The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business in the context of its consistent performance over the last 5 years. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

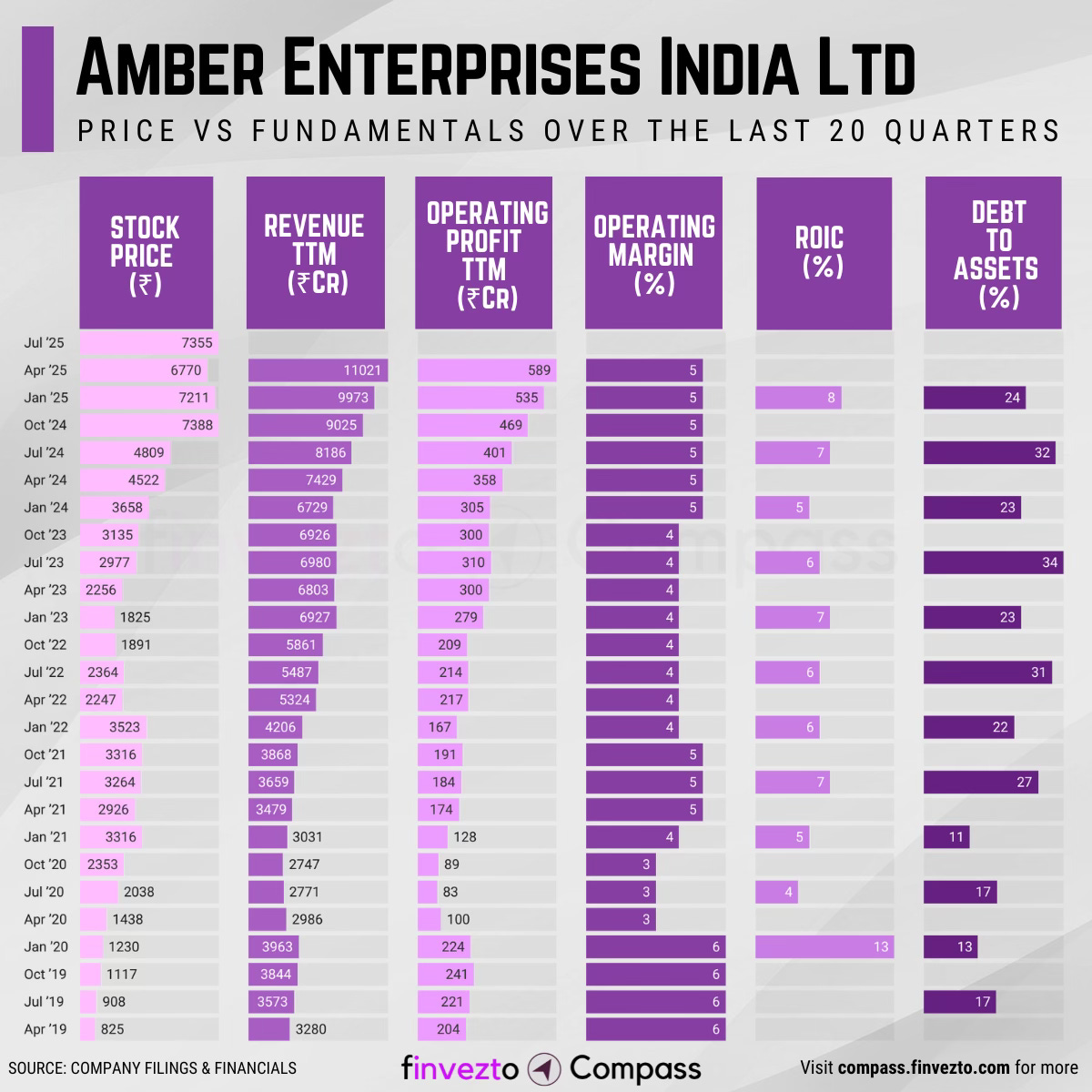

Today, we will look at the key fundamentals & business of Amber Enterprises India Ltd. Click here to learn more about each of the parameters in the chart below.

What Has Led to This Consistency

Company Overview

Founded in 1990, Amber Enterprises India Limited operates as India's contract manufacturer for air conditioning brands. The company provides original design manufacturing and component supply services.

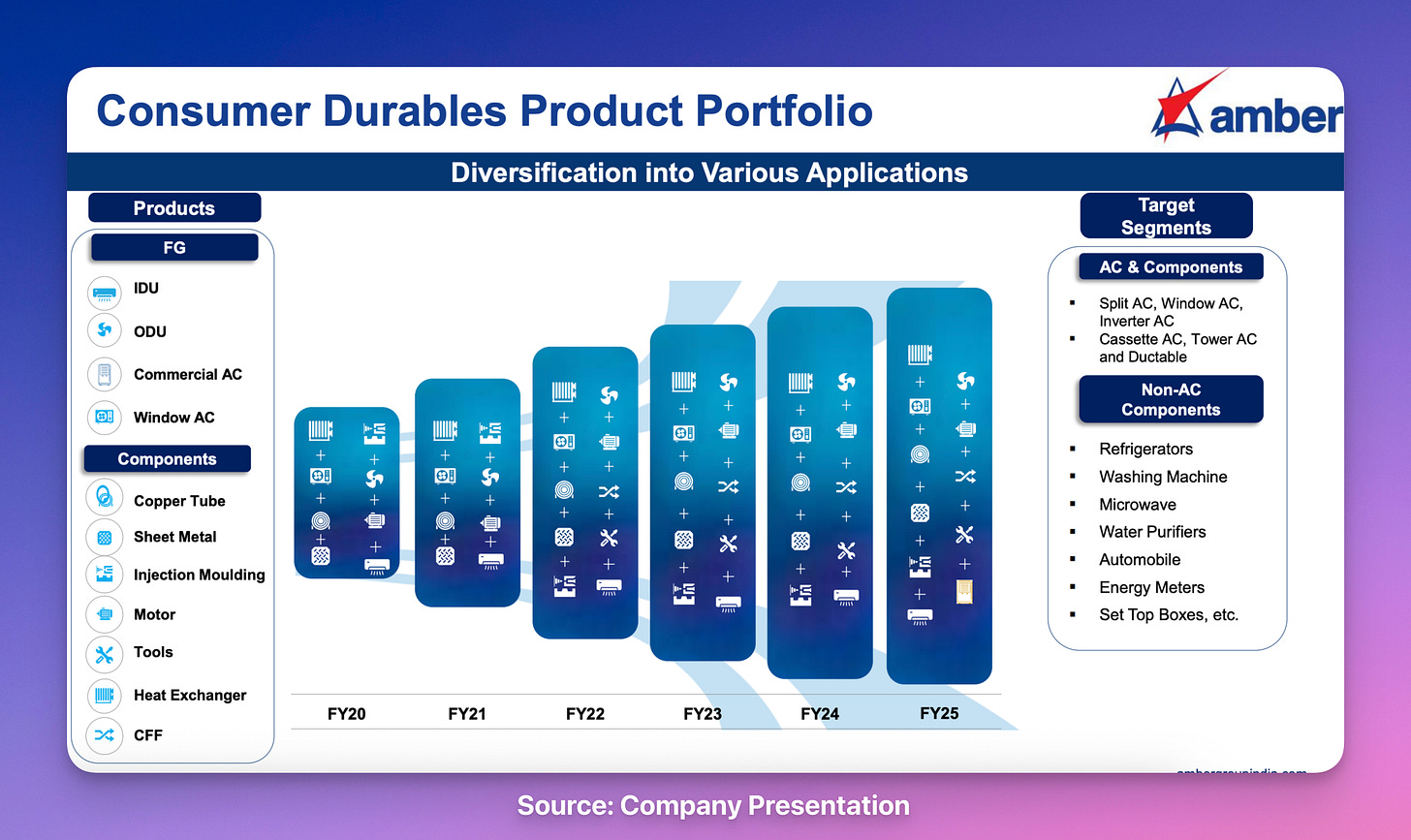

Product Segments include:

Room air conditioner manufacturing and assembly for domestic and international brands

Heat exchangers, motors, sheet metal components, and injection molding parts for HVAC applications

Electronics manufacturing services including PCB assembly and semiconductor packaging through acquired subsidiaries

Railway HVAC systems, doors, and specialized mobility solutions for Indian Railways and metro networks

Industry Tailwinds

Rising Penetration of Air Conditioners in India: Low household AC penetration (~8–10%) compared to global averages, coupled with rising disposable incomes and urbanisation, offers a long runway for demand growth.

Shift Towards Energy-Efficient and Inverter ACs: Increasing regulatory norms and consumer preference for energy-efficient appliances are driving demand for premium AC models, where Amber is a key OEM supplier.

Expansion of Organised Retail and E-commerce: Wider product availability and financing options through modern retail channels are accelerating AC adoption, benefiting Amber’s manufacturing volumes.

Schemes like PLI (Production-Linked Incentive) for AC and component manufacturing, and the “Make in India” initiative, are encouraging import substitution and boosting local production.

Strategic Acquisitions and Backward Integration

Korea Circuit joint venture provides advanced PCB manufacturing capabilities for HDI and semiconductor substrates addressing ₹4.5 billion import substitution opportunity → Technology access

Ascent Circuits acquisition adds specialized PCB manufacturing targeting aerospace, defense, automotive, and telecom sectors → Market expansion

Power-One acquisition provides 17-18% EBITDA margin power electronics capabilities versus industry averages of 6-8% → Margin enhancement

Full-stack electronics integration from bare PCBs to system assembly creates higher switching costs for complex customer requirements → Customer lock-in

Industrial Automation Expansion

Unitronics acquisition provides direct access to US and European industrial automation markets with established customer relationships generating 30%+ EBITDA margins through proprietary software and hardware integration.

Programmable logic controllers and human-machine interface technologies with patent-protected designs limiting competitor replication

US and European market contributing 55% and 40% of Unitronics sales respectively providing diversified revenue streams → Geographic diversification

Industrial automation software licensing creates recurring revenue streams with multi-year customer relationships → Revenue predictability

Integration with IL JIN manufacturing expertise enables localized production reducing costs while maintaining premium positioning → Cost advantages

Consistency Formula

Rising AC Penetration in India → Long-Term Volume Growth

Growth of Organised Retail & E-Commerce → Faster Market Adoption

Advanced Manufacturing Capabilities → Technology Leadership

Industrial Automation Expansion → Premium Margins

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services. Do check out more details below.

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Powering Investing & Trading Research