BLS INTERNATIONAL || Consistently Performing Stocks #3

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business a little bit more, figure out the key growth drivers and identify broader industry trends & patterns. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

Today, we will look at the key fundamentals & business of BLS INTERNATIONAL.

What Has Led to This Consistency

Company Overview

BLS International, established in 2005, is a global leader in tech-enabled government services. Operating across 66 countries through 50,000+ centers, the company has processed over 232 million applications for 46 government clients worldwide.

Provides end-to-end visa, passport, and consular services, streamlining application processing and enhancing citizen experience through digitized solutions.

Delivers e-governance platforms, attestation services, biometric processing, and e-visa systems, setting industry benchmarks for efficiency and security.

Operates as a banking correspondent through BLS E-Services, facilitating financial inclusion by providing services like account opening, cash deposits/withdrawals, balance inquiries, and money transfers through its extensive merchant network.

Lock-In Revenue Model

BLS International operates on an asset-light model with multi-year government contracts spanning 3-7 years, ensuring stable & consistent recurring revenue streams.

Visa and consular services contribute 87% of revenue, where citizens directly pay for services rendered, creating predictable cash flows through long-term contracts.

Government-to-Citizen services and Banking Correspondence business account for 13% of revenue, following a similar upfront payment model that reinforces revenue stability.

Service Portfolio Synergy

BLS International has created a comprehensive cross-selling ecosystem by integrating visa processing, e-governance solutions, and banking correspondent services. This integration enables multiple service offerings to the same customer base, improving customer retention and market differentiation.

Digital services now contribute 19% of revenue, while value-added services generate consistent high-margin income streams, strengthening the company's market position.

Geographic Network Moat

The company's expansive presence across 50,000+ centers in 66 countries creates a formidable network effect and allowa efficient handling of visa volumes.

It also helps maintain consistent service quality through standardized processes and four Global Training Centers strategically located in India, Dubai, Singapore, and London.

Operational & Compliance Excellence

Implementation of CMMI Level 5 certified processes, transition to self-managed centers, and comprehensive compliance standards (ISO 27001:2013, ISO 9001:2015, GDPR) establish BLS as a trusted government partner, delivering 99% application success rates in a market projected to grow at 14% CAGR to $8.3B by 2028.

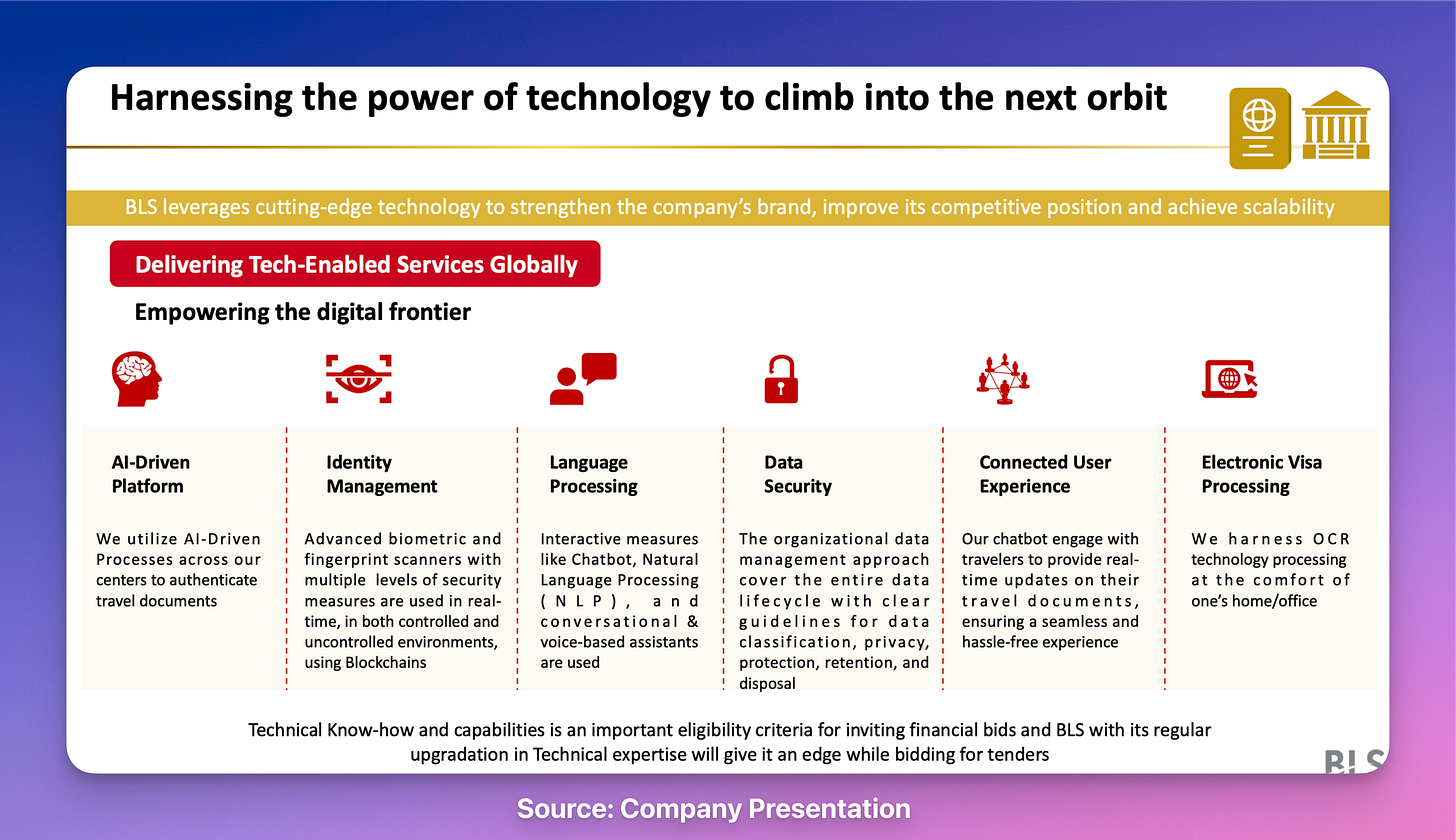

Tech Differentiation

BLS International's proprietary technology stack, featuring AI-driven document verification, biometric authentication, and blockchain security protocols, has created significant entry barriers while reducing processing times by 15-20% in FY2023-24, enabling superior operational efficiency that competitors find difficult to replicate.

Digital Infrastructure Leadership

BLS International has integrated 750+ government services through a unified platform and deployed 110,000+ citizen service touchpoints. The UMANG platform integration enables seamless access to multiple government services with robust security and multilingual support.

Integrated 500+ central and state e-governance services in multiple languages, facilitating access to essential services like PAN/Aadhaar registrations and property records.

Operates 110,000+ service centers for last-mile delivery of digital government services and welfare schemes, ensuring transparent and user-friendly access.

Human Capital

Through specialized training programs focused on embassy-specific requirements, security protocols, and customer relationship management, BLS has built a skilled workforce capable of handling complex documentation processes while maintaining high service standards across diverse geographies.

Travel Industry Momentum

BLS International effectively capitalizes on post-pandemic travel recovery through its strategic presence in high-traffic regions like Germany, Italy, and Spain, processing increased visa volumes 30% faster than industry average.

Consistency Formula

Strategic Revenue Lock-In Models → Revenue Consistency & Predictability

Technology Stack → Service Excellence

Geographic Scale → Network Effect

Integrated Services → Business Resilience

Digital Platform → Growth Scalability

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services.

Conceptual Lessons & Deep Dives

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Useful & Actionable Stock Market Tools