AFFLE INDIA || Consistently Performing Stocks #6

What has led to the consistency?

The aim of this series is to identify consistently performing businesses and understand a little bit more about how they are able to achieve this consistency.

Before we get into today’s stock, let me set some context regarding my research objectives. I do a weekly exercise to study and learn the business of one stock as part of my research activities as a SEBI registered RA. The primary objective is to understand the business a little bit more, figure out the key growth drivers and identify broader industry trends & patterns. Most of the research below is knowledge derived from the past Annual Reports and recent Quarterly Investor presentations. I am not an expert in this domain or industry. And more importantly, this is not a recommendation to buy the stock nor a thesis for a multibagger opportunity.

Let’s start ⬇️

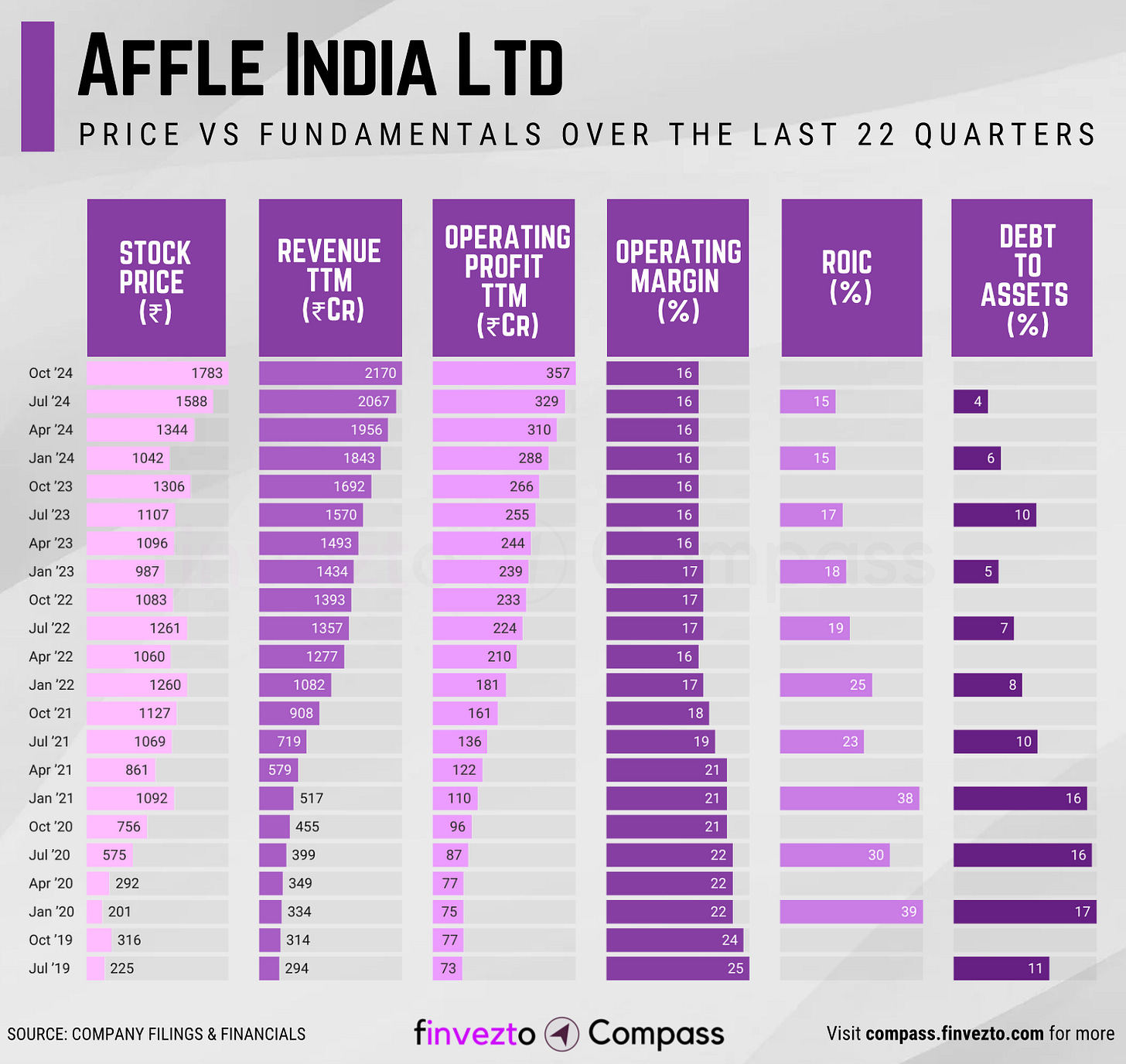

Today, we will look at the key fundamentals & business of Affle India Ltd.

What Has Led to This Consistency

Company Overview

Affle India, established in 1994 and headquartered in Singapore, is a leading ad-tech innovator with global operations. The company primarily operates through its Consumer Platform delivering CPCU-based marketing solutions.

So, this is what they do in simple terms. Affle helps businesses advertise to mobile users. They use data and artificial intelligence to identify potential customers and only charge advertisers when users actually take an action (like downloading an app or making a purchase). Think of them as matchmakers connecting brands with the right mobile consumers.

With a reach of 3.5 billion devices, Affle dominates high-growth emerging markets, serving 1000+ advertisers across e-commerce, fintech, gaming, and entertainment verticals.

Affle's portfolio includes 36 patents and key certifications, supporting its innovations in AI-driven advertising solutions and also ensuring data privacy and security.

Performance-Driven CPCU Business Model

Affle's Cost Per Converted User (CPCU) model is fundamental to its success. Unlike traditional ad networks charging for impressions or clicks, Affle only charges when users complete specific actions like app downloads or purchases. This creates perfect alignment with advertisers' goals by delivering superior ROI.

The model provides Affle with predictable revenue tied to tangible business outcomes rather than volatile metrics, creating a virtuous cycle of value for both Affle and its advertising partners. Steady growth in conversions year after year validates this approach's effectiveness.

Diversified Revenue Streams

Affle's resilience stems from diversified revenue across mobile advertising, user acquisition, analytics, engagement campaigns, app monetization, and enterprise solutions. This buffers against sector-specific downturns. While CPCU forms Affle's core, the company also offers engagement campaigns using CPM, CPV, and CPC models, giving advertisers flexibility.

This balance across complementary services ensures slowdowns in one area can be offset by growth in others, maintaining consistent performance even during market challenges.

AI-Driven Consumer Intelligence Platform

Affle's proprietary AI and machine learning platform provides critical technological edge through hyper-personalized ad targeting that improves conversion rates.

With 36 patents (12 granted, 24 filed), Affle demonstrates commitment to innovation. The platform enhances campaign effectiveness while generating valuable strategic insights.

Global Reach with Localized Execution

Affle balances global reach (over 3.5 billion devices) with deep local expertise across multiple continents. Affle concentrates on emerging markets—India, Southeast Asia, Latin America, and Middle East. These markets are witnessing rapid digital adoption.

This approach enables working with international brands while addressing market-specific needs. Success cases include Localiza in Brazil (Portuguese keyword optimization) and Wallapop in Europe (localized campaigns).

Deep local expertise allows development of tailored solutions that global competitors miss.

Strategic Acquisitions and Partnerships

Affle accelerates growth through strategic acquisitions that enhance technology capabilities and expand global reach. Examples include Appnext and multiple demand-side platforms creating a unified ecosystem.

Affle excels at identifying and incorporating acquisitions that complement core offeringswithout diluting focus.

Adaptability to Industry Trends

Affle stays ahead through adaptability to emerging industry trends. Key examples include expansion into Connected TV advertising and development of privacy-compliant targeting solutions (with Data Protection Trustmark and ISO certifications).

Affle integrates cutting-edge technologies like Generative AI and blockchain while monitoring trends and experimenting with emerging technologies before mainstream adoption.

Consistency Formula

CPCU Business Model + AI-Driven Intelligence → Performance-Linked Revenue Engine

Emerging Market Focus + Localized Execution → High-Growth Market Dominance

Vertical-Specific Solutions + Long-Term Client Relationships → Deep Industry Integration

That’s it for today. Every week, I will pick one consistently performing stock and share a little bit more about their business for learning purposes. Do subcribe if you wish to receive it in your Inbox every Saturday.

At Finvezto Stock Research (Anand Ganapathy, SEBI Registered RA), we offer the following services.

Conceptual Lessons & Deep Dives

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. It does not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.

FINVEZTO.COM | Useful & Actionable Stock Market Tools