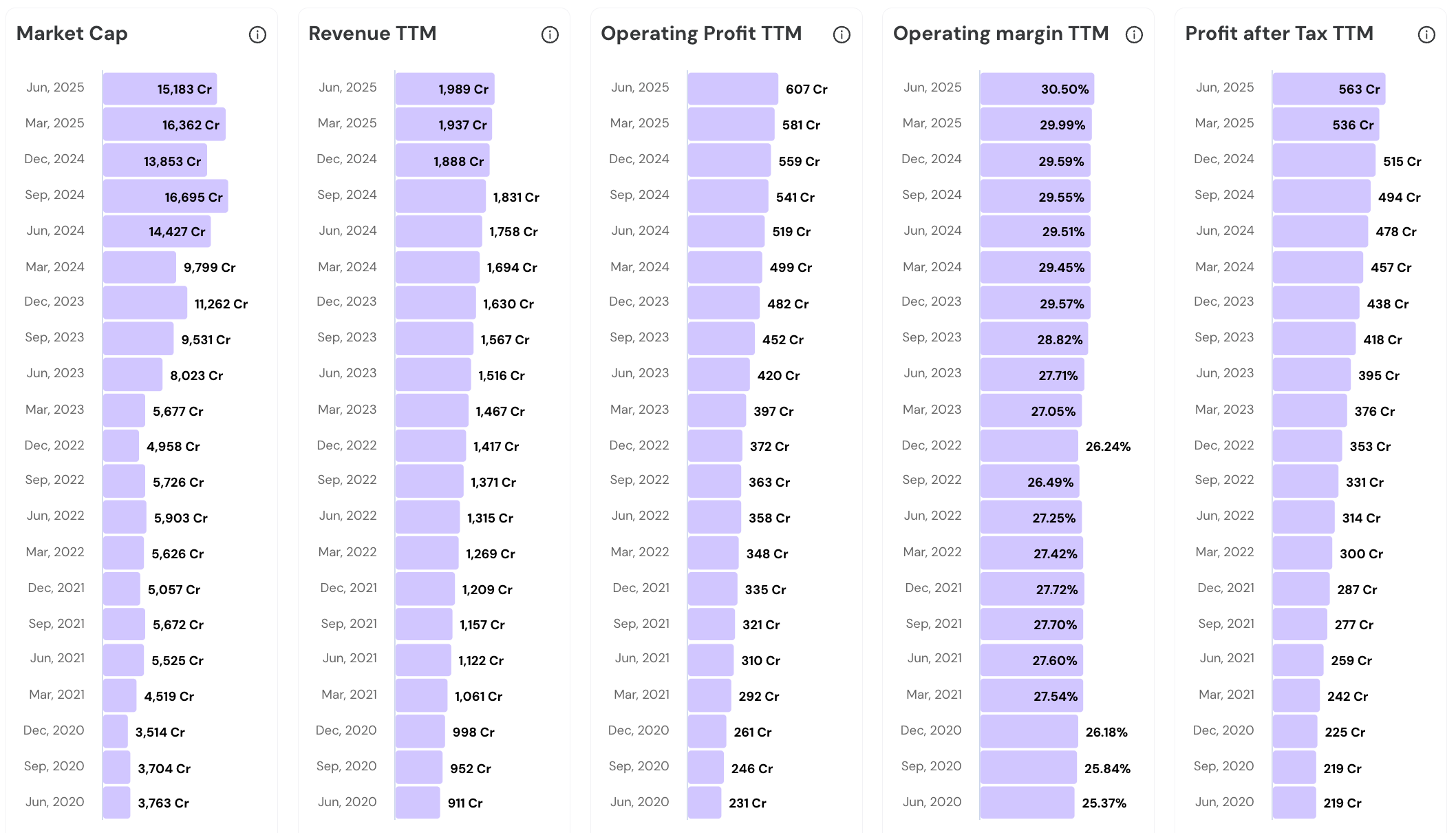

Increasing Revenue, Operating Profit and Net Profit along with steady Operating Margins. How has Caplin Point Laboratories Ltd. been able to perform consistently?

Let us explore.

The Keys to Consistency

The Business Model

Caplin Point Laboratories is a Pharma company with a unique business model focused predominantly on emerging markets in Latin America and Africa.

The company develops and manufactures a broad range of finished formulations (medicines in dosage form) and has also ventured into active pharmaceutical ingredients (APIs) & clinical research.

It has established a “Front-end presence” in key markets. That is, Caplin handles distribution and marketing all by itself, especially in Latin America and Francophone Africa.

This direct approach, coupled with a “Stock & Sale” distribution model initiated in countries like Angola, allows Caplin to control inventory and reach pharmacies directly.

The revenue mix is well-balanced. Roughly 70-75% comes from product sales, while the remaining 25-30% is from profit-sharing and milestone payments via partnerships.

Overall, Caplin’s business spans multiple product segments (tablets, capsules, injectables,ophthalmic solutions) and geographic markets. Their strategy is to target underserved markets and develop niche product areas to drive consistent growth.

Diversified Product Portfolio

The company offers a mix of plain generic drugs, branded generics, and a growing number of specialty formulations.

It has over 4,000 product registrations worldwide, covering 650+ formulations across 36 therapeutic categories.

This breadth means Caplin’s products address a wide range of medical needs. In fact, the portfolio covers over 65% of the WHO Essential Medicines list, indicating that Caplin produces a majority of the basic healthcare drugs required in its markets.

Such diversity reduces reliance on any single product or therapy area and ensures steady revenue streams even if one segment faces challenges.

The company’s expansive product basket also gives it a larger “shelf share” in pharmacies.

In recent years, Caplin has shifted focus toward more complex and niche products, such as injectables, oncology drugs, and even biosimilars.

This proactive portfolio expansion keeps the business growing consistently, as there is a pipeline of new products contributing to revenue each year.

Strong Emerging Market Focus

One of the key drivers of Caplin Point’s steady growth is its deep focus on emerging markets, particularly in Latin America and parts of Africa.

As of FY25, about 83% of the company’s revenue came from Latin American and African countries.

Caplin entered many of these markets early. For example, it established presence in Angola back in 2001 with its novel stock-and-sale model and built up a strong distribution network over the years.

It now operates in over 30 countries with a particularly strong foothold in Central and South America.

Caplin’s strategy in these markets has been to go direct-to-market. It sets up its own local subsidiaries, warehouses, and sales teams.

In countries where it has a direct presence, Caplin can participate in government tenders and supply chains more effectively. For instance, it secured $7.6 million worth of tender orders in a key Central American market in FY26.

By being on the ground, Caplin understands local market needs and regulations better, which allows it to register a high number of products (e.g. 120+ products registered in Chile alone).

Expansion into Regulated Markets

In recent years, Caplin successfully expanded into regulated markets like the United States, which has added new momentum to its growth. Through its subsidiary Caplin Steriles Limited, Caplin entered the U.S. sterile injectables market (initial foray around 2017-18) with focus on niche, high-margin hospital products.

This move is now bearing fruit in 2025. U.S. (and other regulated markets) contributed roughly 15% of Caplin’s revenue in FY25 , up from almost zero a few years prior, and that share is rising.

Caplin has amassed a strong product pipeline for regulated markets. As of mid-2025 it had 38 Abbreviated New Drug Applications (ANDAs) approved by the US FDA and 13 more under review.

Caplin is not limiting itself to the U.S. alone. It is expanding into Canada, Australia, and other regulated or semi-regulated markets. For example, by mid-2025 Caplin had 16 filings in Canada (10 approved) and several products approved/filed in Mexico, Saudi Arabia, the UAE, and South Africa.

Continuous Innovation and R&D Pipeline

The company has established 5 dedicated R&D centers (3 of which are certified by India’s DSIR and 2 pending approval) to drive its product development engine.

Overall, Caplin spends around 4–5% of its sales on R&D.

In FY23 alone, it launched 23 new products in Central America, adding $2.4 million to that year’s revenue. Many of these were first-to-market in their regions or addressed unmet needs, which helped Caplin deepen market share.

Currently the development pipeline is robust, with 55+ products (mostly injectables and ophthalmic formulations) in various stages of development for regulated markets. In fact, Caplin has 55+ ANDAs under development for the US alone, targeting an addressable market of about $5 billion.

Strategic Partnerships

One notable aspect is how the company works with partners for manufacturing and product sourcing. About 45% of Caplin’s products (by volume) are outsourced to “quality-conscious partners” in India and China, while 55% are made in-house.

By outsourcing part of its production to trusted third-party manufacturers, Caplin expands its product range and volumes without large upfront capex. It follows an asset-light expansion model for certain products.

For example, to quickly capitalize on demand, Caplin sometimes uses contract manufacturing organizations (CMOs) to supply initial orders for a new product, and later transitions production in-house once its own new facility is ready.

Partnerships have also been key in entering new markets. In the US, Caplin Steriles partnered with established pharma companies like Baxter, Fresenius, and Xellia to distribute its injectables. These partnerships gave Caplin instant access to marketing and hospital networks, greatly smoothing its US market entry.

Another strategic collaboration initiative is what Caplin terms “China 2.0”. A move to partner with multiple Chinese pharmaceutical and biotech firms to co-develop products like peptides and biosimilars.

These partnerships accelerate product launches, widen market access, and bring in additional know-how. The consistent execution of this partnership-driven strategy is a major reason Caplin has scaled up steadily over the past 5 years.

Vertical Integration and Capacity Expansion

Alongside external partnerships, Caplin Point has been steadily building internal capabilities.

The company recognizes that for complex and critical products, having control over the supply chain improves reliability and margins. To that end, Caplin has invested heavily in new facilities and backward integration projects.

Over the last 7 years, it spent over ₹550 crore (entirely from internal accruals) on capex to enhance manufacturing and R&D infrastructure.

One major initiative is backward integrating into APIs (Active Pharmaceutical Ingredients). Caplin acquired an API manufacturing facility at Vizag (Andhra Pradesh) in 2021, and by 2024 that unit was ready for trial production.

Having its own API source secures Caplin against supply disruptions and will likely improve cost structures (and thus profitability) for those products.

Similarly, Caplin is constructing a new Oncology API facility near Chennai (Thervoy) to support its budding portfolio of cancer drugs.

Notably, all this expansion is being undertaken without straining the balance sheet. Caplin’s entire ₹650 crore capex plan (between 2023-2026) is funded through internal cash flows, and the company stated it expects to remain net cash positive throughout the process.

Consistency Formula

To sum it up, here is Caplin’s broad strategy to achieve consistency.

Focus on underserved markets → Own the last mile → Collect Cash Fast → Reinvest into R&D → Build Internal Capabilities → Control Cost and Quality → Venture into Complex Products & Regulated Markets → Improve Margins → Diversify Revenue → Lock in trust → Achieve Repeat Purchases → Achieve Consistency

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

Sir . Will u share d portfolio of anthem bio science ? Next week . Plz