BANCO INDIA || Consistently Performing Stocks #19

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business a little bit more, figure out the key growth drivers and identify broader industry trends & patterns. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

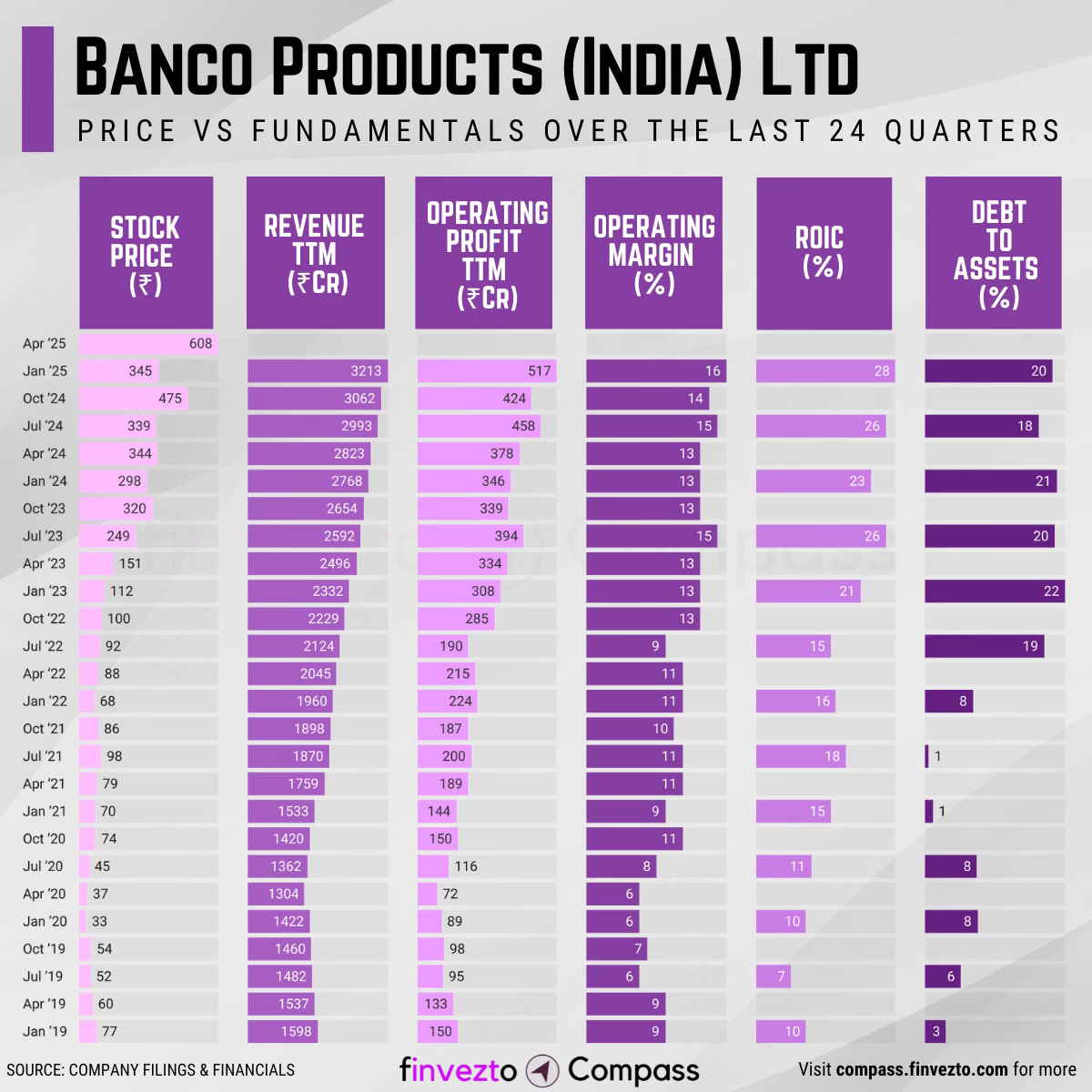

Today, we will look at the key fundamentals & business of Banco Products (India) Ltd.

What Has Led to This Consistency

Company Overview

Established in 1961, Banco Products manufactures comprehensive engine cooling systems including radiators, oil coolers, fuel coolers, battery coolers in aluminum/copper-brass configurations with mounting accessories.

Engine cooling modules and gaskets are integral components for efficient ICE (Internal Combustion Engine) and EV (Electric Vehicles) performance across diverse applications including passenger cars, commercial vehicles, agricultural tractors, construction machinery, mining equipment, rail locomotives, and various power generation equipment.

Banco Products generates majority revenue within India and maintains international presence through its European subsidiary.

The company was listed on the Indian stock exchange in 1987 and is recognized as Star Export House by Ministry of Commerce and Trade, Government of India (prestigious government recognition for exporters achieving $3+ million annual exports).

Good Revenue Mix

Diversified revenue streams with 55-60% from OEM customers, 30% from exports, and 15% from aftermarket sales, reducing dependency on single revenue source.

OEM business provides large-volume orders with predictable demand. Aftermarket offers higher margins and recession-resistant replacement demand.

Well-balanced customer portfolio spanning automobiles, agricultural equipment, power generation, off-road vehicles, and rail locomotives, insulating business from sector-specific downturns.

Strong customer base includes reputed companies like Cummins India, Mahindra & Mahindra, Maruti Suzuki, Tata Motors, Hero MotoCorp, and Caterpillar with established credit ratings.

Low customer concentration risk with top five customers contributing less than 35% of total revenue, ensuring reduced dependency on major clients.

Regulatory Tailwinds

India's 2020 BS VI implementation (stricter emission standards) created mandatory technology upgrades. Manufacturers must integrate diesel particulate filters (DPF) and selective catalytic reduction (SCR) systems that generate significant additional heat. These systems require 25-30% more cooling capacity.

Aluminum radiators mandatory for many BS VI applications.

Regulatory shift favors established players such as Banco with proven R&D and OEM relationships. Banco's DSIR centers and European Euro VI experience provided competitive advantages.

New entrants face 2-3 year validation cycles vs Banco's existing relationships

BS VI-compliant pricing improved margins 8-12% vs BS IV products

Strategic Acquisitions & Innovation

Banco's Vadodara R&D Centre holds DSIR recognition, providing government funding access, customs exemptions, and OEM credibility.

DSIR enables imports of certain restricted material and purchase of European equipment at reduced costs. This reduces R&D costs 25-30% vs non-DSIR competitors.

Joint European programs via NRF accelerated BS VI readiness. Nederlandse Radiateuren Fabriek (NRF), established in 1927, operates across major Western European countries. After 15+ years as supplier, Banco acquired 100% ownership in 2010, gaining access to European markets and 13,000+ aftermarket products. NRF contributes 25-30% of consolidated revenue, reducing India dependency. The NRF acquisition created a platform for European expansion where cooling system replacements command premium pricing vs Indian domestic market.

Integration of Indian costs with European expertise enabled faster time-to-market vs domestic-only competitors.

Banco continues strategic M&A with February 2025 acquisition of Padra Coating Works' coating and plating business for ₹2.52 million, expanding manufacturing ecosystem capabilities.

Manufacturing Prowess

Integrated ecosystem with in-house processing, testing, and production across 4 Indian plants + European operations. Multi-location strategy serves both Indian and European markets well with operational flexibility.

Indian manufacturing provides 25-35% cost advantage vs European suppliers.

Multi-plant capacity also allows production shifting during maintenance/fluctuations.

Consistency Formula

Good Revenue Mix → Demand Stability

Regulatory Compliance Readiness + Advanced Technologies → Pricing Power

Strategic Acquisitions & Innovation + Manufacturing Prowess → Competitive Advantages

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research