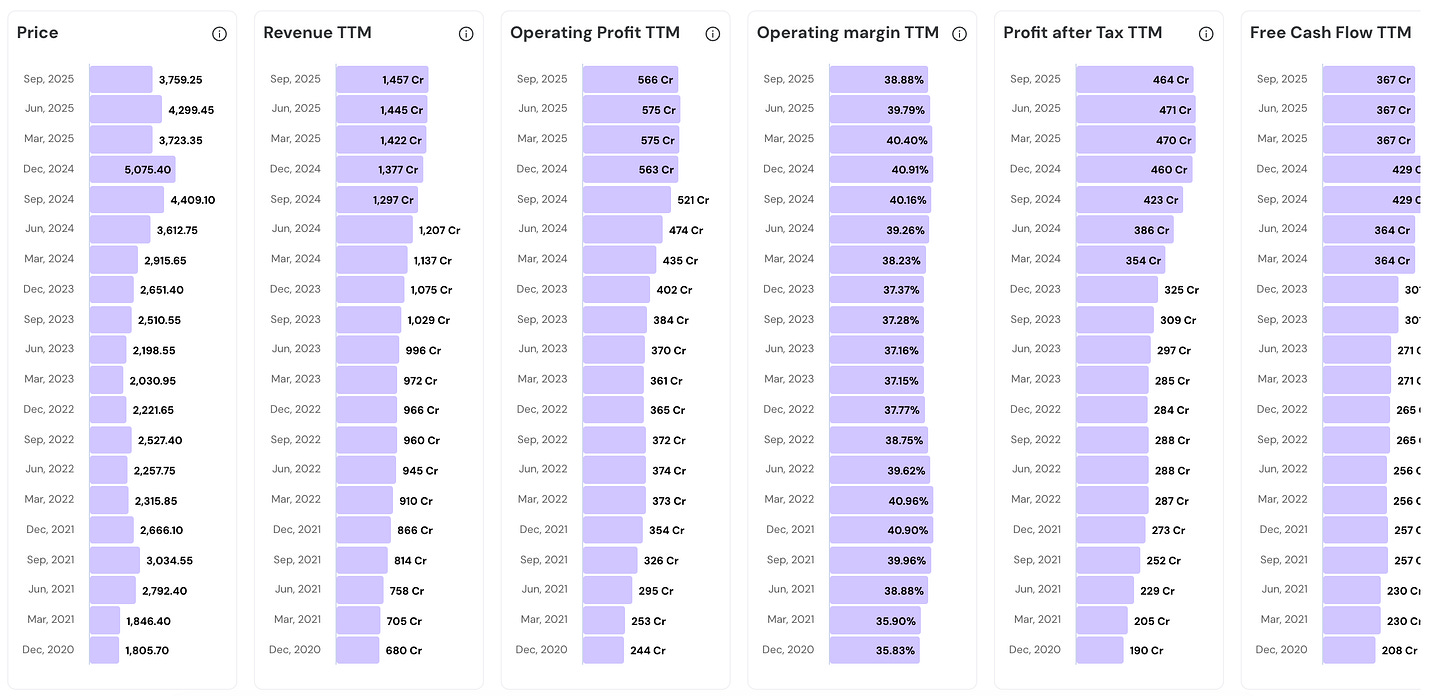

Since Dec 2020…

This Stock’s price has surged 2.1 times.

Revenue has grown 2.1 times.

Operating profit has grown 2.3 times.

PAT has grown 2.4 times.

Operating Margins have increased from 35.8% to 38.8%.

Take a look at the numbers below. Incredible Consistency.Did you guess the stock?

Yes. Today, we will look at the business of Computer Age Management Services (CAMS). CAMS has delivered consistent growth by positioning itself as the invisible backbone of India’s mutual fund revolution.

Let us explore.

Their Road to Consistency

Overview & Business Model

CAMS began operations in 1988 when V Shankar started the company in Chennai with just 20 employees processing IPO applications. The business evolved through India’s financial services transformation, pivoting from share registrations to mutual fund servicing.

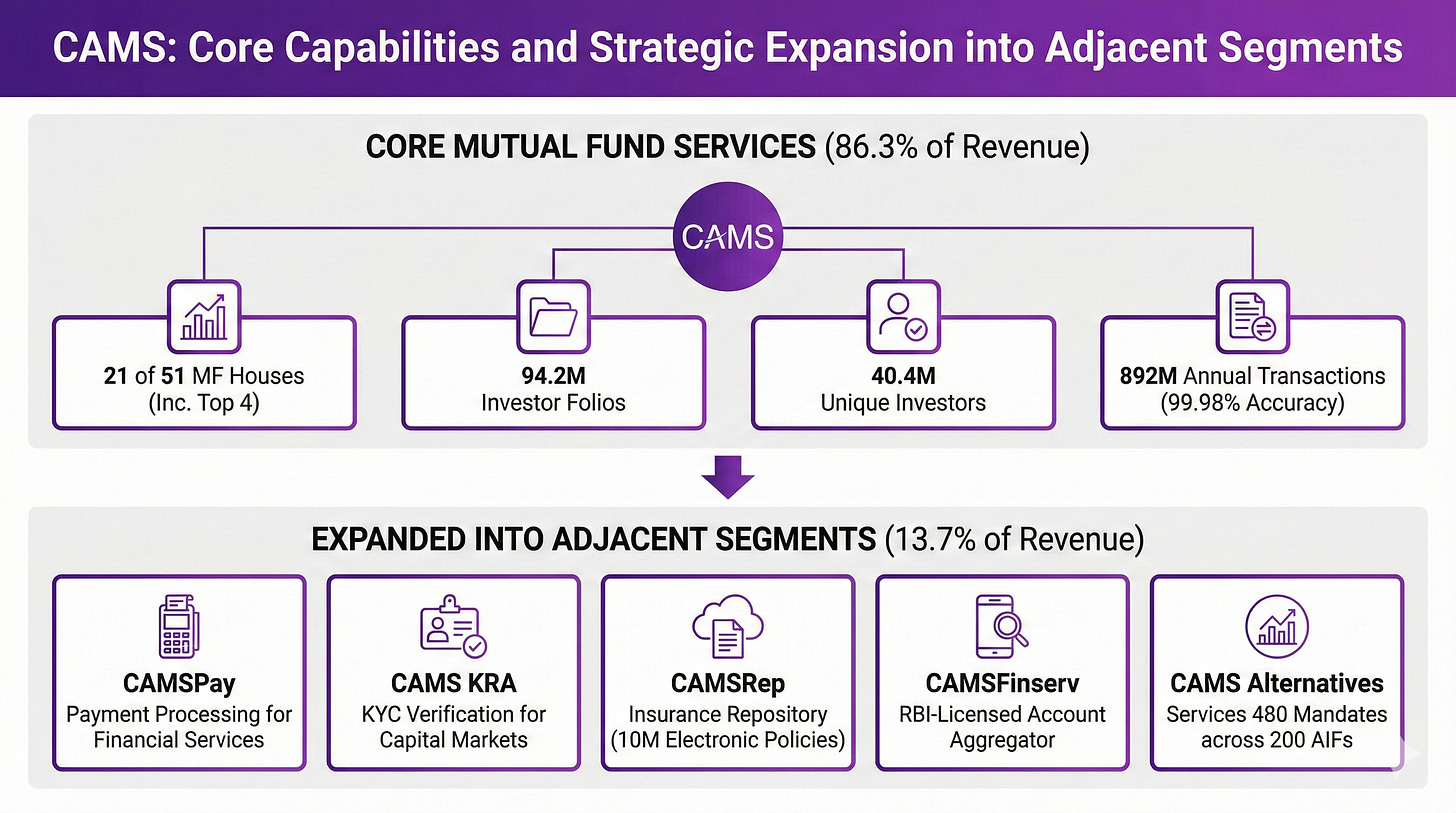

Today, CAMS is primarily a Registrar and Transfer Agent (RTA). It manages the entire back-end process from the moment an investor decides to buy a mutual fund to the point when they receive their redemption proceeds.

Fund houses outsource this work to CAMS because building internal infrastructure would cost more than paying CAMS and distract them from their core business of managing money.

The fee structure combines AUM-linked charges, per-folio fees, and transaction-based pricing, creating revenue that grows automatically as the industry expands.

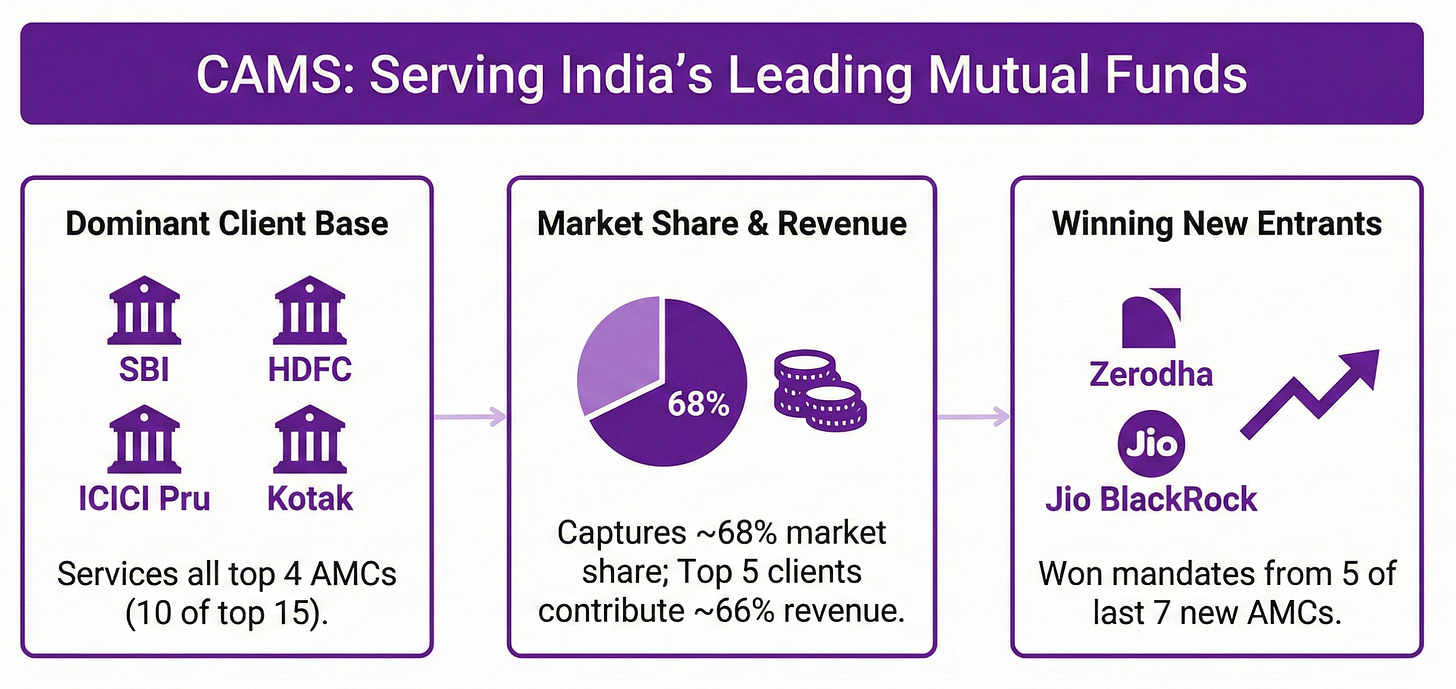

CAMS today serves 21 of India’s 51 mutual fund houses, including the four largest by assets.

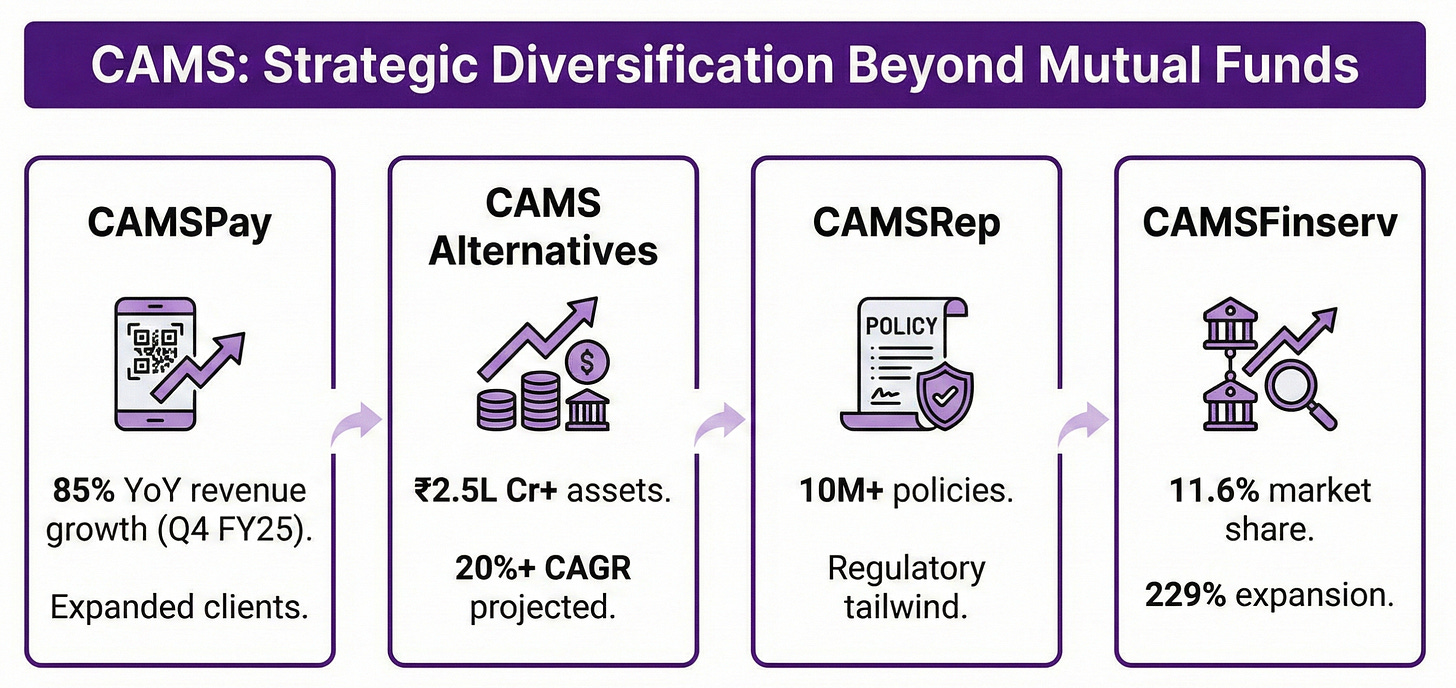

Beyond mutual funds, CAMS has expanded into adjacent segments that now contribute 13.7% of revenue.

CAMSPay handles payment processing for the financial services industry.

CAMS KRA manages KYC verification for capital market participants.

CAMSRep operates an insurance repository holding 10 million electronic policies.

CAMSFinserv runs an RBI-licensed Account Aggregator business.

CAMS Alternatives services 480 mandates across 200 alternative investment funds.

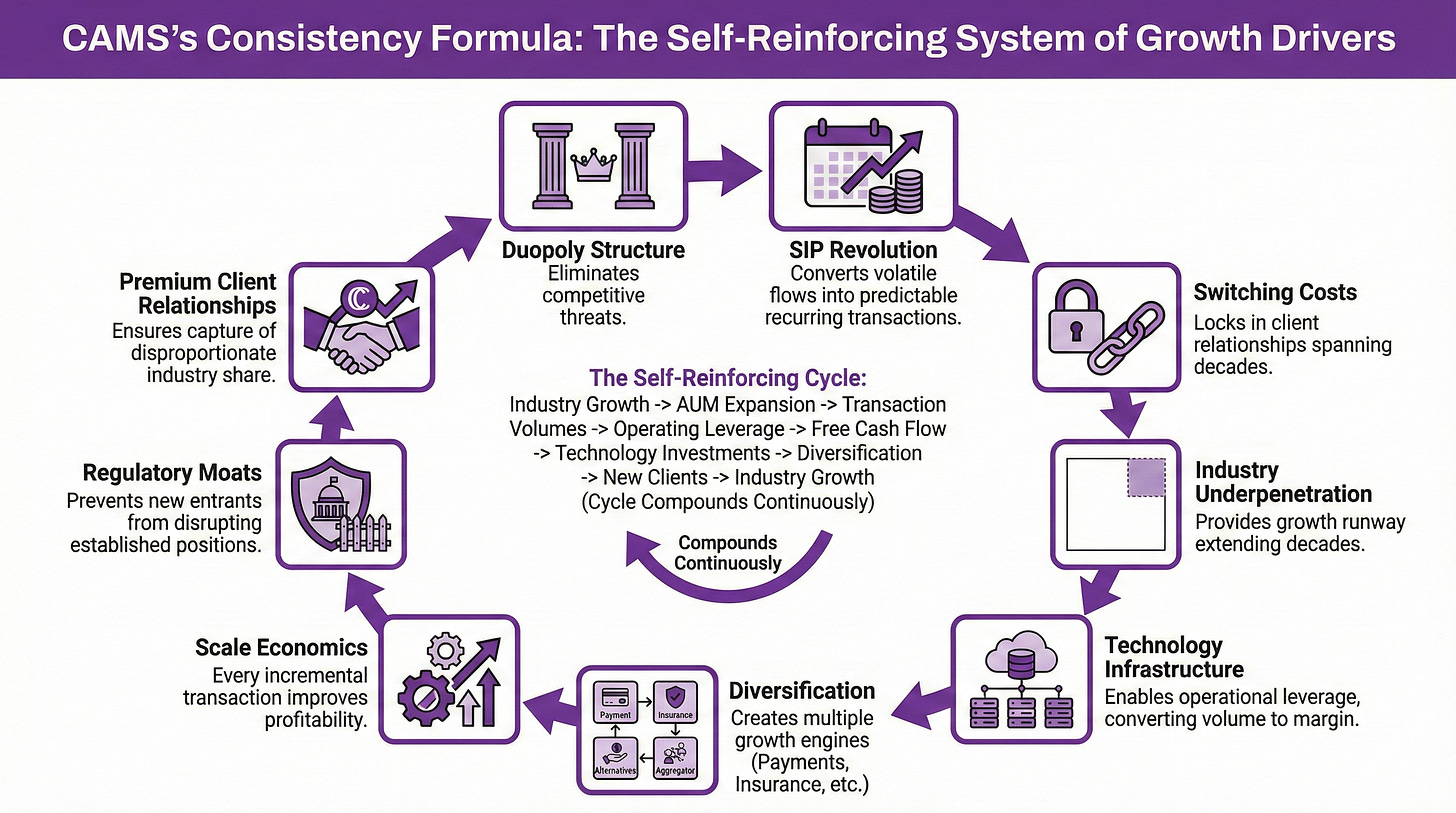

Duopoly Economics

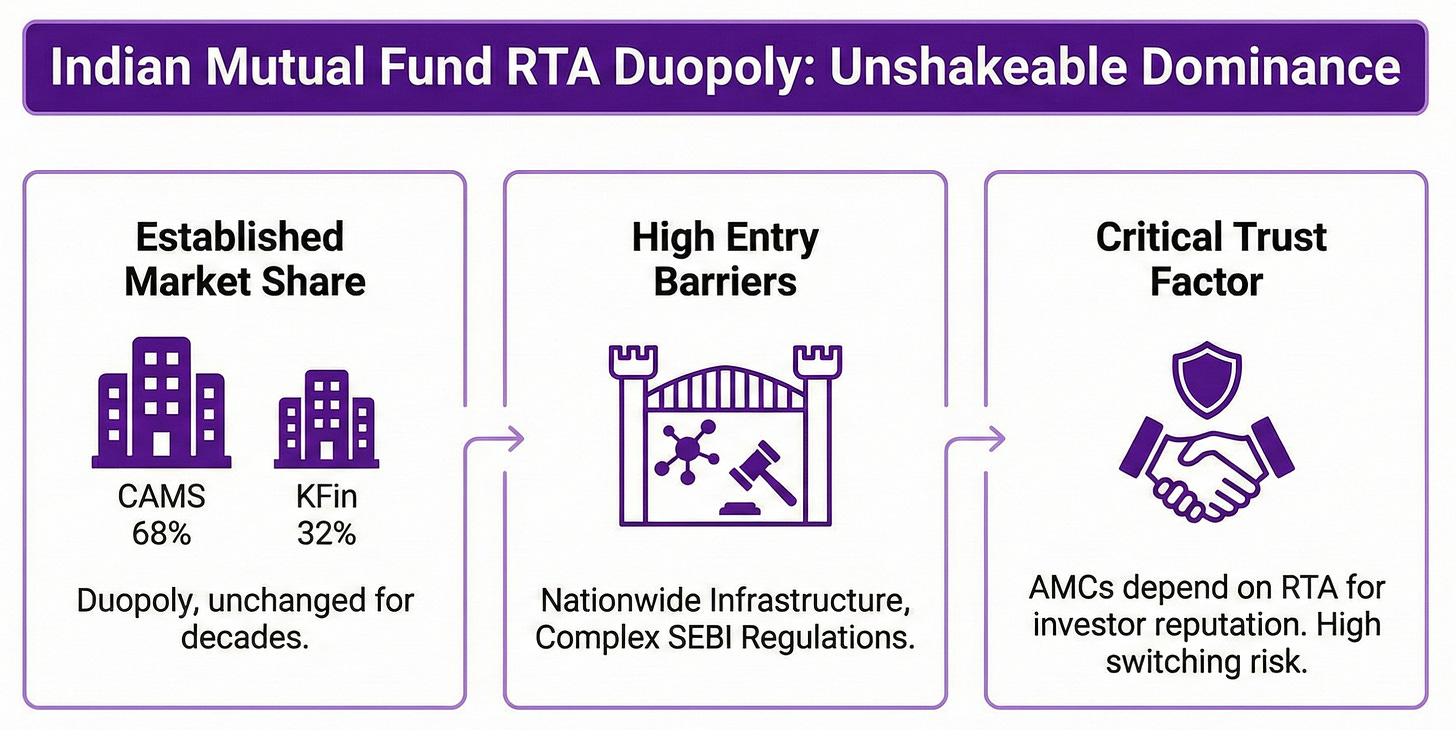

India’s mutual fund industry has exactly 2 registrar and transfer agents of meaningful scale, unchanged for over two decades.

CAMS commands 68% market share while KFin Technologies holds 32%. This duopoly persists because economics make new entry irrational.

Building a competitive RTA requires nationwide technology infrastructure processing millions of daily transactions without errors. CAMS operates 271 service centers across 25 states connected to centralized systems handling twice current capacity. Any new entrant must replicate this network before winning a single client.

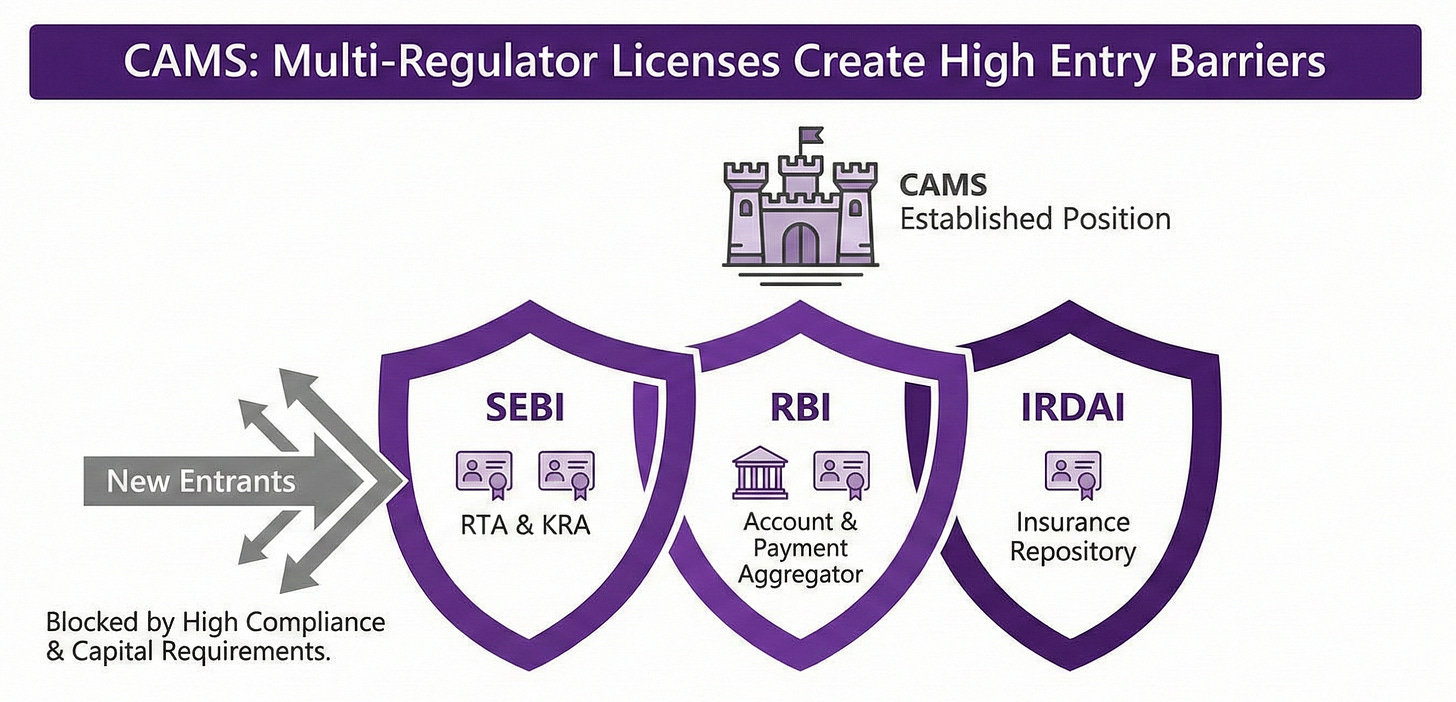

Regulatory requirements compound this. An RTA must register with SEBI, achieve Qualified RTA status for managing over two crore folios, implement extensive cybersecurity measures, and maintain minimum net worth thresholds.

The deeper barrier involves trust. AMCs hand their entire investor relationship to their RTA partner. Every statement, every dividend, every redemption builds the fund house’s reputation. No CFO wants to explain operational disruption from switching RTAs.

The SIP revolution

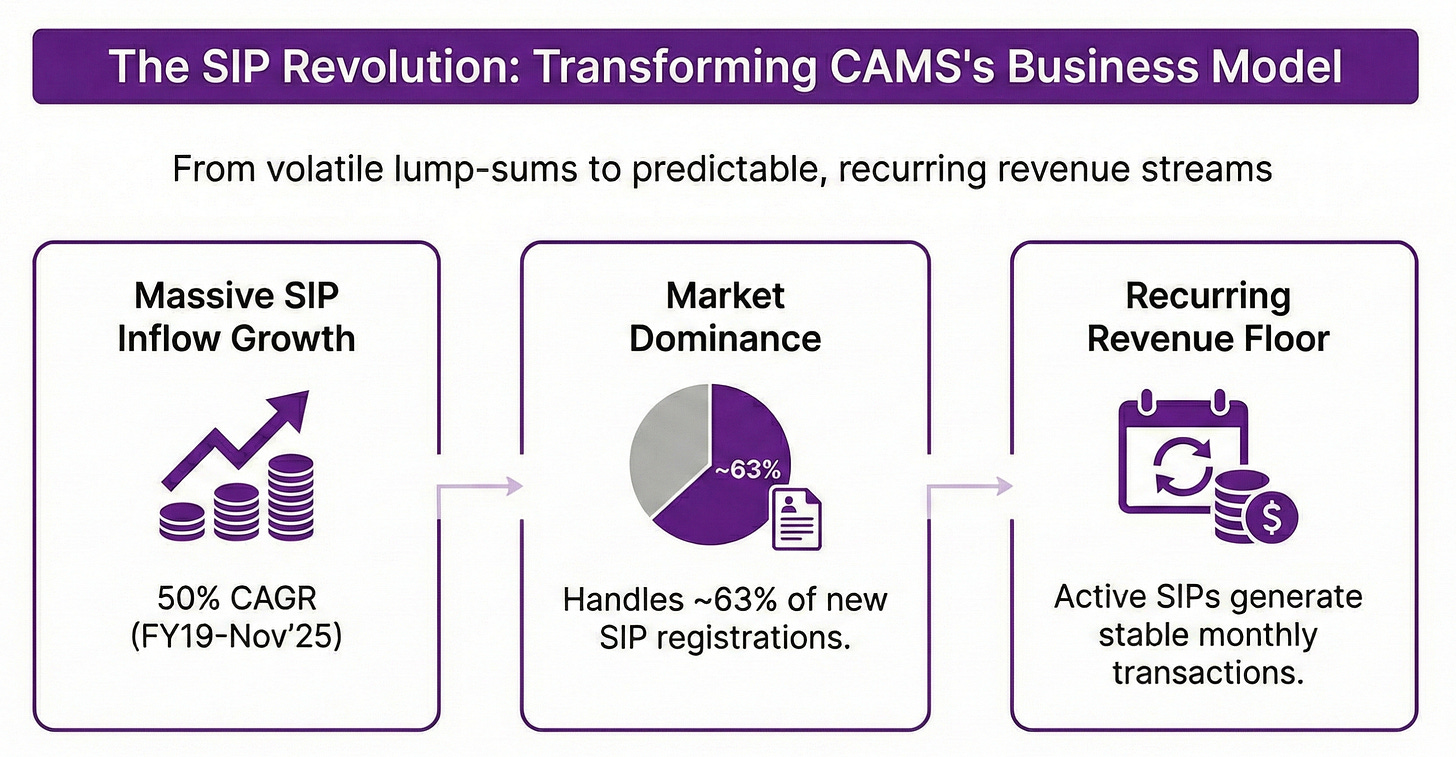

Systematic Investment Plans (SIP) transformed CAMS’s business model.

Monthly SIP inflows have grown from ₹8,055 crore in FY2019 to ₹29,000 crore by November 2025, a 50% CAGR.

This shift from lump-sum investing to automated monthly contributions created predictable, recurring revenue streams.

CAMS processed 57.2 million live SIPs in FY2025, registering 40.4 million new SIPs during the year. The company handles 62-64% of all new SIP registrations. Each active SIP generates recurring transaction volume month after month.

AMFI data shows 45 consecutive months of positive equity mutual fund inflows through mid 2025, a streak made possible by SIP discipline.

CAMS collected ₹1.76 trillion in gross SIP contributions during FY2025. Revenue growth has become more predictable and less correlated with market sentiment.

The company earns fees on every SIP transaction, creating a revenue floor that rises automatically as SIP penetration deepens.

Marquee Client Base

CAMS services 10 of India’s 15 largest mutual funds including all four top funds by AUM: SBI, HDFC, ICICI Prudential, and Kotak. This explains why CAMS captures 68% market share while serving only 21 of 51 fund houses.

The largest fund houses grow faster than industry averages through established brands, distribution networks, and performance track records.

When investors add ₹30,000 crore monthly through SIPs, a disproportionate share flows to household-name funds that CAMS services.

The top 5 clients contribute 65-67% of CAMS revenue, reflecting the oligopolistic structure where the top 5 AMCs control approximately 60% of industry assets.

New fund house launches increasingly choose CAMS. The company won mandates from 5 of the last 7 new AMC licenses, including Zerodha, Angel One, and Jio BlackRock.

High Switching costs for Customers

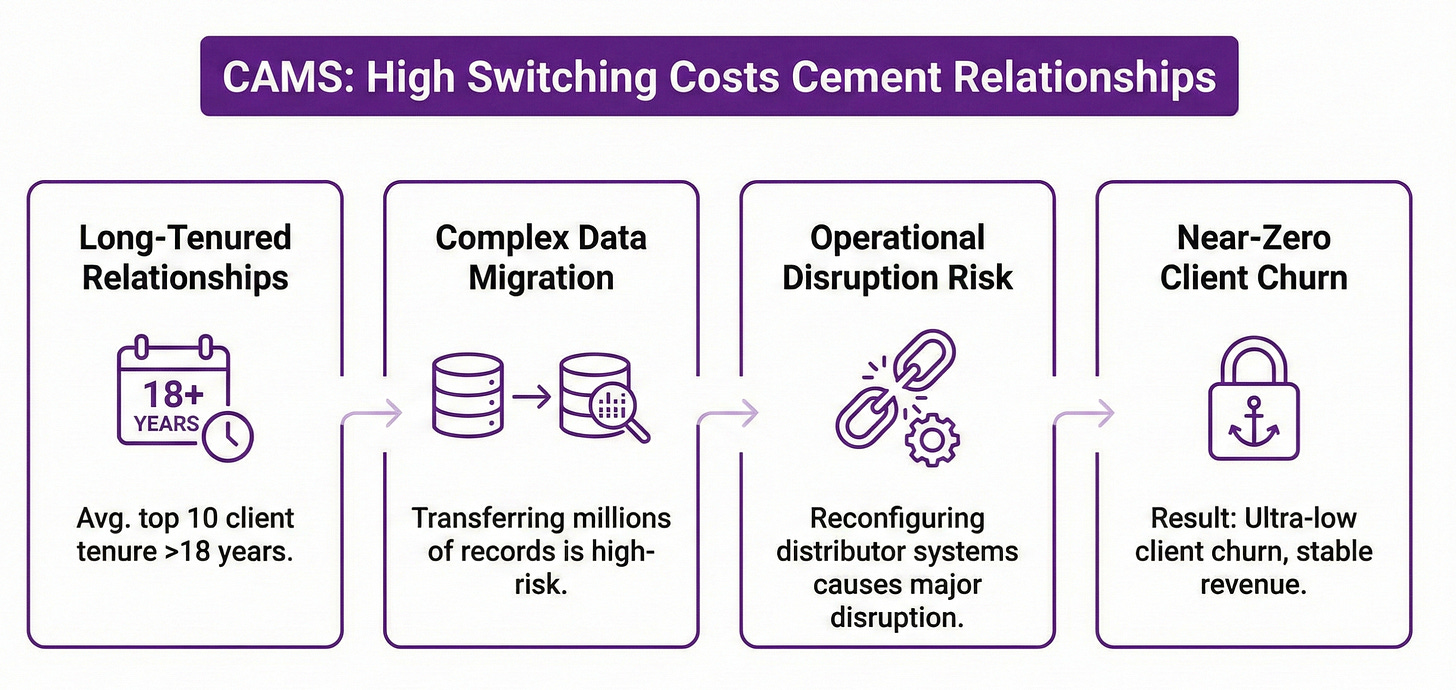

CAMS’s average relationship with its top 10 mutual fund clients spans over 18 years. Fund houses simply do not switch RTAs. Let us understand why.

Migrating from one RTA to another requires transferring millions of investor records with complete accuracy. Every folio number, transaction history, and nominee detail must move without error. SEBI requires notification, investor communication, and oversight of the transition process.

Distributors who have integrated their systems with one RTA must reconfigure everything. The operational risk of even minor disruption during migration far exceeds any cost savings a fund house might achieve.

As expected, CAMS’s client base exhibits near-zero churn.

Industry Tailwinds

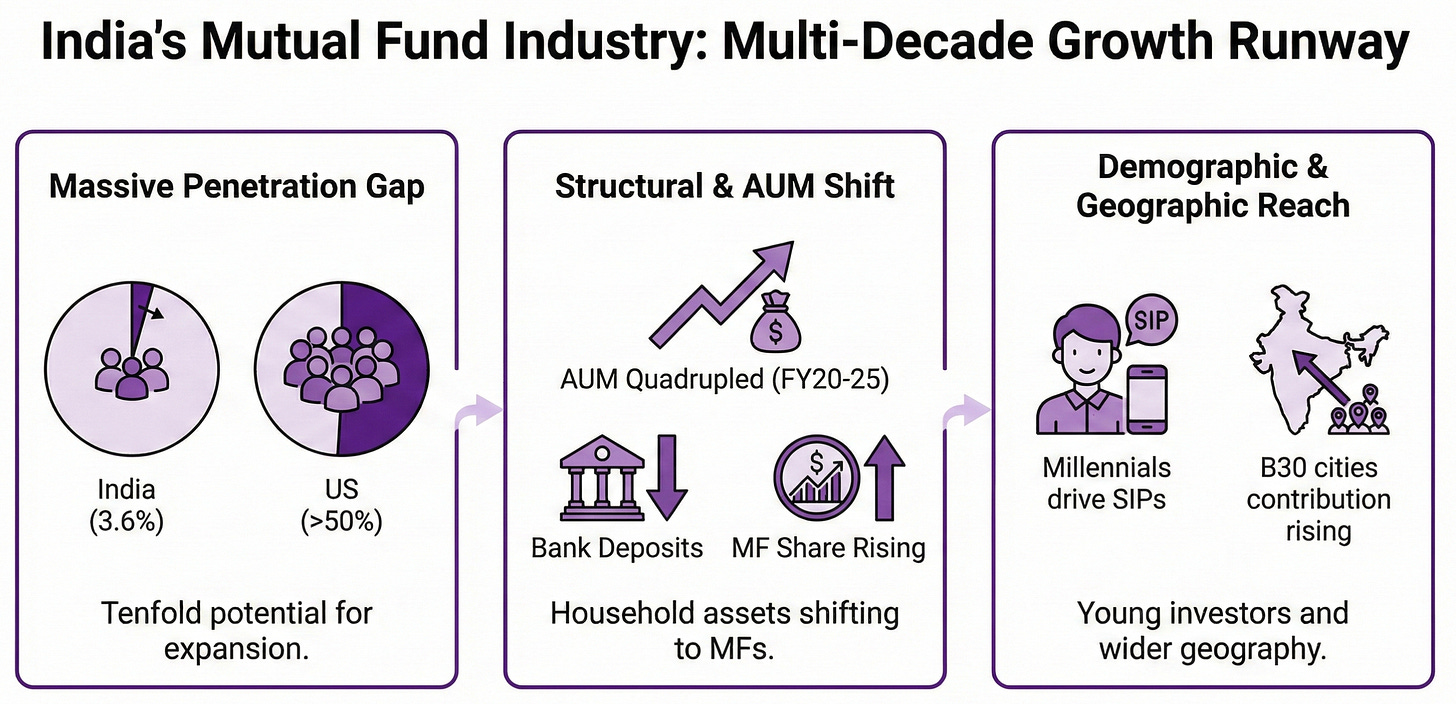

Only 3.6% of India’s 1.4 billion population currently invests in mutual funds. This single statistic explains why CAMS can grow consistently for decades without requiring market share gains.

The United States has mutual fund penetration exceeding 50%, suggesting India’s industry could expand tenfold.

MF Industry AUM quadrupled from ₹22.26 lakh crore in FY2020 to ₹80 lakh crore by November 2025.

Structural shifts in Indian households drive this expansion. Mutual fund share in household financial assets grew from 7.6% in FY21 to 10% in FY25, while bank deposits fell from 38.8% in FY15 to 32% by FY25. Young Indians increasingly treat SIPs as their primary investment vehicle rather than fixed deposits or gold.

CAMS data shows that 54% of new investors are millennials, establishing habits that might persist for decades.

Geographic expansion compounds the opportunity. AUM contribution from B30 cities rose from 9% to approximately 19% of industry assets. CAMS benefits from every dimension of this expansion.

Technology Infrastructure Creates Operating Leverage

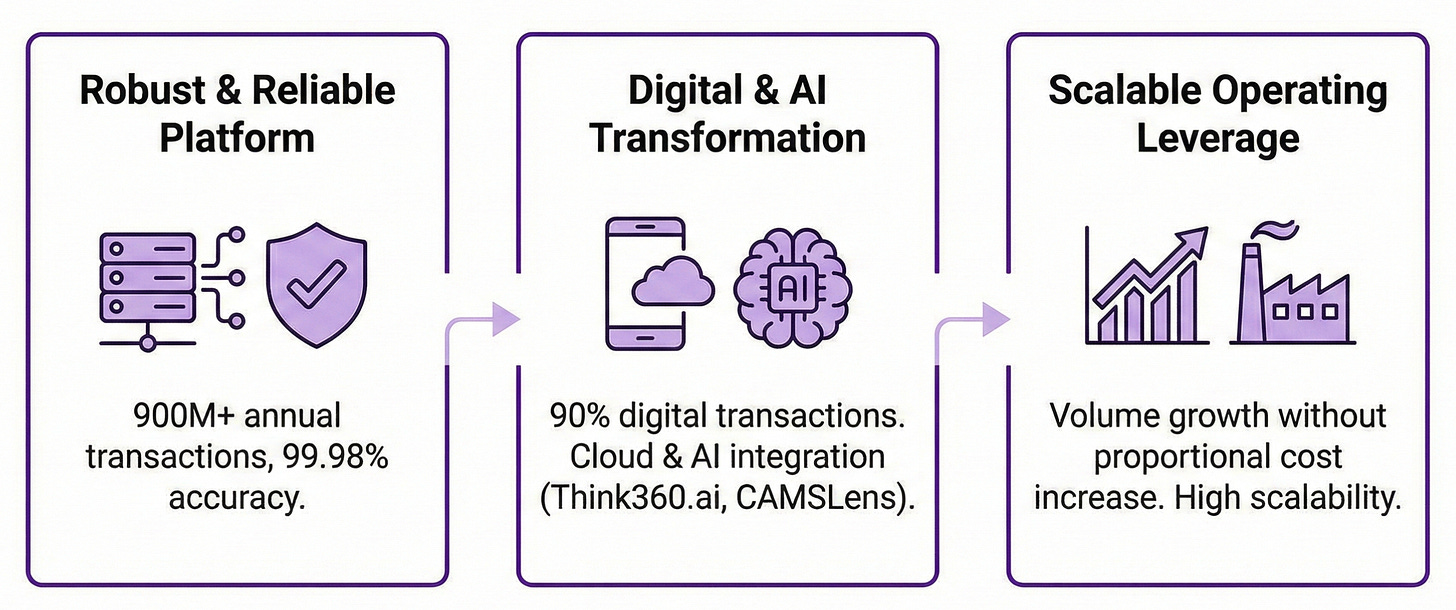

CAMS operates critical financial infrastructure for India’s investment industry. The technology platform processes over 900 million financial transactions annually with 99.98% accuracy. This reliability creates competitive advantage.

The digital transformation of mutual fund distribution directly benefits CAMS operations. Approximately 90% of all mutual fund purchases now occur through digital channels, up from 45% in 2013.

Recent technology investments position CAMS for next-generation capabilities. The company partnered with Google Cloud to build cloud-native infrastructure.

CAMSLens, launched in November 2024, uses AI to analyze regulatory circulars and generate compliance implementation plans within hours.

CAMS can easily onboard up to eight new AMCs per year with current infrastructure.

Diversification Beyond Mutual Funds

CAMS has systematically built adjacent businesses that collectively grew 15.8% year-over-year in FY2025, outpacing the core mutual fund segment.

CAMSPay represents the most rapidly scaling new business. Revenue grew 85% year-over-year in Q4 FY25 following full RBI authorization as a payment aggregator in April 2024.

CAMS Alternatives services the expanding wealth management industry. Assets under service crossed ₹2.5 lakh crore with 57 new mandates won in Q2 FY25 alone.

CAMSRep’s insurance repository business reached 10 million electronic policies with an LIC partnership announced in March 2025.

CAMSFinserv’s Account Aggregator business grew market share from 8.6% to 11.6% in FY2025, expanding 229% year-over-year.

Regulatory Licenses Create Entry Barriers

CAMS holds licenses from every major Indian financial regulator, creating barriers that new entrants cannot easily overcome.

The company operates as a SEBI-registered Registrar and Transfer Agent with Qualified RTA status. CAMS KRA holds KYC Registration Agency authorization. CAMSRep maintains an IRDAI license for insurance repository services. CAMSFinserv operates an RBI-licensed Account Aggregator. CAMSPay received RBI authorization as a payment aggregator in April 2024.

Each license required demonstrating operational capabilities, technology infrastructure, capital adequacy, and governance standards to regulators.

The regulatory environment increasingly favors established players.

Their Consistency Strategy

That’s it for today.

FINVEZTO.COM | Build Wealth, Systematically

At Finvezto Stock Research (SEBI Registered RA), we offer the following services. Do check out more details below.

Long Term Recommendations (Core Portfolio)

Medium Term Recommendations (Satellite Portfolio)

Short Term Strategies (Overlay Portfolio)

Advanced Toolkit for Stock Research (For DIY Investors & Traders)

Disclaimer: Anand Ganapathy K is a SEBI-registered Research Analyst with SEBI registration number INH000016630. This post is purely for learning purposes to understand more about the business. We do not recommend buying or selling stocks mentioned in this newsletter. Securities market investments carry market risks. Kindly review all related documents before investing.